The market next week: Sumeet Bagadia’s 3 Stock Recommendations

The Indian stock market experienced weakness due to sell-offs in technology stocks and snapped its six-day winning streak. NSE Nifty lost 234 points to close at 19,745 levels, while BSE Sensex plummeted 887 points to close at 66,684.

The Bank Nifty index also declined, losing 111 points and closing at 46,075. However, broad market indices, including the Small-cap index, performed better, with the latter ending 0.13 percent in the positive.

Stock to watch – Reliance :

Reliance Industries Limited (RIL) announced its Q1 results for 2023 after the closure of the Indian stock market on Friday last week. Reliance shares are also listed on the London Stock Exchange (LSE), where its Global Depository Receipt (GDR) price fell around 6 percent, ending at $62.70 levels after hitting an intraday low of $62.20 during Friday’s deals.

Experts believe that the significant drop in Reliance GDR prices on LSE could have a negative impact on Reliance shares listed on Dalal Street (Indian stock market) and may trigger a heavy sell-off once the market reopens on Monday.

The Q1 results show a 10 percent dip in net profit, which could further put pressure on the stock’s performance.

Market Next Week:

As per the LiveMint article, Sumeet Bagadia, Executive Director at Choice Broking, believes that the market trend has become cautious after the recent profit booking trigger.

Immediate support for Nifty today has shifted towards 19,600 and 19,500 levels.

Amid the ongoing Q1 results season for 2023, Bagadia advises investors to be cautious and maintain a stock-specific trade approach.

The stock market is currently trading at record highs, making it essential for investors to carefully analyze opportunities.

Recommended Stocks by Sumit Bagadia on Livemint:

Also Read: “Public Sector Banks: Share Prices are Still 80% Down from All-Time Highs Despite Recent Rally

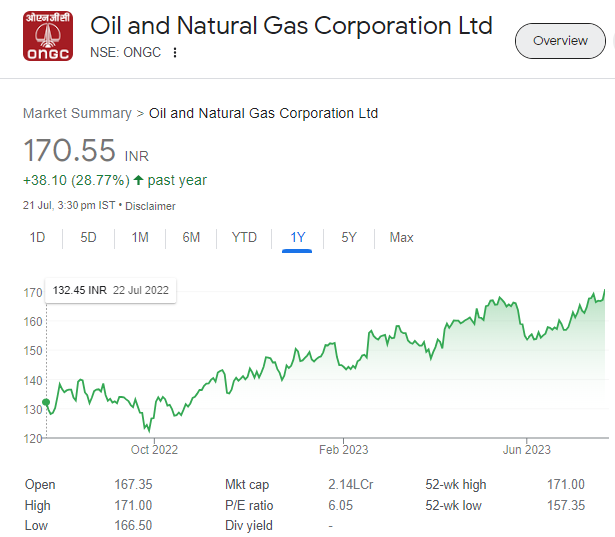

ONGC (Oil & Natural Gas Corporation):

Buy at Rs 170.55,

Target: Rs 180,

Stop loss: Rs 165.

The Technicals:

The stock has consolidated and formed a base near ₹166 levels.

It has given a breakout of a cup and handle pattern on daily charts.

RSI has bounced from lower levels, indicating strength.

A small resistance is seen near ₹172 levels, and a move above this level may lead to ₹180 levels and higher.

Company Information:

Oil & Natural Gas Corporation Limited (ONGC) is a leading Indian multinational oil and gas exploration and production company.

It is a Navratna company, which is a title given to the highest-ranking public sector enterprises in India. ONGC is one of the largest oil and gas companies in the country and plays a crucial role in India’s energy sector.

Business Overview:

ONGC is primarily engaged in exploring, producing, and developing oil and natural gas resources. The company operates onshore and offshore assets and has a diverse portfolio of domestic and international exploration blocks.

ONGC is also involved in downstream activities like refining and marketing of petroleum products.

Product Overview:

ONGC’s main products are crude oil and natural gas. It explores and extracts these resources from various fields and reservoirs.

The company supplies crude oil to refineries for processing, and the natural gas is used for various purposes, including

-Power generation, industries, and household consumption.

Related Read: Will the Nifty Reach 21,000?

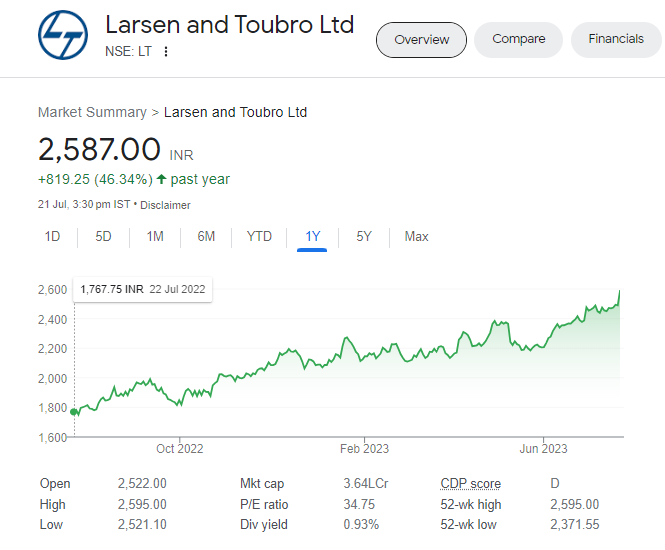

Larsen and Toubro (LT):

Buy at Rs 2586,

Target: Rs 2725 to Rs 2815,

Stop loss: Rs 2515.

The Technicals:

-The stock exhibits a Higher High – Higher Low pattern on the daily time frame, suggesting a bullish trend.

-Gradual increase in trading volume and upward movement of prices further support the bullish sentiment.

-The stock is trading above its 20-day Simple Moving Average (SMA), indicating positive momentum.

-RSI and MACD also validate the positive trend.

Company Information:

Larsen and Toubro Limited (L&T) is a prominent Indian multinational conglomerate with a presence in various sectors.

It is one of the largest engineering and construction companies in India and is recognized for its engineering excellence and project execution capabilities.

Business Overview:

L&T operates across sectors like infrastructure, power, hydrocarbon, heavy engineering, defense, technology, and financial services.

The company is involved in engineering, procurement, and construction (EPC) projects and provides a wide range of solutions for complex engineering challenges.

Product Overview:

L&T’s product offerings include engineering solutions, construction services, power equipment, defense systems, heavy machinery, and technology solutions.

The company undertakes projects such as

-Building roads, bridges, airports, power plants, and oil and gas facilities.

L&T’s technology arm offers IT services and solutions to various industries.

Also Read:Why Many Analysts are Bullish on ITC?

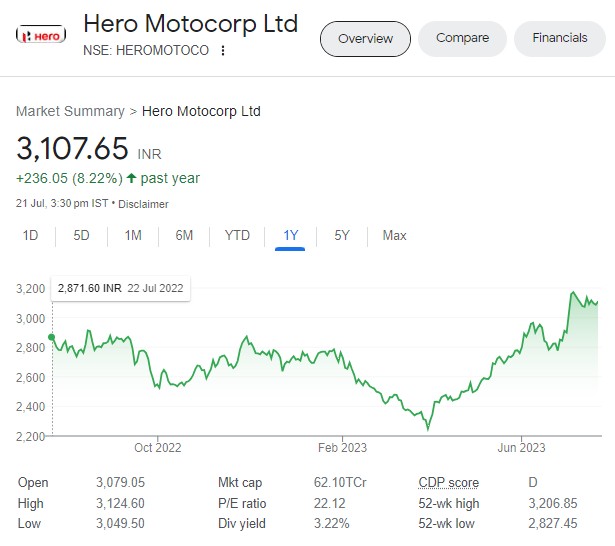

Hero MotoCorp:

Buy at Rs 3102,

Target: Rs 3250,

Stop loss: Rs 3030.

The Technicals:

The stock has rebounded from a solid support level near ₹3049, close to the 20-day EMA.

It is trading above all important moving averages, indicating strength.

Positive crossovers in both RSI and MACD suggest a continued bullish trend.

High trading volume indicates buying interest among short-term traders.

Company Information:

Hero MotoCorp Limited is the world’s largest manufacturer of motorcycles and scooters. Headquartered in India, it was formerly known as Hero Honda and later changed its name to Hero MotoCorp after separating from its joint venture with Honda.

The company has a significant market share in the two-wheeler segment and has a strong presence both in India and international markets.

Business Overview:

Hero MotoCorp is primarily engaged in the design, development, manufacturing, and sales of motorcycles and scooters. The company offers a wide range of two-wheeler models catering to various segments and customer preferences.

It is known for its reliable, fuel-efficient, and affordable bikes, making it a popular choice among consumers.

Product Overview:

Hero MotoCorp’s product portfolio includes commuter bikes, premium bikes, and scooters. Some of its well-known models include

-Splendor, Passion, Glamour, HF Deluxe, Maestro Edge, and Pleasure.

The company continually introduces new models and updates to stay competitive in the market.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“Why this small-cap stock can perform exceptionally in the future? ” What comes to your mind when you hear……Read More

Down 20% in 1 year, but why analysts are bullish on this small cap?