Why this small-cap stock can perform exceptionally in the future?

What comes to your mind when you hear the word “laboratory”? Probably, you might imagine professionals using a wide range of tools and equipment to carry out their work.

But have you ever wondered how crucial a role the tools play in enabling these discoveries?

Today we will talk about a company that has an experience of over 39 years in the field of life science and plastic lab ware.

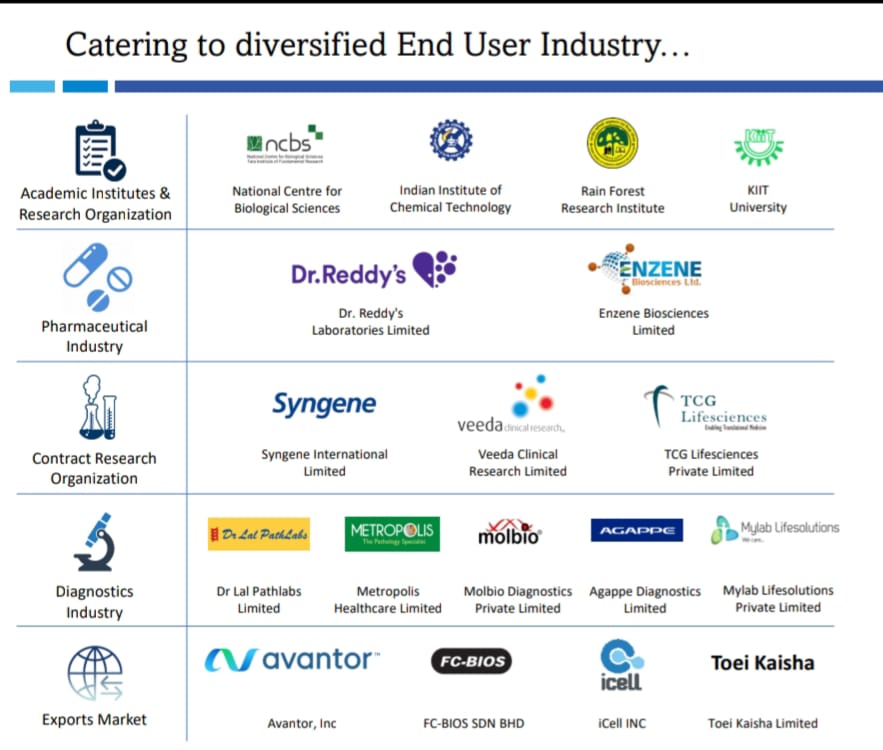

Tarsons Products Limited (TPL) is a leading company that develops and supplies plastic labware. TPL has established itself among the top three players in the lab ware market in India and has a strong presence in over 40 countries worldwide. Their precision-engineered tools ensure that scientists have the best equipment to conduct their experiments and research.

In this blog, we will explore the business of Tarsons Products Limited and discover why so many analysts are bullish on it despite its downfall.To learn more about stock market basics and stock analysis one can consider enrolling in our Stock Market Learning Courses, here.

Understanding Lab Ware:

Labware refers to the special equipment used by scientists in laboratories. It enables them to carry out experiments, make important discoveries, and contribute to scientific advancements.

Tarsons Products Limited has carefully categorized its lab ware products into two main categories:

-Consumables, this segment of the company generated 56% of total revenues in FY23.

-And Reusables, this segment of the company generated 39% of total revenues in FY23.

Each category serves a unique purpose and offers specific tools that scientists rely on.

Consumables:

TPL provides a wide range of consumable lab ware products that are designed for single-use purposes. These include:

-Pipette tips,

-Centrifuge tubes,

-Petri dishes,

-Sterile media bottles,

-Cryo vials,

-Storage vials,

-And Serological pipettes.

Pipette tips are special tools that help scientists move tiny amounts of liquids very accurately. Centrifuge tubes are used for storing liquids and separating different parts. Petri dishes are like homes for growing tiny organisms, and sterile media bottles are used for making and keeping special fluids. Cryo vials are for storing things really, really cold, and storage vials hold different types of samples. Serological pipettes are tools that scientists use only once in experiments with cells and research.

Reusables:

TPL’s range of reusable lab ware products includes:

-Bottles,

-Carboys,

-Beakers,

-Cylinders,

-And Benchtop Instruments.

Bottles are strong containers for keeping and moving chemicals, and carboys are used for mixing fluids and storing intermediate substances. Beakers are handy for mixing liquids, and cylinders help measure volumes accurately. On the laboratory bench, scientists use tools like vortex shakers, centrifuges, and pipettors for tasks like collecting cells, extracting materials, and separating substances. Some of these tools can be used again, while others are only used once.

Others:

In addition to Consumables and Reusables, TPL offers various lab ware products that don’t fit into specific categories. This segment of the company generated 5% of total revenues in FY23. Some products in this category include:

-Centrifuges,

-Pipettors,

-And Vortex shakers.

Small centrifuge machines are made for special tubes used in experiments like PCR and microcentrifuge tubes. Pipettors help scientists move tiny amounts of liquids very carefully and accurately, especially when working with very small amounts. Sturdy and small vortex shakers with adjustable speed settings make sure liquids mix well.

Export business of the company:

With exports contributing to 33% of the total revenue, amounting to Rs. 920 million in the financial year 2023, The company is making waves in the international market. The export business consists of two main segments:

Branded products

And ODM (Original Design Manufacturer) sales

Branded products make up 37% of the total export revenue, while ODM sales account for 63%.

Expanding Global Reach:

The company has ambitious plans to expand its exports to approximately 120 countries over the next 5-10 years. This expansion will be achieved through a dual-purpose approach.

Firstly, the focus will be on emerging markets such as Asia Pacific, the Middle East, and South America, where they will introduce their branded products. These markets present exciting opportunities for growth and reaching a wider customer base.

Secondly, they will engage in ODM sales to supply products to developed markets like the USA and Europe. By partnering with other companies, they will design and manufacture products that will be sold under their brand names in these established markets. This strategic approach allows them to tap into the demand and preferences of customers worldwide.

Manufacturing & Distribution Network:

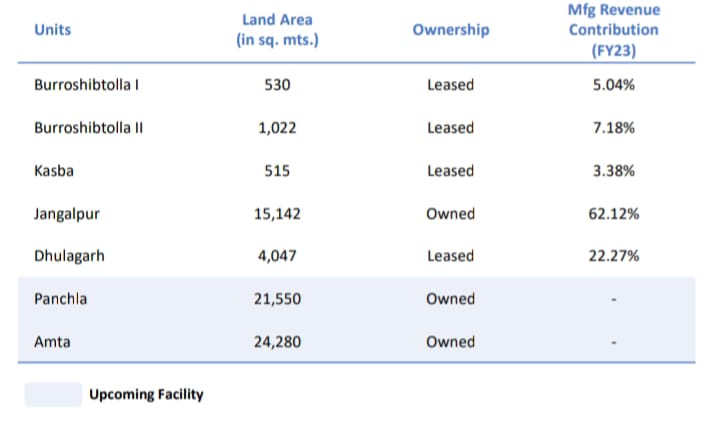

With five advanced manufacturing facilities in West Bengal, Tarsons utilizes cutting-edge technology and automated processes, including the use of robots and overseas partner collaborations.

The manufacturing process takes place in certified clean rooms, upholding strict purity standards validated by third-party organizations.

Tarsons’ wide distribution network across India, coupled with its strong relationships with distributors, ensures the widespread availability of its products.

In terms of regional contributions,

The South region accounts for the largest share (43%) of domestic sales,

followed by the West region (25%),

the North region (17%), and

the East region (16%).

Expansion Plans and Introducing New Product Lines:

Tarpons have acquired land in Panchla and Amta, both in West Bengal, for expansion purposes. The Panchla facility will specialize in cell culture products, while the Amta facility will serve as a fulfillment center and focus on specific product lines.

The expansion aims to increase manufacturing capacity, introduce new product categories such as liquid handling, centrifuge ware, and cryo ware, and support backward integration for an efficient supply chain.

The phased operations of the new facilities are set to commence in the second quarter of FY24, with the goal of achieving full operational capacity by the fourth quarter of FY24.

Fundamentals of the company:

Market cap: 3,122 crores

Current price: 635

High/Low: 914/501

PE TTM: 38.68

Industry PE: 33.75

Face value: 2

Dividend Yield: 0

Return over 1 year: -20.57%

Shareholding pattern:

Promoter holding: 47.31%

FIIs holding: 9.16%

DIIs holding: 7.64%

Public holding: 35.89%

Financials of the company:

ROCE: 19%

ROE: 15%

OPM: 46%

Debt: 111 crore

Debt equity: 0.19

Reserve: 559 crore

Inventory: 114 crore

Company’s financial performance in FY 23:

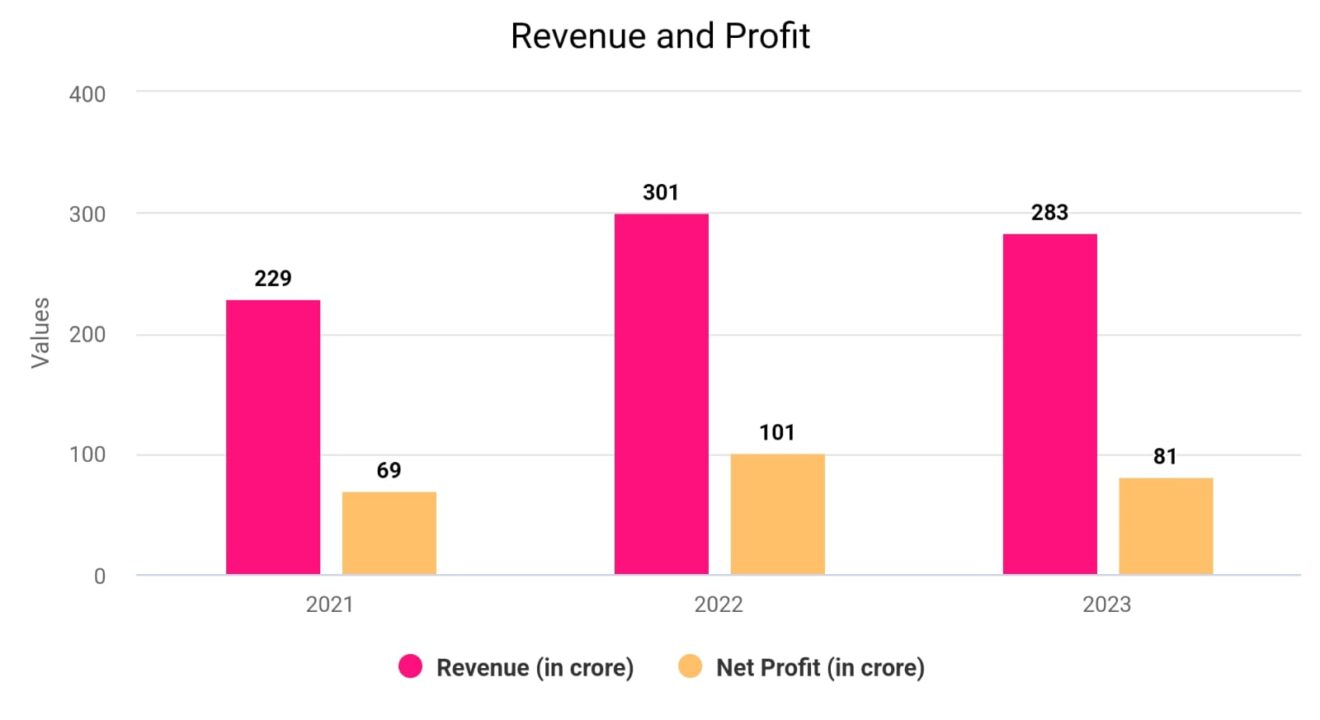

Revenue: In the last fiscal year (FY23), the company’s revenues went down by 6%.

The main reason for the revenue decrease was a temporary slowdown in the life science industry. The company faced losses in revenue due to the COVID-19 pandemic compared to the previous fiscal year (FY22).

However, the company managed to offset the pandemic-related losses with revenues from its regular business activities. The company expects the revenue situation to improve in the future.

EBITDA: The profit margins, measured as EBITDA margins, were 45.8% in FY23, down from 50.8% in FY22.

This decrease in margins happened because the company couldn’t cover its fixed costs as well due to the decline in revenues during the first 9 months of FY23.

In FY23, the company spent more on sales promotion, marketing, and travel expenses compared to FY22. The purpose of these increased expenses was to support future growth in both domestic and international markets.

Inventory days: The company’s inventory days, which measure how long inventory stays in stock, increased from 277 days in FY21 to 642 days in FY23.

The increase in inventory days suggests that the company is holding onto its inventory for a longer time before selling it.

This could be due to various factors, such as changes in demand, production delays, or challenges in selling products.

Key Points to Consider

Strong domestic presence:

Tarsons currently holds a significant market share in India’s labware market, indicating a strong domestic presence. The company has been expanding its market share in the domestic market due to import substitution and high consumer demand for lab consumables.

This positions Tarsons well to benefit from the growing demand in the domestic market.

Robust growth in the export market:

Tarsons has been experiencing substantial growth in its export revenues, with a focus on the US, EU, and South-East Asia markets. The company’s products are priced competitively, being at least 50 percent cheaper than international competitors.

With improved production capabilities, Tarsons is expected to gain significant traction in the export market, which presents an opportunity for further revenue growth.

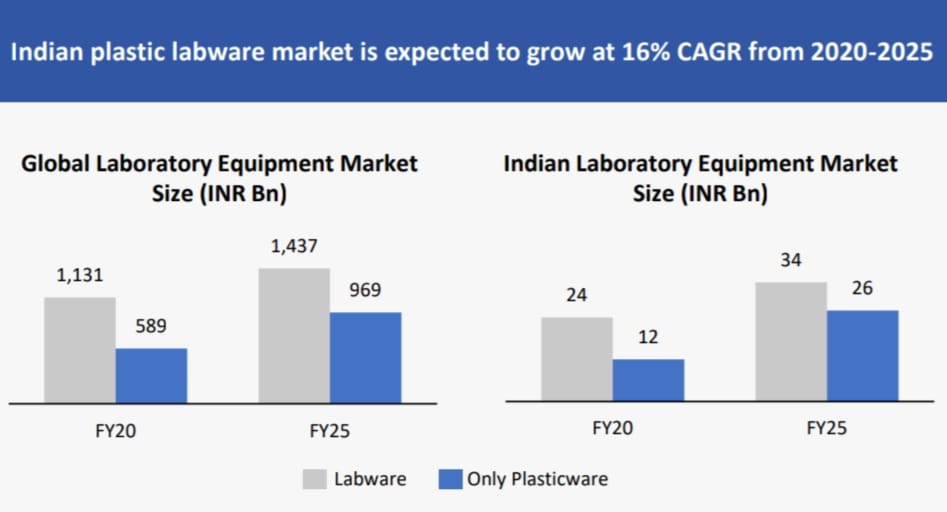

Shift from glassware to plasticware:

The Indian laboratory equipment market has been witnessing a shift from glassware to plasticware. Plasticware has several advantages over glassware, including being cheaper, unbreakable, and safer to use. Tarsons, being a major player in the plasticware segment, is well-positioned to benefit from this trend.

The increasing use of disposable consumables further supports Tarsons’ growth potential in this market.

Capacity expansion: Tarsons is expanding its manufacturing capacity by setting up a new facility, which will double its current capacity. This expansion will enable the company to meet the strong demand from both domestic and export markets.

Additionally, the upcoming sterilization facility will provide Tarsons with an advantage in the PCR and cell culture market, which is a rapidly growing market globally.

Consistent performer:

Tarsons has demonstrated consistent financial performance, maintaining high margins even during challenging times. The company’s revenue and profit after tax have grown at a compound annual growth rate (CAGR) of 13 percent and 57 percent respectively between FY14 and FY23.

Tarsons’ ability to protect its margins is attributed to its strong brand recall value, pan-India distribution network, and growth in its conventional businesses.

Key Risks to consider:

-Tarsons faces the risk of pricing pressures from competitors, which can affect the company’s profit margins. Competitors may offer lower prices, making it challenging for Tarsons to maintain profitability.

-The volatility in raw material prices poses a threat to Tarsons’ profitability. Fluctuations in the prices of materials used to make their products can impact the company’s costs, potentially reducing its margins.

Considering the strong market presence, growth potential in the domestic and export markets, capacity expansion, and consistent financial performance, Tarsons appears to have a compelling investment rationale. However, it’s important to conduct further research and analysis to assess the risks, competitive landscape, and other factors that could impact the company’s future performance.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“Why the Thriving entertainment Industry Should Be on Your Investment Radar” Visualize the glistening waters of Goa, India’s…Read More

“Discovering Hidden Gems: The Investment Potential of the Gaming Stock”