IRFC: Next to hit Life Time High?

The Indian state-owned railway firms continue to ride high on the stock markets, with their winning streak surpassing all records.

The optimism among investors stems from the government’s plan to increase spending on railway infrastructure, which has been boosting the sector’s outlook.

The finance minister’s announcement of a record ₹2.4 lakh crore capital expenditure for the Indian Railways in this year’s budget has further fuelled the sector’s growth. This amount is 71% higher than last year’s budget and almost nine times more than what was provisioned in 2013-14, indicating the government’s commitment to improving the railway infrastructure in India.

The railway public sector undertaking (PSU) shares have been among the best-performing stocks lately, thanks to the government’s efforts to allocate capital for building rail infrastructure across the country.

Market experts believe that the sector’s future prospects look promising, with the rollout of high-speed trains and a target of 100% electrification of the rail network by 2023.

IRFC’s shares rose by 6.3%, hitting a four-month high of ₹36.05 apiece on the NSE.

So, is this rally just a short-term reaction, or does the IRFC has real potential?

Let’s find out…

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

.

History and Background of IRFC

-Majority owned by GoI, IRFC is a Navratna and Schedule ‘A’ Public Sector Enterprise under the administrative control of MoR.

-IRFC was created to finance the acquisition of rolling stock assets and infrastructure projects for the Indian Railways.

-The company started its operations in 1987 and has since played a crucial role in the development of the Indian Railways.

-In line with the divestment objective of GoI, IRFC came up with its initial public offering (IPO) in January 2021 and raised equity of ₹4,633.38 crore, which included fresh equity raise of ₹3,088.92 crore and an offer for sale of shares by GoI amounting to ₹1,544.46 crore.

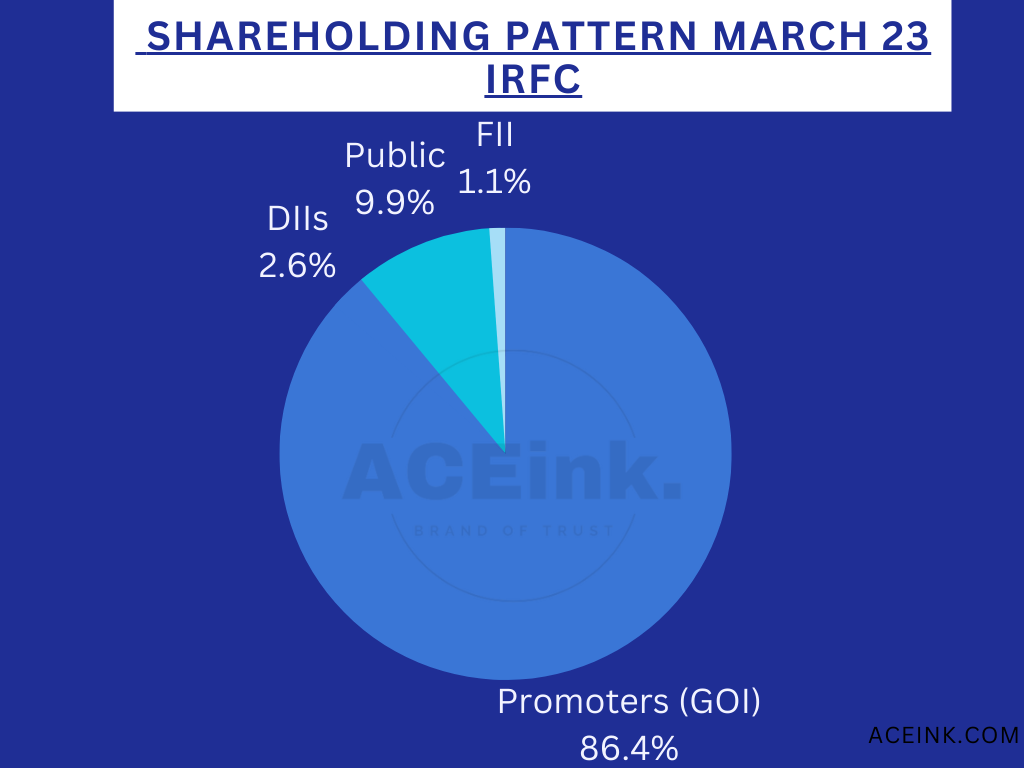

-Through IPO, GoI divested 5% of its shareholding, and as a result, the overall shareholding of GoI came down to 86.36% as on June 30, 2021, from 100% till December 31, 2020, and continues to be so as on December 31, 2022.

Role and Functions of IRFC

-The primary role of IRFC is to finance the acquisition of rolling stock assets and infrastructure projects for the Indian Railways.

-The company also provides leasing services for rolling stock assets to the Indian Railways and other entities in the railway sector.

-IRFC’s financing and leasing activities support the growth and expansion of the Indian Railways.

Financial Instruments Used by IRFC for Financing

-IRFC has a diversified funding profile and raises funds from various sources such as

multilateral agencies,

pension funds,

insurance companies, and

banks.

The company has issued various bonds and debt instruments to raise funds for its business activities.

Current borrowings profile:

As of December 31, 2022, the total borrowings of IRFC stood at ₹403,211 crore.

– 44.8% -domestic bonds market (including 54EC bonds)

– 32.22%- rupee term loans from banks

-17.68%- foreign/external commercial borrowings (ECM),

-4.34% through National Small Saving Fund (NSSF) and

-0.97% -short-term loans.

Financing of Rolling Stock Assets

-IRFC finances the acquisition of rolling stock assets such as

locomotives,

coaches,

wagons, and

other railway equipment for the Indian Railways.

-The company provides financing through various financial instruments such as

term loans,

bonds, and

external commercial borrowings.

Financing of Infrastructure Projects

-In addition to rolling stock assets, IRFC also finances various infrastructure projects such as

construction of new railway lines,

electrification of railway tracks, and

modernization of railway stations.

-The company provides long-term financing for these projects through bonds and other financial instruments.

Leasing of Rolling Stock Assets

-Apart from financing, IRFC is also involved in the leasing of rolling stock assets to the Indian Railways and other entities in the railway sector.

-The company offers leasing services for locomotives, coaches, wagons, and other railway equipment.

-IRFC’s leasing services enable the Indian Railways to acquire the necessary rolling stock assets without incurring the upfront cost of purchasing them.

The Working Framework

-IRFC is responsible for mobilizing resources necessary for the acquisition of rolling stock ordered by the MoR.

-The resources thus raised are used for part-funding for the creation of assets (through lease financing) for IR.

-At the beginning of each fiscal year,the MoR notifies IRFC of its financing requirements that are to be met through market borrowings.

-At the end of each year, a finance lease agreement is drawn in relation to the rolling stock acquired by the MoR from IRFC funds during the previous year.

-The lease is for a period of 30 years comprising a primary lease period of 15 years followed by a secondary lease period of another 15 years.

-Lease rentals comprise IRFC’s capital recovery, cost plus a net interest margin (NIM), which are covered under the primary lease period.

Strong Financials and Fundamentals

-IRFC has had a healthy financial performance and consistent growth over the years with net interest income in Q1 at INR 1,687 crores and

-profit after tax registering an increase of more than 10%.

-It keeps its expenses low by being efficient, which means it doesn’t cost much to run the company.

-Its overheads are only 0.1% of total revenue.

-IRFC has a healthy return ratio with a return on assets at 1.59% and

-return on net worth at about 14.4% annually.

- Market Cap ₹ 45,962 Cr.

- Stock P/E 7

- Book Value ₹ 33.3

- Price to book value 1.04

- Face Value ₹ 10

- Dividend Yield 3.97 %

- Return over 1 year 60.8 %

- ROCE 5.11 %

- ROE 15.8 %

- OPM 99.3 %

- Qtr Profit Var 2.48 %

- Qtr Sales Var 22.0 %

- Return on equity 15.8 %

Healthy capitalization profile:

The capitalization profile of IRFC (given zero percent risk weight is assigned to MoR’s exposure)remains strong marked by an overall capital adequacy ratio (CAR) at 482.11% as on December 31, 2022.

The capitalization metrics are also supported by tangible net worth (TNW) of ₹44,141 crores as on December 31, 2022, up from ₹40,995 crores as on March 31, 2022, on account of sequential positive internal accruals

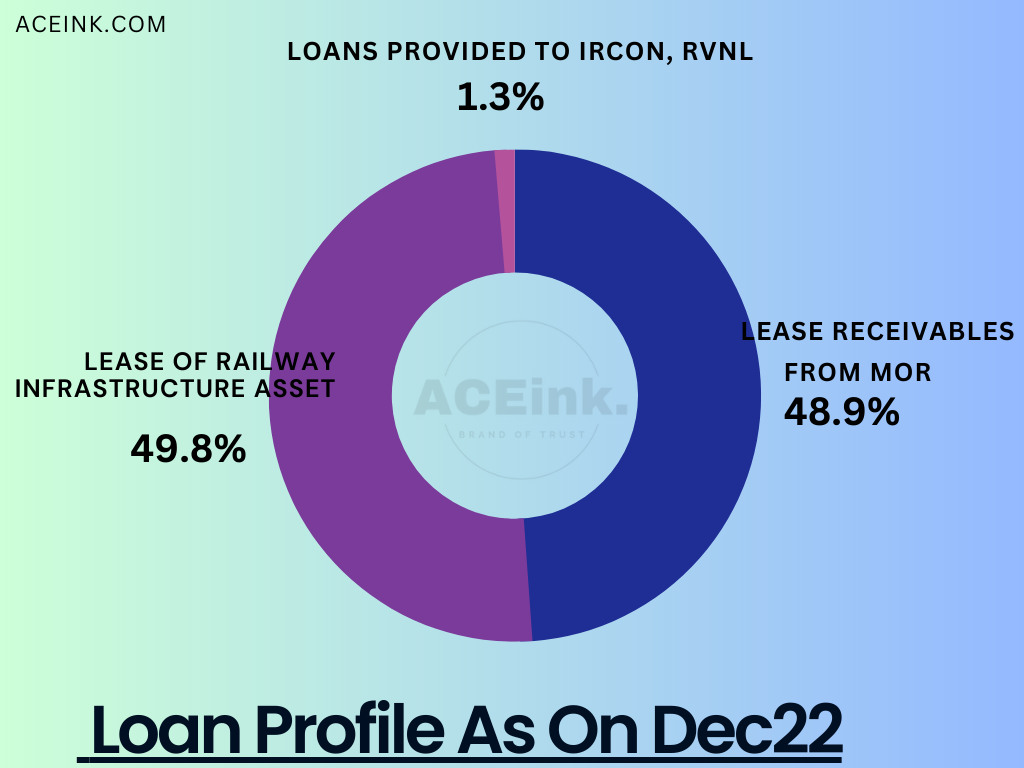

Strong asset quality on account of entire exposure to MoR / MoR-owned entities:

-As a non-banking finance company(NBFC) with majority ownership by GoI, IRFC does not have to comply with the Reserve Bank of India’s (RBI) regulatory requirements on asset classification, liquidity coverage ratio, provisioning, and prudential exposure norms to the extent of its exposure to MoR, which restricts a NBFC’s maximum exposure to a sector or an entity. On account of the entire exposure of IRFC to MoR / MoRowned entities which are controlled by GoI, the recovery risk is mitigated.

As a result, IRFC continues to have strong asset quality with a history of nil non-performing assets (NPAs).

Very Low Risk Associated

IRFC has a low-risk cost-plus business model with a consistent spread on its weighted average cost of funding from the Ministry of Railways.

The company has a demonstrated history of receiving timely and regular parent support in the form of regular capital infusions and can maintain comfortable capitalization levels going forward.

Additionally, the favorable lease agreement with MoR protects IRFC against any

exchange rate volatility,

interest rate

fluctuations

and liquidity risk.

Furthermore, out of six board of directors, two are nominees from the Government of India and two are independent directors.

Biggest Concern:

The biggest concern regarding public sector undertakings (PSUs), especially those in the rail sector and some other PSUs, is that once they begin to perform well, the government may decide to initiate an offer for sale (OFS).

Currently, GOI is holding more than 86% of shares in IRFC and to comply with it needs to sell at least 11.4% of its holding , which is the cause of worry.

Future Outlook

The future outlook for IRFC remains positive as the company continues to support the development of the Indian Railways and expand its business activities in the infrastructure finance sector.

IRFC is expected to play a crucial role in the growth and expansion plans of the Indian Railways in the coming years.

The company’s diversified funding profile and strong financial performance position it well for future growth and success.

——————-

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.