How Israel-Hamas war can fuel fertilizer sector in India — explained

In the complex world of finance and global markets, even seemingly unrelated events can have far-reaching impacts. The Israel-Hamas war, a conflict that has been making headlines worldwide, is no exception.

But how does a regional conflict affect fertilizer stocks in India?

To understand this intriguing connection, let’s delve into the dynamics that link geopolitical tensions with the financial realm.

The outbreak of the Israel-Hamas war has sparked worries about the worldwide fertilizer supply. Experts are pointing to Israel’s Ashdod, a key port for potash exports, which is facing disruptions due to the conflict.

These disruptions include shipping restrictions and increased “war risk” surcharges, potentially affecting the smooth flow of goods.

The Critical Role of the Port of Ashdod

The Port of Ashdod in Israel, situated to the north of Gaza, plays a crucial role in the country’s potash fertilizer exports.

This port accounts for approximately 3% of the global potash supply, which is currently disrupted due to Israel’s conflict with Hamas. A concerning ripple effect that could exacerbate this disruption is if Iran were to become involved in the conflict.

Iran is a major exporter of nitrogen and possesses significant natural gas reserves, both of which are essential components in the production of nitrogen-based fertilizers.

Learning from Past Events

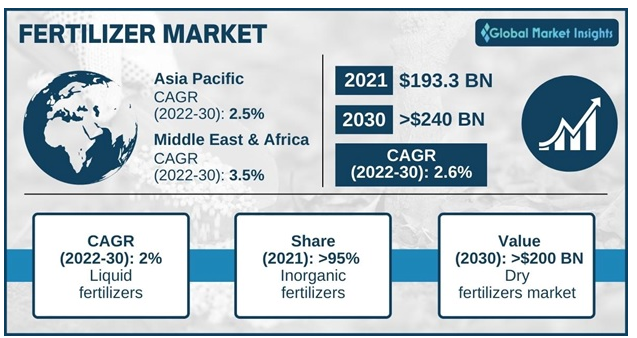

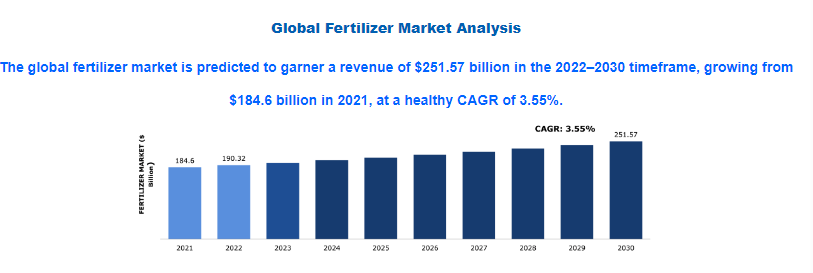

Looking back at the Russia-Ukraine war, experts see a similar pattern. Fertilizer stocks gained value during that period due to concerns about supply. Israel, being a significant potash exporter, is now experiencing similar supply-related worries.

Market Dynamics and Competition

Discussing the market dynamics, it’s worth noting that during the closing stages of Q4FY23 and the entire Q1FY24, fertilizer companies faced strong competition from a significant influx of affordable generic Chinese agrochemicals. This influx made many company managers cautious.

However, in Q2FY24, there were signs of this dumping receding, which led to higher prices and allowed fertilizer companies to improve their realizations.

This progress in the near-term outlook was reflected in the share prices. They also added that the sustainability of this rally is subject to any adverse geopolitical events.

Experts Insights

According to Sonam Srivastava, Founder and Fund Manager at Wright Research, the emergency operations at Ashdod are a cause for concern. Shipping restrictions and “war risk” surcharges have been imposed, which might hinder the smooth movement of goods. ICL Group, one of the world’s largest fertilizer companies, confirmed that they continue their operations despite the emergency.

Sreeram Ramdas, Vice President at Green Portfolio — PMS, draws a parallel with the Russia-Ukraine war and the recent spike in fertilizer stocks. He believes this is a short-term overreaction and predicts no significant impact in the medium term. The absolute value of Potash and Nitrogenous Fertilizers exported from Israel is relatively small at $330 million and $8 million, respectively.

It’s important to note that, unlike the price hike seen after the Russia-Ukraine war, experts do not expect a significant increase in this case.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.