Will the share price increase or decrease after merger?

The boards of IDFC First Bank and its parent company, IDFC, have given their approval for the merger of IDFC with the bank.

This merger aims to create a strong financial institution with diversified public and institutional shareholders, similar to other large private sector banks while eliminating any promoter holding.

The merger details, financial impact, and statements from company officials have been announced, along with information about regulatory approvals and background details.

Let’s delve into the comprehensive report on the IDFC First Bank and IDFC merger.

Also Read:These Stocks to Give Dividends This Week Upto Rs 92

Merger Approval and Shareholder Ratio:

Under the merger scheme,

-Shareholders of IDFC will receive 155 shares of IDFC First Bank for every 100 shares they hold in IDFC.

-This ratio was set to provide a premium of approximately 20% based on the closing market price of IDFC shares compared to IDFC First Bank Limited on June 30, 2023.

Financial Impact:

-The proposed merger is expected to increase the standalone book value per share of the bank by 4.9% based on audited financials as of March 31, 2023.

The Merger :

-The Reserve Bank of India (RBI) granted IDFC in-principle approval to establish a bank in April 2014, resulting in the creation of IDFC Bank Limited and IDFC Financial Holding Company Limited (IDFC FHCL).

-In compliance with RBI regulations, all regulated businesses were transferred to IDFC FHCL.

-IDFC Bank merged with Capital First in December 2018 and was subsequently renamed IDFC First Bank Limited.

-As a promoter, IDFC was required to maintain a minimum of 40% equity in the bank for five years, until September 30, 2020, as per RBI regulations.

-In September 2021, IDFC shareholders made the decision to vote out Vinod Rai from his position as Chairman due to the delay in selling the company’s asset management business. This delay was perceived as a hindrance to the planned merger with IDFC First Bank.

-Following this development, in December 2021, Anil Singhvi was appointed as the new Chairman of the IDFC board. During this period, the board also granted in-principle approval for the merger.

-Following the RBI’s “in principle approval” to merge IDFC/IDFC FHCL with the bank in December 2021, the IDFC board undertook various actions to simplify its business, including the sale of the mutual fund to the Bandhan Group.

-Recognizing the importance of resolving the delay in selling the asset management business, IDFC took steps to address the issue. In April 2022, IDFC successfully completed the sale of IDFC Asset Management Co. and IDFC AMC Trustee to Bandhan Bank Ltd. The deal amounted to a significant Rs 4,500 crore.

-This resulted in a significant increase in IDFC’s market capitalization, from Rs. 8,000 Crores to Rs. 17,000 Crores.

-To facilitate the transaction, IDFC First Bank sought the expertise of various firms. Deloitte Touche Tohmatsu India LLP and Harsh Chandrakant Ruparelia served as valuers for IDFC First Bank. Additionally, ICICI Securities provided a fair opinion on the valuation of the assets involved in the deal.

-In terms of legal and financial advisory support, AZB & Partners acted as legal advisors, while JM Financial served as financial advisors to IDFC First Bank throughout the process.

-These strategic moves and collaborations were aimed at ensuring a smooth transition and resolving the delays that had previously impacted the merger plans between IDFC and IDFC First Bank

Future Steps and Approvals:

The merger is subject to approvals from the stock exchanges, the RBI, the Competition Commission of India, and shareholders. Additionally, the scheme of amalgamation will require approval from the National Company Law Tribunal (NCLT), Chennai bench.

The approved merger of IDFC with IDFC First Bank is set to create a robust financial institution with diversified public and institutional shareholders. The merger is expected to bring operational efficiency, synergies, and enhanced shareholder value.

The boards of IDFC First Bank and its parent company, IDFC, have given their approval for the merger of IDFC with the bank. The merger aims to create a strong financial institution with diversified public and institutional shareholders, similar to other large private sector banks, eliminating any promoter holding.

The Companies

IDFC Ltd

IDFC Limited, incorporated in 1997, is a Non-Banking Finance Company (NBFC) that operates under the regulation of the Reserve Bank of India (RBI).

The company maintains investments in IDFC FIRST Bank and IDFC AMC.

IDFC Limited held a 39.98% stake in IDFC FIRST Bank and a 99.96% stake in IDFC AMC.

However, it is worth noting that IDFC’s ownership in IDFC FIRST Bank decreased to 36.60% after the Bank conducted a Qualified Institutional Placement (QIP) issue in April 2021.

IDFC First Bank

Branch Network:

IDFC First Bank currently operates a network of 641 branches and 719 ATMs across India.

Financial Ratios (9MFY23):

a) Capital Adequacy Ratio – 16.06%

b) Net Interest Margin – 6.36%

c) Gross NPA – 2.96%

d) Net NPA – 1.03%

e) CASA Ratio – 50%

Transformation:

The bank is undergoing a transformation from being a corporate-focused, low Net Interest Margin (NIM) bank to a retail-focused, high NIM bank.

In FY22, IDFC First Bank focused on scaling up various aspects of its business operations, includes expanding its

-Digital Cash Management solutions,

-Trade Forex, wealth management,

-FASTag,

-Toll-acquiring business, and

-Credit card offerings.

The bank has also introduced new variants of current accounts.

Key Statements from Company Officials

Anil Singhvi, chairman of IDFC, expressed that the merger with IDFC First Bank would help create a financial services powerhouse, enhancing operational efficiency and generating synergies for shareholders.

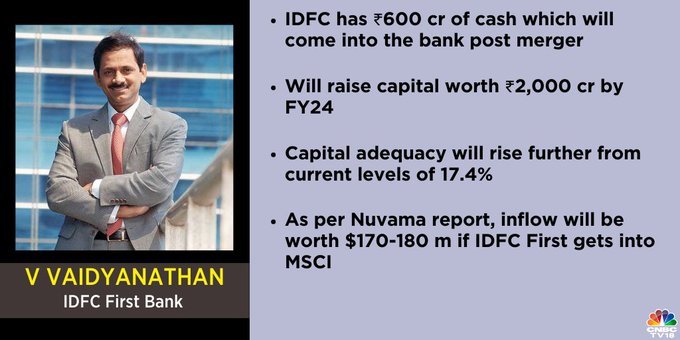

V Vaidyanathan, MD & CEO of IDFC First Bank, highlighted that the merger would make IDFC investors direct shareholders of IDFC First Bank. He emphasized the bank’s strong foundation, including a robust deposit franchise, digital innovation, customer-friendly products, and a focus on corporate governance.

The Impact on Share Price

Let’s consider the price factor in the two scenarios based on your shareholding in IDFC Ltd and IDFC First Bank with the current share prices of both.

Scenario 1: Shareholder of IDFC Ltd (100 shares)

In this scenario, you own 100 shares of IDFC Ltd. With the merger, you will exchange your IDFC Ltd shares for IDFC First Bank shares based on the share exchange ratio of 155 shares of IDFC First Bank for every 100 shares of IDFC.

Additionally, let’s assume the current share prices are:

- IDFC Ltd share price: Rs. 110

- IDFC First Bank share price: Rs. 80

To calculate the impact on your investment, we’ll consider the value before and after the merger:

Before the merger: Value of IDFC Ltd shares = 100 (shares) * Rs. 110 (share price) = Rs. 11,000

After the merger: Value of IDFC First Bank shares = 155 (shares) * Rs. 80 (share price) = Rs. 12,400

After the merger, the value of your investment increases from Rs. 11,000 to Rs. 12,400, assuming the current share price of both companies.

Scenario 2: Shareholder of IDFC First Bank (100 shares)

The merger does not impact your existing shareholding in IDFC First Bank.

So based obn the calculation, In the current scenario there must be an adjustment in either IDFC First Bank’s share price or IDFC Ltd’s share price to maintain the balance in the exchange, either IDFC First Bank’s share price should decrease or IDFC Ltd shares price should increase.

Please note that these calculations are based on the given share exchange ratio and share prices, and they provide an estimate of the potential impact on your investment. Actual values may vary depending on market conditions and other factors.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“Why the Thriving entertainment Industry Should Be on Your Investment Radar” Visualize the glistening waters of Goa, India’s…Read More

“Discovering Hidden Gems: The Investment Potential of the Gaming Stock”