Ethanol blending is a great innovation will it cut retail prices so drastically?

“All the vehicles will now run on ethanol produced by farmers. If an average of 60% ethanol and 40% electricity is taken, petrol will be available at the rate of INR15 per litre and people will benefit. Pollution and import [bill] will reduce.”

Union minister Nitin Gadkari recently proposed a bold solution to bring down petrol prices to INR15 per litre by implementing 60% ethanol blending and 40% electricity in vehicles.

Ethanol blending presents a promising solution to reduce India’s crude oil import bill significantly. With a simple 60% ethanol blending, the country’s current import expenses of INR126,000 crore could be cut nearly in half. This offers an attractive prospect for enhancing energy security and decreasing India’s dependence on costly foreign oil.

While the potential cost savings from ethanol blending are considerable, the crucial question remains:

will the common man benefit from reduced petrol prices?

Analyzing the global price trend over the last eight years in comparison to India’s, the answer seems uncertain.

Despite fluctuations in global crude oil prices, the retail petrol prices in India have not always mirrored these changes. The discrepancy between global crude prices and domestic retail prices raises doubts about the transparency and effectiveness of the fuel pricing mechanism.

To learn more about Fundamentals & Basics of Economy and Stock Market one can consider enrolling in our Stock Market Learning Courses, here.

The Potential Benefits of Ethanol Blending:

Despite the challenges, ethanol blending offers substantial benefits. Many countries worldwide have successfully implemented ethanol blending programs, and in India, the existing ethanol blending initiative has already saved the government more than INR60,000 crore.

Furthermore, the planned rollout of the E20 blending program (20% blending) for motor vehicles by 2025 could potentially save the country up to USD 4 billion annually.

Understanding the Cost Structure of Petrol:

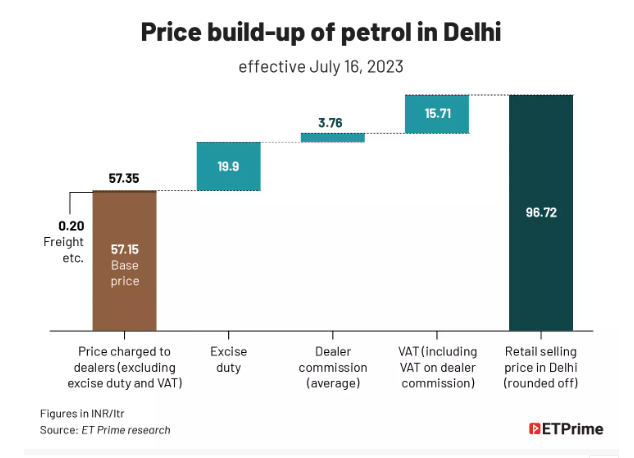

Examining the current petrol prices in the national capital, we find that the base price of petrol stands at INR 57.15 per litre, while dealer commission, duty, and taxes contribute to the final retail price of INR 96.72 per litre.

Notably, the prominent factor driving high fuel prices in the country is the rate of central and state taxes, as depicted in the accompanying graphic.

While Union Minister Nitin Gadkari proposes 60% ethanol blending as a measure to reduce petrol prices, even an ambitious 80% blending achievement would not suffice to bring the base price below INR35 per litre.

Last year, taxes constituted a staggering 69% of the petrol pump price, making India the world’s highest in terms of fuel tax rates. However, the tax burden has now been reduced to 40%.

Challenges in Achieving INR15/Litre Petrol:

Despite the advantages of ethanol blending, the reality of reducing petrol prices to INR15 per litre is far more complex.

-Existing taxation policies,

-Heavy central and state taxes, and

-The overall fuel pricing structure

make it challenging to achieve such a drastic reduction.

The Potential of Ethanol Blending:

Notwithstanding the challenges, ethanol blending remains a remarkable innovation that various countries across the globe have adopted incrementally. In India, the ethanol blending program has already contributed to significant savings of over INR60,000 crore for the government.

The Centre has set a progressive goal of implementing the E20 blending program (20% blending) for motor vehicles by 2025, advancing it by five years from the initial target of 2030.

If executed effectively, the E20 scheme has the potential to save the country up to USD 4 billion annually.

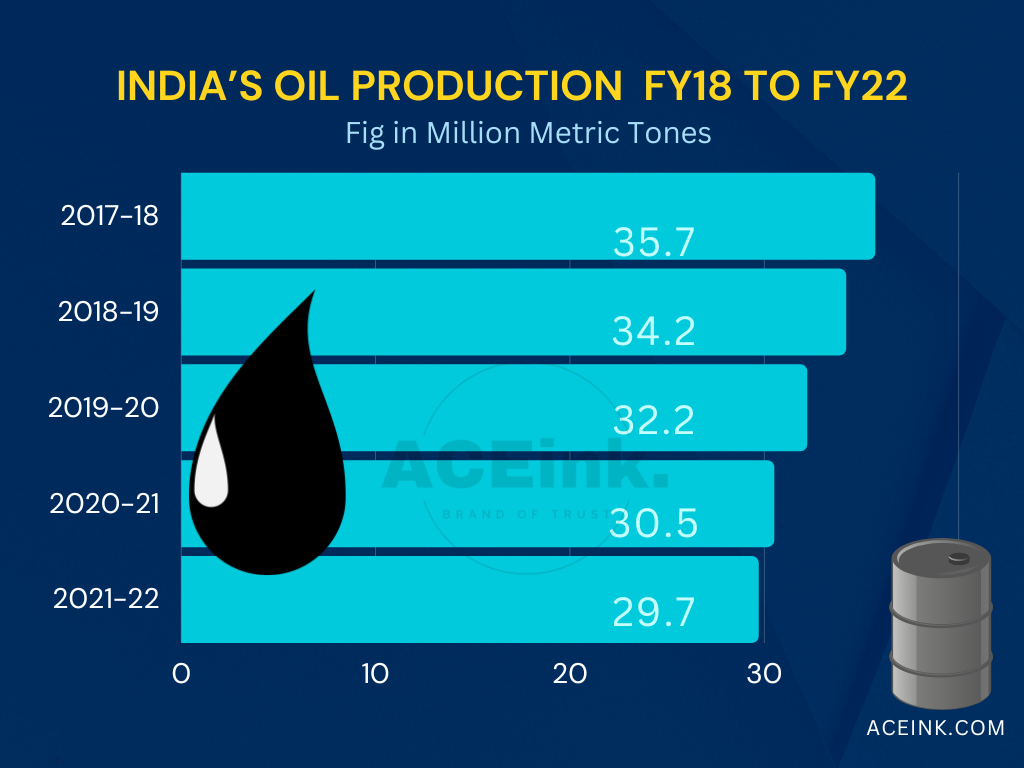

Ethanol blending presents a viable opportunity to decrease India’s crude oil imports, which currently account for over 86% of the country’s requirements.

By promoting a shift towards alternative and renewable energy sources like ethanol, India can enhance its energy security and reduce its dependency on imported oil. India’s domestic oil production has been on a steady decline due to reduced output from aging oil wells and a lack of significant new discoveries.

To achieve self-sufficiency in oil production, a stronger emphasis on exploration and increasing production is essential.

Fuel Price Trends:

Global Crude vs. Domestic Retail Prices:

Although fuel prices are theoretically linked to global crude oil rates, the reality is different.

Petrol prices in India tend to rise rapidly when global crude prices increase but do not decline proportionally when crude prices fall, raising concerns about the transparency of fuel pricing mechanisms.

A glaring example of the complexities in Indian petrol pricing lies in the recent global crude price correction.

In March 2022, as global crude prices surged from USD 70 to USD 138 per barrel, petrol prices in some regions of India skyrocketed to as high as INR 115 per litre. However, despite the subsequent correction in international crude prices, with the benchmark Brent crude oil dropping nearly 50% to USD 79 per barrel, domestic pump prices have not been revised downwards for the last five months. For instance, petrol is still being sold at INR 96.72 per litre in Delhi.

Benefit from Russian Oil Imports:

Currently, India is reaping the benefits of a sharp increase in Russian oil imports, which were secured at a considerable discount to the Brent benchmark. Although these discounts have reduced from last year, Indian refiners are processing a significant volume of Russian crude, accounting for 40% of their total imports, a substantial increase from the previous 3%.

While the discounted oil imports from Russia have contributed to reducing India’s overall import bill, the oil marketing companies (OMCs) have been witnessing substantial profit growth.

Over the last six years, the net profit of the three largest OMCs

– Indian Oil Corporation (IOCL), Bharat Petroleum (BPCL), and Hindustan Petroleum (HPCL)

has grown exponentially.

The net profit of IOCL exemplifies the remarkable profit growth witnessed by OMCs.

In 2021-22, IOCL’s net profit soared to INR 24,184 crore, a significant increase from INR 5,273 crore recorded in 2014-15. This exponential growth in profits is evident across all three major OMCs. For the financial year 2020-21, the combined net profit of these companies stood at INR 51,542 crore.

Despite this advantage, the benefit has not been effectively passed on to the people in the form of reduced petrol prices.

To illustrate the contrast in petrol prices over the years, let’s look back at July 2008 when crude oil prices averaged USD 132 per barrel (with Brent reaching a historic high of USD 147/barrel during that month). Remarkably, petrol was priced at just INR 50.62 per litre at that time, underscoring the significant disparity between historical and current fuel costs.

During the entire FY21, when global crude prices were averaging around USD20 per barrel, the Indian government took significant actions in response to the market conditions. Instead of passing on the benefits of low crude prices to consumers, the government increased taxes on fuel and raised petrol and diesel prices for 76 consecutive days. As a result, the government collected substantial revenue during this period.

At the time when crude futures plummeted to a negative USD 30 per barrel, numerous global oil companies faced financial challenges and even bankruptcy. In contrast, India saw an opportunity in the depressed prices and strategically utilized the situation. The country took advantage of the low crude prices and purchased oil at an average rate of USD19 per barrel.

While consumers continue to face high petrol, diesel, and cooking gas prices, oil marketing companies (OMCs) have witnessed exponential profit growth in recent years. Addressing this imbalance between OMC profits and consumer burden is crucial to ensure fair pricing.

A Comprehensive Approach for Lower Fuel Prices:

To tackle the challenges of high petrol prices, a comprehensive approach is needed.

This includes reforming taxation policies, focusing on boosting domestic oil production through exploration and innovation, and ensuring cost-saving benefits reach consumers.

Investing in renewable energy sources like electric vehicles and solar power is crucial for a sustainable and environmentally friendly energy future. By diversifying the energy mix, India can reduce its carbon footprint and decrease reliance on fossil fuels in the long term.

Conclusion:

While the proposal of ethanol blending is a step in the right direction, achieving petrol prices of INR15 per litre remains a significant challenge. It necessitates addressing the complexities of fuel pricing, taxation, and domestic oil production through a multifaceted approach. Moreover, embracing renewable energy sources is crucial for creating a sustainable energy landscape that benefits both the economy and the environment.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————

“Why this small-cap stock can perform exceptionally in the future? ” What comes to your mind when you hear……Read More

Down 20% in 1 year, but why analysts are bullish on this small cap?