ITC’s Hotel Business Demerger: Understanding the Impact on Shareholders- Benefit, Loss, Analysts Outlook

ITC, a prominent conglomerate in India, today announced its decision to demerge its hotel business, generating both anticipation and speculation among investors and market analysts. The move aims to unlock value and create a more focused entity, concentrating on cigarettes, FMCG, paper, and agri businesses.

While some experts believe this move could create significant value in the medium to long term, others argue that it may not be a game-changer, given the capital-intensive nature of the hotel business compared to ITC’s core segments such as cigarettes and FMCG operations.

In this article, we’ll explore both perspectives to gain a comprehensive understanding of the implications of ITC’s hotel business demerger on its shareholders discussing both positive and negative aspects.

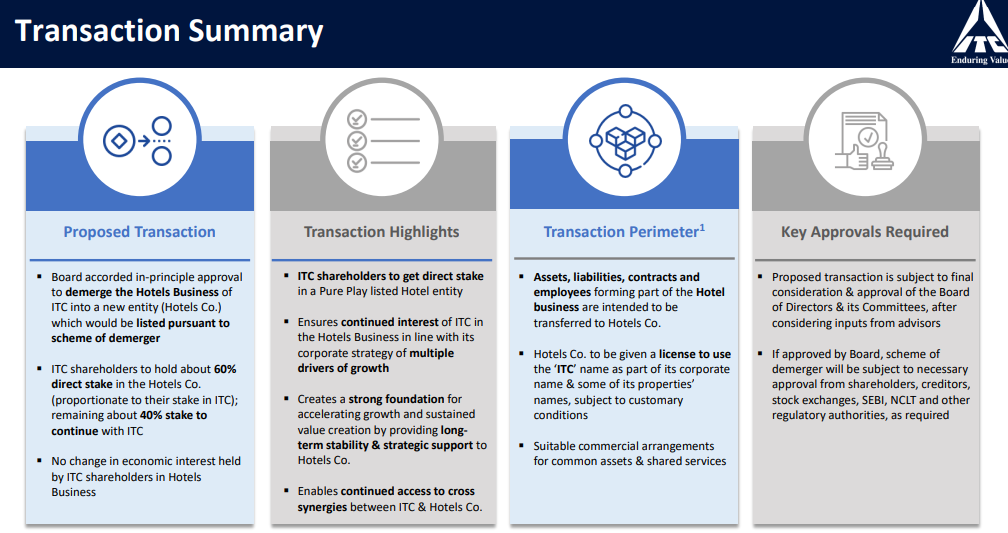

Proposed Transaction:

ITC’s Board has given initial approval to demerge its Hotels Business into a new entity called Hotels Co., which will be listed as a separate company after the demerger.

-In this transaction, ITC shareholders will hold approximately 60% direct stake in Hotels Co., proportionate to their current stake in ITC.

-The remaining 40% stake in the Hotels Business will continue to be held by ITC.

-We will need to await further clarity on the matter as the management has scheduled an investor presentation on 27th July.

Key facts about ITC Hotels:

Size and Positioning:

-ITC Hotels is the second-largest listed hotel player in India, with 11,600 keys (rooms) across 120 hotels.

-The brand portfolio includes ‘ITC Hotels’ in the luxury segment, ‘Welcomhotel’ in the premium segment, ‘Fortune’ in the midmarket to upper-upscale segment, and ‘WelcomHeritage’ in the leisure & heritage segment.

-Two new brands, ‘Mementos’ in the luxury lifestyle segment and ‘Storii’ in the premium segment, have recently been launched.

Revenues and Margins:

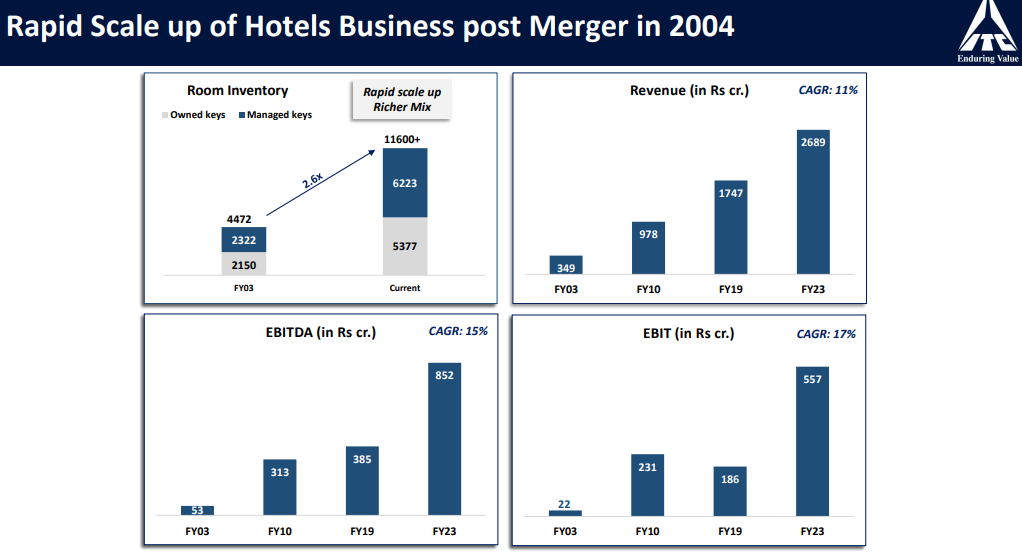

ITC’s hotel business adopted an ‘asset-right’ strategy, resulting in robust growth and margin expansion in FY 2022-23.

-In FY 2022-23, the hotels’ segment revenue more than doubled to Rs 2,689 crore, with EBITDA margins at 32% and EBITDA at Rs 852 crore.

-Profit before tax and interest (segment results) from hotels in FY 2022-23 was Rs 542 crore, compared to a loss of Rs 183 crore in FY 2021-22.

Expected Market Cap:

ITC’s hotel business, with Rs 2,689 crore in revenue, could be ascribed a market cap between Rs 18,000-25,800 crore, representing around 4% of ITC’s current market cap.

The estimated market cap should place it between Indian Hotels Co Ltd (IHCL) at Rs 55,800 crore and EIH Ltd at Rs 13,700 crore, aligning with their EBITDA margins.

Analysts View

Potential Valuation:

The analyst suggests that the hotel business (Hotels Co.) may achieve a valuation of not Rs 30,000 crore (as it was estimated before the demerger) but possibly higher, ranging from Rs 35,000 crore to Rs 40,000 crore.

This higher valuation is based on favorable conditions in the hotel industry, such as improving travel activities and high occupancy rates.

Impact on Shareholders:

Despite the potential increase in valuation, the analyst believes that the demerger might not be a significant game-changer from the shareholders’ perspective.

The reason for this assessment is that the value per share for the hotel business is estimated to be Rs 23, and even with a presumed 20-25% premium post-demerger, it might not exceed Rs 30 per share.

This means that the value-unlocking for shareholders may not be substantial, considering the current share price of ITC.

Lighter Balance Sheet:

The demerger will result in the hotel business becoming a separate entity, and it will no longer be consolidated in ITC’s financial statements. This will make ITC’s balance sheet “a tad lighter,” meaning it will have fewer assets and liabilities to account for, as the hotel business will be independently managed.

Stock Price Downfall:

The correction in ITC’s stock price is primarily due to profit-taking and a sell-on-news reaction.

The stock had experienced a significant rally leading up to the demerger announcement, prompting some investors to book profits by selling their shares. Such profit booking is a common market phenomenon.

The demerger of ITC’s hotel business has evoked mixed responses from experts.

Positive Perspective: Value Creation in the Medium to Long Term

According to Abneesh Roy, Executive Director of Nuvama Institutional Equities,

ITC’s FMCG business has shown robust growth and is free cash flow positive. The tobacco business is also performing well, experiencing volume growth and gaining market share from the illicit market. Moreover, the hotel business is currently witnessing a bullish trend, and the paper business is thriving like never before.

The demerger of ITC’s hotel business is seen as a positive step towards value creation in the medium to long term.

The hotel business has been capital-intensive and contributed to around 20% of the company’s capex in recent years.

By demerging this segment, ITC will become a more focused entity, concentrating on cigarettes, FMCG, paper, and agri.

This alignment with consumer-facing businesses is expected to strengthen ITC’s position and increase its value proposition for investors.

Additionally, the demerger is likely to address investor concerns about the low return ratio of the hotel business and the need for a more streamlined approach. By unlocking value through this strategic move, ITC aims to attract more investors interested in focused entities.

According to Jefferies,

The hotel business is currently experiencing favorable conditions, benefiting from a rise in travel activities and a lack of significant new room supply in the industry. This has resulted in high occupancy rates and an increase in Average Room Rates (ARR).

It has conducted an estimation of the enterprise value of ITC Hotels. They have valued it at an 18 times EV/Ebitda multiple, which amounts to Rs 18,300 crore.

It’s worth noting that this valuation reflects a 20% discount compared to the valuation of Indian Hotels Company Limited (IHCL), a key competitor in the hospitality sector.

Negative Perspective: Limited Impact on Shareholders

Amnish Aggarwal, Head of Research at Prabhudas Lilladher, presents a different viewpoint.

He suggests that the demerger may not be a significant game-changer for ITC shareholders.

The hotel business, while important, contributes only around 5% of ITC’s overall value, with the majority of value derived from cigarettes and FMCG operations, accounting for 80% of the company’s worth.

According to Aggarwal, expectations of substantial value unlocking might have been overestimated by the market.

The demerger may not result in a substantial increase in shareholder value, especially when compared to the size of ITC as a company.

So, While some analysts believe it will lead to significant value creation in the medium to long term, others argue that its impact on shareholders may be limited given the dominance of cigarettes and FMCG operations in ITC’s value.

As the company proceeds with the demerger, investors will closely watch the unfolding scenario during the upcoming Annual General Meeting for more clarity on the structuring and potential effects on shareholder value. Regardless of the immediate market reaction, the long-term performance of ITC’s core businesses and the hotel segment will ultimately determine the success of this strategic move.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————

“Why this small-cap stock can perform exceptionally in the future? ” What comes to your mind when you hear……Read More

Down 20% in 1 year, but why analysts are bullish on this small cap?