Market This Week: 3 Recommended Stocks to Watch on Monday For Medium Term by Sumeet Bagadia

Indian benchmark indices traded in a narrow range as investors closely monitored the debt deal negotiations in the US. The Nifty 50 ended the week with flat returns, while the broader markets performed exceptionally well.

Smallcap stocks stole the spotlight, with around 20 stocks delivering impressive returns of 20-40% during the week.

Analysts maintained a positive stance on the market, citing strong momentum in the broader market and the potential for benchmark indices to reach new all-time highs.

Also Read:IKIO Lighting IPO Details – GMP, Date, Price, Reviews & More

Positive factors such as better-than-expected national income data, encouraging manufacturing PMI, and the resolution of the US debt ceiling discussions contributed to the market sentiment.

Several key macroeconomic indicators will be released in the upcoming week, including the composite services PMI for India, the US, UK, European Union, and China. Additionally, trade data will be released in the US.

To learn more about stock market basics and stock analysis one can consider enrolling in our Stock Market Learning Courses, here.

Last Week’s Performance:

-On June 2, the Sensex closed 119 points higher at 62,547.11, representing a 0.19 percent increase, while the Nifty ended at 18,534.10, up 46 points or 0.25 percent.

-The key benchmark indices gained on June 2 after falling two days prior, and the passing of the US debt ceiling legislation by the American government helped strengthen market sentiment.

-The BSE Midcap index hit its all-time high of 27,322.22 in intraday trade before ending 0.60 percent higher at 27,294.10.

-The Smallcap index hit its 52-week high of 30,969.95 in intraday trade and closed 0.57 percent higher at 30,885.70.

Factors To Watch Out This Week:

-In the upcoming week, investors will be closely monitoring the Reserve Bank of India’s monetary policy announcement and the question of whether foreign investors will continue to invest in Indian markets.

-Despite recent outperformance compared to global peers, a further deterioration of the trend, particularly in the US markets, could change market sentiment.

-The lack of decisiveness in the banking sector, specifically around its record high, is impacting sentiment and will play a critical role in the coming week.

-However, there is a positive view reiterated, suggesting a focus on sectors and stocks that are performing well.

-On the index front, it is expected that the Nifty will hold the 18,100-18,300 zone in case of any dip, while a decisive close above 18,700 would indicate a potential new high.

RBI’s Policy

The Reserve Bank of India (RBI) will hold its three-day policy meeting from June 6-8. Market participants are eager to know if the central bank will maintain the current interest rates.

The outcome of the RBI’s policy meeting and the subsequent speech by the RBI governor will be closely watched for any indications of the central bank’s stance on monetary policy.

FII Flows

Foreign Institutional Investors (FIIs) played a significant role in India’s market performance, with constant inflows observed in recent months. In May, FIIs invested over Rs 43,800 crore in the stock market and primary market combined, according to NSDL data.

FPIs are expected to continue investing in India in June, driven by robust GDP data and positive high-frequency indicators, signaling a strong and growing economy.

A survey among foreign portfolio investors indicated that India is now the consensus overweight among all emerging markets, further highlighting the positive sentiment towards Indian equities.

Recommendation by Sumeet Bagadia, Executive Director at Choice Broking:

Sumeet Bagadia, recommends buying three stocks this week highlighting the positive technical indicators and potential price targets for each stock.: SBI (State Bank of India) , Dr Reddy’s, and Bajaj Finserv .

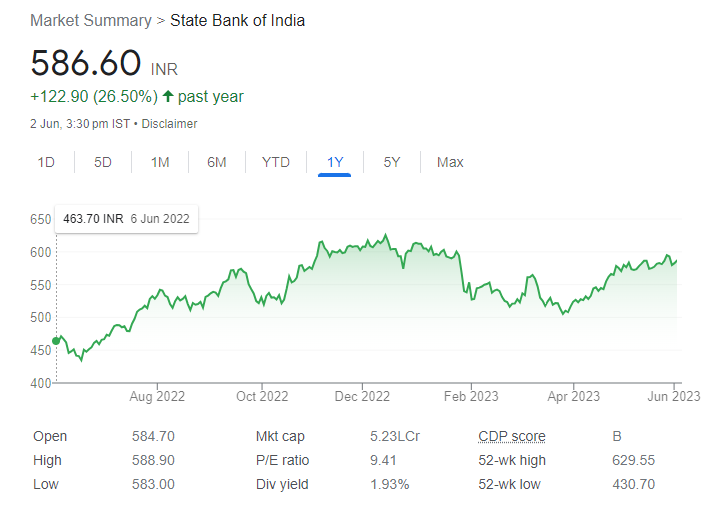

SBI (State Bank of India)

CMP : Rs 587

Medium-term Target Price : Rs 605

Stop Loss: Rs 575

Technical Indicators

-SBI has a strong support at 580 levels, currently trading around 587.20.

-A smaller resistance is visible on the charts near 590 levels.

-Overcoming this resistance can lead to moving closer to the target price of 605 and higher.

-The stock is trading above all important moving averages, indicating strength.

-Bollinger band has squeezed, and the price is trading above the middle band, suggesting potential upward movement.

Company Overview

State Bank of India (SBI) is the largest public sector bank in India and one of the leading banking and financial services companies in the country. It is a government-owned institution and serves as the flagship bank of the Indian banking sector.

SBI offers a comprehensive range of banking services to individuals, businesses, and corporate clients. The bank operates through a vast network of branches and ATMs across India and has a significant international presence as well.

It provides services such as

-Savings and current accounts,

-Fixed deposits,

-Loans,

-Credit cards,

-Wealth management, and

-Insurance products.

As a full-service bank, SBI caters to the diverse financial needs of its customers. It offers various types of loans, including home loans, personal loans, auto loans, education loans, and business loans. SBI’s loan products are known for their competitive interest rates, flexible repayment options, and efficient processing.

The bank also provides a range of investment and wealth management services to help customers grow and manage their finances effectively. SBI Mutual Fund is a prominent asset management company operated by SBI, offering a wide range of mutual fund schemes to investors.

SBI has a strong focus on digital banking and has introduced several innovative digital platforms and services to enhance customer experience and convenience. It offers internet banking, mobile banking, and other digital channels for seamless and secure transactions.

In addition to its core banking operations, SBI is involved in various subsidiaries and joint ventures across different sectors. It has subsidiaries dedicated to life insurance, general insurance, investment banking, merchant banking, and more. These subsidiaries complement SBI’s banking services and contribute to the overall strength and diversification of the organization.

Being a government-owned bank, SBI plays a crucial role in the financial inclusion and socioeconomic development of the country. It provides banking services to individuals and businesses across different segments, including rural and underprivileged areas.

Bajaj Finserv

CMP : Rs 1455

Anticipated target range: 1515-1540.

Stop Loss: Rs 1415

Technical Indicators

-The stock has surpassed all of its short, medium, and long-term exponential moving averages.

-It has experienced a breakout above the key level of 1440, demonstrating its ability to sustain this level.

-The Relative Strength Index (RSI) remains above 67, indicating a strong market sentiment.

Company Overview

Bajaj Finserv Limited is a leading financial services company in India. It is a part of the Bajaj Group, a conglomerate with diverse business interests.

Bajaj Finserv operates through its various subsidiaries and provides a wide range of financial solutions to individuals, businesses, and institutions.

The company operates in multiple sectors, including

-Lending,

-Insurance,

-Wealth management, and

-Asset management.

Bajaj Finserv offers consumer finance, mortgage loans, personal loans, business loans, and other financial products to meet the diverse needs of its customers.

In the lending segment, Bajaj Finserv has gained a strong reputation for its innovative and customer-centric approach. It provides hassle-free loans with attractive interest rates and flexible repayment options. The company has a wide distribution network, making its financial products accessible to customers across India.

Bajaj Finserv is also involved in the insurance sector, offering life insurance, general insurance, and health insurance products. It has partnered with leading insurance providers to offer comprehensive coverage and risk management solutions to individuals and businesses.

Additionally, Bajaj Finserv operates in the wealth management and asset management sectors, providing investment advisory services and managing mutual funds and other investment portfolios. The company aims to help customers achieve their financial goals through strategic planning and investment solutions.

With a strong focus on technology and digital innovation, Bajaj Finserv has developed user-friendly platforms and mobile applications, enabling customers to access and manage their financial products and services conveniently.

Dr Reddy’s

CMP : Rs 4610

Anticipated target range: Rs 4770

Stop Loss: Rs 4520

Technical Indicators

-The stock has reversed from its base following a respectable consolidation as the Pharma Index rises.

-It is trading higher than 20 and 50 daily moving averages.

-Positive crossover indicated in RSI and MACD, suggesting continuity in the bullish trend.

-Buying interest among short-term traders, supported by high volume.

Company Overview

Dr. Reddy’s Laboratories is a leading Indian multinational pharmaceutical company headquartered in Hyderabad, Telangana, India. Founded in 1984, Dr. Reddy’s has emerged as a global pharmaceutical player, with a presence in over 100 countries worldwide.

The company is engaged in the research, development, manufacturing, and marketing of a wide range of pharmaceutical products, including prescription medications, generic drugs, over-the-counter (OTC) products, and active pharmaceutical ingredients (APIs).

Dr. Reddy’s operates in various therapeutic areas, including

-Cardiovascular,

-Oncology,

-Neurology,

-Gastroenterology,

-Dermatology, and more.

Dr. Reddy’s has a strong focus on innovation and research and development (R&D), investing a significant portion of its revenue into R&D activities. The company has a dedicated R&D team that works on developing new formulations, improving existing products, and exploring new drug delivery systems. Dr. Reddy’s has several research centers and manufacturing facilities equipped with advanced technologies and adheres to stringent quality standards.

With a diverse product portfolio, Dr. Reddy’s caters to both domestic and international markets. The company has established strategic partnerships and collaborations with global pharmaceutical companies to enhance its product offerings and expand its market reach.

It has a strong presence in the United States, Europe, Russia, India, and other emerging markets.

Dr. Reddy’s has received numerous certifications and accreditations for its manufacturing facilities and quality control processes, ensuring compliance with international regulatory standards. The company is committed to ensuring accessibility, affordability, and quality healthcare through its wide range of products.

In addition to its pharmaceutical business, Dr. Reddy’s has ventured into the consumer health and diagnostics segments. It offers a range of OTC products, including vitamins, supplements, and personal care items. The diagnostics division provides a range of diagnostic services and products, including medical devices and genetic testing.

Important Note:

Please consider that the information provided is based on the recommendation from Sumeet Bagadia,and market conditions as of June 2. It’s essential to conduct further research and analysis or consult with a financial advisor before making any investment decisions.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.