All you need to know about PSU Stocks

The stock market can be a great way to grow your wealth over time. However, it can also be a risky venture, particularly if you are investing in Public Sector Undertaking (PSU) stocks.

PSU stocks are a type of stock that is issued by a company owned and operated by the government.These stocks are often considered to be a safe haven for risk-averse investors, but they can also be volatile and unpredictable.

So, are PSU stocks worth the risk?

This is a question that many investors ask themselves when considering investing in this type of stock. To answer this question, we need to take a comprehensive look at PSU stocks and understand the factors that influence their performance.

In this comprehensive analysis, we will explore the world of PSU stocks and delve into the various factors that influence their performance.

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

What are PSUs?

Public Sector Undertakings (PSUs) are companies in which the government holds a majority stake, i.e., over 51%. They are established to carry out specific objectives and functions that are in the public interest, such as providing essential goods and services, promoting economic development, and supporting strategic sectors.

How have PSUs performed historically compared to private sector companies?

Historically, PSUs have tended to offer relatively stable returns, but have often underperformed compared to private sector companies in terms of growth and profitability. However, there have been exceptions, and there are certainly some highly successful PSUs that have outperformed their private sector peers.

What factors should I consider when choosing which PSU to invest in?

When evaluating which PSU to invest in, there are a number of factors to consider, including:

-A.Sector-specific factors:

Different sectors will have different growth prospects, competitive dynamics, and regulatory environments, so it’s important to assess these factors on a case-by-case basis.

-B.Financial metrics:

Investors should consider key financial metrics such as revenue growth, profitability, debt levels, and dividend yields when evaluating a PSU investment.

1. Revenue and profit growth: Investors should look for PSUs that have a consistent track record of revenue and profit growth. This is an indicator of a healthy and growing company.

2. Return on equity (ROE): ROE is a measure of how efficiently a company is using its equity to generate profits. A higher ROE is generally considered to be better.

3. Price-to-earnings ratio (P/E): P/E ratio is a measure of the price investors are willing to pay for each rupee of earnings. A lower P/E ratio indicates that the stock may be undervalued.

4. Dividend yield: Dividend yield is the percentage of the current stock price that a company pays out as dividends each year. A higher dividend yield is generally seen as a positive sign for investors.

5. Debt-to-equity ratio: This ratio measures a company’s debt relative to its equity. A lower ratio is generally considered to be better as it indicates that the company has a lower debt burden.

6. Price-to-book ratio (P/B): P/B ratio is a measure of the price investors are willing to pay for each rupee of book value. A lower P/B ratio indicates that the stock may be undervalued.

7. Earnings per share (EPS): EPS is a measure of a company’s profit per share of stock. A higher EPS is generally seen as a positive sign for investors.

8. Operating margin: This metric measures a company’s profitability by comparing its operating income to its revenue. A higher operating margin is generally seen as a positive sign for investors.

-C.Management team:

The quality and experience of the management team can be a critical factor in the success of a PSU, so it’s important to assess their track record and leadership capabilities.

Q: Why are the Pros and Cons of investing in PSUs?

Investing in Public Sector Unit (PSU) Stocks in India: Pros and Cons

-Pros:

Government backing:

Since PSUs are government-owned, they often have a strong market position and the backing of the government, which can make them a more secure investment option.

Stability:

PSUs often have stable revenue streams due to their dominant market position, which can provide a sense of security for investors.

Dividends:

Many PSUs offer regular dividends to their shareholders, which can provide a reliable source of income for investors.

Growth potential:

Some PSUs have significant growth potential due to their market position and the potential for expansion into new sectors or markets.

-Cons:

Bureaucracy:

PSUs are often subject to bureaucratic processes and decision-making, which can slow down their ability to respond to market changes or implement new strategies.

Lack of innovation:

Due to their government ownership and bureaucratic processes, some PSUs may struggle to keep up with the pace of innovation in the private sector, which could impact their long-term growth potential.

Economic downturns:

Like any investment in the stock market, investing in PSU stocks carries the risk of economic downturns or market instability, which could impact the performance of these stocks.

Limited diversification:

Investing heavily in PSU stocks could limit the diversification of an investor’s portfolio, which could increase their overall risk exposure.

Regulatory changes:

Changes in government regulations or policies could impact the performance of PSU stocks, which could be a risk for investors.

Let’s understand it with some examples from Public sector undertakings (PSUs) in different Sectors:

Banks:

Pros:

-PSUs in the banking sector have a strong presence in rural and semi-urban areas, which helps to promote financial inclusion and provide banking services to a larger segment of the population.

-They are considered to be more stable and less risky, as they are backed by the government and have a long history of serving the public.

-PSUs in the banking sector have played a key role in funding large infrastructure projects, which has contributed to the growth of the economy.

Cons:

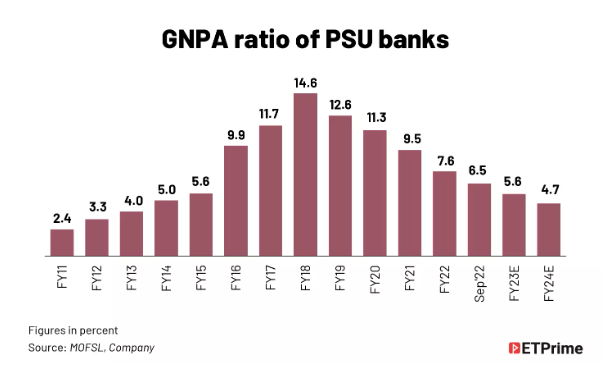

-They can be slow to adopt new technologies and may not be as agile as their private sector counterparts.

-They may be burdened by excessive bureaucracy and red tape, which can hinder their decision-making process and make it difficult to respond to changing market conditions.

-There have been cases of corruption and mismanagement in some PSUs in the banking sector, which can erode public trust and confidence in these institutions.

Oil:

Pros:

-PSUs in the oil sector have played a critical role in ensuring energy security and meeting the country’s energy needs.

-They have also contributed to the development of the oil and gas sector, which has created jobs and generated revenue for the government.

-PSUs in the oil sector have also helped to keep the prices of petroleum products in check and have provided subsidies for certain segments of the population.

Cons:

-They can be vulnerable to fluctuations in global oil prices, which can impact their profitability and financial stability.

-Some PSUs in the oil sector may struggle to adopt new technologies and adapt to changing market conditions.

Power:

Pros:

-PSUs in the power sector have played a key role in ensuring reliable and affordable power supply across the country.

-They have helped to develop and expand the power generation and transmission infrastructure, which has contributed to the growth of the sector and the economy.

-PSUs in the power sector have also contributed to the government’s revenue through taxes and fees.

Cons:

-They can be burdened by bureaucratic procedures and may struggle to keep up with changing market conditions and technological advancements.

-Some PSUs in the power sector may have outdated infrastructure, which can impact their efficiency and competitiveness.

-There have been cases of mismanagement and corruption in some PSUs in the power sector, which can erode public trust and confidence in these institutions.

Any potential catalysts that could drive the performance of PSUs in the near future?

Yes, there are several potential catalysts that could drive the performance of PSUs in the near future.

-One potential catalyst is the government’s continued focus on infrastructure development and investment in key sectors such as power, railways, and highways. This could lead to increased demand for the products and services provided by PSUs in these sectors.

-Another potential catalyst is the government’s privatization drive, which aims to raise funds and reduce the burden of non-performing assets on the government’s books. This could lead to increased efficiency and profitability of PSUs that are privatized or undergo strategic disinvestment.

-Additionally, the global economic recovery and the positive outlook for commodity prices could also have a positive impact on PSUs that are involved in commodity-based sectors such as oil and gas, mining, and metals. This could lead to increased revenue and profitability for these PSUs.

-Finally, the implementation of reforms such as the Goods and Services Tax (GST) and the Insolvency and Bankruptcy Code (IBC) could also have a positive impact on the performance of PSUs by improving the ease of doing business and reducing transaction costs.

Investing in PSU stocks in India can be an attractive investment option for some investors, but it comes with its own set of risks and challenges that need to be carefully evaluated.

Investors should conduct thorough research and analysis before investing in any PSU stock, taking into account factors such as the company’s financial performance, growth potential, management quality, market position, and overall economic conditions. By weighing the pros and cons of investing in PSU stocks, investors can make informed decisions about how to allocate their investment portfolios.

——————-

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.