“Volatile Markets? These 5 Stocks Offer 40% Upside Potential as Suggested by the Analysts”

Global equity markets, both in emerging and developed economies, have entered a phase of correction. The duration of this correction remains uncertain. In such times, it is prudent for both traders and investors to focus on stocks that have demonstrated resilience in bearish markets.

While the Nifty index experiences a correction, examining other indicators like the relative performance of mid and small-cap indices reveals that bullish sentiment still prevails.

On most days when the index undergoes a correction, select stocks continue to show strength.

The correction pattern, featuring sharp downward moves followed by sessions of stability and subsequent market breadth improvement, suggests that, at least for now, the bullish sentiment persists.

Strategies for Identifying Outperforming Stocks

The focus here is on the stocks that have exhibited strong performance even amid bullish phases. Such outperformance can be assessed through different means:

-Stocks that decline less than the Nifty during corrections,

-Those that move upwards despite the index downturn, and

-Those that swiftly rebound when the Nifty recovers.

There are a few scenarios that explain such outperformance. First, fundamental developments within the company or sector may be driving this trend. Second, these stocks might have already undergone a correction, positioning them for an upward move. To learn more about stock market basics and stock analysis one can consider enrolling in our Stock Market Learning Courses, here.

Here’s a compilation of stocks by ET meeting specific criteria:

They have delivered positive returns over the past month, displayed positive upside potential, and have been rated as “Strong Buy,” “Buy,” or “Hold.”

The question remains:

will these stocks exhibit accelerated growth as the market recovers consistently?

This is an aspect to carefully monitor. The data-driven insights provided by these factors offer valuable guidance to investors in these uncertain times.

Also Read: Why Analysts are Bullish on This Midcap Stock?

TVS Motor Company Limited:

- 1M Return: 1.4%

- Analyst Count: 38

- Upside Potential: 40.3%

- Institutional Stake: 32.1%

Overview:

Engaged in manufacturing motorcycles, scooters, mopeds, and three-wheelers, along with parts and accessories.

Product Range:

Motorcycles: Apache Series RTR, Apache RR 310, Apache RTR 165RP, TVS Raider, and more.

Scooters: TVS Jupiter 125, TVS NTORQ 125, TVS Zest 110, TVS Scooty Pep+, and others.

Mopeds: TVS XL 100 Win Edition, TVS XL 100 Comfort, TVS XL 100 Heavy Duty, and more.

Electric Vehicle: Offers TVS iQube.

Augmented Reality App:

Provides TVS Augmented Reality Interactive Vehicle Experience (ARIVE) app for exploring vehicles and booking test rides.

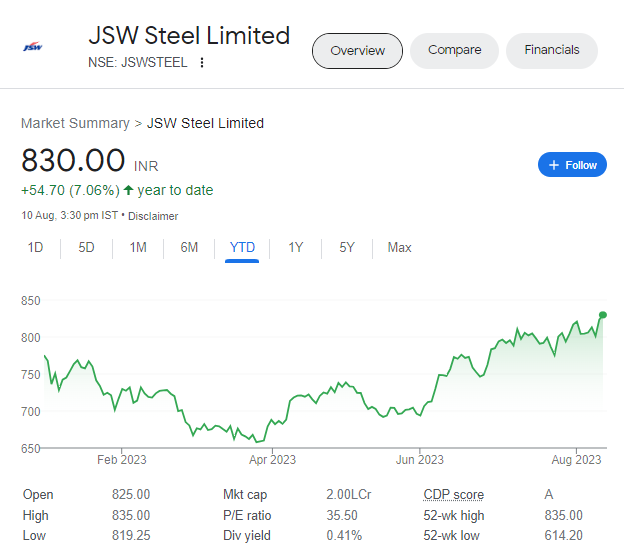

JSW Steel Limited:

- 1M Return: 4.5%

- Analyst Count: 27

- Upside Potential: 20.2%

- Institutional Stake: 16.6%

Overview:

Involved in producing and distributing iron and steel products.

Product Portfolio:

Flat Steel: Hot rolled coils, sheets, plates, cold rolled coils, and more.

Long Steel: TMT bars, wire rods, rails, and special steel bars.

Color Coated and Roofing Products: Under various brands like JSW Radiance and JSW Colouron+.

Manufacturing Plants:

Operates manufacturing plants in Vijayanagar (Karnataka), Dolvi (Maharashtra), and Salem (Tamil Nadu).

United Spirits Limited:

- 1M Return: 11.4%

- Analyst Count: 23

- Upside Potential: 17.8%

- Institutional Stake: 19.6%

Overview:

Engaged in manufacturing, selling, and distributing alcoholic beverages.

Brands: Offers a collection of brands including

-Johnnie Walker, Black Dog, Vat 69, Royal Challenge, and more.

Subsidiary:

Owns the Royal Challengers Bangalore (RCB) cricket franchise in the Indian Premier League (IPL) through a subsidiary.

Colgate-Palmolive (India) Limited:

- 1M Return: 11.3%

- Analyst Count: 31

- Upside Potential: 16.8%

- Institutional Stake: 19.3%

Overview:

Manufactures and trades toothpaste, toothbrushes, mouthwash, and personal care products.

Oral Care Products:

Toothpaste options like Colgate Active Salt, Cibaca Vedshakti, and more.

Mouthwash and Rinses:

Plax Active Salt Mouthwash, Plax Complete Care Mouthwash, and more.

Also Read: IRFC @ 52 Week High: Buy, Sell, Hold: What Analysts Say?

HDFC Asset Management Company Limited:

- 1M Return: 11.9%

- Analyst Count: 20

- Upside Potential: 15.8%

- Institutional Stake: 28.7%

Services Offered:

-Portfolio management, segregated account services, including discretionary, non-discretionary, and advisory services.

Product Portfolio:

Offers equity-oriented, debt-oriented, liquid, and other schemes including ETFs and fund of funds.

Clients:

Serves high-net-worth individuals, family offices, corporates, trusts, and institutions.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————

“Riding High – Key Drivers Behind the Momentum of this small-cap stock” This small-cap stock is poised to…Read More