The market next week: Sumeet Bagadia’s 3 Stock Recommendations

The Indian stock market continued its record-breaking run as the Sensex closed above 66,000 and the Nifty crossed the 19,500 mark for the first time. This surge came after US inflation data showed a slower-than-expected rise in June, leading to speculation that the Federal Reserve might be nearing the end of its rate-hiking cycle.

Foreign fund managers continued to invest in Indian equities, buying stocks worth ₹2,636.43 crore on Friday. The weakening US dollar, which fell to a 15-month low, has contributed to the inflow of foreign funds into riskier assets like emerging markets.

The Sensex rose by 502.01 points or 0.77% to close at 66,060.90, surpassing the previous closing high. The Nifty reached a new high of 19,595.35 and closed at 19,564.50, up 150.75 points or 0.78% from the previous close.

Market experts suggest that India is attracting hot money from overseas investors due to its promising value and long-term growth prospects. However, caution is advised as valuations have surpassed long-term averages. Investors are optimistic about the end of the rate-hike cycle and the potential for earnings expansion in India.

Nifty Range:

Sumeet Bagadia believes that the Nifty index is currently in the range of Rs19,300 to Rs19,900. If it sustains above Rs19,500 levels for the next one to two sessions, it may test Rs20,000 levels.

Recommended Stocks by Sumit Bagadia on livemint:

Related Read: Will the Nifty Reach 21,000?

a. Tata Consumer:

Buy at Rs 851.50,

Target Rs 900,

Stop-loss Rs 825.

The Technicals

-Bullish reversal patterns were observed on the daily chart.

-Trading above key moving averages.

-Bollinger bands suggest strength.

-Resistance near Rs860 levels; breaking this level may move the stock towards Rs 900 levels and higher.

Company Information:

Tata Consumer Products Limited is a multinational consumer goods company based in India.

It is part of the Tata Group conglomerate, one of India’s largest business groups.

Business Overview:

Tata Consumer operates in the consumer packaged goods sector, primarily focusing on beverages and food products.

It has a diversified product portfolio that includes tea, coffee, water, salt, spices, pulses, ready-to-eat foods, and more.

Product Overview:

Tata Consumer’s popular brands include

-Tata Tea, Tetley, Starbucks (ready-to-drink beverages), Himalayan Mineral Water, Tata Salt, Tata Sampann (spices and pulses), and Tata Q (ready-to-eat foods).

The company caters to both domestic and international markets, offering a wide range of consumer products.

b. Cipla:

Buy at Rs 1030,

Target Rs 1055 to Rs 1065,

Stop loss Rs 1010.

The Technicals

-Strong support zone around Rs 1015-985.

-Surpassed resilient levels of Rs 1000.

-Bullish candle pattern observed on the weekly chart.

-RSI indicator suggests room for the stock to rise.

-Maintaining the 20-day EMA, indicating positive momentum.

Company Information:

Cipla Limited is a leading Indian pharmaceutical and biotechnology company headquartered in Mumbai.

It operates globally and has a strong presence in over 100 countries.

Business Overview:

Cipla is engaged in the development, manufacturing, and marketing of a diverse range of pharmaceutical products.

It focuses on both prescription drugs and generic medicines, covering various therapeutic areas.

Product Overview:

Cipla’s product portfolio includes

-Medicines for respiratory disorders, cardiovascular diseases, central nervous system disorders, anti-infectives, oncology, diabetes management, and more.

The company is known for its emphasis on affordable healthcare and making essential medicines accessible to people worldwide.

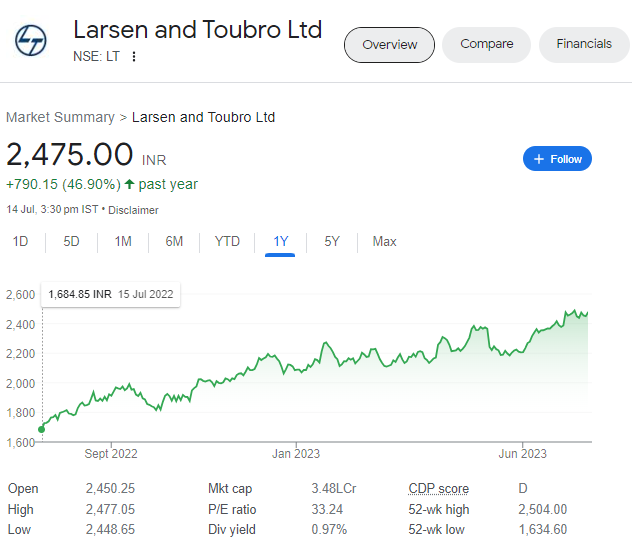

c. Larsen and Toubro (LT):

Buy above Rs 2475,

Target Rs 2570 to Rs 2600,

Stop loss Rs 2440.

The Technicals

-Exhibiting a Higher High – Higher Low pattern on the daily chart.

-Gradual increase in trading volume and upward movement of prices.

-Trading above the 20-day Simple Moving Average (SMA), indicating bullish sentiment.

Company Information:

Larsen and Toubro Limited, commonly known as L&T, is a multinational conglomerate based in India.

It operates across various sectors, including engineering, construction, technology, and more.

Business Overview:

L&T is primarily engaged in engineering, procurement, and construction (EPC) projects.

The company specializes in infrastructure development, power generation and transmission, hydrocarbon exploration and production, heavy engineering, defense, and technology services.

Product Overview:

L&T offers a wide range of products and services, including

-Construction of roads, bridges, airports, power plants, oil and gas infrastructure, defense equipment, heavy machinery, and technology solutions.

The company’s expertise lies in executing complex engineering projects and providing integrated solutions across multiple sectors.

Please note that these are brief summaries, and it’s essential to conduct in-depth research and analysis specific to each company to gain a comprehensive understanding of their business operations, financials, and market dynamics.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“Why this small-cap stock can perform exceptionally in the future? ” What comes to your mind when you hear……Read More

Down 20% in 1 year, but why analysts are bullish on this small cap?