IRCON- Robust capex on Railways: Will it get benefited?

Imagine a company that started its journey in 1976, primarily building railways but gradually evolved into a versatile infrastructure powerhouse by 1985.

That’s IRCON – an integrated engineering and construction giant involved in big projects like railways and highways.

IRCON stands as the sole Indian PSU and one of five Indian companies in the top 250 international contractors list, showcasing its global standing. It leads in transportation infrastructure among public sector construction companies in India, particularly excelling in turnkey Railway Projects.

With a rich history of 46 years, IRCON has delivered 128+ projects in 25 countries and over 401 projects in India.

Notable domestic customers include BHEL and NTPC, while international clients range from the Ministry of Transport, Govt. of Sri Lanka, to Bangladesh Railways.

Also Read: “From Crisis to Confidence: YES Bank’s Journey to Stability”

Subsidiaries &; Joint Ventures

- As of FY23, IRCON Group comprises 11 subsidiary companies and 7 joint venture companies, reflecting a robust corporate structure.

- In FY23, IRCON strategically partnered with Cochin Port Authority for a joint venture, aiming to bid for a proposed Harbour in a neighboring country, indicating a proactive approach to expansion.

- They’re eyeing an Internal Rate of Return (IRR) of 12% to 14% and an equity IRR of 14% to 16% for their Joint Venture (JV) projects.

Also Read: “Why IREDA is up 200% from IPO price?”

Let’s talk numbers – the language of finance.

- Turnover Milestone: In Q2 FY24, Ircon International achieved its highest-ever turnover, defying the seasonally weak quarter trend.

- Revenue Surge: Total revenue for Q2 FY24 witnessed an impressive 36% increase compared to the same period last year.

- Profitability Boost: Profit After Tax (PAT) surged by 44% to Rs. 251 crore in Q2 FY24.

- EBITDA Growth: Core EBITDA increased by a notable 16%.

- Other Income: Anticipated other income, including Hybrid Annuity Mode (HAM) annuity, is expected to range between Rs. 520 to Rs. 550 crore for FY24.

- Future Outlook: The company projects a robust revenue growth of approximately 15% over FY23.

- EBITDA Margin: The Core EBITDA margin is anticipated to be in the range of 10% to 11%.

Railway Capex and Revenue Guidance

Ircon International Limited holds the prestigious Navratna status granted by the Government of India, bolstering its market credibility and enabling the undertaking of larger-sized PPP projects.

With the government allocating Rs 2.9 lakh crore for railway capex in the upcoming budget, Ircon, with a revenue of around Rs 10,000 crore, is well-positioned to capitalize on the significant addressable market. The management reaffirms a revenue guidance of 15% for FY24.

Also Read: “Suzlon 2.0: What Lies Ahead -Post Turnaround?”

Key Fundamentals

- Market Cap ₹ 16,548 Cr.

- Current Price ₹ 174

- High / Low ₹ 179 / 48.8

- Stock P/E 18.6

- Book Value ₹ 58.9

- Dividend Yield 1.63 %

- Face Value ₹ 2.00

- Industry PE 22.6

- PEG Ratio 1.39

Growth Ratio

- Sales growth 32.1 %

- Profit growth 27.1 %

- Profit Var 3Yrs 18.0 %

- Sales growth 3Years 24.4 %

- ROCE 15.7 %

- ROE 15.4 %

- OPM 6.42 %

Debt Profile

- Debt ₹ 1,680 Cr.

- Debt to equity 0.30

- Free Cash Flow ₹ -266 Cr.

- Int Coverage 9.04

- Cash Equivalents ₹ 5,568 Cr.

Also Read: The Remarkable Turnaround of JLR: From Tata’s “Biggest Mistake” to a “Biggest Victory”

Order Book and Projects Overview:

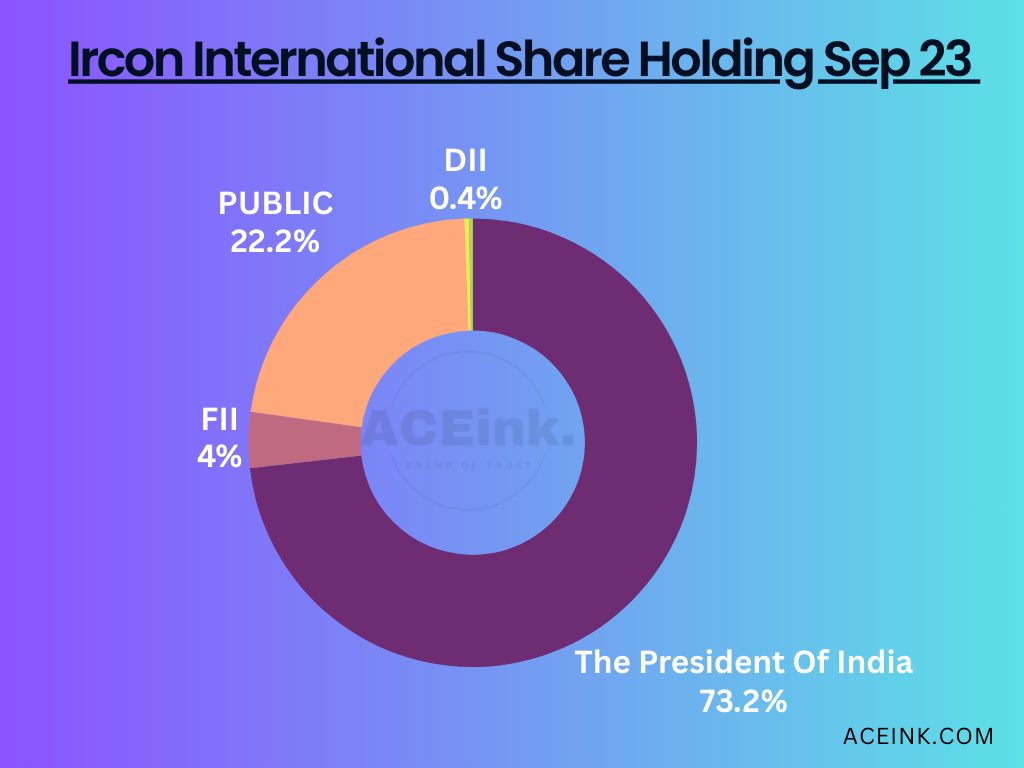

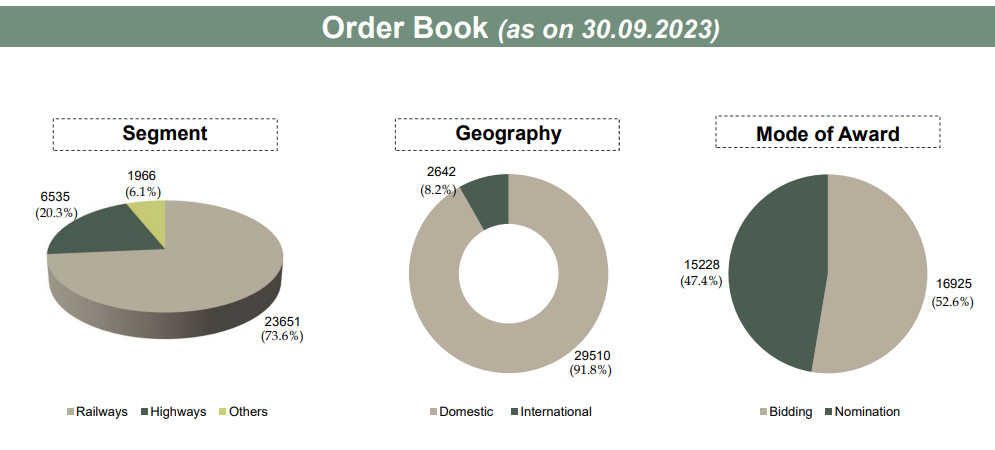

- As of September 30, 2023, the order book stands at an impressive Rs. 32,152 crore, with 53% of orders secured on a competitive basis and 92% related to domestic business.

- The company aims to achieve a total order book of about Rs. 50,000 crore by the end of FY24.

- Ircon is strategically targeting bids worth Rs. 30,000 crore, with a pipeline of about Rs. 5,000 crore.

- The revenue contribution from the top five projects for the half-year is approximately Rs. 2,600 crore.

- Well-positioned to participate in railway projects both in India and internationally, aligning with government initiatives

Outlook and Valuations

Ircon’s strategic focus on railway infrastructure aligns with the government’s emphasis on improvement. Its total order book stands at Rs 32,152 crore as on September 30, 2023, out of which 73 percent is railways, and 20 percent is highway. The H2 should be even better because of the nature of the business as a large portion of revenue is typically booked in the fourth quarter.

The stock, trading at 13 times its fiscal 2026 estimated earnings, signifies a favorable valuation considering earnings visibility, a robust order book, and a decent dividend yield of 2.4%.

Particular risks associated with investing in Ircon

Investing in any company carries inherent risks, and Ircon International Limited is no exception. Here are some particular risks associated with investing in Ircon:

- Government Dependency: As a company heavily involved in infrastructure projects, Ircon is dependent on government initiatives and policies. Changes in government priorities, regulations, or budget allocations for infrastructure projects can affect Ircon’s business operations and growth prospects.

- Project Execution Risks: Infrastructure projects often face challenges related to execution, including delays, cost overruns, and unforeseen technical issues. Ircon’s financial performance is closely tied to its ability to efficiently execute projects, and any hiccups in this process can impact profitability.

- Competition in Bidding: Ircon competes with other companies in the bidding process for major projects. Intense competition may lead to a reduction in profit margins or the company losing out on lucrative projects, affecting its order book and revenue.

- Global Economic Factors: Ircon’s overseas projects expose it to global economic conditions and geopolitical risks. Changes in foreign exchange rates, political instability, or economic downturns in countries where Ircon operates can impact its financial performance.

It’s crucial for investors to thoroughly assess these risks and conduct due diligence before making investment decisions. Diversification and staying informed about the company’s performance, industry trends, and macroeconomic factors are essential practices for managing investment risks.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.