Indian Hotels Company: A Comprehensive Analysis

In the dynamic world of investments, certain stocks emerge as frontrunners, offering investors promising opportunities for growth and profitability. One such standout is Indian Hotels Company Ltd (IHCL), a prominent player in the Indian hospitality industry.

Let’s delve into IHCL’s recent performance, its strategic initiatives, and why it stands as an attractive investment option in today’s market landscape.

Also Read: Why Jefferies is Bullish on These 26 Companies: A Comprehensive Analysis

Company Overview:

IHCL, with a history dating back to 1902, has established itself as a symbol of luxury and quality in the hospitality sector. Boasting a comprehensive portfolio of brands catering to various price points, IHCL has a strong brand reputation and a rich heritage spanning over a century.

Hotel Brands and Business Strategy

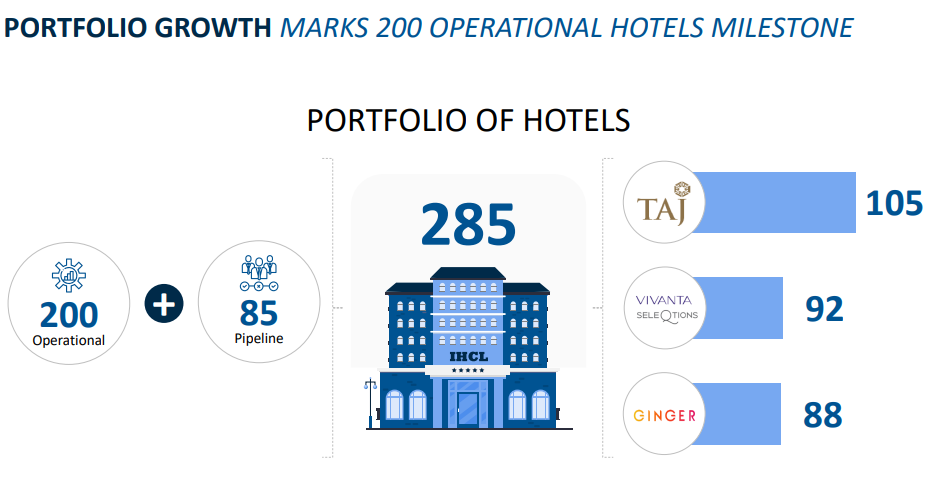

Brand Portfolio: Indian Hotels Company Ltd (IHCL) operates its hotels under four main brands catering to different market segments:

- Taj: Regarded as the crown jewel of IHCL, Taj is recognized as the world’s strongest hotel brand. With 82 hotels in its portfolio, Taj contributes approximately 72% to the revenue portfolio.

- Vivanta+Seleqtions: Launched in 2018, this portfolio comprises 28 Vivanta and 22 Seleqtions hotels, contributing 16% to the revenue as of Q1FY24.

- Ginger: IHCL has 59 Ginger hotels in its portfolio as of Q1FY24, with plans to expand to around 100 hotels by FY26.

Hotel Ownership: In FY23-24, IHCL’s hotel ownership was evenly split:

- 50% owned by the company/group.

- 50% under management contracts, reflecting IHCL’s focus on the asset-light model for growth.

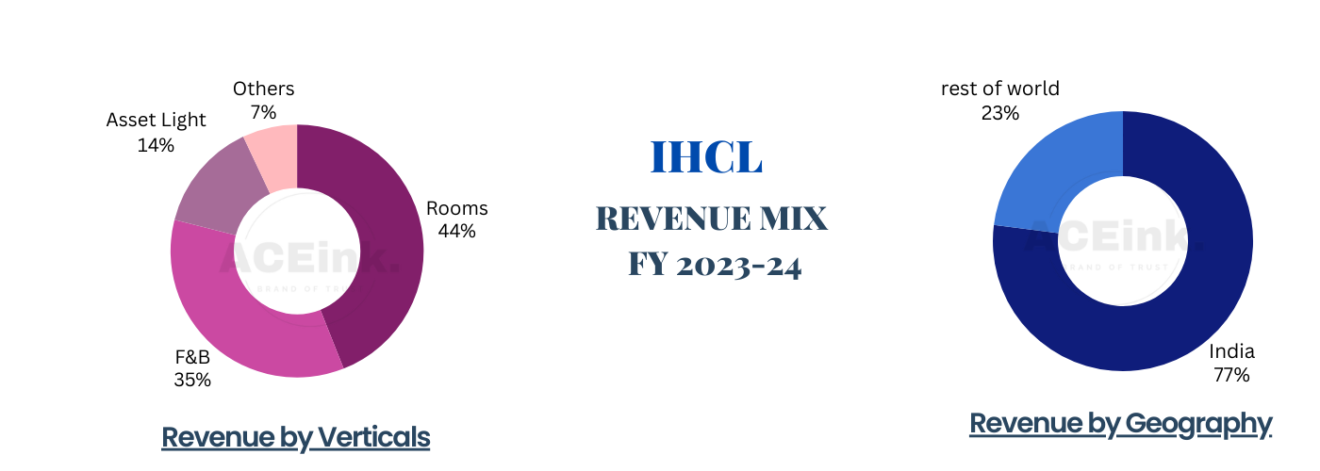

Revenue Breakup: In FY23, IHCL’s revenue breakdown was as follows:

- Rooms: 44%

- Food & Beverage (F&B): 35%

- Asset Light: 14%

- Others: 7% The Average Room Rate (ARR) for FY23 was Rs 8,660 domestically and $288 internationally.

International Expansion: IHCL’s export revenues in Q1FY24 were distributed as follows:

- Domestic: 77%

- International: 23%

Future Expansion Plans: IHCL aims to increase its room inventory to approximately 31,500 by FY27. To support this growth, the company plans a capital expenditure (capex) expansion of over 600 crores in FY24.

Also Read: “How does the market trend move in a pre-election month?”

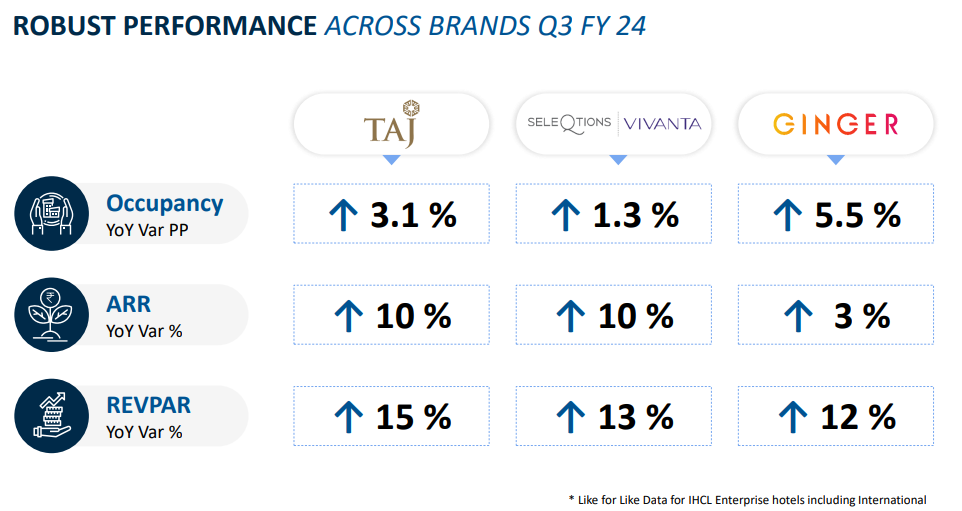

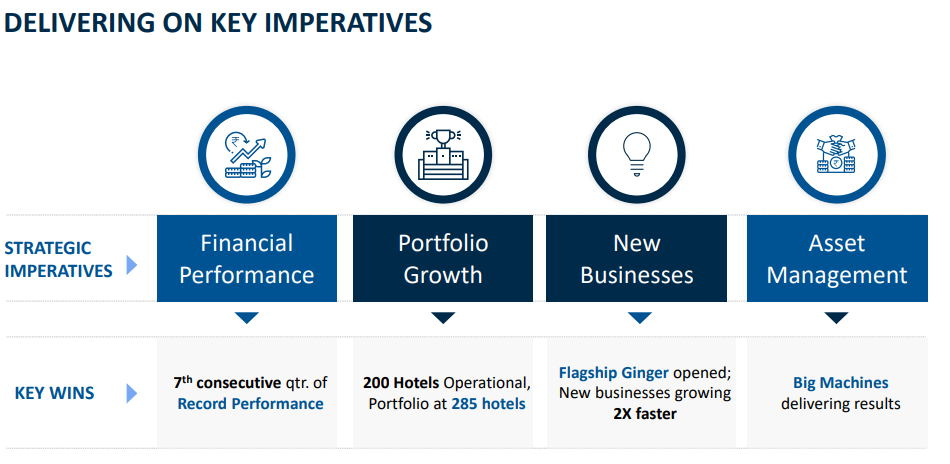

Financial: IHCL recently reported its best-ever Q3 results in FY24, showcasing robust double-digit revenue growth and margin expansion. The standalone domestic hotel business witnessed a remarkable 22% growth, driven by improvements in occupancy rates and average room rates. The international business segment also demonstrated promising growth, albeit at a slower pace.

- OPM 31.3 %

- ROCE 12.6 %

- ROE 12.7 %

- Sales growth 28.3 %

- Profit growth 60.8 %

Fundamental:

- Market Cap ₹ 81,195 Cr.

- Current Price ₹ 571

- High / Low ₹ 603 / 302

- Stock P/E 69.4

- Book Value ₹ 58.2

- Dividend Yield 0.18 %

- Face Value₹ 1.00

- Industry PE45.8

- PEG Ratio1.19

- Return over 1year 83.7 %

Debt profile

- Debt ₹ 2,718 Cr.

- Debt to equity 0.33

- Profit Var 3Yrs 50.6 %

- Sales growth 3Years 9.19 %

- Int Coverage 7.78

- Cash Equivalents ₹ 951 Cr.

- Free Cash Flow ₹ 1,191 Cr.

Also Read: The Paytm Saga: What Went Wrong?

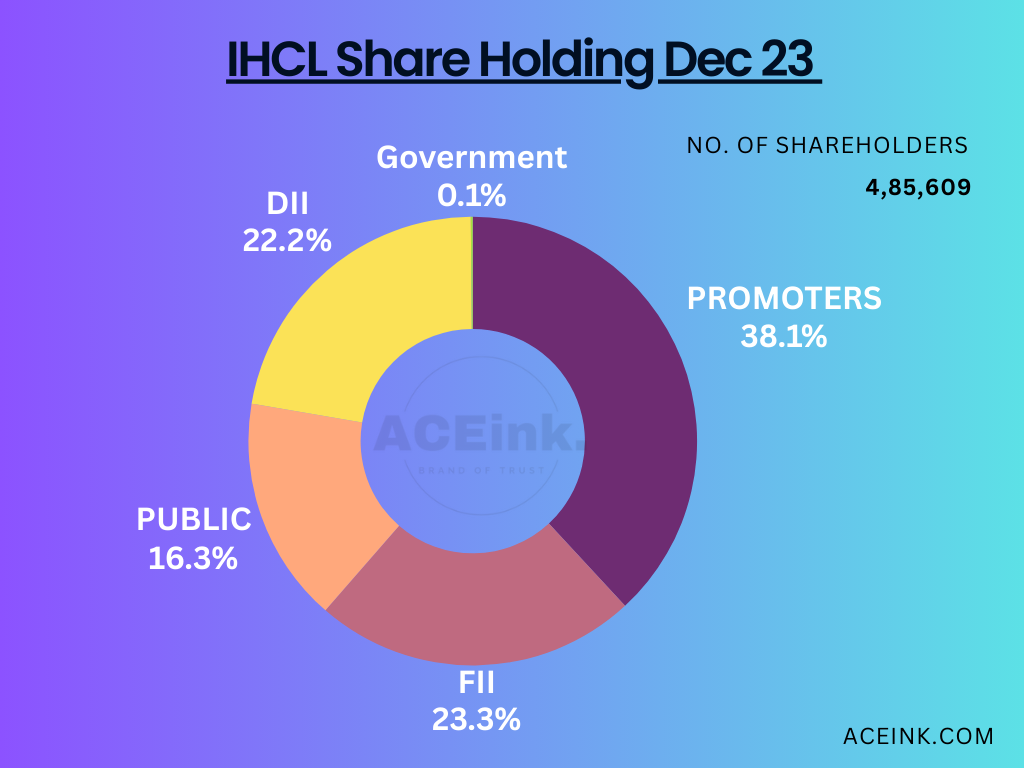

Strategic Initiatives: IHCL’s robust expansion plans include aggressive inventory additions and exploration of inorganic growth opportunities. The company’s strong balance sheet, with net cash reserves of Rs 1,550 crore as of December 2023, positions it well to tap into growth opportunities. Additionally, IHCL is diversifying its revenue streams by scaling up new businesses such as Ginger, Q-Min, and Ama.

Future Growth Prospects: IHCL anticipates sustaining its double-digit revenue growth trajectory in FY25, driven by continued improvements in occupancies and average room rates. The company plans to accelerate its room inventory expansion efforts and introduce a new upscale brand targeting mass consumers in Tier 2 & 3 cities.

Investment Risks in Indian Hotels Company Ltd (IHCL)

While Indian Hotels Company Ltd (IHCL) presents an attractive investment opportunity, it’s essential for investors to consider potential risks associated with their investment decision:

1. Economic Downturn: IHCL’s performance is closely linked to economic cycles. Economic downturns can lead to reduced consumer spending on travel and leisure, impacting the company’s revenue and profitability.

2. Industry Competition: The hospitality industry is highly competitive, with numerous players vying for market share. Intense competition can pressure IHCL’s pricing power and market position, affecting its financial performance.

3. Regulatory Environment: IHCL operates in a regulated environment, subject to various laws and regulations related to licensing, health, safety, and labor. Changes in regulations or compliance requirements could increase operational costs and hinder business operations.

4. Cyclical Nature of Tourism: Tourism trends are cyclical and susceptible to external factors such as geopolitical tensions, natural disasters, and pandemics. Any adverse events impacting tourism can negatively affect IHCL’s occupancy rates and revenue.

5. Dependence on Brand Perception: IHCL’s success is heavily reliant on the perception of its brands, particularly Taj, which serves as its flagship brand. Any damage to the brand’s reputation due to incidents or negative publicity could harm customer trust and loyalty.

Indian Hotels Company Ltd continues to shine as a beacon of excellence in the hospitality sector, driven by its unwavering commitment to quality, innovation, and customer satisfaction. Despite trading at a premium valuation, IHCL presents an attractive investment opportunity for discerning investors.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.