The market next week: Sumeet Bagadia’s 3 Stock Recommendations

Due to strong global market sentiments bolstered by better-than-expected Chinese economic data, the Indian stock market concluded in positive territory for the third consecutive session.

Market Performance:

- The Indian stock market ended the week on a positive note for the third consecutive session.

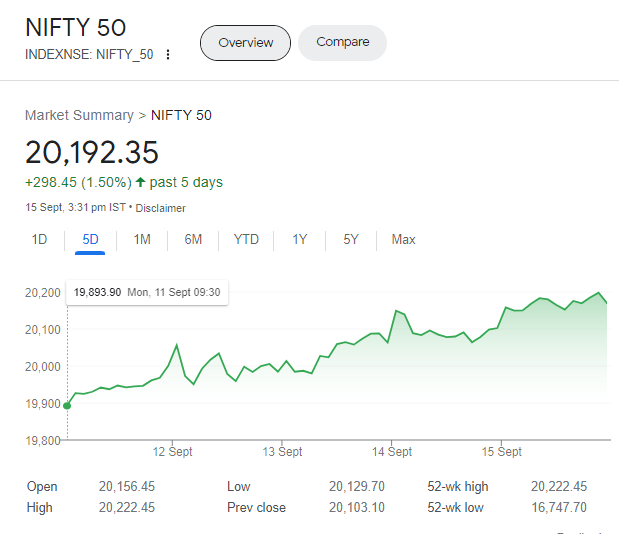

- NSE Nifty achieved a record close of 20,192 levels and hit a new all-time high of 20,222 during Friday’s trading.

- BSE Sensex also closed at a record high of 67,838 levels, reaching a peak of 67,927.

- The Nifty Bank index recorded a gain of 230 points, closing at 46,231 levels.

Institutional Investors (FIIs) Activity:

- FIIs continued their selling streak, marking the eighth consecutive week of offloading equities. They sold equities worth Rs 746.62 crore during the week.

- In contrast, DIIs exhibited a strong buying trend by purchasing equities worth Rs 3,363.36 crore in the same week.

Here’s a summary of the business events for the week ahead, from September 18th to September 22nd, 2023:

Monday, September 18:

- IPO Listing: Shares of Jupiter Life Line Hospitals may list on the stock exchanges.

Tuesday, September 19:

- Canada Inflation: Canada will release the inflation rate for August.

- US Building Permits: Data for August will be released.

Wednesday, September 20:

- IPO: The IPO of Sai Silks (Kalamandir) will open for subscription.

- India Money Supply: The Reserve Bank of India will release the money supply data.

- China Loan Prime Rate: China’s central bank will decide on the loan prime rates.

- UK Inflation: Data for August will be released.

- US Interest Rate Decision: The US Federal Reserve will decide on the interest rates.

Thursday, September 21:

- IPO Listing: Shares of EMS may list on the stock exchanges.

- UK Interest Rate Decision: The Bank of England will decide on the interest rates.

- Interest Rate Decisions: The central banks of Brazil, Indonesia, South Africa, Saudi Arabia, and Turkey will also decide on interest rates.

- US Jobless Claims, Existing Home Sales: Data for jobless claims and existing home sales will be released.

Friday, September 22:

- IPO: The IPO of Manoj Vaibhav Gems N Jewellers will be open for subscription.

- India Bank Loan, Deposit Growth: Data on bank loans and deposits will be released.

- Japan Interest Rate Decision, Inflation: The Bank of Japan will decide on interest rates and release inflation data.

- Euro Area Manufacturing, Services PMI: HCOB flash PMI data for manufacturing and services sectors will be released.

- US Services, Manufacturing PMI: The S&P Global will release the flash PMI data for September.

Market Strategy for Next Week:

Looking ahead to the next week, Sumeet Bagadia, Executive Director at Choice Broking, is optimistic about the Indian stock market, particularly as mid-cap and small-cap stocks have resumed their participation in the current rally. Bagadia suggests that Nifty appears poised to reach a near-term target of 20,350.

He also recommends three stocks to buy on Monday as part of the stock market strategy for the upcoming week on Livemint.

Also Read: “Midcap stocks with ‘strong buy’ & ‘buy’ recommendations by Experts”

Bharti Airtel:

- Buy Price: Rs. 926-930

- Target Price: Rs. 980

- Stop Loss: Rs. 900

Bharti Airtel is one of India’s leading telecommunications companies. It provides a wide range of telecommunication services, including mobile, broadband, and digital TV.

Bharti Airtel is known for its extensive network and has a significant presence in the Indian telecom industry.

Technical Analysis:

- Uptrend: Bharti Airtel shares are in an uptrend, forming higher highs and higher lows, indicating growing confidence in the stock’s potential.

- Strong Support: The previous resistance near Rs. 900 has become a strong support level, indicating a breakthrough and potential for further price appreciation.

- Moving Averages: The stock is trading above the 20, 50, and 200-day Exponential Moving Averages (EMAs), emphasizing its bullish momentum.

- Volume: Strong trading volumes suggest substantial investor interest and confidence.

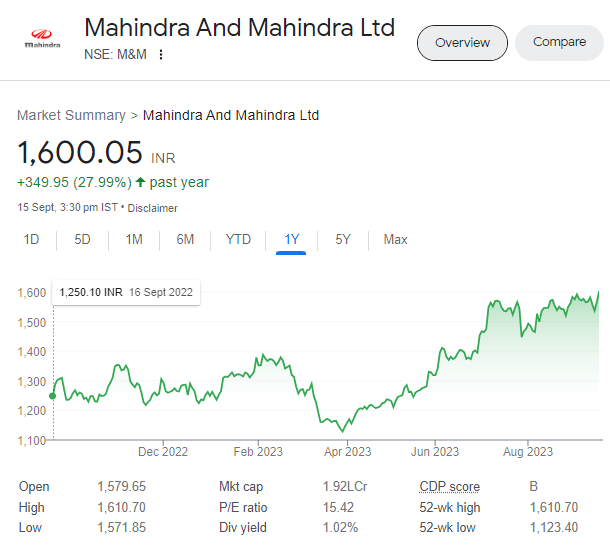

Mahindra & Mahindra (M&M):

- Buy Price: Rs. 1600

- Target Price: Rs. 1780

- Stop Loss: Rs. 1535

Mahindra & Mahindra (M&M) is a prominent Indian automotive manufacturer. It produces a variety of vehicles, including SUVs, trucks, and tractors.

M&M is recognized for its strong presence in the automotive and farm equipment sectors.

Technical Analysis:

- Rounding Bottom: M&M’s share price has formed a rounding bottom pattern, indicating potential upward movement.

- Moving Averages: The stock is trading above crucial EMAs, including the 20-day, 50-day, 100-day, and 200-day EMAs, reflecting bullish momentum.

- RSI and Stoch RSI: RSI at 60 with an upward trajectory and positive crossover in Stoch RSI indicate increasing buying momentum.

Rainbow Children’s Medicare Limited:

- Buy Price: Rs. 1025

- Target Price: Rs. 1075

- Stop Loss: Rs. 985

The primary focus of Rainbow Children’s Medicare Ltd is pediatric healthcare. They specialize in providing a wide range of medical services for children, including neonatology, pediatrics, pediatric surgery, and other pediatric subspecialties.

Rainbow Children’s Medicare Ltd is known for its state-of-the-art facilities and expertise in pediatric care.

Technical Analysis:

- Support Zone: Rainbow’s stock price has a robust support zone between Rs. 1000 to Rs. 1016, indicating a rebound from this range.

- RSI: Relative Strength Index (RSI) at 48 with a recent crossover suggests positive momentum.

- Moving Averages: Trading above pivotal moving averages, including the 100 and 200 Exponential Moving Averages (EMAs), signifies bullish sentiment.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.