Midcap stocks with ‘strong buy’ & ‘buy’ recommendations by Experts

During the recent phase of the market correction that’s been shaking up the Nifty, something interesting has been happening in the arena of the mid-cap stock. These mid-sized players seem to be defying the bears and dancing to the bull’s tune. The market participation in this segment is on the rise, with positive market breadth.

As things stand, the overall sentiment in all segments of the market is bullish. Of course, this could change if there are major global or domestic developments. But as of now, the spotlight is firmly on mid-cap stocks.

In such a buoyant environment, market analysts are enthusiastic about a select group of mid-cap stocks spanning various sectors. We used a meticulous methodology to filter them:

Step 1: Minimum 20% Upside Potential

We calculated the average price targets for all the stocks, considering analyst target prices for the next 12 months. This average price target was then compared to current market prices to determine the average upside potential, expressed as a percentage. To make it onto this list, stocks had to have a minimum upside potential of 20%.

Step 2: “Buy” or “Strong Buy” Rating with at Least 10 Analysts

After the first step, we only considered stocks with a “buy” or “strong buy” rating, and a minimum of 10 analysts who provided price targets for the stock. Any stocks that didn’t meet these criteria were removed from the list.

Step 3: Market Capitalization Between Rs 5,000 Crore and Rs 25,000 Crore

In the final step, we selected only those stocks with a market capitalization ranging from Rs 5,000 crore to Rs 25,000 crore.

So, there you have it, a curated list of mid-cap stocks with exciting potential, spanning various sectors and handpicked using a rigorous selection process.

Also Read: Buy or Sell: Sumeet Bagadia’s 3 Stock Recommendations for This Week

Karur Vysya Bank

- Recommendation: Strong Buy

- Analyst Count: 12

- Upside Potential: 24.4%

- MarketCap Rs Cr: 10,386

The Karur Vysya Bank Limited (the Bank): The Karur Vysya Bank Limited is a banking company that offers a range of banking and financial services. The bank operates in several segments:

- Treasury: This segment involves investments in central and state government securities, debt instruments of banks, certificates of deposit, equity shares, mutual funds, and security receipts, among others.

- Corporate/Wholesale Banking: In this segment, the bank provides credit facilities and other banking services to corporate and other clients.

- Retail Banking: The retail banking segment includes lending and other banking services offered to individuals and small business customers, excluding corporate or wholesale banking clients.

- Other Banking Operations: This segment covers para-banking activities such as bancassurance, third-party product distribution, demat services, and other banking transactions

Also Read: “ Stock on Radar : Tata Power- Time to Buy?”

Sobha

- Recommendation: Strong Buy

- Analyst Count: 17

- Upside Potential: 31.8%

- MarketCap Rs Cr: 5,693

Sobha Limited (SL): Sobha Limited is a real estate developer that operates in two main segments:

- Real Estate Segment: This segment is primarily involved in construction, development, sale, management, and operation of townships, housing projects, and related activities. It also includes leasing of commercial premises. Sobha Limited is known for constructing various types of residential properties, including presidential apartments, villas, row houses, luxury and super luxury apartments, plotted developments, and aspirational homes.

- Contractual and Manufacturing Segment: This segment includes the development of commercial premises and related activities. It also encompasses manufacturing activities related to interiors, glazing, metal works, and concrete products. Additionally, it provides backward integration to the company’s turnkey projects. The portfolio of this segment includes the development of offices, convention centers, software development blocks, hostel facilities, restaurants, and clubhouses.

Also Read: “ 6 Large Cap Stocks For Volatile Markets”

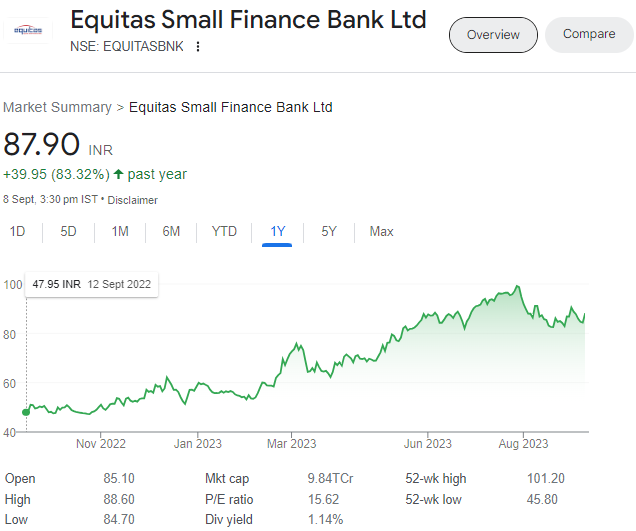

Equitas Small Finance Bank

- Recommendation: Buy

- Analyst Count: 17

- Upside Potential: 24.0%

- MarketCap Rs Cr: 9,478

Equitas Small Finance Bank Limited: Equitas Small Finance Bank Limited is a banking company that offers a range of financial services. The bank operates through three main segments:

- Treasury: This segment encompasses various financial activities related to the bank’s treasury operations. It includes managing the bank’s investment portfolios, profit or loss on the sale of investments, fees earned from priority sector lending certificates (PSLC), profit or loss on foreign exchange transactions, equities, income from derivatives, and money market operations.

- Corporate / Wholesale Banking: This segment involves providing financial services to corporate entities, trusts, partnership firms, companies, and statutory bodies. It includes advances or loans extended to these entities, which do not fall under the category of Retail Banking.

- Retail Banking: The Retail Banking segment focuses on serving retail customers. It includes lending to retail customers, accepting deposits from them, and managing the identified earnings and expenses of this segment. The bank offers various retail banking products and services, such as micro-loans against property, commercial vehicle finance lending, microfinance lending, demand deposits, time deposits, and fee-based products.

Additionally, Equitas Small Finance Bank provides distribution services for insurance and mutual fund products, and it offers locker facilities to its customers.

PNC Infratech

- Recommendation: Strong Buy

- Analyst Count: 16

- Upside Potential: 21.9%

- MarketCap Rs Cr: 8,958

PNC Infratech Limited: PNC Infratech Limited is an infrastructure construction, development, and management company. The company operates primarily in the field of infrastructure projects, which encompass various areas such as:

- Highways: PNC Infratech is involved in the construction and development of highways, which are critical for transportation and connectivity.

- Bridges: The company also undertakes bridge construction projects, vital for overcoming geographical obstacles.

- Flyovers: Construction of flyovers is another area of expertise for PNC Infratech, aiding in traffic management and decongestion in urban areas.

- Power Transmission Lines: PNC Infratech participates in the construction of power transmission lines, contributing to the energy infrastructure.

- Airport Runways: Airport runway development is essential for the aviation sector’s growth, and PNC Infratech is involved in such projects.

The company operates in two main segments:

- EPC Contract: This segment involves engineering, procurement, and construction (EPC) services, providing end-to-end infrastructure implementation solutions.

- BOT (Toll and Annuity): PNC Infratech is also involved in build-operate-transfer (BOT) projects, including both toll-based and annuity-based models.

PNC Infratech focuses on infrastructure projects in various states, including Uttar Pradesh, Madhya Pradesh, Rajasthan, Uttarakhand, Bihar, Delhi, Karnataka, and Maharashtra. They participate in projects under public-private partnership (PPP) formats, such as design-build finance-operate-transfer (DBFOT) and hybrid models.

Gujarat State Petronet

- Recommendation: Buy

- Analyst Count: 24

- Upside Potential: 21.0%

- MarketCap Rs Cr: 15,801

Gujarat State Petronet Limited: Gujarat State Petronet Limited is primarily engaged in the transmission of natural gas through pipelines on an open access basis. The company plays a crucial role in transporting natural gas from supply points to demand centers and eventually distributing it to end customers.

Additionally, Gujarat State Petronet Limited is involved in various activities:

- City Gas Distribution (CGD): The company implements and operates City Gas Distribution projects, which involve supplying natural gas to households, industries, and commercial establishments in urban areas.

- Electricity Generation: Gujarat State Petronet Limited is also engaged in generating electricity through windmills, contributing to the renewable energy sector.

- Energy Transportation Infrastructure: The company focuses on developing energy transportation infrastructure, including pipelines, to connect natural gas supply sources, including liquefied natural gas (LNG) terminals, to various markets.

Gujarat State Petronet Limited serves a wide range of customers, including refineries, steel plants, fertilizer plants, petrochemical plants, power plants, glass industries, textiles, chemical manufacturers, city gas distribution (CGD) companies, and other miscellaneous industries.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.