“Rising Profits and Growth: A New Age Business Story”

In the dynamic world of modern business, certain trends and sectors are taking center stage.

The new-age business segment has been making waves, and one key player within this realm has recently experienced a notable transformation. With rising profits, this company exemplifies the vibrancy and potential of businesses operating in the digital age.

Zomato, a global leader in the food technology industry, is on a mission to redefine the way the world experiences food.

With its humble beginnings in India, Zomato has rapidly grown into a renowned international brand that connects people with culinary delights, ensuring that foodies across the globe enjoy a seamless and delightful dining experience.

Business Overview:

Zomato’s Innovative Approach to Food

Zomato is not just a food delivery service; it’s an integral part of modern gastronomy. The company’s business model encompasses a broad spectrum of services and innovations, ensuring it remains at the forefront of the ever-evolving food industry.

- Food Delivery: Zomato’s primary service is food delivery, making it a lifeline for those who savor restaurant-quality meals from the comfort of their homes. With a vast network of partner restaurants and an easy-to-use app, Zomato offers a diverse range of culinary options at the fingertips of users.

- Restaurant Discovery: Zomato’s platform is a treasure trove for food enthusiasts, providing detailed restaurant listings, user reviews, and ratings. This allows users to explore and discover dining establishments that align with their tastes and preferences.

- Zomato Gold: Zomato Gold is a subscription-based program that grants members exclusive benefits, including complimentary dishes and drinks at partner restaurants. It’s a testament to Zomato’s commitment to enhancing the dining experience.

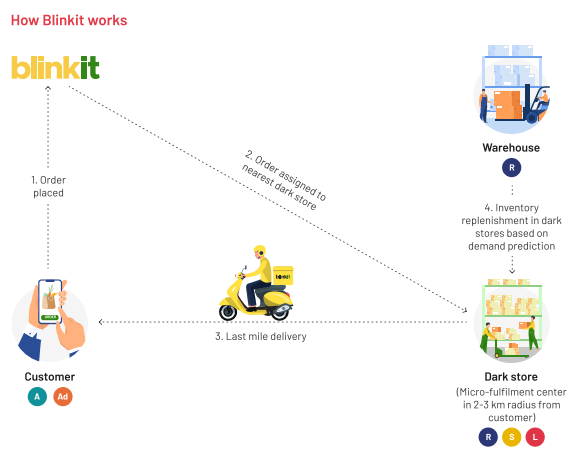

- Quick Commerce with Blinkit: The acquisition of Blinkit, a quick commerce platform, has expanded Zomato’s offerings to include fast delivery of groceries, essentials, and more. This diversification ensures Zomato remains an integral part of users’ daily lives beyond restaurant dining.

- Hyperpure: Zomato’s Hyperpure initiative is dedicated to ensuring that partner restaurants receive top-quality ingredients and supplies. By doing so, Zomato contributes to the overall improvement of the food industry.

- Sustainability: Beyond food, Zomato has taken a significant step toward environmental responsibility. The company is committed to transitioning to 100 percent electric vehicle-based food deliveries by 2030, a commendable effort in reducing its carbon footprint.

Zomato’s Impressive Growth and Future Plans

In the fiscal year 2022-23 (FY23), Zomato, witnessed significant growth and implemented strategic changes that fueled its success. Here’s a closer look at the key factors driving this growth and what lies ahead:

1. Expanding User Base:

- The number of unique transacting users in the food delivery business increased by 9 percent year-on-year, reaching 58 million in FY23.

- This growth can be attributed to the optimization of operational efficiency, the introduction of the Zomato Gold program, and the consolidation of multiple accounts within households.

2. Rising Order Values:

- Zomato’s average order value (AOV) in FY23 increased by 2 percent year-on-year, reaching Rs 407.

- This rise in AOV was driven by increased revenue per order, reduced variable costs, and minor reductions in delivery expenses.

- Food inflation also played a role in balancing the impact of smaller-sized orders following the COVID-19 pandemic.

3. Projected Growth:

- Analysts forecast a promising future for Zomato, with the company’s gross order value (GOV) expected to grow at a compound annual growth rate (CAGR) of 19 percent over FY23-26E.

4. Blinkit Acquisition:

- After acquiring the quick commerce platform Blinkit, Zomato focused on enhancing store-level productivity.

- This move resulted in a 77 percent year-on-year increase in monthly transacting users for Blinkit during the June-ended quarter.

- Moreover, the reduced store counts led to a threefold increase in GOV per day for dark stores, contributing to a significant improvement in contribution margin.

5. Hyperpure Initiative:

- Hyperpure, an initiative by Zomato, provides high-quality ingredients and supplies to restaurants.

- In FY23, Hyperpure’s revenue grew by 90 percent year-on-year, driven by an increase in partner restaurant count and revenue per restaurant.

- There is still ample room for Zomato to expand its restaurant network in the Hyperpure business.

6. Financials:

- Zomato’s cash balance experienced a modest 2 percent year-on-year decline in FY23 due to losses in the core business and cash outflow related to the Blinkit acquisition.

- Additionally, the company’s other liabilities saw a 42 percent year-on-year increase, primarily due to payments owed to merchants.

7. Commitment to Sustainability:

- Zomato is committed to environmental sustainability and has pledged to achieve 100 percent electric vehicle (EV)–based food deliveries by 2030.

- The company reported a threefold year-on-year increase in active EV-based delivery partners, reaching 13,500 in FY23.

- Zomato has partnered with over 50 companies in the EV ecosystem to onboard around 1 lakh EV-based delivery partners within the next two years.

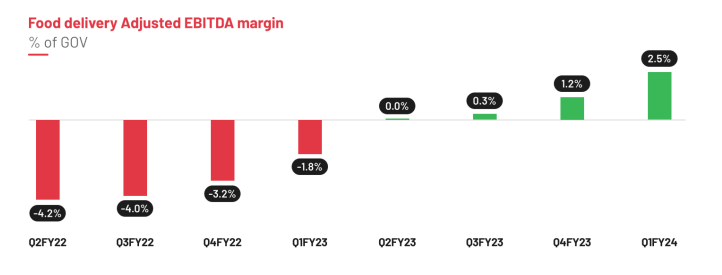

The Turnaround

Zomato has witnessed a turnaround with rising profits in recent quarters. This upswing in profitability has had a positive impact on the company’s share price. Zomato’s affiliation with the new age business segment, known for its digital innovation, contributes to this rise. The upcoming Q2FY24 results will be a crucial factor in determining the future trajectory of Zomato’s share price.

These developments demonstrate Zomato’s remarkable growth, strategic acquisitions, and commitment to a sustainable future, making it a noteworthy player in the food delivery industry.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.