Defense stock rally up to 64% on strong growth prospects but here is a twist!

In recent times, India has been achieving remarkable milestones in various sectors like defense and space. India has been launching satellites into space. India is also strengthening its defense by promoting domestic manufacturing.

Behind every successful space mission or defense project, there are tiny yet very crucial components working tirelessly. These precision-engineered components play a pivotal role in ensuring the mission’s success. From critical precision parts that guide rockets through space, to assemblies that power nuclear reactors, each component has a specific role that contributes to the bigger picture.

One of the unsung heroes working behind the scenes to make these missions successful is MTAR Technologies. They are a leading player in India’s precision engineering industry.

MTAR Technologies has been contributing to India’s space and defense projects by making special components that are very important. These components work together perfectly, making sure everything goes smoothly and missions are successful.

About the Company

MTAR makes important parts and equipment for various industries like defense, aerospace, nuclear, and clean energy.

It was founded in 1970 by Mr. PR Reddy, Mr. KSN Reddy, and Mr. PJ Reddy.

The company was set up to help the Indian government with technical and engineering requirements after certain restrictions were lifted. MTAR’s manufacturing facilities are based in Hyderabad and consist of seven units within a 4 km area, along with a special facility for exporting their products.

Powering Clean Energy Innovations with Precision Engineering

In the Clean Energy sector, the company provides important things like SOFC and hydrogen units, sheet metal assemblies, enclosures, and more for fuel cells. They also make electrolyzer units for solid oxide electrolyzers.

Recently, they’ve started making cable harnessing assemblies and working on orders for special structures in the Hydel (hydropower) and Waste to Energy sectors.

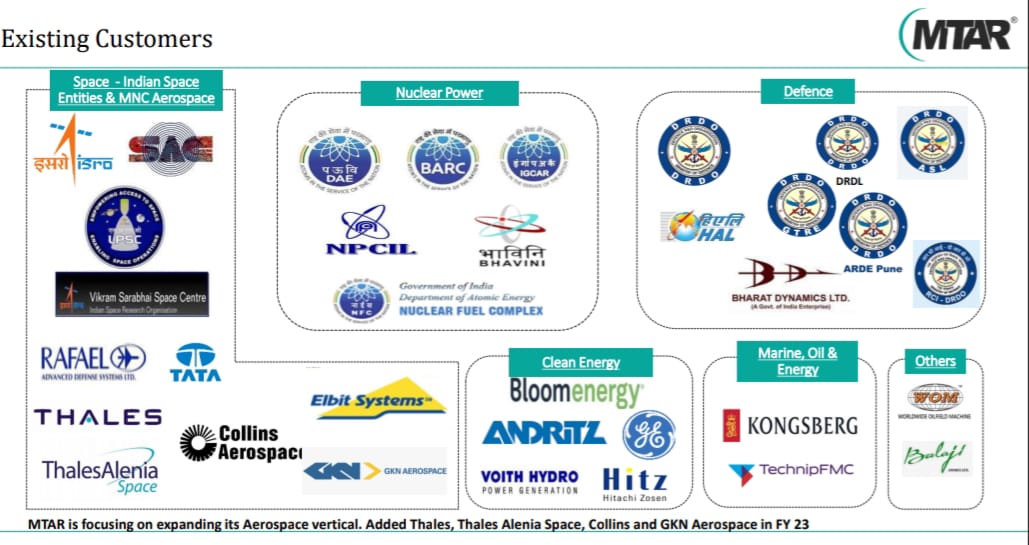

They make crucial parts for companies like Bloom Energy and Andritz. Bloom Energy, a key customer, accounts for over 80.0% of MTAR’s revenues. This partnership has been ongoing for over nine years, indicating a strong and stable business relationship.

Currently, the company is developing and making hydrogen boxes and electrolyzers for Bloom Energy to use.

In the Hydel sector, they create important structures for clients such as Andritz, Voith, and GE Power. These structures are essential for hydropower projects.

Key Role in India’s Nuclear Power Program and Essential Reactor Products

For the last four decades, the company has actively participated in India’s civilian nuclear power program. They specialize in manufacturing and supplying highly complex products that are crucial components of nuclear reactors.

Their product portfolio includes various items for the nuclear industry, such as Fuel Machining Heads which are used to load and unload fuel bundles in the reactor’s core, Drive Mechanisms are essential for regulating and shutting down nuclear reactors under normal and challenging conditions. Bridge and Column Assemblies help move the fuel machining head sideways and vertically to load and unload different nuclear fuel bundles in the reactor.

They also produce Coolant Channel Assemblies, which consist of components like Sealing Plugs, Shielding Plugs, Liner Tubes, and End Fittings. These play a significant role in the core of civilian nuclear reactors and involve assembling a large number of components.

These products are not only used in new pressurized heavy-water reactors (PHWR) but also play a crucial role in refurbishing existing reactors. By providing these components, the company ensures the safe and efficient operation of nuclear power plants, contributing to the generation of electricity for homes and cities.

Company’s Mission-Critical Expertise for ISRO and Thrilling Spacecraft Components

MTAR has been a reliable supplier for various missions of ISRO (Indian Space Research Organisation). One of the company’s significant contributions was supplying the engine for PSLV-C25. This rocket successfully launched the Mars Orbiter Mission, also known as the Mangalyaan spacecraft, as part of ISRO’s Mars mission. It was a remarkable achievement for both ISRO and the company.

The company’s expertise lies in making different kinds of rocket engines. They are skilled in manufacturing liquid propulsion engines, cryogenic engines, and electro-pneumatic modules specifically designed for space launch vehicles. These engines are essential for powering the rockets and ensuring they can carry satellites and spacecraft safely into space.

Apart from engines, the company supplies important components for cryogenic engines such as turbopumps, booster pumps, gas generators, and injector heads. These parts play a crucial role in the functioning of cryogenic engines.

A Leading Force in India’s Defence Sector and Aerospace Industry

MTAR is an important company in India’s defense sector, they’ve been supplying highly precise components, subsystems, and systems for defense and aerospace programs for over four decades. They have been part of prestigious Indian defense programs, working with organizations like DRDO labs and DPSUs, and have collaborated with international players like ELBIT Israel and Rafael Israel.

Some of the things they supply are Helicopter Housings, Magnesium Gear Boxes, Dalia Actuators for LCA Tejas, and Aerostructures like Wing Kit Assemblies.

In the aerospace industry, MTAR gained significant customers in 2022-23, including Collins Aerospace, Thales, and GKN/Aerospace. These partnerships are essential for their growth and contributions to the aerospace sector.

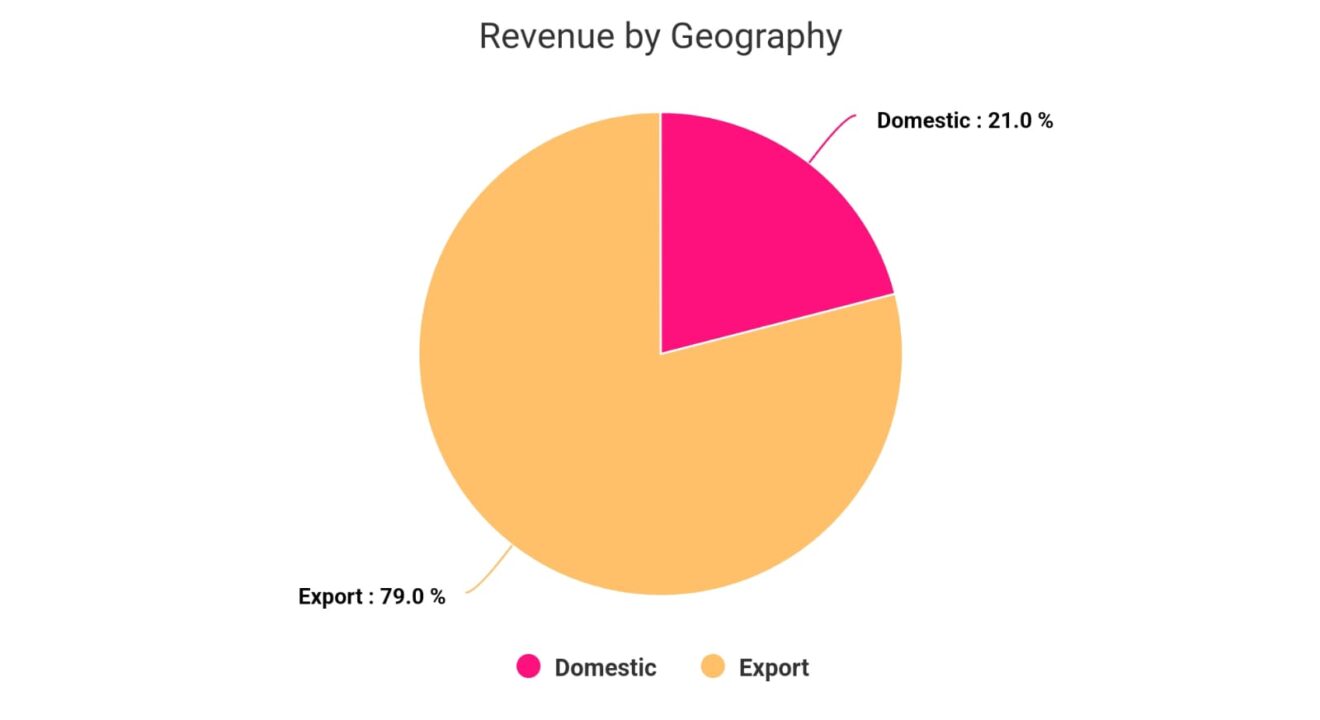

REVENUE BY GEOGRAPHY

KEY CUSTOMERS OF THE COMPANY’S PRODUCTS

MTAR’s Modern Manufacturing and Growth through Innovation

The company has seven modern manufacturing facilities in Hyderabad, Telangana, with state-of-the-art capabilities. They have in-house product design, advanced machining, specialized fabrication, system integration, surface treatment, and heat treatment capabilities.

To ensure top-notch quality, they have a strict testing and quality control process at every stage of production, making sure the finished products meet the exact requirements of their customers.

MTAR is actively working on developing several new products, such as the Small Satellite Launch Vehicle, cable harness assemblies, and electro-mechanical actuation systems.

They have invested in futuristic manufacturing technologies for advanced machining, assembly & integration, surface treatment, heat treatment, and quality control capabilities, all available under one roof. These investments help MTAR stay at the forefront of innovation and expansion in the manufacturing industry.

MTAR’s New Opportunities and Growth Prospects

MTAR is coming up with new products and reaching out to new customers, which is good news for the company. They have unique capabilities in 14 packages related to nuclear energy, and they are hoping to receive orders worth around Rs. 600 crores in the current financial year for these packages.

Apart from nuclear energy, they are also expecting orders from other sectors like aerospace, clean energy, space, and defense. They are planning to collaborate with Fluence Energy for energy storage systems, and this partnership is expected to bring in revenues of about INR 400 crores by the end of the third year starting from FY25.

Furthermore, MTAR is set to benefit from the Indian space policy, which encourages private sector involvement in the space industry. The company plans to design and develop its own launch vehicle in the small satellite launch vehicle segment. This move opens up exciting opportunities for MTAR in the space sector.

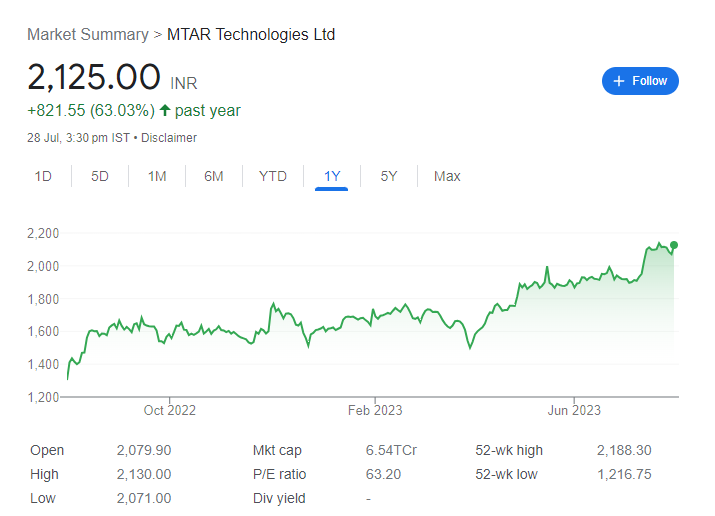

Fundamentals of the company:

• Market cap: 6,369 crores

• Current price: 2,126

• High/Low: 2,188/1,205

• PE TTM: 61.58

• Industry PE: 37

• Face value: 10

• Dividend Yield: 0.22%

• Return over 1 year: 71%

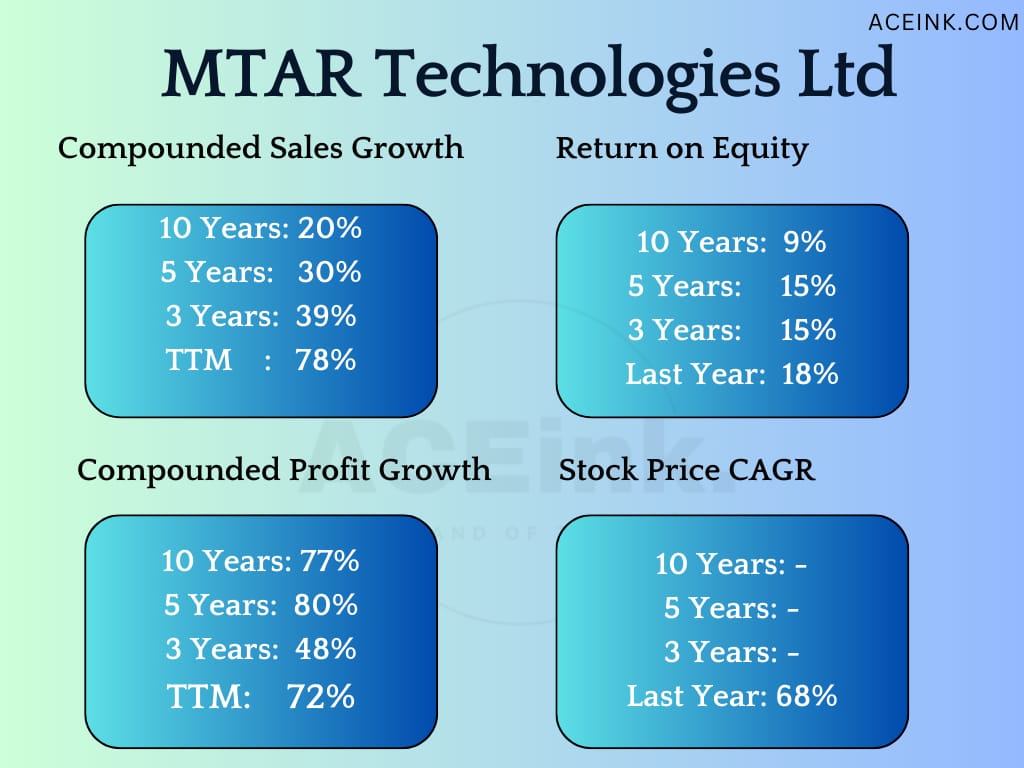

Financials of the company:

• ROCE: 22%

• ROE: 18%

• OPM: 27%

• Debt: 143 crores

• Debt equity: 0.23

• Reserve: 590 crores

• Inventory: 386 crores

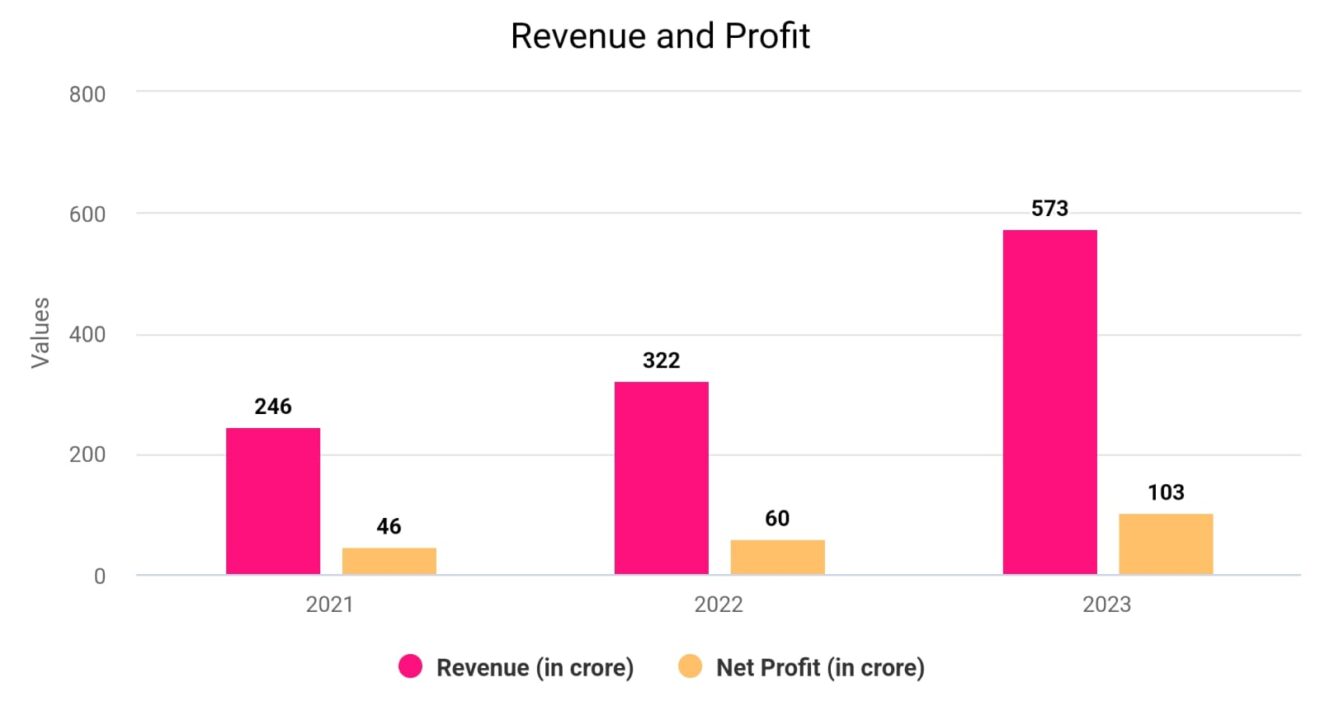

Company’s financial performance in FY 23:

Revenue Growth:

The company’s overall revenue witnessed an impressive growth of 78%.

The clean energy segment, comprising fuel cells, hydel, and others, led the way with an exceptional growth rate of 120%.

Additionally, the defense segment of the company also showed substantial progress with a growth rate of 87%.

Improved Net Working Capital:

The company successfully reduced its Net Working Capital days to 230, compared to 275 days in the previous year.

This reduction was achieved by decreasing receivable days, resulting from faster exports and improved global supply chains.

These improvements led to quicker customer payments after a challenging three-year period.

Strong Order Book:

The company has a closing order book valued at Rs 1,172 crore.

This indicates a robust pipeline of future projects and business opportunities for the company.

MTAR’s Ambitious Roadmap for Future Growth

MTAR has shared some positive expectations for its financial performance and growth. For the fiscal year FY24, they are confident that their revenues will increase by 45% to 50% compared to the previous year. Additionally, they expect their EBITDA margins to be around 28% for the same period.

The company is also looking forward to a strong order book, aiming to reach Rs. 1,500 crores by the end of FY24. Looking ahead, MTAR has set a clear roadmap to become a company with a revenue base of Rs. 3,000 crores by FY28. To achieve this, they plan to focus on diversifying their customer portfolio and generating substantial revenues from each of these customers.

Furthermore, MTAR is conservative in its approach to the clean energy segment, allocating 55% of their focus to it, while the remaining 45% is directed to other segments. This shows their prudent strategy for balanced growth across different business areas.

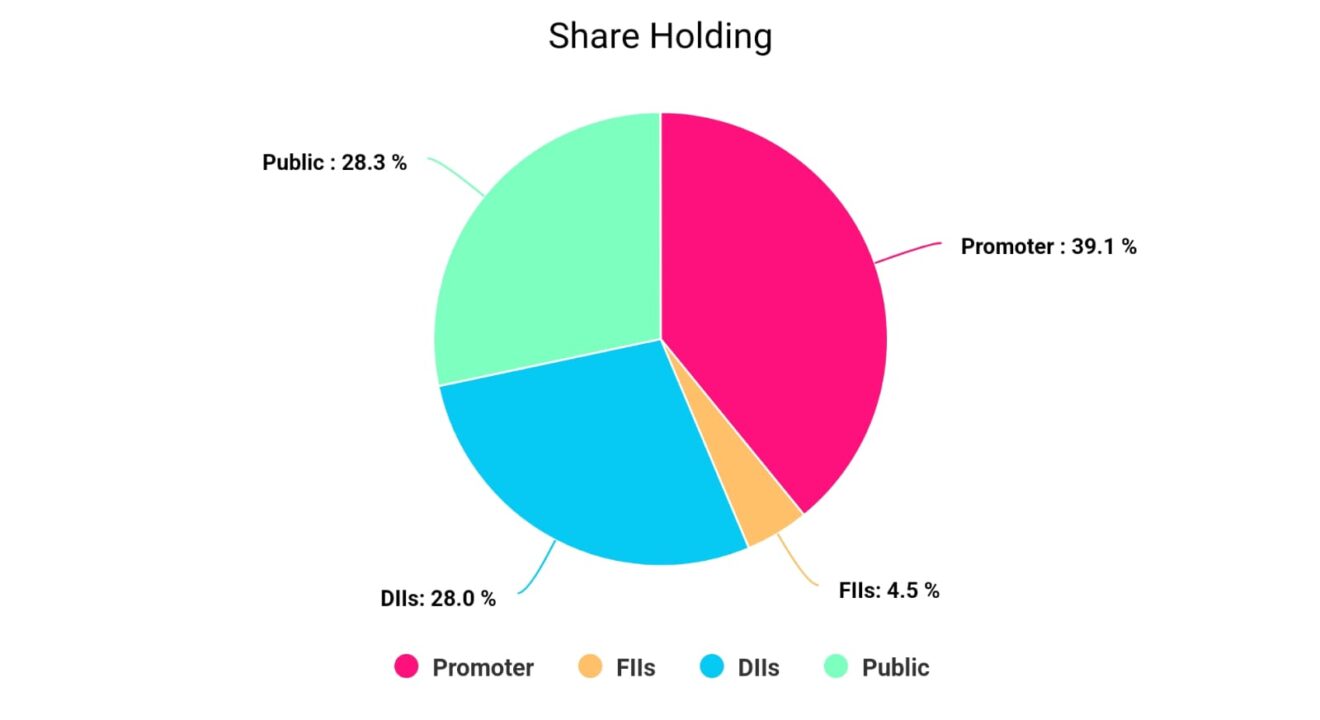

Shareholding Pattern: The Alarming Sign?

As of the quarter ending in June 2023, the promoters of MTAR Technologies held approximately 39.14 percent stake in the company. What has sparked interest is the consistent increase in the percentage of pledged shares relative to promoter holding since the quarter ending in June 2022. Let’s delve into the specific details:

Mar-22: Promoter Holding: 50.26%, Pledge: 1.46%

Jun-22: Promoter Holding: 47.47%, Pledge: 0.98%

Sep-22: Promoter Holding: 47.18%, Pledge: 1.25%

Dec-22: Promoter Holding: 47.18%, Pledge: 3.25%

Mar-23: Promoter Holding: 46.63%, Pledge: 3.86%

Jun-23: Promoter Holding: 39.14%, Pledge: 2.60%

This trend raises questions about the reasons behind these pledges and the potential risks involved.

Pledging shares is often seen as a way for promoters to raise funds or provide collateral for loans. However, it also means that the promoters have encumbered their ownership, potentially affecting the stock’s stability and giving rise to concerns about corporate governance.

Additionally, recent disclosures made under SEBI Prohibition of Insider Trading regulations revealed that Kavitha Reddy Gangapatnam, one of the promoters of MTAR Technologies, sold 114,862 equity shares at an average price of Rs. 1950 on June 21, 2023. While this transaction may not necessarily be alarming, it does highlight the importance for investors to closely monitor the stock’s developments and the actions of its promoters.

However, A positive development to note is that Plutus Wealth acquired MTAR Technologies’ shares for Rs 247 crore during the same quarter for a 4.23% stake.

SWOT Analysis:

SWOT analysis is a way to examine the strengths, weaknesses, opportunities, and threats of a Company.

To learn more about stock market basics and stock analysis one can consider enrolling in our Stock Market Learning Courses, here.

Strength:

– The company’s customer base is diverse, serving a wide range of segments both in India and internationally. This approach helps them reduce dependence on any single market, ensuring business stability.

– MTAR has earned a reputation as one of the top three suppliers of precision engineering in India’s critical sectors, including nuclear, defense, and space industries. Their expertise lies in manufacturing highly precise and complex components.

– MTAR has built strong, long-lasting relationships with major customers such as the Defence Research and Development Organization, the Nuclear Power Corporation of India, the Liquid Propulsion Systems Centre, and the Indian Space Research Organization, spanning more than 35-40 years. These relationships have led to repeat orders and a high level of trust between MTAR and its customers.

– MTAR has experienced significant growth in its operations, with revenue increasing from Rs. 157 crores in fiscal 2018 to Rs. 574 crores in fiscal 2023. This growth is attributed to high repeat orders from key customers.

– MTAR is not significantly affected by the increase in raw material costs since the company reviews and addresses these cost changes at the end of each quarter.

Weakness:

– MTAR relies heavily on government contracts and projects indirectly for a significant portion of its domestic revenue. This reliance makes the company vulnerable to fluctuations in government spending and bureaucratic delays, which can affect its business operations.

– MTAR’s high dependence on Bloom Energy, which contributes around 75% of its revenue, poses a significant risk. Any loss of business or adverse events involving Bloom Energy could severely impact the company’s financial condition and cash flows, leading to potential challenges in sustaining its operations.

Opportunities:

– The Clean Energy sector, especially the Fuel Cells segment, is expected to grow rapidly at a rate of 30%-35% CAGR over the next decade. This growth presents significant opportunities for MTAR Technologies to expand its business in this promising market.

– MTAR is exploring opportunities in the emerging hydrogen market and engaging in discussions with customers involved in Hydrogen Storage Systems. Leveraging their specialized engineering capabilities, they aim to tap into the potential of this evolving market.

– MTAR is in advanced discussions with Fluence Energy, a battery storage systems company. This opens up potential collaboration prospects in the growing renewable energy storage market, allowing MTAR to be part of the expanding sustainable energy sector.

– MTAR benefits from its expertise in handling high technical complexity and know-how, which has helped retain customers who prefer established suppliers over the long term.

Threat:

– Since a significant portion of MTAR’s revenue comes from exports, any fluctuations in exchange rates can pose a threat to the company’s financial performance. Unfavorable currency movements may impact their profitability and competitiveness in international markets.

– With over 60% of revenue coming from mass production, any equipment breakdowns or production delays could risk MTAR’s ability to deliver products on time. This situation might lead to orders being diverted to competitors, affecting the company’s market share and revenue.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.