“Driving Growth – A Fundamentally Strong Small Cap Company”

A key player in the chemical industry, showcasing remarkable growth and ambitious capacity expansion initiatives the company is creating a buzz.

Their focus is on standalone business realization and gradual margin improvement adds to their promising prospects.

With a commitment to innovation and customer-centricity, Balaji Specialty Chemicals is poised for future growth.

Balaji Amines Ltd

Balaji Amines Ltd has emerged as a key player in the chemical industry

– Showcasing remarkable financial performance

– Ambitious capacity expansion initiatives with new plants

– Aiming to double its current capacity by 2026

– Focus on margin improvement

In today’s discussion, we will try to understand the strategies and opportunities driving the success of Balaji Amines along with the challenges and risks the company is and could face.

ABOUT THE COMPANY :

* Balaji Amines Limited was established in 1988, to manufacture Methyl Amines and later added Ethyl Amines to the range.

* Balaji is India’s largest manufacturer of aliphatic amines and derivatives

* Market Share of ~50% in Aliphatic amines and derivatives in India

* Amines category accounts for ~19% of its revenues but are low margins products

* Amines derivatives category accounts for ~28% of revenues which are higher margins products

* The company also owns Balaji Sarovar Premiere which is a 5-star hotel in Solapur

—————————————————————

BUSINESS MODEL :

The company’s strategic approach is to focus on

* High-value derivatives

* High-value specialty chemicals

* Focus on creating their own technology to manufacture their products

* Investing in R&D to introduce new products

* Investing to enhance their systems and processes

* Investing wisely in products that are either heavily imported or face little competition

Company cater to fast-growing industries such as :

* Pharmaceuticals

* Agro chemicals

* Refineries

* Water treatment

* Rubber

* Electronics

* Dye stuff

* Paints

* Animal feeds

* Photographic chemicals

* Leather processing

—————————————————————

PRODUCT SEGMENTS:

The company has a diversified product portfolio categorised under 3 main categories.

* Amines

* Amine derivatives

* Speciality chemicals

—————————————————————

1. AMINES

Aliphatic amines are in high demand in mature chemical industries.

Such as

* India

* Europe

* US

* China

* Japan

APPLICATIONS

* Pharma

* Agro chemicals

* Photographic chemicals

* Rocket fuel

* Dye stuff intermediates

* Rubber chemical, etc.

KEY CLIENTS

* Dr reddy’s

* Lupin

* Aurobindo pharma

* Cipla

* Jubilant lifesciences

—————————————————————

2. AMINE DERIVATIVES :

* Amine derivatives are utilised to create salts, intermediates, and APIs.

* Di-Methyl Amine Hydrochloride (DMA HCL) is one of Balaji’s key product offerings.

APPLICATIONS :

* Pharma

* Pesticides

* Performance chemical

* Speciality chemicals

* Animal/poultry feed additive, etc.

KEY CLIENTS :

* Sun Pharma

* Natco

* Granules

* Aarti drugs

* Ipca

—————————————————————

3. SPECIALITY CHEMICALS :

* Company operates its specialty chemicals business through its subsidiary

* Balaji Specialty Chemicals Pvt Ltd

* In which the company holds a 55% stake

APPLICATIONS :

* Pharma

* Petrochemicals

* Dyes

* Agro & paint industries

* Water treatment chemicals

* Pesticide formulations , etc.

KEY CLIENTS :

* Deepak Nitrite

* Indian oil

* Gail

* Cadila pharma

* Hikal

—————————————————————

4. HOTEL BUSINESS :

* Company owns a 5-star hotel “Balaji Sarovar Premiere “ in Solapur, Maharashtra

* Contributes 1% of the total revenues of the company

* The hotel has 129 rooms

* Hotel had an occupancy rate of 47%

—————————————————————

MANUFACTURING :

* Company has 5 manufacturing facilities

* Located in Maharashtra and Telangana

Total Production capacity

* 2,31,000 MTPA for amines and amines derivatives.

* 45,000 MTPA for specialty chemicals

Recent developments :

* Ethylamines plant started in May 2021

* DMC/PC and PG plant in September 2022

—————————————————————

GROWTH AND EXPANSION :

Future expansion plans include adding :

* Methylamine

* N-Butylamines

* Acetonitrile

* DMF

Expansion to begin in mid-FY24 to FY25 to increase total capacity by 1,15,500 MTPA by 2025.

The company expects to reach double the current capacity by 2026.

The subsidiary has applied for new land for expansion and acquired new technology for Sodium cyanide, which will lead to new products in the coming years.

The company plans to fund expansions with internal accruals.

Expected expenditure of Rs. 250-300 crores in FY24 and FY25.

—————————————————————

INDUSTRY OVERVIEW :

* Global Aliphatic Amines industry size is $4.9 billion

* It is an oligopolistic market with a few major producers.

* Top six companies control 50% of global capacities.

* China leads in consumption and production, accounting for 60% of global output.

* Europe contributes 45-55% of export revenue for Indian Amine manufacturers, followed by USA and Japan.

Globally Consumption by Sector

* Pharmaceutical sector consumes 61%

* Agrochemicals industry consumes 26%

—————————————————————

China Factor

– China was one of the major suppliers of amines to India

– In 2018, almost 30% of China’s amine capacities were shut down due to pollution issues

– This helped the Indian industry to improve sales as well as margins

– Some of these capacities have started manufacturing again but their costs have increased substantially because of environmental compliances

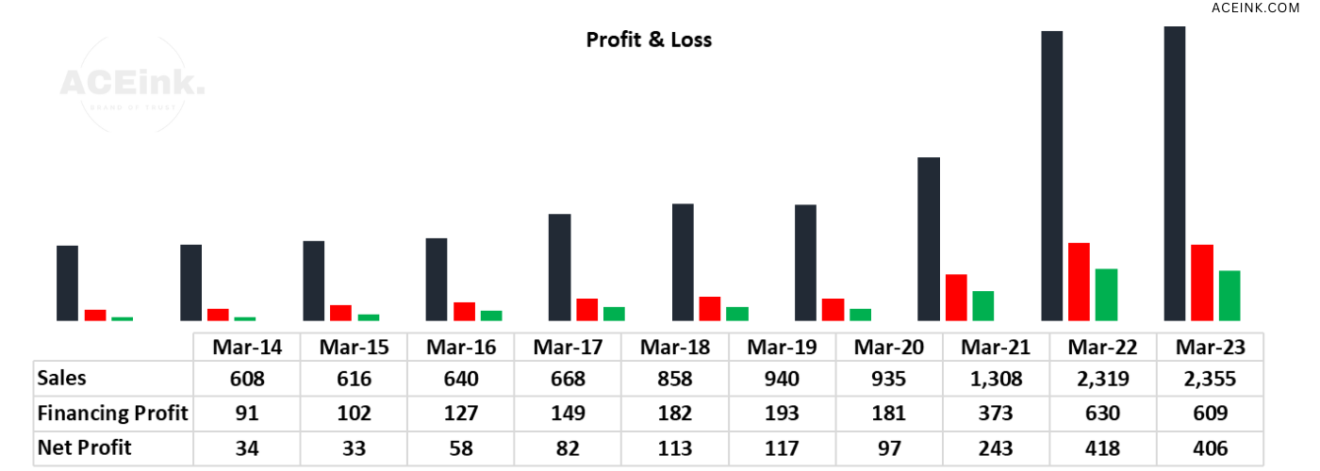

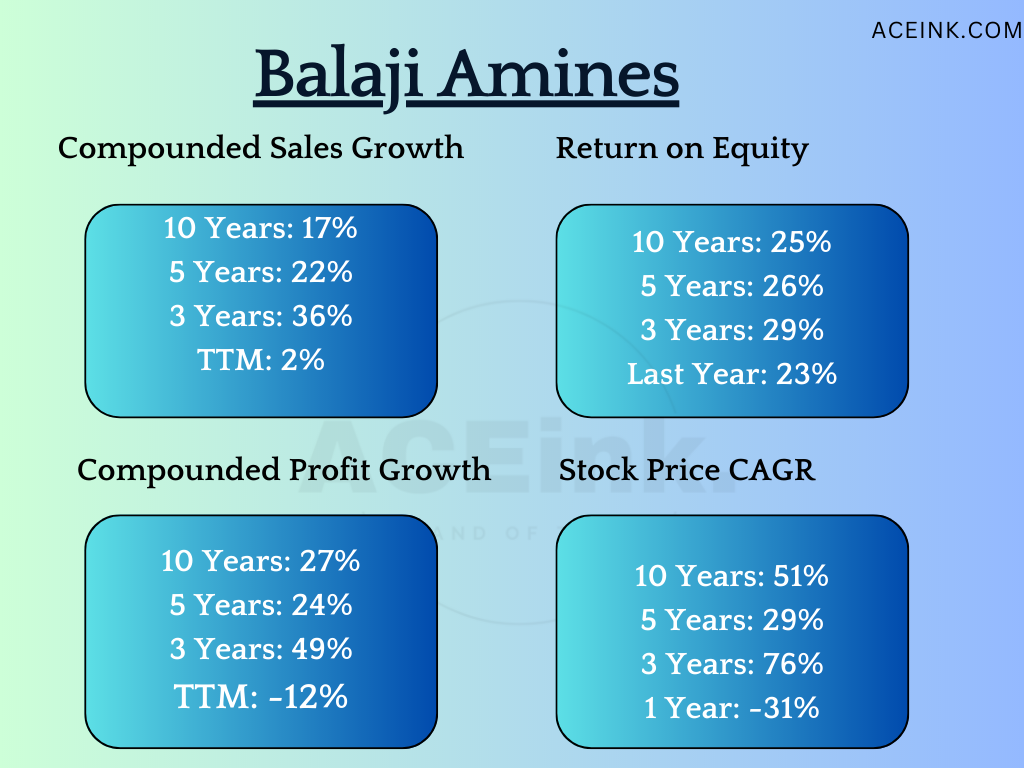

FUNDAMENTALS of Balaji Amines Ltd

– Market cap: 7000 Cr

Returns Paraments

– ROE : 23.2%

– ROE 3Yr : 28.6 %

– ROCE : 39%

– ROCE 3Yr : 41.7 %

Debt Parameters

– Debt : ₹ 57.6 Cr

– Cash Equivalents : ₹ 236 Cr

– Inventory : ₹ 303 Cr

– Debt equity : 0.07

– Int Coverage : 48.4

Valuation Parameters

– PE Ratio (TTM) : 21.12

– PEG : 0.89

– Industry PE : 26

Growth parameters

– Sales growth : 1.55 %

– Sales growth 3Years : 36.1 %

– Profit growth : -11.6 %

– Profit Var 3Yrs : 49.5 %

Shareholding Pattern : As on Mar-23

Promoters : 53.71%

FIIs : 4.45%

DIIs : 0.34%

Public : 41.5%

From June 2020

– Promoters holding increased by 0.01%

– FII holding increased by 2.71%

– DII holding reduced by -0.05%

– Public holding reduced by -2.67%

—————————————————————

SWOT ANALYSIS : Strengths, Weaknesses, Opportunities, and Threats

STRENGTH :

* Company is the sole producer for a few specialty chemicals which protects company from competition.

* Company’s R&D skills help create better products and reduce dependence on imports.

* Balaji Amines and Alkyl Amines dominates 90% share of the aliphatic amines industry in India.

* Balaji Amines has developed lasting connections with a wide range of customers, ensuring steady and consistent revenue.

WEAKNESS :

* Balaji’s heavy dependence on pharmaceuticals and agrochemicals (75% of revenue) makes it vulnerable to sector-related challenges.

* Imported raw materials from Iran and Saudi Arabia impact Balaji’s profitability due to cost fluctuations.

* Raw material supply has been a challenge due to unexpected shutdowns of big plants, but the situation is expected to improve going forward.

* The company’s sales have decreased due to industry precautions and the rejection of bad customers.

OPPORTUNITIES :

* Aliphatic Amines industry is expected to grow at a CAGR of 5% – 7%

* Balaji Amines can benefit from the increasing perception of India as a viable alternative to China in the chemical sector which is creating potential for growth and attracting new customers.

* Company is expanding its manufacturing capacity and it has the potential to export its products to a wider geography.

* The subsidiary has opportunities for capacity doubling, new products and derivatives, and debottlenecking.

* The decision on a new 50,000-ton plant for DMC is dependent on the consumption of the product and lithium deposits in the country.

* Improvement in API market and raw material prices expected to return to pre-COVID levels.

THREAT :

* Balaji faces a threat from the imported aliphatic amine products in the market.

* Strict Regulations in the chemical industry can be challenging and increase operational costs.

* The market situation for end users like Pharma API was not good, leading to a de-growth of 22%

—————————————————————

DISCLAIMER : THE INFORMATION PROVIDED IN THIS POST IS SOLELY FOR EDUCATIONAL PURPOSES.

THIS IS NOT AN INVESTMENT ADVICE.

We are NOT REGISTERED WITH SEBI as investment advisers or research analysts.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.