2 Midcap Stocks suggested by Research Analysts that can give Potential Returns in 1-2 years

The Indian stock market has experienced robust growth since the start of the financial year 2024.

The Nifty index has surged by over 7% since April, primarily driven by continuous inflows of foreign capital, impressive corporate earnings in the March quarter, and a favorable macroeconomic environment.

Contrary to the popular adage “sell in May and go away,” the market has remained resilient, with the benchmark Sensex rising by 2.5% and the Nifty gaining 2.6% during the month.

This upward trend can be attributed to increased buying activity across various sectors. Given the optimistic sentiment prevailing in the market, investors are actively seeking stocks that are outperforming the overall market performance.

Here are 2 stocks from the mid-cap space, which are collated in the Livemint article and shared by different Analysts and Experts, that show potential for delivering healthy returns within the next one to two-year timeframe.

Also Read: NPS withdrawal rule set to change Soon- All you need to know about NPS

Analysts: Narendra Solanki, Head of Equity Research at Anand Rathi Shares & Stock Brokers

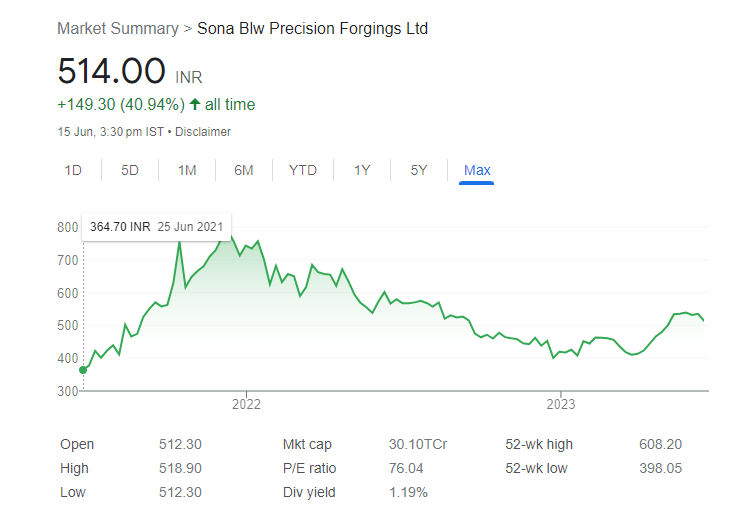

Sona BLW Precision Forgings:

Target Price: Rs 680

Company Overview:

Sona BLW Precision Forgings Limited (formerly known as Sona Koyo Steering Systems Limited) is a leading automotive technology company based in India.

The company specializes in the design, development, and manufacturing of precision-forged bevel gears and other automotive components. Sona BLW Precision is a subsidiary of Sona Autocomp Holding Private Limited.

Business and Products:

Precision-Forged Bevel Gears: Sona BLW Precision is renowned for its expertise in manufacturing precision-forged bevel gears. These gears are critical components used in the powertrain systems of automobiles, providing efficient torque transfer and smooth operation.

The company leverages advanced forging techniques to produce high-quality bevel gears that meet the stringent requirements of the automotive industry.

Differential Assemblies: Sona BLW Precision specializes in manufacturing differential assemblies, which are essential components in the drivetrain of vehicles. These assemblies enable torque distribution between the wheels, ensuring optimal traction and stability.

The company’s differential assemblies are designed to meet the performance and durability demands of various vehicle types, including passenger cars, commercial vehicles, and off-road vehicles.

Starter Motors: Sona BLW Precision is also engaged in the production of starter motors for automotive applications. Starter motors play a vital role in starting the engine by providing the initial rotational power required.

The company’s starter motors are designed to deliver reliable performance and quick start-up capabilities, contributing to the overall efficiency and reliability of the vehicle’s electrical system.

Electric Vehicle (EV) Components: Recognizing the growing importance of electric mobility, Sona BLW Precision has expanded its focus on manufacturing components for electric vehicles.

The company provides specialized solutions for EV powertrains, including gears, differential assemblies, and other drivetrain components tailored to meet the unique requirements of electric vehicles. Sona BLW Precision aims to capitalize on the increasing demand for electric mobility and contribute to the advancement of sustainable transportation.

Sona BLW Precision Forgings has established a strong reputation for its precision engineering capabilities, product quality, and customer-centric approach. The company serves major automotive manufacturers globally and maintains strong relationships with leading OEMs (Original Equipment Manufacturers). With its focus on innovation, technological advancement, and commitment to excellence, Sona BLW Precision continues to be a key player in the automotive component industry.

Investment Rationale By Analyst

Strong Order Book Growth:

Sona BLW Precision Forgings has witnessed a significant increase in its order book, reaching Rs 21,500 crores in FY23 compared to Rs 18,600 crore in FY22. This growth indicates promising business prospects for the company, highlighting its ability to secure new contracts and projects.

Organic Growth:

Despite a decline of approximately 7 percent in the overall market, Sona BLW Precision has achieved organic growth. This showcases the company’s resilience and ability to thrive even during challenging periods. It reflects the company’s strong fundamentals and effective strategies in capturing market opportunities.

Customer Concentration Reduction:

Sona BLW Precision has successfully reduced its customer concentration, aiming to maintain it at a level of 15-20 percent over the next 3-5 years. This diversification strategy helps mitigate risks associated with heavy reliance on a few customers and enhances the company’s stability and long-term growth prospects.

Market Dominance in Differential Gears:

Sona BLW Precision has established its dominance in the market for differential gears. The company’s market share in this segment has increased from 4.5 percent in CY19 to 7.2 percent in CY22. This indicates a strong position in the market and demonstrates Sona BLW Precision’s ability to capture a significant share of the market demand for differential gears.

Fundamentals

- Market Cap ₹ 30,207 Cr.

- Current Price ₹ 516

- High / Low ₹ 609 / 397

- Stock P/E 75.9

- Industry PE 27.4

- Return over 1year -9.68 %

- PEG Ratio1.96

- Price to book value 13.2

- Book Value ₹ 39.1

- Dividend Yield 0.55 %

Financials

- ROCE 22.4 %

- ROE 18.6 %

- OPM 25.4 %

- Debt ₹ 295 Cr.

- Debt to equity 0.13

- Qtr Profit Var 17.0 %

- Qtr Sales Var 35.5 %

- Return on equity 18.6 %

- Free Cash Flow ₹ 198 Cr.

Shareholding Pattern

- Promoter holding 33.0 %

- FII holding 24.7 %

- Public holding 11.0 %

- DII holding 31.3 %

- Change in Prom Hold -20.5 %

- Chg in FII Hold 13.4 %

- Chg in DII Hold 6.91 %

APL Apollo Tubes

Target Price: Rs 1,500

Company Overview:

APL Apollo Tubes is the largest producer of Structural Steel Tubes in India.

The company has gained significant market share through a combination of innovation, acquisitions, branding, and distribution strategies.

Business and Products:

Structural Steel Tubes: APL Apollo specializes in the manufacturing of Structural Steel Tubes, which are widely used in various industries such as construction, infrastructure, and engineering.

The company offers a comprehensive range of steel tubes, including hollow sections, black pipes, galvanized pipes, pre-galvanized pipes, and customized solutions to cater to diverse customer needs.

Manufacturing Facilities: APL Apollo operates 11 manufacturing facilities strategically located across India. These facilities are situated in Uttar Pradesh, Hyderabad, Bangalore, Tamil Nadu, Chhattisgarh, Karnataka, and Maharashtra.

With a current manufacturing capacity of nearly 3.6 million tonnes per annum (MTPA) in FY23, the company has a strong production infrastructure to meet market demands.

APL Apollo Tubes is a leading player in the production of Structural Steel Tubes in India. With its diverse range of products, strong manufacturing capabilities, resilient financial performance, and promising growth prospects, the company is well-positioned to capitalize on the evolving market dynamics in the steel industry.

Investment Rationale By Analyst:

Market Leadership and Growth:

APL Apollo Tubes has established itself as the largest producer of Structural Steel Tubes in India. Through a combination of innovation, strategic acquisitions, effective branding, and robust distribution, the company has gained significant market share, increasing from 27% in FY16 to 55% in FY22. This market leadership and growth trajectory position APL Apollo for continued success in the industry.

Strong Manufacturing Capacity and Strategic Presence:

With a current manufacturing capacity of nearly 3.6 MTPA in FY23, APL Apollo operates 11 manufacturing facilities strategically located across India. These facilities are situated in Uttar Pradesh, Hyderabad, Bangalore, Tamil Nadu, Chhattisgarh, Karnataka, and Maharashtra. This widespread presence enables the company to cater to diverse customer demands and strengthens its market position.

Resilient Financial Performance:

Despite the challenges posed by the Covid-19 pandemic, APL Apollo has demonstrated resilience with an intact EBITDA margin of 7%. This resilience reflects the company’s competitive edge over its peers, highlighting its ability to adapt to market conditions and maintain stable financial performance.

Future Growth Initiatives:

APL Apollo has embarked on new initiatives to fuel its growth. These include launching specialized products, expanding its manufacturing capacity to 5 million tonnes by FY26, and leveraging its distribution network. These strategic moves position the company to capitalize on evolving market trends and drive future growth.

Projected Financial Performance:

Analysts anticipate robust financial performance for APL Apollo Tubes, with expected compound annual growth rates (CAGR) of 33% in revenue, 32% in EBITDA, and 38% in PAT from FY23 to FY25E. These projections reflect the company’s strong momentum and its ability to deliver sustainable growth.

Fundamentals

- Market Cap ₹ 35,831 Cr.

- Current Price ₹ 1,292

- High / Low₹ 1,352 / 816

- Stock P/E 55.8

- Industry PE 14.6

- PEG Ratio 1.73

- Book Value ₹ 108

- Price to book value 11.9

- Dividend Yield 0.27 %

- Return over 1year 47.0 %

Financials

- ROCE 27.7 %

- ROE 24.4 %

- OPM 6.32 %

- Debt ₹ 873 Cr.

- Debt to equity 0.29

- Qtr Profit Var 23.8 %

- Qtr Sales Var 5.13 %

Shareholding Pattern

- Promoter holding 31.2 %

- FII holding 25.7 %

- Public holding 32.0 %

- DII holding 11.1 %

- Change in Prom Hold 0.00 %

- Chg in FII Hold 1.40 %

- Chg in DII Hold 0.66 %

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“Driving Growth – A Fundamentally Strong Small Cap Company” A key player in the chemical industry , showcasing growth. Here is the reason why…Read More