Tata Power’s Share Soars on INR 13,000 Crore Hydropower Investment

Tata Power’s shares hit new highs following a significant INR 13,000 crore investment in pumped storage hydropower projects in Maharashtra.

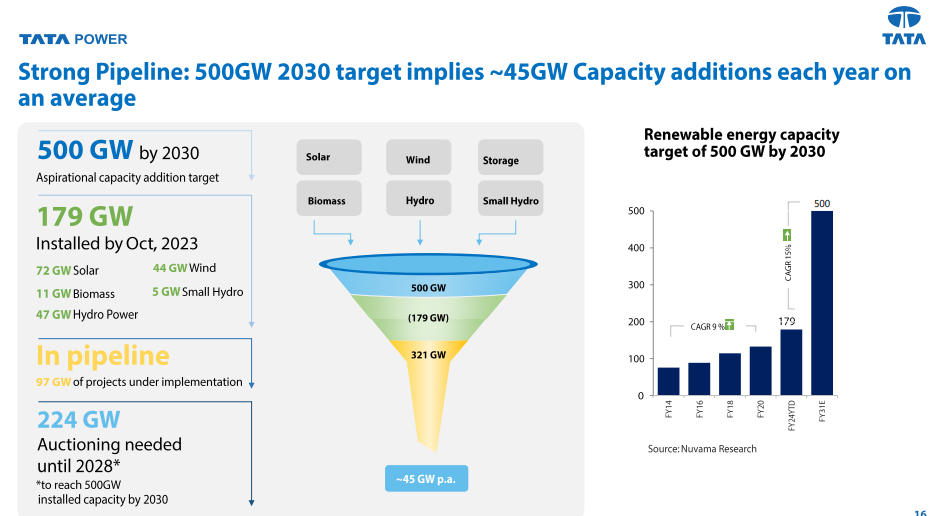

Despite India’s recent decision not to join the Global Renewables and Energy Efficiency Pledge, Tata Power, as the country’s largest integrated power company, remains committed to investing 45% of its capital in renewable energy between FY24 and FY27, with an estimated capex of INR 60,000 crore. The company’s bet on pumped storage hydropower underscores its dedication to shaping India’s sustainable energy future.

Also Read: “From Crisis to Confidence: YES Bank’s Journey to Stability”

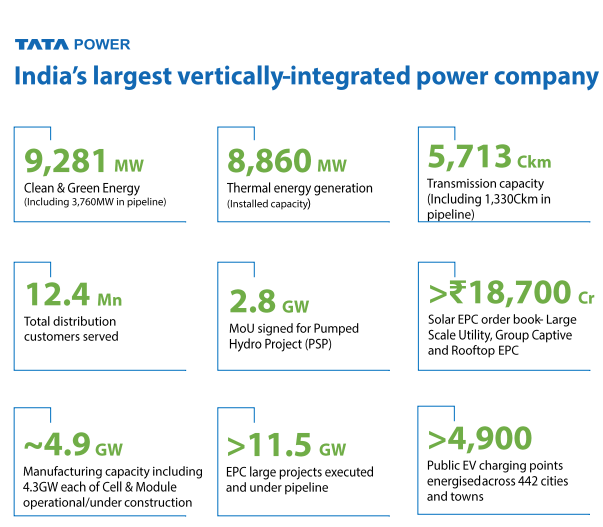

Step into the world of Tata Power, where a century-old journey began in 1911. Originally Tata Hydroelectric Power Supply Company has evolved into a major player in electricity, with a strong focus on clean and sustainable energy like solar and wind power.

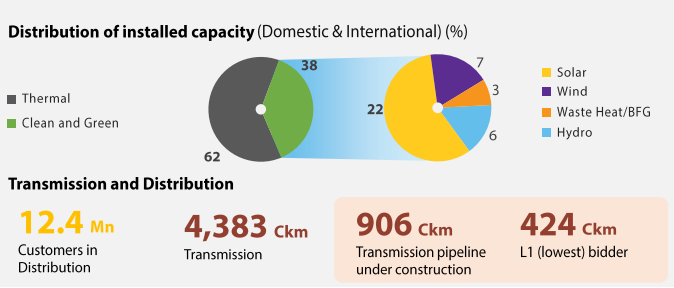

Tata Power is a big player in making and delivering electricity. From making power to sending it to your homes, Tata Power is involved in various aspects. The company is not just about traditional power – it’s also into cleaner and greener energy. Think solar, wind, and hydro projects; Tata Power is leading the charge in making energy that’s good for the environment.

Also Read: “Why Big Investors are still Bullish on PNB”

Source: Company Presentation

The Project: Pumped Hydro Storage

- Tata Power is committing a substantial capital investment of INR13,000 crore for two pumped storage hydropower projects in Maharashtra.

- These projects include a 1,800MW unit at Shirawata in Pune district and a 1,000MW unit in Bhivpuri in Raigard district.

- Tata Power aims to commence work on both pumped hydro plants by mid-2024.

- The Bhivpuri plant is expected to be operational in 36-40 months, while the Shirawata unit will take about 48 months.

- By the end of 2027, Tata Power plans to offer blended 24/7 renewable power to consumers from both these plants.

Pumped Hydro Storage Mechanism

- Tata Power’s pumped storage hydropower facilities will utilize existing dams and reservoirs for efficient energy generation and storage.

- The technology allows bidirectional use of the same motor for both electricity generation and pumping water back to the reservoir during surplus electricity periods.

- Pumped hydro storage plants, according to Tata Power CEO Praveer Sinha, can provide cheaper electricity compared to battery storage systems.

Also Read: The Remarkable Turnaround of JLR: From Tata’s “Biggest Mistake” to a “Biggest Victory”

Source: Company Presentation

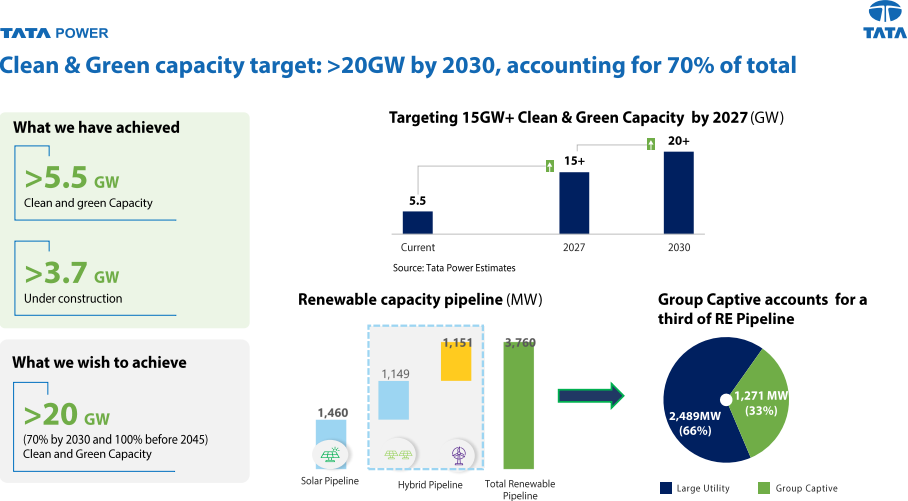

Clean Energy Goals

- Tata Power envisions achieving 70% capacity generation from clean and green energy by 2030.

- The company has progressively increased its clean-energy portfolio, currently standing at 38% of the installed capacity, with plans to reach 50% by 2023.

- As per the National Electricity Plan (NEP) 2023, India aims to have 16.13GW of energy storage capacity by 2026-27, with Tata Power expected to contribute significantly to this target.

Diversification Beyond Generation

- Tata Power has expanded its operations across the clean-energy value chain, including solar, rooftop solar, public electric vehicle charging infrastructure, and off-grid solar.

Phasing Out Coal

- Unlike other energy producers, Tata Power plans to phase out all coal-based generation by 2045.

- The company’s thermal portfolio has shown minimal growth, while the renewable-generation portfolio has rapidly expanded.

Also Read: “Suzlon 2.0: What Lies Ahead -Post Turnaround?”

Source: Company Presentation

Financial Performance

- Tata Power reported revenues exceeding INR30,000 crore for the first half of FY24, with profits around INR2,000 crore.

- Profit growth for the 16th consecutive quarter.

- 9% increase in consolidated PAT and revenue growth.

- The Zambia unit has resolved payment issues.

- Resulted in a payment of USD 51 million to Tata Power.

- The Mundra plant is expected to break even at the PAT level.

Amidst global reliance on coal, Tata Power stands out, committed to phasing out thermal plants. Beyond tradition, the company leads in solar engineering, boasting an INR 10,000 crore order book and an expansive rooftop solar network across 275+ districts.

Diving into electric mobility, Tata Power enters public EV charging, deploying 4,500 chargers and eyeing home EV charging prominence.

Tata Power foresees improved financials with the rising adoption of renewable energy. The strategic investment in pumped storage hydropower positions the company for success in an evolving and sustainable energy landscape.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any investment decision.