NCC Limited: Why it’s a Top Pick in Infrastructure

Infrastructure projects might slow down short-term, but NCC Limited (CMP: Rs 218; market cap: Rs 13,696 crore; Rating: Overweight) is poised for long-term gains.

Company Profile: NCC Limited

Established in 1978, NCC Limited specializes in turnkey Engineering, Procurement, and Construction (EPC) contracts and Build-Operate-Transfer (BOT) projects under Public-Private Partnership (PPP) arrangements.

NCC operates pan India with offices in 13 cities across key states such as Maharashtra, Andhra Pradesh, Telangana, Karnataka, Gujarat, Uttar Pradesh, West Bengal, and Tamil Nadu.

Subsidiaries:

As of March 31, 2021, NCC had 35 subsidiaries. Notably, the Ropeway Project at Patnitop, awarded by the Government of Jammu and Kashmir, was canceled, leading to the liquidation of the SPV, Patnitop Ropeway & Resorts Ltd., through voluntary winding-up process.

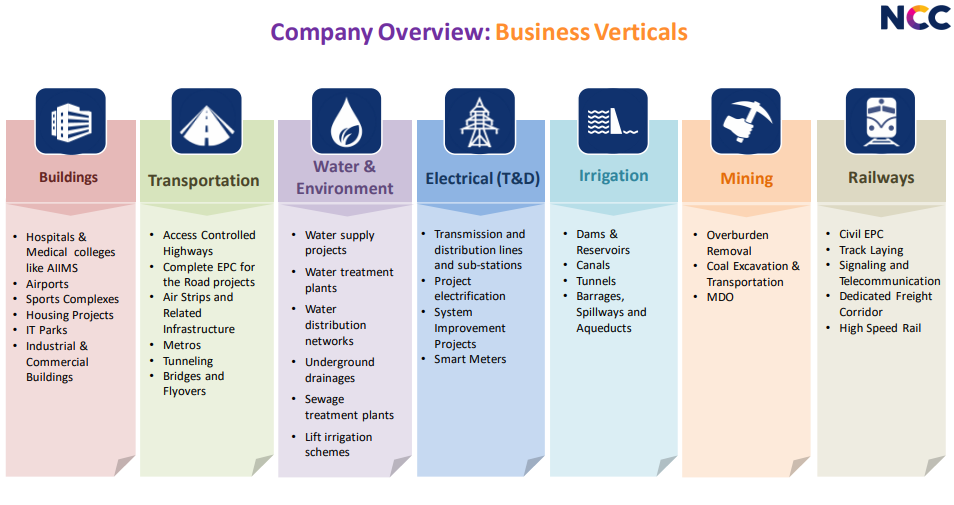

Business Overview:

NCC specializes in construction across various sectors, including roads, buildings, irrigation, water, environment, electrical, metals, mining, and railways. Additionally, it has investments in road and energy projects through its subsidiary, NCC Infrastructure Holdings Limited, and in real estate through NCC Urban Infrastructure. The company also operates in the Middle East through its subsidiaries in Muscat and Dubai.

Settlement of Legacy Power Project:

With settlements reached for legacy projects like Sembcorp and TAQA, NCC has overcome significant hurdles.

- On March 14, NCC’s subsidiary NCC Infrastructure Holdings Limited (NCCIHL) reached a settlement with TAQA India Power Ventures Private Limited (TAQA) and Himachal Sorang Pvt Ltd (HSPL) regarding Arbitration Awards linked to the Himachal Sorang Power Project, divested to TAQA in September 2012.

- Pursuant to the settlement, NCCIHL agreed to pay TAQA Rs 175 crore in three instalments, guaranteed by NCC.

- Although NCC had already provisioned a liability of Rs 140 crore, an additional charge of Rs 35 crore is expected in Q4FY24.

- The settlement resolves a significant burden on NCC, removing a major overhang.

Expected Margin Improvement:

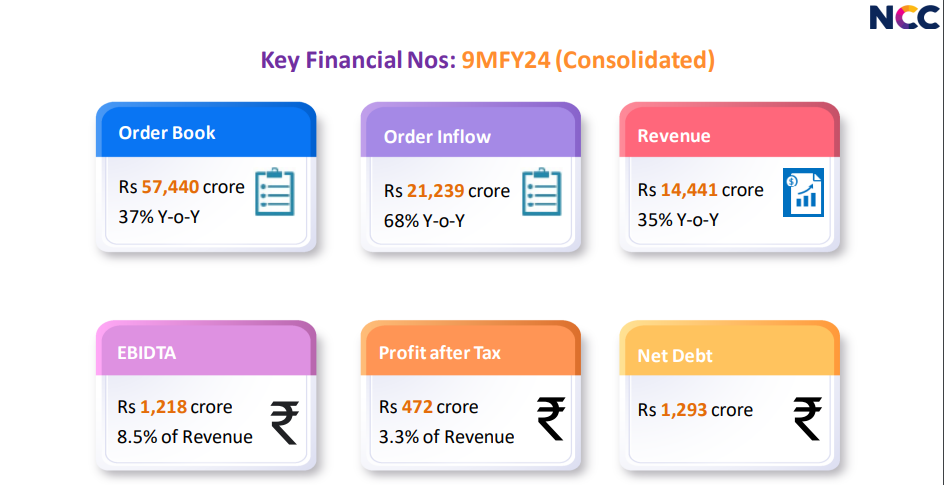

- NCC’s margins were impacted in 9MFY24 due to charges of about Rs 200 crore, primarily from the legacy Sembcorp power project (EBIDTA impact of about 140 bps).

- Additionally, Q4FY24 may see an additional charge of about Rs 35 crore due to the TAQA settlement.

- Margin decline of ~100 bps is anticipated in FY2024. However, with the TAQA settlement, NCC is expected to largely resolve past project-related burdens, leading to margin improvement from FY2025.

- NCC aims for marginal improvement in FY2025 margins compared to FY2023 levels. The company is implementing digital operational procedures and enhancing technology use at construction sites to reduce costs. Moreover, operational efficiencies driven by strong top-line growth should support higher margins.

Fundamentals:

- Market Cap₹ 17,135 Cr.

- Current Price₹ 273

- High / Low₹ 278 / 99.6

- Stock P/E25.5

- Book Value₹ 100

- Dividend Yield0.81 %

- ROCE18.7 %

- ROE9.99 %

- Face Value₹ 2.00

- Industry PE37.8

- PEG Ratio1.07

- Sales growth37.1 %

- Return over 1year151 %

- Profit growth31.8 %

- OPM8.72 %

- Debt₹ 1,439 Cr.

- Debt to equity0.23

- Free Cash Flow₹ 877 Cr.

- Promoter holding22.0 %

- FII holding23.9 %

- DII holding10.5 %

- Public holding43.6 %

- Profit Var 3Yrs19.7 %

- Sales growth 3Years20.4 %

- Int Coverage2.73

- Cash Equivalents₹ 774 Cr.

Financial Performance:

Infrastructure Sector Outlook:

- Near-Term Slowdown: The announcement of election dates and the ensuing model code of conduct will likely delay new government infrastructure projects.

- Long-Term Focus Intact: Despite short-term disruptions, the government’s commitment to infrastructure development remains firm.

NCC’s Growth Trajectory:

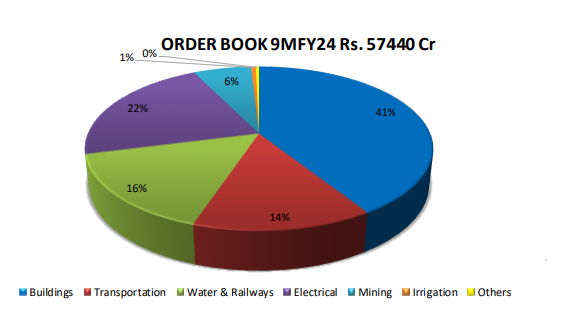

- Robust Order Book: NCC’s substantial order book ensures continued revenue growth, even amidst project awarding slowdowns.

- Strong Execution: The company’s focus on project execution, especially in initiatives like the Jal Jeevan Mission and smart meter projects, ensures steady progress.

Specific Risks in Investing in NCC Limited:

- Project Execution Risks: NCC’s business heavily relies on successful project execution. Any delays, cost overruns, or quality issues in project completion could impact profitability and investor confidence.

- Dependency on Government Contracts: NCC secures a significant portion of its revenue from government contracts. Changes in government policies, project delays due to bureaucratic processes, or non-payment issues could adversely affect the company’s financial performance.

- Industry Competition: The infrastructure sector in which NCC operates is highly competitive, with several established players vying for contracts. Intense competition could lead to pricing pressures, reduced margins, and difficulty in securing new projects.

- Regulatory and Legal Risks: The infrastructure sector is subject to various regulatory and legal requirements. Changes in regulations, compliance issues, or legal disputes could result in financial losses and reputational damage for NCC.

- Economic Downturns: NCC’s performance is closely tied to the overall economic environment. Economic downturns, recessionary pressures, or fluctuations in GDP growth could impact infrastructure spending, leading to reduced demand for NCC’s services.

- Project Funding Risks: NCC undertakes large-scale projects that require substantial funding. Any difficulty in securing project financing, higher borrowing costs, or liquidity constraints could hamper project execution and financial stability.

- Operational Risks: NCC operates in diverse segments across multiple geographies, exposing it to operational risks such as supply chain disruptions, labor shortages, equipment failures, and natural disasters, which could disrupt project timelines and increase costs.

- Debt Burden: Despite efforts to reduce debt, NCC’s debt levels remain relatively high. Higher interest expenses and debt servicing obligations could strain cash flows and limit the company’s financial flexibility.

- Political and Geopolitical Risks: NCC’s operations in different regions, including the Middle East, expose it to political instability, regulatory changes, and geopolitical tensions, which could disrupt operations and impact financial performance.

- Market Volatility: NCC’s stock price may experience significant volatility due to factors such as market sentiment, investor perception, macroeconomic trends, and sector-specific news, posing challenges for long-term investors.

Investors should carefully assess these risks along with NCC’s financial performance, growth prospects, and management strategies before making investment decisions. Diversification and thorough due diligence are essential to mitigate risks associated with investing in NCC Limited.