“Why this stock has the growth Potential?”

In today’s world, the need for sustainable energy solutions has never been more critical.

Praj Industries, a leading player in the bioenergy sector, has been making significant strides in India’s energy transition towards a greener future.

With its recent joint venture with Indian Oil Corporation Limited (IndianOil) to strengthen biofuel production capacities, Praj Industries is poised for substantial growth.

Praj Industries Limited, a leading player in the environment, energy, and agri-process sectors, has recently made headlines with its joint venture (JV) announcement with Indian Oil Corporation Limited (IndianOil).

This strategic partnership between Praj Industries and IndianOil is expected to drive the growth of various biofuels, including Sustainable Aviation Fuel (SAF), Ethanol, Compressed Bio-Gas (CBG), Biodiesel, and Bio-bitumen. With a 50:50 joint venture agreement signed in October 2021, both companies are poised to leverage their respective expertise and technologies to revolutionize the bioenergy landscape in India. To learn more about stock market basics and stock analysis one can consider enrolling in our Stock Market Learning Courses, here.

Praj Industries’ strong performance and potential have also caught the attention of industry analysts.

Prabhudas Lilladher, a domestic brokerage firm, views the partnership with IndianOil as a positive development for Praj Industries, with biodiesel expected to be among the next growth drivers for the company. The brokerage highlights Praj’s strong market presence in domestic ethanol plants, its global footprint, and its focus on future-ready technologies such as 2G plants, Compressed Biogas (CBG), ECTA, and SAF.

Prabhudas Lilladher rates Praj Industries as a Buy with a target price (TP) of Rs 475, emphasizing the company’s potential to capitalize on upcoming opportunities.

The Company

Praj Industries, founded in November 1985, is a company led by Mr Pramod Chaudhari and his associates. They established their manufacturing facility in the special economic zone in Kandla, Gujarat, in 2007. The company’s commitment to research and development led to the launch of a pilot plant in 2008, dedicated to exploring second-generation cellulosic ethanol technology at the Praj Matrix R&D Center.

In 2012, Praj Industries expanded its portfolio by acquiring a 50.2% stake in Praj HiPurity Systems Ltd. Over time, they increased their stake to 100% in 2015. Praj HiPurity Systems specializes in manufacturing and setting up water treatment plants and modular process systems. Their clientele mainly consists of industries such as pharmaceuticals, biotechnology, cosmetics, and food and beverages.

The company has a strong global presence, with more than 750 references in over 75 countries.

Key Business Segments:

a. Bioenergy Solutions:

Praj Industries offers technology solutions for bioenergy production, including first-generation ethanol, second-generation ethanol, compressed biogas (CBG), and biodiesel systems.

The company’s bioenergy solutions contribute to reducing dependence on fossil fuels and promoting the use of renewable energy sources.

b. High Purity Systems (PHS):

Praj Hipurity Systems, a wholly-owned subsidiary of Praj Industries, provides water systems, modular process systems, and value-added services to industries such as biopharma, sterile formulations, cosmetics, and nutraceuticals.

PHS ensures the highest purity and quality standards in critical processes, supporting the production of high-quality pharmaceutical and healthcare products.

c. Engineering Products:

Praj Industries’ Engineering Products segment offers critical process equipment and systems to various industries, including oil and gas, refining, and chemicals.

The company supplies customized static equipment like pressure vessels and reactors, designed to meet the specific requirements of its clients.

Revenue Contribution:

In FY22,

-Bioenergy segment accounted for 71% of Praj Industries’ total revenue and

-High Purity Systems segment accounted for 9% and

-Engineering Products segment accounted for 20%.

Research and Development (R&D) Initiatives:

-Praj Industries places significant emphasis on research and development to drive innovation and technological advancements.

-The company operates Praj Matrix, an innovation center dedicated to improving second-generation (2G) ethanol technology and exploring different feedstocks.

-Praj Industries has filed over 300 patents, both in India and internationally, reflecting its commitment to innovation and intellectual property development.

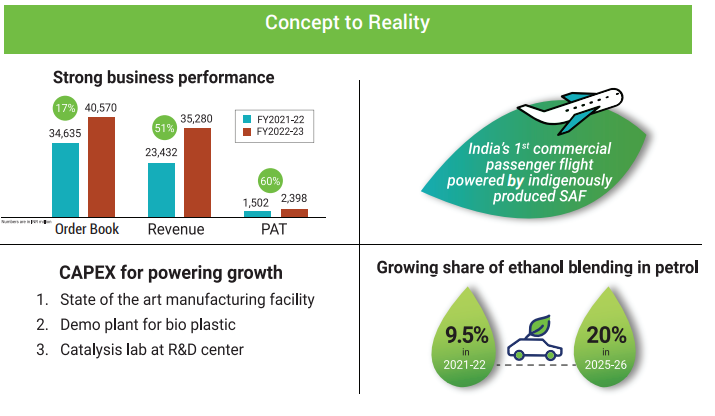

CAPEX Proposal:

Praj Industries has received final approval for a CAPEX proposal of Rs. 200+ crores.

This investment will establish a modern manufacturing facility focused on energy transition and climate action. This initiative underscores the company’s commitment to expanding its capabilities and meeting the growing demand for sustainable solutions.

National Bio-Chemical Policy:

Praj Industries actively participates in the development of the National Bio-Chemical policy as a knowledge partner.

The company’s involvement aims to reduce dependence on petrochemicals across multiple sectors while attracting significant investments of over ₹10,000 crores.

This policy alignment underscores Praj Industries’ commitment to sustainable development and its contribution to the national agenda.

Financial Performance:

Consolidated Income from Operations:

-Praj Industries achieved impressive financial performance in Q4 FY23, with consolidated income from operations reaching 10 billion, compared to 8 billion in Q4 FY22.

-In FY23, Praj Industries reported a significant increase in full-year income from operations, amounting to 35 billion compared to 23 billion in FY22.

-The company’s order intake during the quarter was 10 billion, with a majority of 76.5% coming from the domestic market.

-Export revenue accounted for 17.4% of FY23, with the bioenergy segment contributing 73.8%, engineering segment contributing 19.3%, and PHS business contributing 6.9%.

-Praj Industries has a robust order book, which has grown by 20% YoY. The company’s win rate on order inflow has also increased, indicating strong demand and a healthy pipeline for future growth.

-Praj Industries is focused on protecting its margins by establishing a higher value product mix and improving internal processes through digitalization and standardization.

-As newer orders come in, the company expects margins to improve.

Key Drivers & Detailed Description

Established market position:

Praj Industries holds a dominant market position in the domestic ethanol plant installation and equipment business as well as the domestic breweries installation segment. The company’s global presence with over 1,000 references in more than 100 countries across five continents further supports its market position. Praj provides end-to-end solutions, including process technology and equipment for distillery and brewery segments, wastewater treatment technology, and critical process equipment.

The successful commercialization of their second-generation ethanol plant and upcoming projects in India enhance the company’s business risk profile. Collaborations with international partners and increased government focus on ethanol blending targets are expected to drive growth in the medium term.

Satisfactory order pipeline:

Praj Industries has a strong order book of Rs 3,380 crore as of December 31, 2022, across its three business segments, ensuring medium-term revenue visibility.

Praj Industries witnessed a robust 20% YoY growth in its outstanding order book.

The company’s improved win rate on order inflow, increasing from 700 crores to 900-1050 crores in the last five quarters, showcases its ability to secure new projects and maintain a strong pipeline for future growth.

The ethanol business has witnessed improved order inflows due to favorable government policies. Rising demand and support from recent policies are expected to benefit the bioenergy segment. The company expects order inflow to gradually improve, and any developments in this front will be closely monitored.

Healthy diversity in revenue profile:

-Praj Industries has successfully diversified its revenue streams beyond ethanol-based products.

-The company has ventured into water and wastewater management, critical process equipment, bio-nutrients, and HiPurity Systems, reducing its dependence on its core ethanol business.

-These diversified areas, divided into two business divisions – HiPurity and engineering businesses, contributed 25-30% to the consolidated revenue for the first nine months of fiscal 2023. Praj Industries also has a diversified geographical presence, with exports contributing 15-20% to revenue over the past five fiscal years.

Strong financial risk profile and liquidity:

Praj Industries maintains a strong financial risk profile, supported by robust cash accruals and negligible debt.

The company’s net worth stood at Rs 927 crore as of September 30, 2022, and is expected to exceed Rs 950 crore in the coming fiscal years, with an estimated annual cash accrual of over Rs 150 crore.

Debt protection metrics are comfortable, with an adjusted interest coverage ratio of 89.4 times in fiscal 2022.

Risks and Considerations:

Exposure to cyclicality in the capital goods industry:

Praj Industries operates in the inherently cyclical capital goods sector, where demand is dependent on the capital expenditure cycle of its end-user industries. Economic downturns or weak capex momentum can impact the company’s revenue and profitability. The working capital cycle can also be stretched during economic slowdowns, affecting project execution.

Commodity Price Volatility:

Praj Industries is exposed to price fluctuations in key commodities, such as steel and raw materials. Rapid changes in commodity prices can impact the company’s profitability and margins.

Regulatory and Policy Changes:

Changes in government policies and regulations, particularly in the bioenergy sector, can create uncertainties and affect the demand for Praj Industries’ products and solutions.

Market Competition:

The environment, energy, and agri-process sectors are highly competitive, with both domestic and international players vying for market share. Praj Industries faces competition from companies offering similar solutions, requiring continuous innovation and effective marketing strategies.

Exposure to project-related risks:

Praj Industries faces project-related risks, including fluctuations in input prices. The average duration of a project is 12 months, and volatility in input prices during this period can impact costs and profitability. While the company collects advance payment in most fixed price contracts and has prudent purchase policies in place, adverse movements in raw material costs can still have an impact.

Outlook

Praj Industries is expected to benefit from its established market position, improving order pipeline, and revenue diversification. The company’s financial risk profile is projected to remain strong, supported by steady cash accrual, prudent funding for capital expenditure, and strong liquidity.

However, the company is exposed to risks related to cyclicality in the capital goods industry and project-related uncertainties.

Continued weak operating profitability and higher debt-funded capital expenditure could lead to a downgrade in the rating. Conversely, substantial and sustainable increases in revenue and profitability along with a healthy financial risk profile could lead to an upward revision in the rating.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“Why this small-cap stock can perform exceptionally in the future? ” What comes to your mind when you hear……Read More

Down 20% in 1 year, but why analysts are bullish on this small cap?