“Why the Thriving entertainment Industry Should Be on Your Investment Radar”

Visualize the glistening waters of Goa, India’s coastal gem, serving as the backdrop for a collection of extraordinary casinos. Delta Corp, a trailblazer in the gaming and hospitality industry, has transformed this picturesque paradise into a playground for those seeking indulgence and excitement.

With an impressive portfolio of exceptional properties, both on land and at sea, Delta Corp has curated an unmatched selection of gaming destinations that redefine entertainment in the region.

Join us as we explore the investment potential of Delta Corp, where the thrill of gaming meets the excitement of financial possibilities.

Discover why Delta Corp stands out as an exciting option and what the risks involved in it are.

The Company

Delta Corp Limited is the largest gaming company in India, with a dominant presence in the casino gaming industry.

The company operates casinos, online gaming platforms, and hospitality businesses.

Delta Corp has established itself as a leader in the Indian gaming market and has gained significant market share in the organized casino segment

History and Background:

Delta Corp was incorporated in 1990 and initially started as a textiles and real estate company.

In 2006, the company diversified its business and entered the gaming and hospitality industry. Delta Corp recognized the growing potential of the gaming market in India and strategically positioned itself as a key player in the sector.

The company began its gaming operations by acquiring Adda52, an online gaming platform that offers poker and other card games. This move allowed Delta Corp to tap into the rapidly growing online gaming market in India.

Delta Corp expanded its presence in the casino gaming sector by acquiring casino licenses in

-Goa,

-Sikkim, and

-Daman.

It currently operates several offshore and land-based casinos in these regions. The company has consistently invested in upgrading its gaming infrastructure and enhancing the overall customer experience.

Over the years, Delta Corp has focused on building a strong brand and establishing itself as a trusted and reliable gaming company in India. It has continued to innovate and diversify its offerings to cater to the evolving preferences of its customers.

Today, Delta Corp is recognized as a pioneer in the Indian gaming industry and has played a significant role in shaping the landscape of the casino gaming sector in the country. The company continues to explore growth opportunities, expand its footprint, and deliver superior gaming experiences to its customers.

Jaydev Mody, the founder, and chairman of Delta Corp, has been instrumental in shaping the company’s strategic direction and success. Under his leadership, Delta Corp has become a prominent player in the Indian gaming and hospitality sectors.

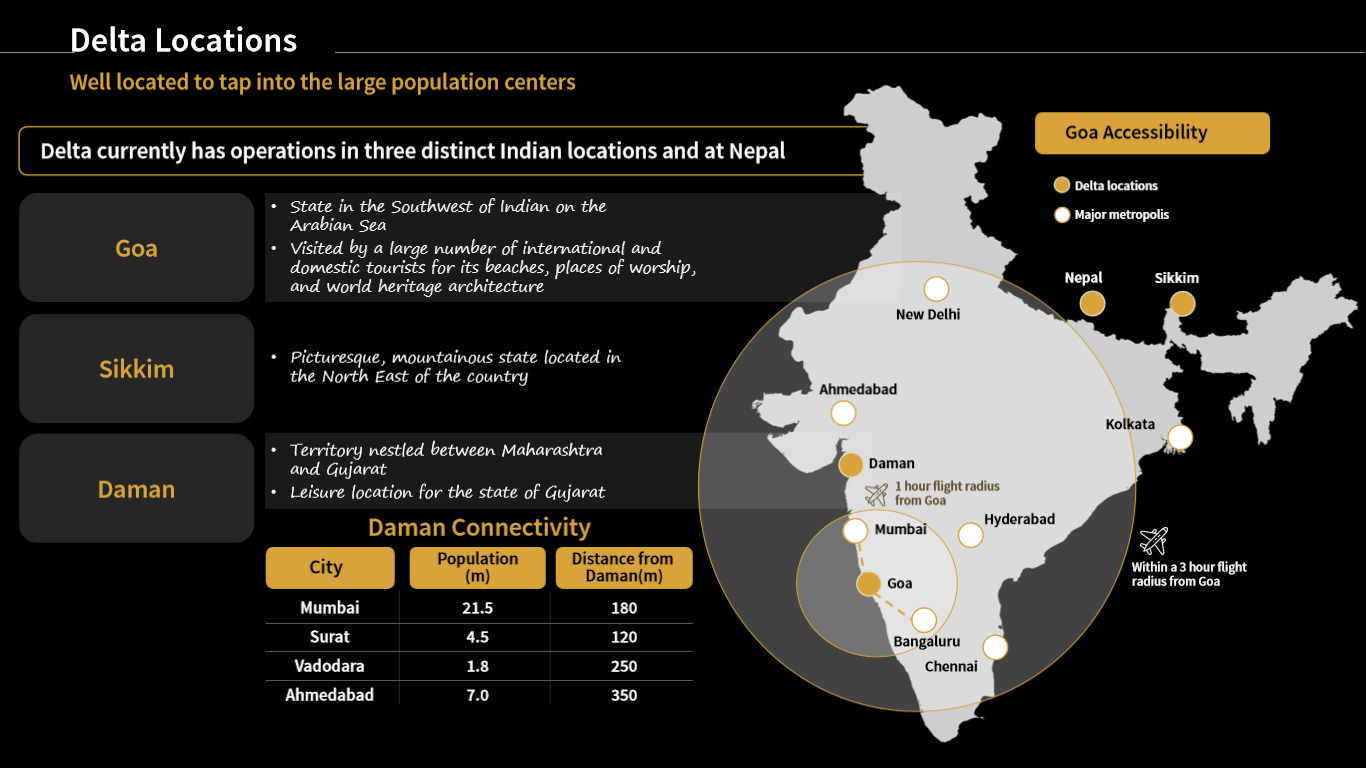

Geographic Presence:

Delta Corp’s operations span multiple regions in India, including Goa, Sikkim, and Daman.

This geographic diversification reduces the company’s dependence on a single location and provides opportunities for capturing a broader market share.

Market Leadership:

Delta Corp’s position as the largest gaming company in India, capturing 55% of the organized casino market, underscores its market leadership and brand recognition.

This leadership position offers a competitive advantage, allowing the company to leverage its reputation and customer base for further growth.

Business Focus:

Delta Corp focuses on three main business segments:

-Gaming, hospitality, and real estate.

Delta Corp has built a strong brand portfolio with its casinos, online gaming platforms, and hospitality offerings.

The brand recognition and customer loyalty associated with Delta Corp’s portfolio contribute to its revenue growth and market positioning.

Gaming:

Offshore Casinos:

Delta Corp operates several offshore casinos in Goa, India.

These casinos are located on ships anchored in the Mandovi River. Some of the prominent offshore casinos include

-Deltin Royale,

-Deltin JAQK, and

-Deltin Caravela.

These establishments offer a range of gaming options, including slot machines, table games like poker, roulette, blackjack, and more.

Onshore Casinos:

Apart from the offshore casinos, Delta Corp also operates onshore casinos in Goa.

These are land-based casinos situated in five-star hotels and resorts.

The onshore casinos provide similar gaming experiences as the offshore ones.

Online Gaming:

Delta Corp’s online gaming brand, Adda52, is a popular platform for online poker and other skill-based games in India.

Adda52 offers a variety of tournaments, cash games, and promotions to cater to the growing online gaming community.

Hospitality:

Luxury Hotels and Resorts:

Delta Corp owns and operates luxury hotels and resorts in Goa, catering to both leisure and business travelers.

These properties provide premium accommodation, dining options, and other amenities. Some of its well-known properties include

-Deltin Suites,

-Deltin Palms, and

-Deltin Hotel

-Casino.

Real Estate:

Residential Projects:

Delta Corp’s real estate division focuses on the development of residential projects in Goa.

They undertake the construction and sale of high-end residential properties such as villas, apartments, and condominiums.

Commercial Projects:

The company also engages in the development of commercial projects, including office spaces and retail complexes, to meet the growing demand for commercial properties in Goa.

Expansion and Growth Potential:

The new airport in Goa is expected to have a positive impact on attracting more visitors to the region, benefiting Delta Corp’s business.

Delta Corp has been exploring opportunities to expand its gaming and hospitality operations beyond Goa.

They have been actively monitoring regulatory developments in other states where gambling and casinos are legal to identify potential avenues for future growth.

Delta Corp does not have capacity constraints for the next 4-6 years, indicating the ability to accommodate future growth. The company has the potential for further growth if India achieves its target of becoming a 10 trillion economy by 2030, as increased economic activity can drive demand for gaming and hospitality services.

Casino Business:

-Delta Corp is the largest gaming company in India and holds a dominant market share in the organized casino market.

-The company’s ownership of multiple licenses and plans for an integrated resort in Goa showcase its commitment to expanding and diversifying its casino business.

-Achieving revenue milestones of INR 1,000 crores and exceeding INR 1,200 crores indicate strong growth and financial success in the casino segment.

-The launch of the new vessel is expected in the fourth quarter of the financial year, with slight delays due to operational yard-related issues.

-The company has invested around INR 140-160 crores in the new ship, with the remaining 30-40% of capital expenditure yet to be incurred.

-The old vessel will be replaced by the new one, as Delta Corp holds three licenses.

-The vessel upgrade for Caravela, along with the increased license fee, signifies Delta Corp’s commitment to enhancing its gaming offerings and capacity. These upgrades can improve the customer experience and attract a larger audience, potentially leading to increased revenue in the future.

Online Gaming:

-Delta Corp’s online gaming business, primarily focused on poker through Adda52.com, has experienced significant growth.

-Despite initial investments in the multi-gaming platform, the online gaming business is breaking even.

-Regulatory clarity and the non-impact of GST on online gaming provide a stable environment for this segment’s growth.

Hospitality:

-Delta Corp’s hospitality segment, closely linked to its gaming business, operates hotels in Goa and Daman.

-The Goa hotel maintains a 75% occupancy rate with an ARR of INR 5,700, while Daman has a 52% occupancy rate with an ARR of INR 7,000.

-While the company is not incurring operational losses in Daman, revenue generation for the Goa hotel is affected by the lack of marketing and sales efforts.

Integrated Resort Development:

Delta Corp’s plans to establish an integrated resort in Pernem, Goa, signify its strategic expansion and diversification efforts. While the project is awaiting environmental clearance, once approved, it has the potential to contribute significantly to the company’s revenue and overall growth.

The objections raised regarding the integrated resort project in Pernem, Goa, highlight potential challenges and regulatory scrutiny that Delta Corp may face during the development and licensing processes.

IPO of Subsidiary:

The announcement of an upcoming IPO by Deltatech Gaming Limited, a subsidiary of Delta Corp, suggests that the company is exploring avenues to unlock value and raise capital. This IPO could attract investor interest and potentially increase the overall valuation of Delta Corp as a holding company.

Delta Corp is actively working on launching an IPO, having resolved the previous ambiguity, and aims to successfully close it. Audited numbers and approvals valid until October 2023 provide a solid foundation for the gaming IPO.

The actual percentage of dilution for the IPO will depend on valuation and pricing.

Foreign Tourist Appeal:

The allowance for foreign tourists to play in Delta Corp’s casinos and repatriate their winnings in foreign currency enhances the company’s appeal as a destination for international travelers.

This provides an additional revenue stream and helps attract a diverse customer base.

Scalable Business Model:

Delta Corp’s scalable business model enables it to expand and replicate its successful operations in new locations.

This scalability factor allows the company to seize opportunities in emerging markets and further consolidate its market position.

Customer Experience:

Delta Corp places a strong emphasis on providing a high-quality customer experience, both in its physical casinos and online gaming platforms.

Investments in upgrading its ships, developing integrated resorts, and offering a multi-gaming platform reflect the company’s commitment to delivering exceptional customer service and entertainment.

Competitive Advantage:

Delta Corp enjoys a competitive advantage in the gaming industry as the only listed company with a significant presence in casino gaming in India.

This advantage provides the company with greater visibility, access to capital markets, and opportunities for expansion.

Technological Advancements:

Delta Corp’s focus on online gaming demonstrates its recognition of the growing importance of technology in the industry.

By leveraging technological advancements, such as mobile platforms and innovative gaming experiences, the company can reach a wider audience and enhance customer engagement.

The Synergy between Gaming and Hospitality:

The integration of gaming and hospitality operations provides Delta Corp with a synergistic business model.

Customers visiting the company’s casinos can also enjoy accommodation, dining, and entertainment services, creating a comprehensive and immersive experience.

Emphasis on Responsible Gaming:

Delta Corp recognizes the importance of responsible gaming practices and implements measures to ensure the well-being of its customers.

By promoting responsible gambling, the company enhances its reputation and fosters a positive relationship with regulators and the community.

Experienced Board of Directors:

Delta Corp benefits from the expertise and guidance of its experienced board of directors.

The board’s diverse backgrounds and industry knowledge provide strategic direction and governance oversight, supporting the company’s long-term success.

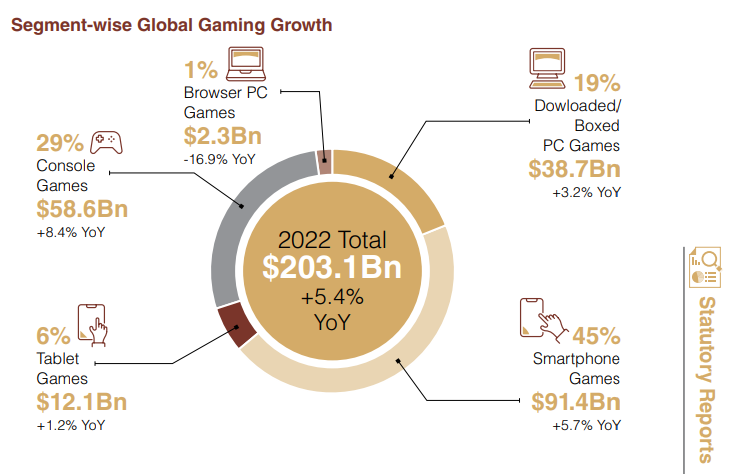

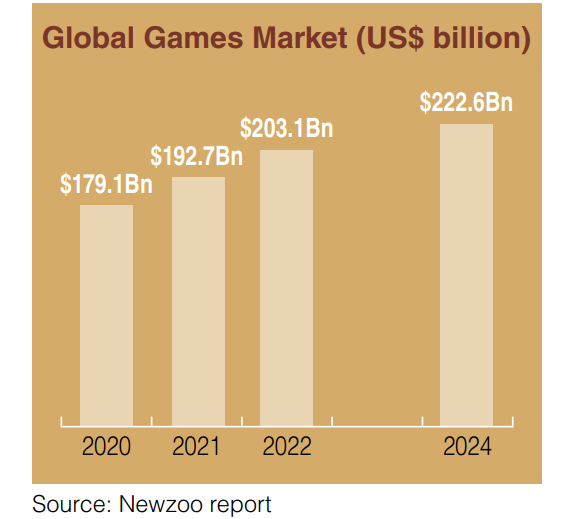

Positive Industry Outlook:

The gaming and hospitality industry in India is witnessing a positive outlook, with increasing disposable incomes, changing consumer preferences, and growing tourism.

Delta Corp is well-positioned to capitalize on this favorable industry trend and further expand its market presence.

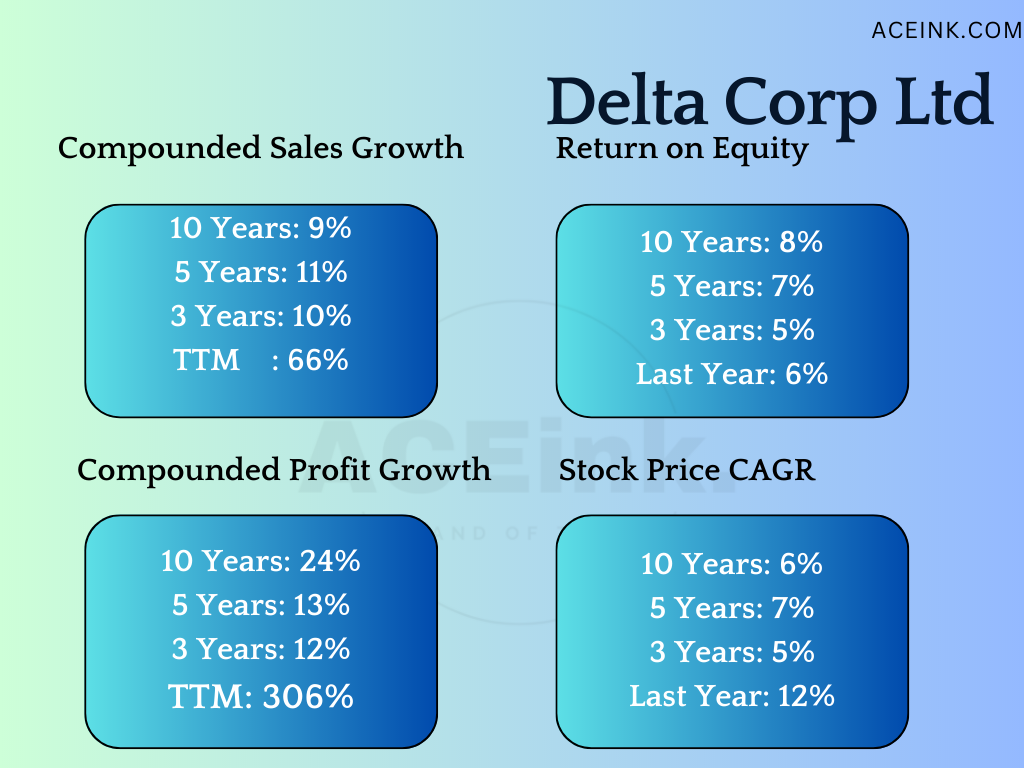

Revenue Milestones:

-Delta Corp achieving INR 1,000 crores in gaming business revenue for the first time signifies significant growth and financial success.

-Surpassing the milestone of INR 1,200 crores indicates continued growth and further consolidation of Delta Corp’s market position.

-Crossing the INR 200 crores mark in gross turnover for the online gaming business showcases the increasing popularity and financial success of Delta Corp’s online gaming offerings.

-Recording an online revenue of INR 22.5 crores in a single month (March) demonstrates strong performance and potential for further revenue growth in the online gaming segment.

-The better trajectory and run rate in online gaming indicate a positive trend and increased customer engagement in this segment.

-EBITDA for the company as a whole saw a 50% jump on an annual basis, indicating improved financial performance.

-Gaming revenue increased from INR 780 crores in FY2020 to INR 1,010 crores in FY2022-23, showing growth in the gaming business segment.

-The company has a substantial cash reserve of INR 535 crores, which includes mutual funds, fixed deposits, and cash in various accounts.

-Delta Corp’s operations in Nepal generate INR 4 crores per month and have growth potential once the destination fully recovers from the impact of COVID-19.

-Sikkim operations have stabilized at INR 2-2.5 crores per month, representing double the pre-COVID levels.

-The regulation of online gaming by the Ministry of Information and Technology (METI) provides a clear regulatory framework for the industry, ensuring compliance and stability.

Risks in investing

Regulatory and Legal Risks:

Delta Corp operates in a highly regulated industry, and changes in regulations or legal challenges could impact its operations and profitability.

Example: The ban on online gaming in Tamil Nadu could have implications for Delta Corp’s online gaming business in that region.

Company’s Capacity to Deal: Delta Corp has a track record of complying with regulatory requirements and adapting to changes in the legal landscape. The company can engage with regulators and legal experts to navigate any regulatory or legal challenges effectively.

Competitive Risks:

The gaming and hospitality industry is highly competitive, and Delta Corp faces competition from both domestic and international players.

Example: The entry of new competitors or existing competitors expanding their operations could impact Delta Corp’s market share and revenue.

Company’s Capacity to Deal: Delta Corp’s strong brand presence, market leadership, and customer loyalty provide a competitive advantage. The company can continue to focus on providing exceptional customer experiences, innovative offerings, and strategic expansion to stay ahead of competitors.

Economic Risks:

Delta Corp’s performance is influenced by economic factors such as GDP growth, consumer spending, and tourism trends.

Example: Economic downturns or fluctuations in discretionary spending could lead to reduced demand for gaming and hospitality services.

Company’s Capacity to Deal: Delta Corp’s diversified operations across different regions in India mitigate the impact of localized economic fluctuations. The company can closely monitor economic indicators, adapt its marketing strategies, and adjust pricing and offerings to align with changing consumer preferences.

Operational Risks:

Delta Corp faces operational risks related to its casino operations, online gaming platforms, and hospitality services.

Example: Technical glitches in online gaming platforms or disruptions in casino operations due to unforeseen events could impact customer experience and revenue generation.

Company’s Capacity to Deal: Delta Corp can implement robust risk management and disaster recovery plans to mitigate operational risks. The company can invest in technology infrastructure, employ skilled personnel, and conduct regular maintenance and testing to ensure smooth operations and minimize disruptions.

Environmental Risks:

Delta Corp’s expansion plans, such as the integrated resort development, may face environmental risks and the need to obtain necessary clearances.

Example: Delays in obtaining environmental clearances or opposition from local communities could impact project timelines and financial outcomes.

Company’s Capacity to Deal: Delta Corp can proactively engage with environmental authorities, conduct thorough assessments, and implement sustainable practices to minimize environmental impact. The company can also maintain open communication with local communities, address concerns, and seek partnerships to navigate environmental risks effectively.

Macroeconomic Risks:

Delta Corp’s growth potential is influenced by macroeconomic factors such as government policies, taxation, and overall economic stability.

Example: Changes in tax rates, foreign exchange regulations, or political instability could impact the company’s profitability and expansion plans.

Company’s Capacity to Deal: Delta Corp can closely monitor macroeconomic trends, maintain dialogue with government authorities, and adapt its strategies to align with evolving policies. The company’s financial strength and diversified operations provide a level of resilience to withstand potential macroeconomic risks.

Dependence on Goa Market:

Delta Corp’s operations are heavily concentrated in Goa, which exposes the company to risks associated with a single market.

Example: Any adverse developments in the Goa market, such as changes in regulations or a decline in tourism, could significantly impact Delta Corp’s revenue and profitability.

Company’s Capacity to Deal: Delta Corp can mitigate this risk by diversifying its operations geographically and exploring opportunities in other regions of India. This could involve expanding into new markets or acquiring existing gaming and hospitality assets in different states.

Infrastructure and Development Risks:

Reputation and Brand Risks:

Delta Corp’s reputation and brand value are essential for attracting and retaining customers.

Example: Negative publicity, customer dissatisfaction, or incidents related to responsible gambling practices can harm the company’s reputation and erode customer trust.

Company’s Capacity to Deal: Delta Corp can actively manage its brand reputation by investing in customer service, responsible gambling initiatives, and employee training programs. By maintaining a strong corporate governance framework and transparent communication with stakeholders, the company can safeguard its reputation and mitigate brand-related risks.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.