Defense stocks having ‘Buy’ recommendations with an upside potential of up to 25%

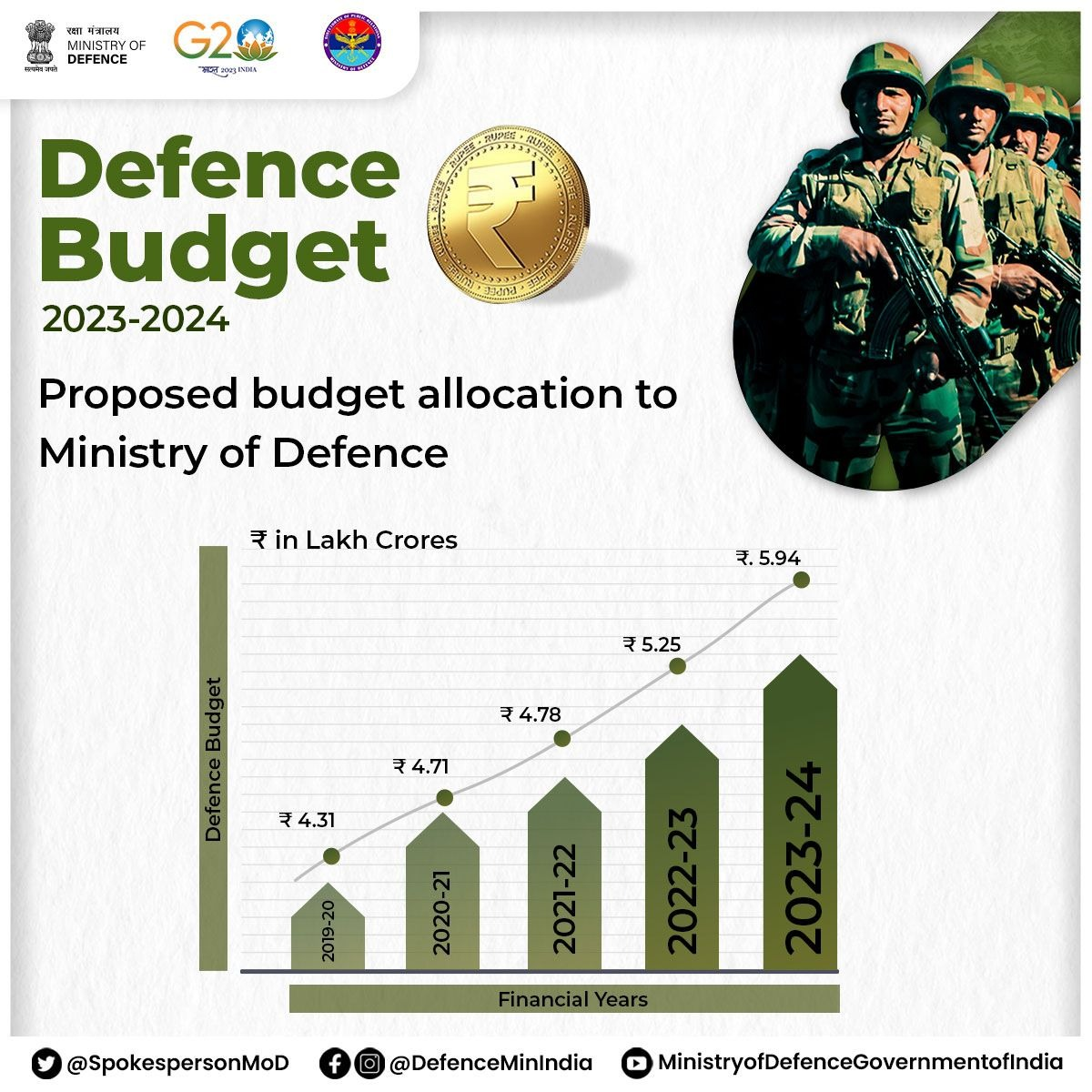

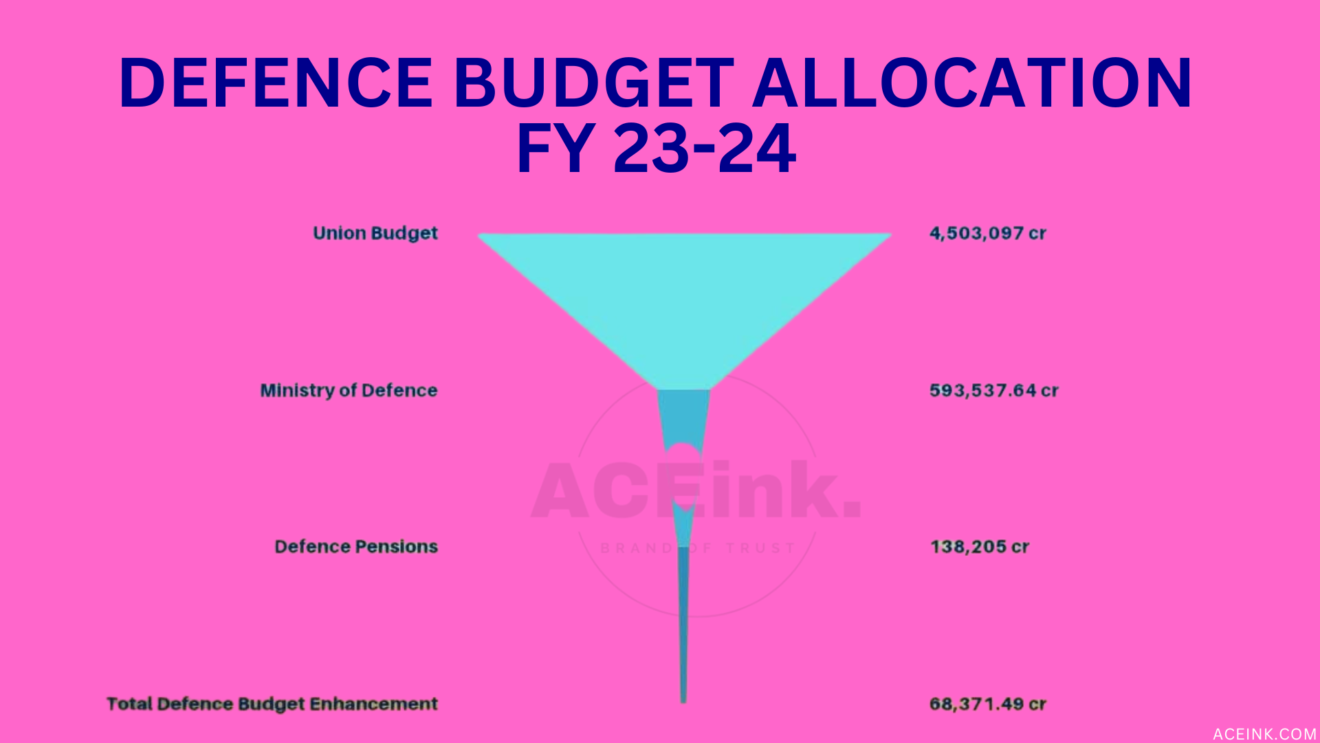

In the past two years, defense sector stocks have outperformed those of every other sector.

While the defense sector opened to private players long ago, the true impact of policy initiatives has become evident on Dalal Street in the last eight quarters. Even before the escalation of geopolitical tensions, the government emphasized giving preference to domestic defense manufacturing and has consistently released orders.

Policy initiatives by the government have brought about changes both in the actual operations and perception of defense sector companies.

Also Read: IRFC @ 52 Week High: Buy, Sell, Hold: What Analysts Say?

Also Read: These banking stocks may give up to 30% returns

These companies’ order books are full, and their stocks have been outperforming the broader market indices for over a year, attracting growing institutional interest.

Investors may wonder how to gain exposure to this sector since many large companies and industrial houses are involved in the defense business through their subsidiaries. This complexity makes it difficult to obtain direct exposure to the defense segment.

A better approach for investors seeking exposure would be to focus on companies solely dedicated to defense, including several PSU (Public Sector Undertaking) companies.

PSUs have a distinct advantage in the defense sector, both in terms of securing orders and meeting high working capital requirements. A common trait among these companies is their high return on equity (ROE), despite the government being their primary buyer.

To learn more about stock market basics and stock analysis one can consider enrolling in our Stock Market Learning Courses, here.

Below is the list of stocks with high Return on Equity (ROE) and Operating Profit Margin (OPM) with the exception of one private sector player whose margins remain in the single digits., along with the analysts count and potential upside update:

Also Read: 25% in 10 days: Why RailTel Rallied So Much- Buy, Sell, hold?

Note: BEL has given Bonus shares at the ratio of 2:1 on September 16, 2022.

Bharat Electronics Limited (BEL)

Analyst Count: 24

Upside Potential: 25.7%

Institutional Stake: 33.0%

Overview

Bharat Electronics Limited (BEL) is an India-based company that specializes in manufacturing and supplying electronic equipment and systems. The company serves both the defense sector and non-defense markets.

Defense Products

BEL offers a wide range of defense products, including:

- Defense Communication Products

- Land-based Radars

- Naval Systems

- Electronic Warfare Systems

- Avionics

- Electro-Optics

- Tank and Armored Fighting Vehicle Electronic Systems

- C4I Systems

- Weapon Systems

- Shelters and Masts

- Simulators

- Batteries

- And more.

Non-Defense Products

Apart from its defense-related offerings, BEL provides non-defense products, including:

- Cyber Security

- e-Governance Systems

- Homeland Security

- Civilian Radars

- Telecom and Broadcast Systems

- And more.

Target Markets

BEL manufactures electronic products and systems to cater to the needs of the Army, navy, and air force.

It serves the defense sector comprehensively.

Electronic Manufacturing Services

In addition to its product offerings, BEL provides electronic manufacturing services, covering various areas:

- Printed Circuit Board Assembly and Testing

- Precision Machining and Fabrication

- Opto Electronics Components and Assemblies

- Microwave Integrated Circuit Assemblies

- Super Components Modules

- Offsets

- And more.

BEL leverages its expertise in electronic manufacturing to meet diverse customer requirements.

Also Read: Buy or Sell: Sumeet Bagadia’s 3 Stock Recommendations for This Week

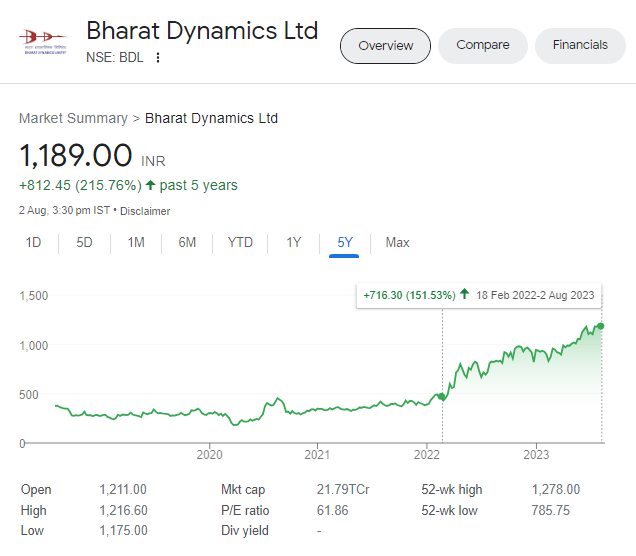

Bharat Dynamics Limited (BDL)

Analyst Count: 6

Upside Potential: 16.8%

Institutional Stake: 15.3%

Overview

Bharat Dynamics Limited (BDL) is a prominent player engaged in the manufacturing and production of guided missile systems. The company’s primary focus is on defense production, providing essential equipment and systems to strengthen India’s defense capabilities.

Product Portfolio

BDL boasts a diverse product portfolio that includes the following guided missile systems:

- Surface to Air missiles (SAMs)

- Anti-Tank Guided Missiles (ATGMs)

- Underwater weapons

- Launchers

- Countermeasures Dispensing systems (CMOS)

- Test Equipment

Among its offerings, BDL provides the Akash weapon system, Milan 2T, Konkurs-M, TAL (torpedo advanced lightweight), Milan equipment, and the medium-range surface-to-air missile (MRSAM).

Scope of Services

In addition to missile systems, BDL is involved in the manufacturing and supply of various defense equipment, including Guided Missiles, Underwater Weapons, Air-borne products, Ground Support Equipment, Product Life Cycle Support, and Refurbishment / Life Extension of vintage Missiles and allied defense equipment for the Indian Armed Forces.

Manufacturing Facilities

BDL operates modern manufacturing facilities at three locations:

- Hyderabad

- Bhanur

- Visakhapatnam

These facilities are strategically positioned to cater to the growing demand for defense products in India.

BDL plays a significant role in fortifying India’s defense capabilities by providing advanced guided missile systems and other defense equipment to the Indian Armed Forces. Its commitment to producing cutting-edge technology contributes to the nation’s defense preparedness and security.

Astra Micro Wave Products Limited

Analyst Count: 2

Upside Potential: 15.0%

Institutional Stake: 11.1%

Overview

Astra Micro Wave Products Limited is a company engaged in the business of designing, developing, and manufacturing sub-systems for Radio Frequency (RF) and microwave systems. These systems find applications in defense, space, meteorology, and telecommunication sectors.

Product Range

The company’s principal activities involve manufacturing, producing, assembling, repairing, maintaining, importing, exporting, buying, selling, and dealing in various electronic items and components. These components include:

- Filters

- Power dividers

- Directional couplers

- Amplifiers

- Circulators

- Isolators

- Power combiners

- Antennae

- Sources

- Voltage-controlled oscillators

- Terminations

- Loads

- And others

Applications

Astra Micro Wave Products specializes in systems and subsystems operating in very high frequency (VHF), ultra-high frequency (UHF), and microwave bands. These products cater to a wide range of applications in various sectors, including:

- Radar systems

- Space onboard and ground subsystems

- Missile electronics and subsystems

Diverse Range of Microwave Products

The company offers an extensive array of microwave products, including filters, transmitters, receivers, and antennas. These products play a critical role in enabling advanced RF and microwave technologies.

Astra Micro Wave Products Limited’s expertise in designing and manufacturing RF and microwave subsystems has led to its involvement in defense, space, meteorology, and telecommunication projects. The company’s contributions in these domains are crucial to enhancing communication, surveillance, and overall technological capabilities.

Hindustan Aeronautics Limited (HAL)

Analyst Count: 9

Upside Potential: 12.5%

Institutional Stake: 16.1%

Overview

Hindustan Aeronautics Limited (HAL) is a prominent company engaged in various aspects of the aerospace industry. It specializes in the design, development, manufacturing, repair, overhaul, upgrade, and servicing of a wide range of products related to aircraft, helicopters, aero engines, avionics, accessories, and aerospace structures.

Aircraft

HAL’s portfolio includes a diverse range of aircraft, such as:

- Hawk- Advanced Jet Trainer

- Light Combat Aircraft (LCA)

- Su-30 MKI aircraft

- Intermediate Jet Trainer (IJT)

- Dornier Do-228 aircraft

Helicopters

The company is also involved in the production of helicopters, including:

- Advanced Light Helicopter (ALH- DHRUV)

- Cheetah Helicopter

- Chetak Helicopter

- Lancer Helicopter

Avionics

HAL offers a comprehensive range of avionics systems, which include:

- Inertial Navigation System

- Auto Stabilizer

- Head-up Display

- Laser Range System

- Flight Data Recorder

- Communication Equipment

- Radio Navigation Equipment

- Airborne Secondary Radar

Systems and Accessories

HAL provides essential systems and accessories for aerospace applications, including:

- Hydraulic system

- Wheels and Brake System

- Flight Control System

Jigs, Fixtures, and Templates

In addition to its product range, HAL is also involved in the design and manufacture of jigs, fixtures, templates, and pressure test fixtures.

HAL’s contributions in the aerospace industry play a vital role in strengthening India’s aviation capabilities. Its expertise in designing, manufacturing, and servicing a wide range of aerospace products enables the company to support both the defense and civilian sectors with advanced and reliable aviation solutions.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.