Rs 782 to Rs 3,552 in three years: Can multi-bagger FMEG stock hit the Rs 4,000 mark?

In today’s world, it’s hard to imagine a life without electricity.

Even if there is a power cut for a single day, we face so many difficulties like not being able to charge our gadgets, turn on the lights, or watch our favorite shows. Fortunately, we live in an era where accessing light and electricity has become easy and hassle-free.

Today, 97% of India’s households have electricity. But have you ever wondered how electricity is distributed throughout the country, or who has taken the initiative to ensure that lights shine in every corner of the nation?

In this blog, we will discuss the key player in the industry that took the initiative to make sure that the whole country is connected through their wires and cables.

We are talking about Polycab India, India’s largest manufacturer, and seller of wires & cables company that has been working hard since 1996 to ensure that light and electricity are easily accessible to people like you and me.

Let’s find out more about the exciting business of Polycab India and discover how they make a difference in our everyday lives.

Wires and Cables – Connecting the Nation:

Polycab is a renowned company that manufactures and sells wires, cables, and FMEG products under the trusted ‘POLYCAB’ brand. It has a diverse range of 600+ products available on popular E-commerce portals.

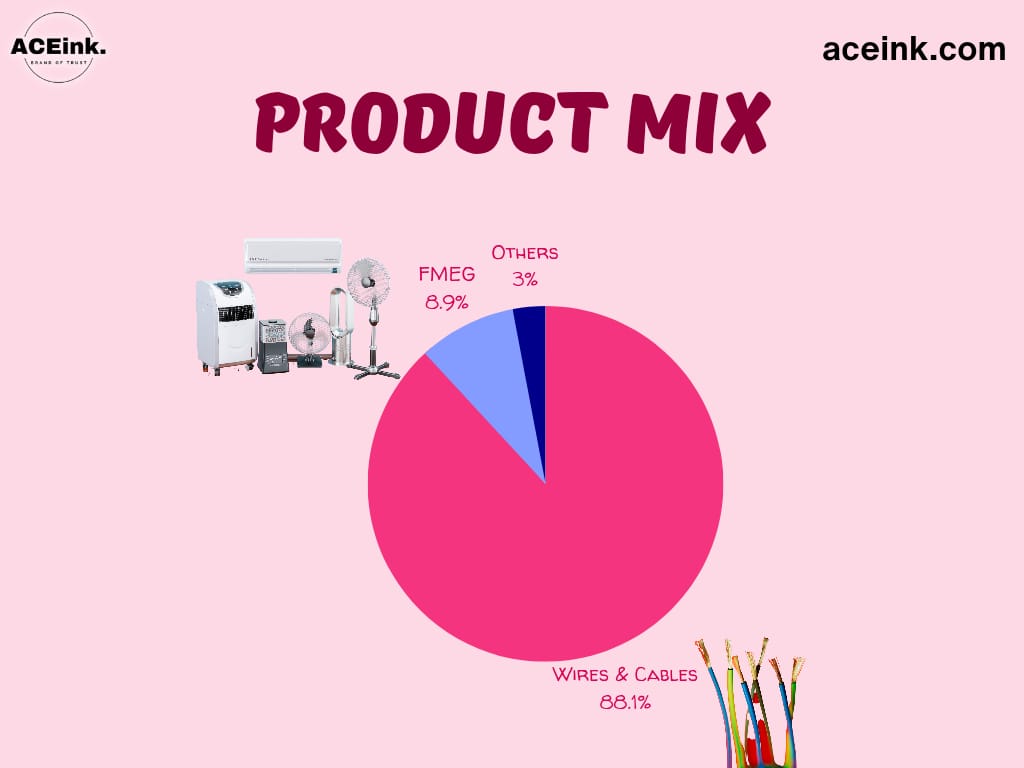

Polycab dominates the wires and cables market in India, with an impressive market share of 22-24% in the organized segment. This segment of the business earns 89% of its total revenue. Their wires and cables cater to both retail and industrial customers, serving various sectors like

- Chemicals,

- Energy,

- Technology, </li

- Infrastructure, and more.

From house wires to industrial flexible wires, Polycab provides a wide range of reliable solutions for different needs. Polycab offers various types of wires to suit different needs. Some of the popular ones include:

- House wires: These are commonly used for residential electrical installations.

- Green wires: Polycab Green Wire is a special offering that utilizes 5-in-1 Greenshields technology.

- Industrial Flexible Wires: Designed to sustain the challenges of industrial environments.

- Speaker wires: Specifically crafted for audio systems and speaker installations.

In addition to wires, Polycab provides a comprehensive selection of cables to meet diverse requirements. These include:

- Optical Fibre Cables (OFC): Used for high-speed data transmission over long distances.

- Fire survival cables: Designed to maintain functionality in case of fire emergencies.

- Solar cables: Specifically engineered for solar power systems.

- Railway signaling cables: Ensuring reliable signaling and communication in railways.

- Other cables: Polycab also offers specialized cables such as CCTV, festoon, and submersible cables. In FY23,Polycab witnessed remarkable growth in its wire and cable segment.

- Revenue increased by 17% year-on-year (YOY),

- While EBIT (earnings before interest and taxes) witnessed a significant 58% YOY growth.

Despite a strong base and lower commodity prices, the company achieved an EBITDA margin range of 11% to 13% for the cables and wires business.

Polycab is determined to accelerate the growth of its wires segment by improving the product mix in its overall cables and wires portfolio.

Recognizing that wires offer better margin potential, the company aims to further enhance its market presence and cater to the evolving needs of customers.

Fast-Moving Electrical Goods (FMEG)- Beyond Wires and Cables:

Alongside their wires and cables segment, Polycab has ventured into the fast-moving electrical goods (FMEG) business. This segment contributes around 9% of their sales and focuses on providing a diverse range of electrical products to consumers.

With a commitment to innovation and customer satisfaction, Polycab continuously launches new models and expands their offerings to cater to different price ranges and meet evolving consumer demands.

Expanding Product Offerings Polycab’s FMEG portfolio includes a wide range of products designed to meet various needs. Some of the key product categories are:

Solar Products: Polycab offers solar solutions to harness renewable energy, including solar panels, solar inverters, and solar cables.

Fans: Polycab offers a range of fans, including ceiling fans, pedestal fans, and table fans.

IoT-based Smart Range “Hohm”: Polycab has introduced a smart range of products that leverage Internet of Things (IoT) technology. These include smart switches, smart lighting solutions, and smart home automation systems.

LED Lighting and Luminaries: Polycab offers energy-efficient LED lighting solutions for residential, commercial, and industrial applications.

Switches and Switchgears: Their product range includes modular switches, sockets, MCBs (Miniature Circuit Breakers), and distribution boards.

Polycab’s FMEG business has made significant improvements in recent years. They have focused on distribution expansion, product innovation, and investment in brand building. Some notable achievements and initiatives include:

Polycab has witnessed market share gains across various FMEG categories, driven by product differentiation and customer-centric strategies.

To strengthen their presence in the home automation market and meet evolving consumer demands, Polycab acquired Silvan Innovation Labs.

Polycab has established a state-of-the-art switch manufacturing plant with an annual capacity of 12 million units.

They have also set up a new factory for fan production, adding an annual capacity of 6 million fan units.

International Presence – Powering the Global Stage:

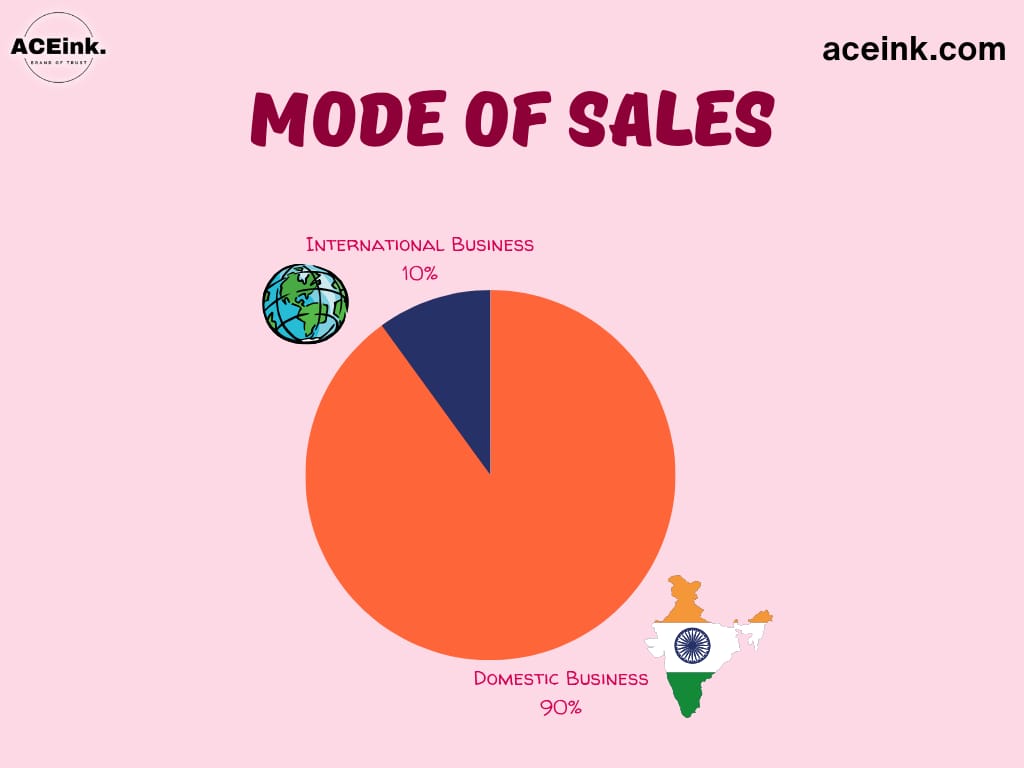

Polycab’s influence extends beyond the borders of India, as they operate in over 70 countries worldwide and had generated 9.8% of total revenue from their international business.

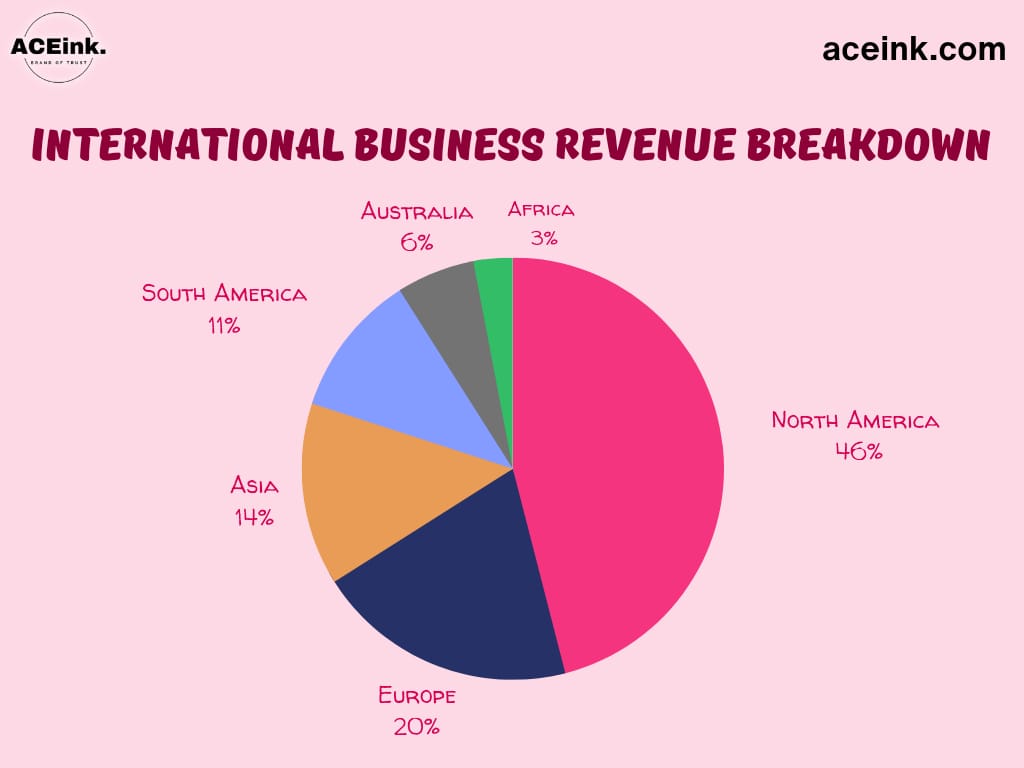

Their international cables and wires business largely focuses on business-to-business (B2B) sales, catering to a diverse range of industries and projects. Geographical Breakdown of International Business Revenue:

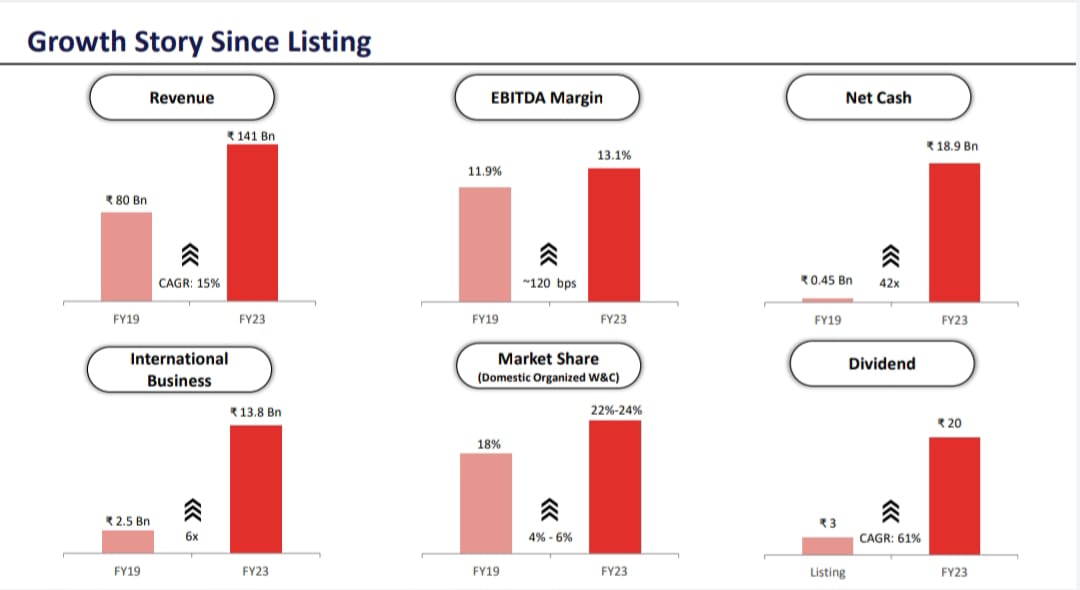

In FY23, their international business revenue witnessed a remarkable 50% year-on-year (YOY) growth. Polycab aims to achieve over 10% of its total revenue from its international business.

Polycab’s Remarkable Achievements:

Polycab’s reputation extends beyond manufacturing wires, cables, and FMEG products. They take immense pride in being the supplier of cables to India’s prestigious warships, INS Vikram Aditya and INS Vikrant.

Additionally, Polycab became an official partner of the International Cricket Council (ICC) in FY23, strengthening its connection with existing and potential customers while raising awareness and engagement worldwide.Manufacturing and Distribution:

Polycab has 25 manufacturing facilities and 23 warehouses and depots to keep its products safe. The best part is that they make almost all their products themselves! In fact, 95% of their products are made in-house to ensure top quality.

To bring their products to customers like us, Polycab has partnered with over 4,300 authorized distributors, along with more than 2 lakh retail outlets across the country.

Polycab added 317 new distributors for their wires and 371 new distributors for their other electrical products in just one year. These distributors and dealers are very important to Polycab because they contribute around 83% of the company’s revenue.

Expansion Plans:

Polycab is not resting on its accomplishments, they have big plans to further strengthen their manufacturing capabilities. In FY23, they invested a substantial amount of money, around Rs. 4,584 million, to improve their facilities.

But that’s not all! They have plans to invest even more, between $6-7 billion, to expand their manufacturing capabilities further.

The majority of this investment will be allocated to expanding their wires and cables business, while the remaining funds will be used for their other electrical products. The goal is to meet the growing demand, increase production capacity, and gain a larger market share.

Fundamentals of the company:

- Market cap: 54,162 crores

- Current price: 3,551

- High/Low: 3,637/2,104

- PE TTM: 42.61

- Industry PE: 27.18

- Face value: 10

- Dividend Yield: 0.55%

- Return over 1 year: 61.23%

Financials of the company:

- ROCE: 27%

- ROE: 21%

- OPM: 13%

- Debt: 191 crore

- Debt equity: 0.02

- Reserve: 6,481 crore

- Inventory: 2,951 crore

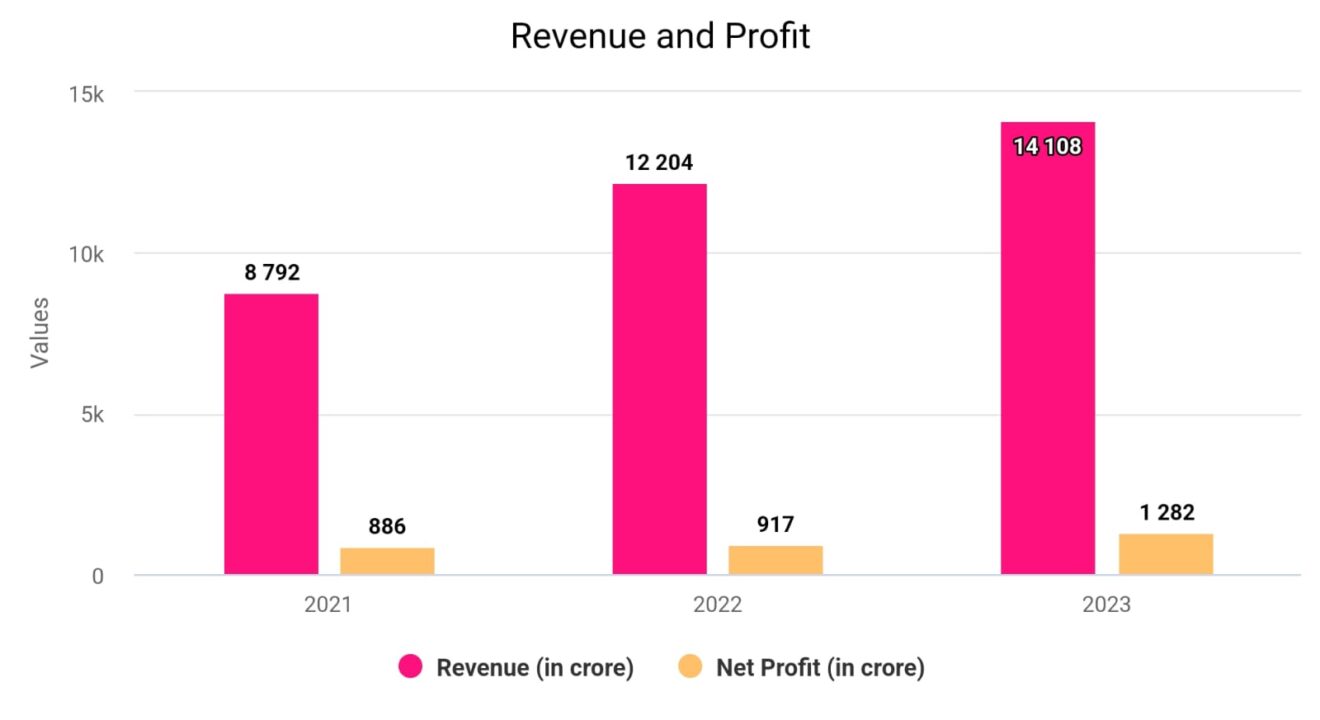

Financial Performance in FY 23:

Revenue: Polycab India made more money than ever before! They earned over ₹140 billion, This is a 16% increase compared to the previous year.

EBITDA: This term means the company’s earnings before subtracting expenses. Polycab India’s EBITDA grew even faster than their revenue. It increased by a whopping 46%! They also had a good EBITDA margin of 13.1%.

Valuation: Valuation means how much a company is worth compared to it’s similar companies. Polycab India’s valuation seems high when compared to its peers (other similar companies). However, this is because the company is expected to grow faster than others in its industry.

Shareholders: Polycab India has been creating value for its shareholders. The company’s market capitalization, which is the total value of all its shares, has been growing at a fast pace. It has increased by an average of 57% since the company was listed. Dividends, which are like rewards for shareholders, have also been growing by 63% each year.

Share holding pattern:

- Promoter holding: 66.21%

- FIIs holding: 9.78%

- DIIs holding: 9.34%

- Public holding: 14.67%

SWOT Analysis:

SWOT analysis is a way to examine the strengths, weaknesses, opportunities, and threats of a Company.

Strength:

Polycab India is a leading player in the domestic wires and cables industry, known for its quality products and reliability. With the largest distribution channels and a wide range of offerings, they are the biggest cable and wire business in India. They also have ambitious goals of global expansion and becoming one of the top 5 companies in the world.

The company’s quick turnaround time for delivering products, usually within 24 hours, has helped reduce inventory maintenance for dealers. This efficient supply chain management enhances customer satisfaction and reduces costs.

Polycab India demonstrates effective cost management, including employee costs, by allocating a reasonable portion of operating revenues to this aspect. This reflects their efficient use of resources and labour expenses.

Weakness:

The electrical wires and cables industry in India is highly competitive, making it challenging for Polycab India Limited to maintain a strong competitive position. Building strong customer relationships through excellent service and high customer satisfaction can help retain customers and maintain a stable customer base.

Polycab India Limited relies heavily on the Indian market, which exposes it to risks associated with local market conditions and the Indian economy. In recent times, the company has considered diversifying its business internationally to reduce dependence on the Indian market

Opportunities:

There is a growing demand for quality wires and cables in emerging countries like India, driven by the push for renewable energy and the modernization of infrastructure and communication facilities. This presents an opportunity for Polycab India to expand its market presence and cater to the increasing demand.

Favorable demographics in India, including a young working population, rising incomes, changing lifestyles, and rapid urbanization, create opportunities for Polycab India to meet the growing demand for consumer durables, electronic goods, and stronger urban infrastructure.

Polycab India is confident about improving its revenue and profit performance starting from FY24. This presents an opportunity for the company to enhance its financial performance and create value for its share holders.

Threat:

Fluctuations in raw material prices, particularly copper and aluminum, can impact Polycab India Limited’s profitability and production costs. Company have implement effective supply chain management practices to negotiate better pricing with suppliers .

Economic slowdowns or reduced consumer spending can pose a threat to the demand for electrical wires and cables, as well as FMEG products, affecting the company’s sales and profit growth. Company have focused on competitive pricing and exceptional customer service.Polycab India’s growth is tied to infrastructure development, and any delays or changes in projects can affect the demand for their products, requiring the company to adapt accordingly.

The company’s focus on higher-end products in the premium and super-premium categories demonstrates their commitment to providing high-quality offerings. This has contributed to higher profit margins and a strong reputation for their products. Polycab India has shown financial strength, with improved EBITDA margins, increased net cash on the balance sheet, and efficient management of debt. They have also effectively reduced their working capital days and increased dividend payouts, indicating their profitability and commitment to rewarding shareholders.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“Why the Thriving entertainment Industry Should Be on Your Investment Radar” Visualize the glistening waters of Goa, India’s…Read More

“Discovering Hidden Gems: The Investment Potential of the Gaming Stock”