08 Feb AUTO STOCK WITH 20% UPSIDE TARGET

AUTO STOCK WITH 20% UPSIDE TARGET

Post-budget 2023, the outlook on certain sectors looks promising, and the auto sector is also considered one of those sectors.

Religare Broking also believes the outlook for the auto sector to be promising as the government has continued to focus on allocating funds for infrastructure projects. This could lead to a rally in the automotive, cement, and consumer durables sectors.

The broker has listed the following Auto share with a potential upside:

Mahindra and Mahindra (M&M):

Target price: Rs 1,515 | Stop loss: Rs 1,320

According to Religare Broking: M&M is taking full advantage of its strengths with the following initiatives

– Launching new products

– Expanding capacity

– Entering the electric vehicle (EV) segment.

Moreover, commodity prices have dropped, creating a favourable environment for premium vehicles, potentially resulting in margin improvement and improved financials.

About Mahindra & Mahindra Ltd

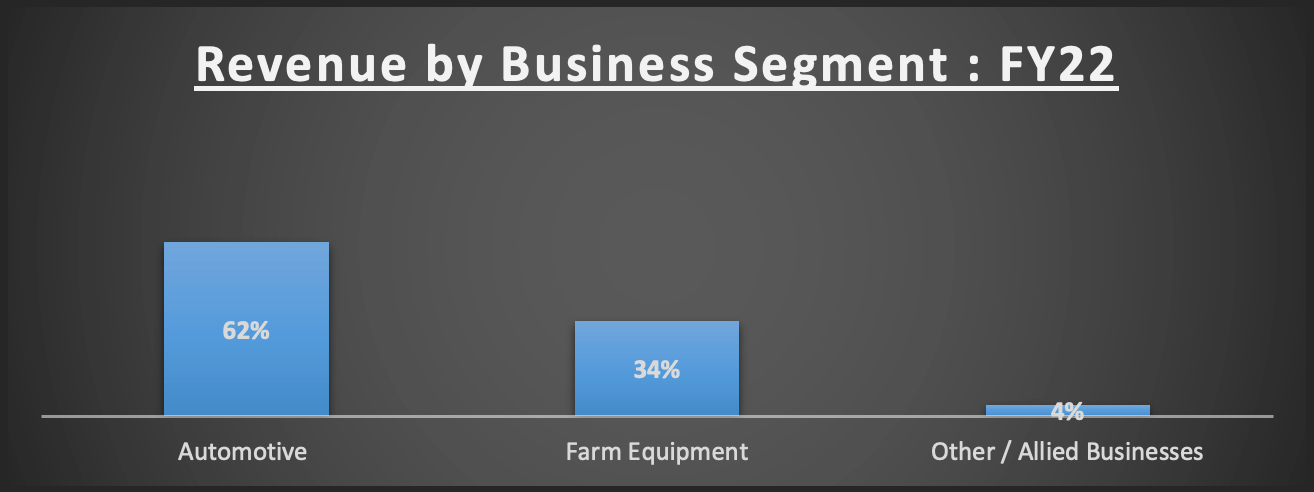

– One of the most diversified automobile companies in the Indian Market today

– Offering a wide range of vehicles from 2-wheelers to earthmovers

– Presence across 22 industries

– Operating in 150+ entities in 100+ countries

Market leadership in the Indian domestic market

– 4th largest Passenger Vehicle player

– 2nd largest commercial vehicles (CV) player

– Largest small commercial vehicle (LCV) player

Capacity Expansion:

– Committed to investing about Rs 17,000 crores

– Over the next three years (FY22-24)

– Investment will be made to strengthen its product portfolio

– Also plan to invest Rs 5,000 crores in subsidiaries and group companies

EV segment plans

– Entered a strategic partnership with British International Investment (BII)

– For the development, manufacturing and selling of 4-Wheeler Electric Passenger Vehicles

Cost Control Measures

– During FY21, the company implemented tight capital allocation norms to achieve 18% ROE

– Company stopped investing in unprofitable businesses

Disclaimer: The views and tips expressed by investment experts/broking houses/rating agencies are their own, not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.

No Comments