“YES Bank’s Road to Recovery: What Investors Need to Know”

In recent months, the banking sector has become a focal point of discussions, highlighting both public and private players exhibiting noteworthy performance in its impressive retail growth, resilient asset quality, and robust financial results.

If we look at the last six months, YES Bank’s stock wasn’t doing much exciting—it was kind of quiet. But suddenly, things changed. The stock shot up by about 23% in just one month!

Now, why did this happen? What’s making YES Bank talk of the town?

Also Read: “Suzlon 2.0: What Lies Ahead -Post Turnaround?”

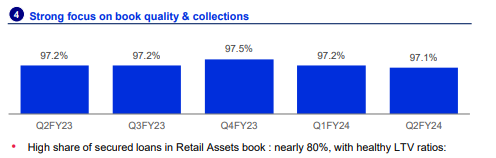

#1 Improved Asset Quality

The primary catalyst behind YES Bank’s recent stock surge is its stellar performance in the September 2023 quarter. Several key financial indicators reflect the bank’s robust standing:

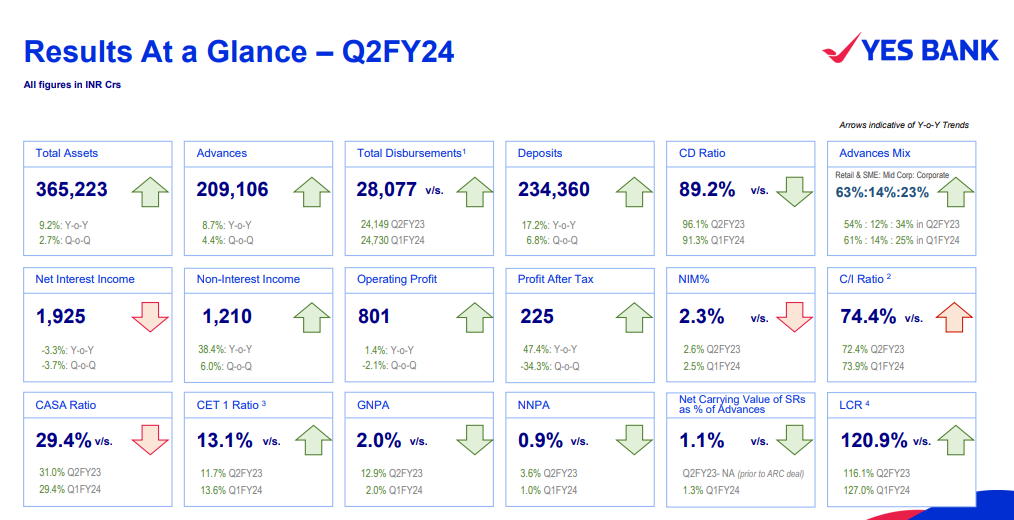

- Total assets grew by 9.2%, reaching Rs 3,652 billion (bn) compared to the same quarter last year.

- Total advances witnessed an 8.7% increase, reaching Rs 2,091 bn during the same period.

- Deposits experienced a significant uptick, marking a 17.2% year-on-year increase.

- Profit after tax (PAT) exhibited a notable jump of 47.4% to Rs 2.3 bn compared to the same quarter last year.

Furthermore, YES Bank witnessed a remarkable improvement in asset quality, with gross non-performing assets (GNPA) dropping from 12.9% to 2% YoY, and net non-performing assets (NNPA) decreasing from 3.6% to 0.9% YoY.

#2 Proceeds from the Sale of NPA Portfolio to JC Flowers ARC

Another significant factor in YES Bank’s recent rally is the infusion of Rs 1.2 bn from the sale of its non-performing asset (NPA) portfolio to JC Flowers Asset Reconstruction (JC Flowers ARC). This strategic move, initiated in December 2022, involved offloading troublesome loans to JC Flowers ARC for a substantial sum of Rs 480 bn.

As part of this deal, YES Bank transferred shares of Dish TV India and other entities to JC Flowers ARC, relieving itself of the responsibility of recovering funds from these stressed assets.

Adding another dimension to its strategic moves, YES Bank announced the appointment of Tushar Patankar as its Chief Risk Officer.

What went wrong with Yes Bank earlier?

The Timeline

Founding Years (2004): Yes Bank, founded in 2004 by Rana Kapoor and Ashok Kapur, emerged as a new player in India’s banking sector. With a vision to provide innovative financial solutions, the bank aimed to cater to the diverse needs of businesses and individuals.

Early Growth and Expansion: In its initial years, Yes Bank focused on building a robust foundation and expanding its reach. The bank gained recognition for its customer-centric approach and commitment to technology-driven banking solutions.

IPO and Market Presence (2005 – 2010): Yes Bank made a mark in 2005 with its Initial Public Offering (IPO), becoming one of the few banks to go public in India.

During this period, Yes Bank strengthened its presence in the market, establishing itself as a prominent player in retail and corporate banking. The bank’s commitment to innovation and customer service contributed to its growing reputation.

Challenges and Reconstruction (2020):

- Yes Bank faced challenges related to high Gross Non-Performing Asset (GNPA) ratios due to defaults on corporate advances. Notable defaults included loans to entities like Anil Ambani Group, Essel Group, DHFL, Jet Airways, and others.

- In March 2020, the Reserve Bank of India (RBI) intervened, superseding the Board of Directors and appointing Prashant Kumar as the administrator of the bank.

Reconstruction Scheme 2020:

- To prevent Yes Bank’s collapse, a reconstruction scheme was implemented in March 2020. Private and public institutions infused equity into the bank, with a lock-in period for 75% of allotted equity shares for three years.

- The State Bank of India’s shareholding in the bank was safeguarded, not falling below 26% for three years.

Follow-on Public Offering (FPO) and Capital Raise:

- In July 2020, Yes Bank approved a capital raise through an FPO, issuing 1,250 crore shares at ₹12 per share, increasing its equity capital from ~Rs. 2,500 crores to ~Rs, 5,000 crores.

- In March 2023, shares locked under the Reconstruction Scheme were released.

Stock Options and Sale of Subsidiaries:

- In FY22, the bank issued around 47,000 equity shares through stock options.

- Yes Bank strategically sold its entire stake in YES Asset Management (India) Limited and YES Trustee Limited to GPL Finance and Investments Limited on November 1st, 2021.

What Next: Navigating Growth and Transformation

Capex Initiatives:

- YES Bank is gearing up for growth in the Wholesale Banking segment, focusing on ELC (Emerging Corporate and Large Corporate) businesses through strategic senior hires.

Technological Strength:

- Leveraging robust technology and digital capabilities, YES Bank continues to excel in current account acquisition, fee income generation, and transaction banking, reinforcing its position in the digital banking landscape.

Strategic Focus on Retail:

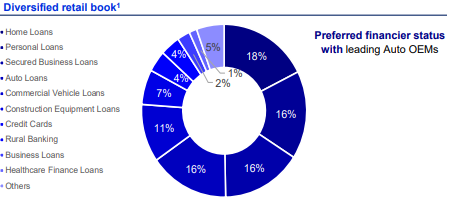

- Retail advances have surpassed the 1 lakh Crore mark, constituting 48% of the total, with strong disbursement momentum across various asset classes.

- A strategic focus on acquiring affluent, mass affluent, and MSME clients in its granular retail deposit franchise is underway.

Cost of Funding and CASA Acquisition:

- The cost of funding has played out, and YES Bank anticipates improved yields as it shifts away from the super prime segment.

- The CASA (Current Account Savings Account) New-To-Bank (NTB) acquisition run rate has increased, with an incremental retail CASA ratio reaching 34.8% in Q2.

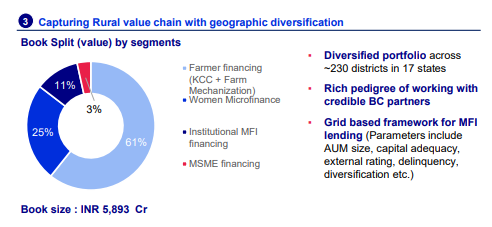

Microfinance Exploration:

- YES Bank is actively exploring the acquisition of a microfinance business, showcasing its commitment to diversification and potential growth avenues.

Guidance for the Future:

- The near-term outlook includes ambitious goals such as mid-teens loan and advances growth, margin expansion, controlled gross slippage, and a credit cost target of around 50 basis points on total assets.

- The bank anticipates a substantial reduction in the net carrying value of security receipts by the end of the financial year.

- YES Bank remains focused on overcoming challenges, aiming for a medium-term Return on Assets (ROA) target of 1%.

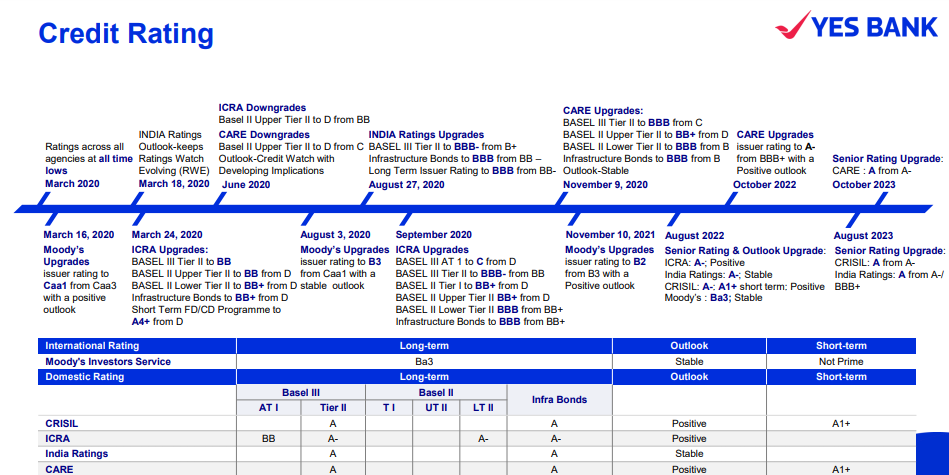

Additionally, credit rating information services of India Limited (CRISIL) have upgraded Yes Bank’s long-term rating on tier-II and infrastructure bonds to CRISIL A/Positive from CRISIL A-/Positive.

In summary, YES Bank is navigating a path of transformation and growth, underpinned by strategic initiatives, technological advancements, and a focus on diverse customer segments. The bank’s resilience and strategic outlook position it for a promising future in the ever-evolving financial landscape

Understanding Risks in Investing in YES Bank

While considering an investment in YES Bank, it’s essential to be aware of potential risks that could impact your investment. Here are some specific risks associated with investing in YES Bank:

- Asset Quality Concerns: Historically, YES Bank faced challenges related to the quality of its assets. Non-performing assets (NPAs) and exposure to stressed sectors could pose risks to the bank’s financial health.

- Regulatory Changes: Banking is highly regulated, and changes in regulations can affect how banks operate. Any modifications in banking or financial regulations may impact YES Bank’s business model and profitability.

- Liquidity Risks: Liquidity risk arises when a bank faces difficulties in meeting its short-term financial obligations. Changes in market conditions or a sudden withdrawal of deposits could impact YES Bank’s liquidity position.

- Market Perception: Public perception and market sentiment can significantly impact a bank’s stock. Negative news or sentiment about YES Bank could lead to a decline in its stock price.

- Technology and Cybersecurity Risks: In an increasingly digital world, banks face cybersecurity threats. Any breach or disruption in technology systems could harm YES Bank’s operations and reputation.

- Interest Rate Risk: Banks like YES Bank are susceptible to changes in interest rates. Fluctuations in interest rates can impact the bank’s net interest margin (NIM), influencing its profitability.

- Dependence on Wholesale Funding: If YES Bank heavily relies on wholesale funding, it could face challenges if there’s a disruption in the wholesale funding markets or if the cost of such funding increases.

Investors should keep these risks in mind, conduct thorough due diligence, and regularly monitor the evolving economic and market conditions when considering an investment in YES Bank.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.