Infosys share price underperformed the Index & BSE IT in the last one year; should you buy it now?

Have you heard about the recent investments made by mutual funds in the IT sector?

It’s quite interesting! ICICI Prudential AMC has been busy buying shares in Cognizant Technology Solutions, while Aditya Birla Sun Life AMC decided to invest in Wipro. And let’s not forget Mirae Asset Management, who made a move by acquiring shares in Coforge.

It’s clear that these funds are betting on the growth potential of the IT industry.

However, there are some concerns about potential earnings downgrades, especially with Accenture Plc, a major US company, reporting a weak earnings outlook. Analysts mentioned challenges in the global macro environment and reduced growth guidance. It’s definitely something to keep an eye on!

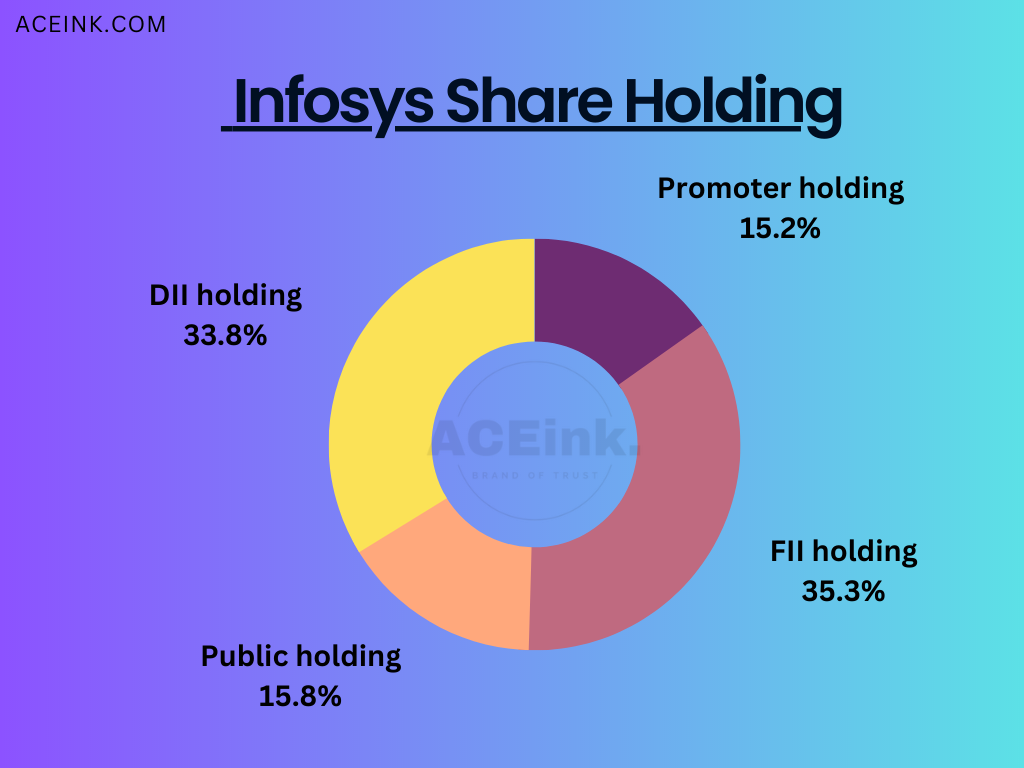

Mutual funds are displaying confidence in the IT sector, shrugging off concerns about the macroeconomic slowdown in the US and Europe. Recent data reveals that mutual funds purchased a significant number of shares in Infosys, with a net buying of 1 crore shares in May.

This increased their total holdings in the software giant to 69.08 crore shares, compared to 67.87 crore shares in April.

In May alone, this faith in Infosys resulted in a 5% return for mutual fund investors.

Also Read: Buy or Sell: Sumeet Bagadia’s 3 Stock Recommendations for This Week

Apart from Infosys, mutual funds have also shown interest in other large-cap and mid-cap IT stocks.

ICICI Prudential AMC bought shares in Cognizant Technology Solutions, Aditya Birla Sun Life AMC acquired shares in Wipro, and Mirae Asset Management invested in Coforge. The collective buying by mutual funds offset the selling by foreign investors and contributed to a 6% gain in the Nifty IT index during May.

Although Infosys shares have experienced a year-to-date decline of over 15%, mutual funds remain optimistic about the sector’s growth potential. This positive sentiment is reflected in their investments and has helped drive the Nifty IT index to outperform the benchmark Nifty 50, which has provided only 3% positive returns this year.

All is not Well

While mutual funds have shown confidence in the IT sector, it’s important to acknowledge the persistent headwinds and risks associated with further earnings downgrades.

The recent weak earnings outlook provided by Accenture Plc, a major US technology company, has raised concerns. Accenture has revised its annual growth guidance downward for the second time, attributing it to clients reducing discretionary spending in the face of a challenging global macro environment.

Taking a cautious stance on the IT sector, Jefferies India has highlighted potential risks for companies like

-Infosys, HCL Technologies, Tech Mahindra, and LTI Mindtree.

These companies, due to their significant dependence on North America, may face increased vulnerability in the current scenario.

It’s crucial for investors to consider these factors and exercise caution while navigating the IT sector, as the risks associated with the prevailing headwinds should not be overlooked.

More to Read: These Stocks to Give Dividends This Week up to Rs 140

The Contra View of MF

Despite the prevailing concerns of a slowdown in earnings, some market experts and mutual fund managers have taken a contrarian view, seeing potential opportunities in the information technology (IT) sector.

-Umesh Kumar Mehta of Samco Mutual Fund believes that

The recent correction in the IT sector has created attractive bottom-fishing opportunities.

He suggests that investors consider bottom-picking in sectors like IT and pharma, which have faced FPI outflows in the past year but now offer a stable risk-return profile from a longer-term perspective.

-Gulaq, a quant investment firm, has also turned overweight on the IT sector and currently holds a bullish outlook.

–Vivek Sharma, Director (strategy) and Head of Investments at Gulaq highlights their shift from being underweight on IT a year ago to now being most bullish on the sector.

An overweight sector allocation indicates that a higher percentage of a portfolio’s assets are invested in it, exceeding its representation in the broader market.

This overweight position reflects the confidence these mutual fund managers have in the growth potential of the IT sector.

It’s important to note that these perspectives present a counterpoint to the concerns mentioned earlier, suggesting that there are differing viewpoints within the mutual fund industry regarding the outlook for the IT sector.

The Fundamentals

- Market Cap₹ 5,27,220 Cr.

- Current Price₹ 1,270

- High / Low ₹ 1,673 / 1,185

- Face Value₹ 5.00

- Return over 1year-13.8 %

- PEG Ratio 2.54

- Stock P/E 22.0

- Industry PE25.1

- Dividend Yield 2.68 %

The Financials

- ROCE 40.7 %

- ROE 31.8 %

- OPM 23.9 %

- Debt ₹ 8,299 Cr.

- Debt to equity 0.11

- Qtr Profit Var 7.77 %

- Qtr Sales Var 16.0 %

- Free Cash Flow ₹ 19,888 Cr.

Revenue and Growth:

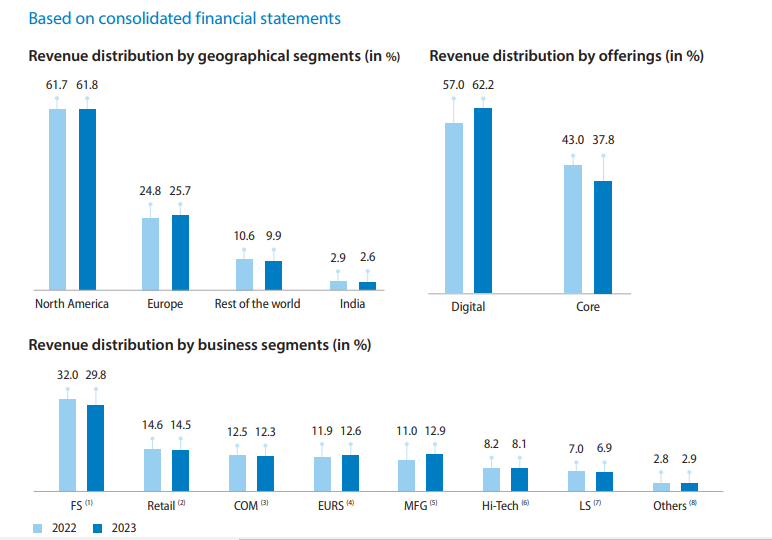

-Infosys had a strong performance in FY23, achieving a growth of 15.4% in constant currency, primarily driven by a 25.6% growth in the digital business.

-The company secured 95 large deals in FY23, totaling $9.8 billion, with 40% of these deals being net new.

-However, in Q4, Infosys experienced unplanned project ramp-downs and delays in decision-making, leading to lower volumes.

AI and Automation:

-Infosys is utilizing generative AI capabilities to enhance productivity for both its clients and within the company.

-The company employs various tools, including automation, utilization, onsite-offshore mix, and pricing, to safeguard margins.

-Digital transformation and automation are identified as the two key growth drivers for Infosys.

Why Motilal is Bullish despite Downturns

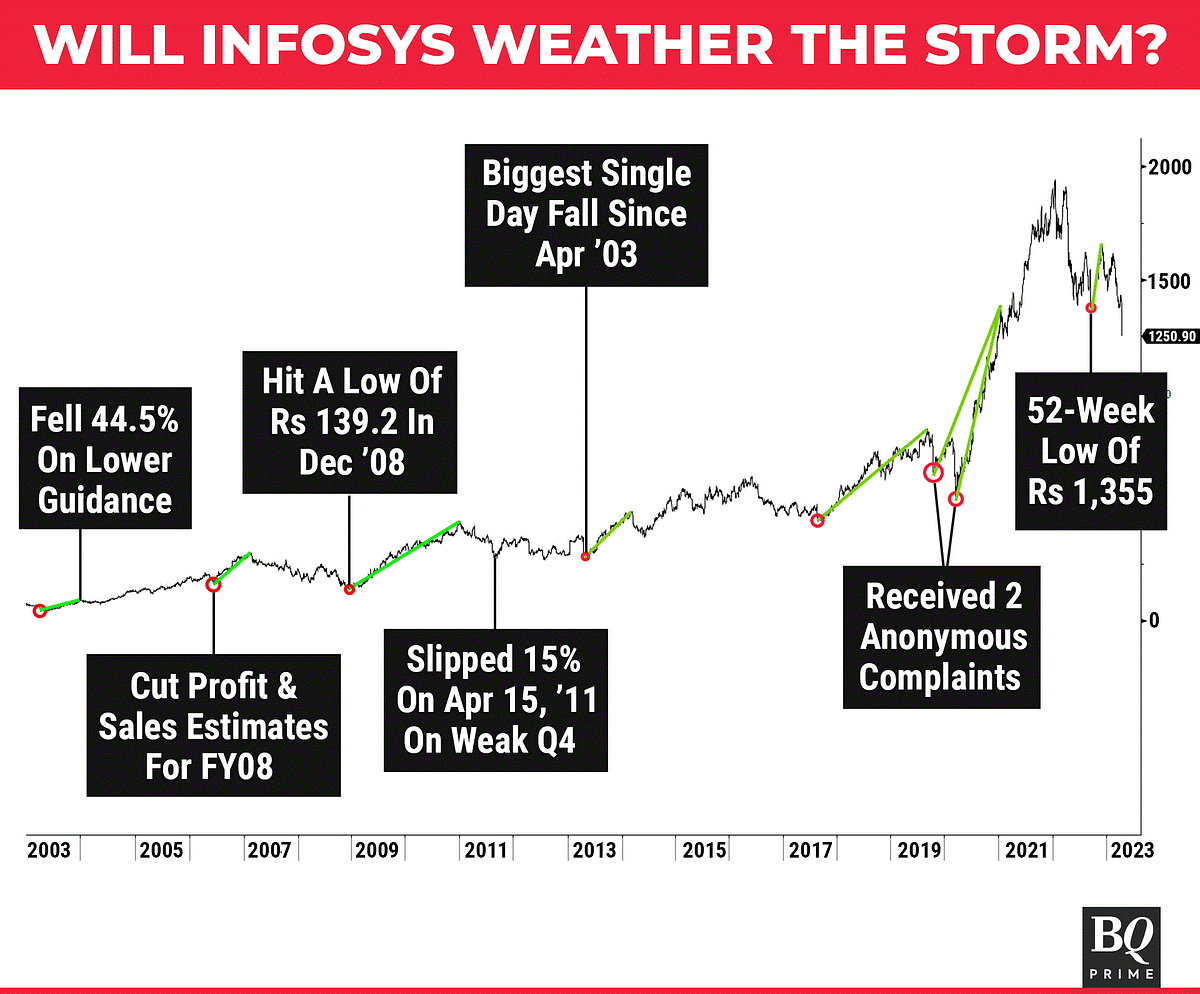

Infosys, one of India’s leading IT companies, has experienced a decline in its share price amid weak market sentiment and concerns over potential rate hikes. The stock has faced pressure over the past year due to worries about a slowdown in key markets, specifically in the US and Europe.

While the BSE IT index has recorded a 3 percent gain and the equity benchmark Sensex has seen a 21 percent increase in the last year, Infosys shares have dropped by 12 percent during the same period.

The stock hit a 52-week high in December 2022 but has since fallen by 23 percent.

Despite these challenges, brokerage firm Motilal Oswal Financial Services remains positive about Infosys for the medium to long term, indicating that there are varying opinions on the company’s outlook.

Structural Growth Prospects:

Motilal Oswal Financial Services remains positive about Infosys for the medium to long term, as the company’s structural growth prospects are seen as intact.

Attractive Valuation:

The stock of Infosys has corrected significantly, trading at an attractive valuation of 18 times FY25E EPS (earnings per share), making it appealing from an investment standpoint.

Long-Term Demand Potential:

While near-term demand may be weak, Motilal Oswal believes that long-term demand for IT services remains intact. They anticipate a bounce-back for companies in the sector, including Infosys, once the macro environment stabilizes.

Concerns about Leadership Attrition:

Motilal Oswal highlights the recent reports of senior executive exits at Infosys, including Narsimha Mannepalli and Vishal Salvi, which may raise concerns about leadership attrition.

Potential Impact on Project Timelines:

The brokerage firm advises investors to be watchful of further exits, particularly in delivery leadership roles, as a supply-demand gap in project management could potentially affect project timelines in the short term.

Q4FY23 Financial Performance:

-Infosys’ Q4FY23 numbers fell below Street estimates, with a decline in profit after tax and revenue.

-Despite missing estimates, the company’s revenue growth in constant currency terms remained positive, with a 3.2 percent QoQ (quarter-on-quarter) and 8.8 percent YoY (year-on-year) increase.

– Infosys’ operating margin stood at 21 percent in Q4FY23.

‘Buy’ Call and Target Price:

Motilal Oswal Financial Services has a ‘buy’ call on Infosys with a target price of Rs 1,520, indicating a 19 percent upside.

The brokerage firm expects Infosys to benefit from the acceleration in IT spending in the medium term.

Technical Analysts’ View:

Technical analysts suggest that it is not an ideal time for fresh buying in Infosys’ stock.

Jigar S. Patel of Anand Rathi Share and Stock Brokers points out that

The stock is trading below key exponential moving averages, and the daily RSI (relative strength index) is reversing, hinting at downside potential to levels around Rs 1,220-1,230, which could be an ideal buy price.

Gaurav Bissa, VP of InCred Equities, has analyzed the technical chart of Infosys and observed the following:

-Infosys experienced a significant correction after its last quarterly numbers, impacting its price performance.

-Although the stock managed to rebound from the lows it reached in April, it failed to fully capitalize on the strong market rally and also contributed to a decline in the Nifty IT index.

-The stock is currently forming a bearish continuation pattern in the short term, as indicated by a clear breakout in the daily charts. This breakout was followed by a correction, consolidation, and a fresh breakdown.

–Infosys saw a limited upside from around ₹1,150 levels to ₹1,350 levels, which served as a breakdown retest on the daily charts. Since then, the stock has experienced a strong decline and is currently trading within a consolidation phase.

-Bissa anticipates Infosys to trade within the range of Rs 1,150-1,350 in the upcoming weeks unless a confirmed break above or below either of these levels occurs.

This technical analysis suggests that Infosys is currently facing resistance and undergoing a consolidation phase.

Traders and investors should closely monitor the stock’s price movement and wait for a confirmed break of the mentioned levels to determine the next directional move.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“These Stocks to Give Dividends This Week up to Rs 140 ” These 19 stocks are to turn ex-dividend this week ….Read More

——————-

“Driving Growth – A Fundamentally Strong Small Cap Company” A key player in the chemical industry , showcasing growth. Here is the reason why…Read More

——————-