Railway stocks and PSUs are performing well and are currently available at attractive valuations- But, What are the Analysts’ views?

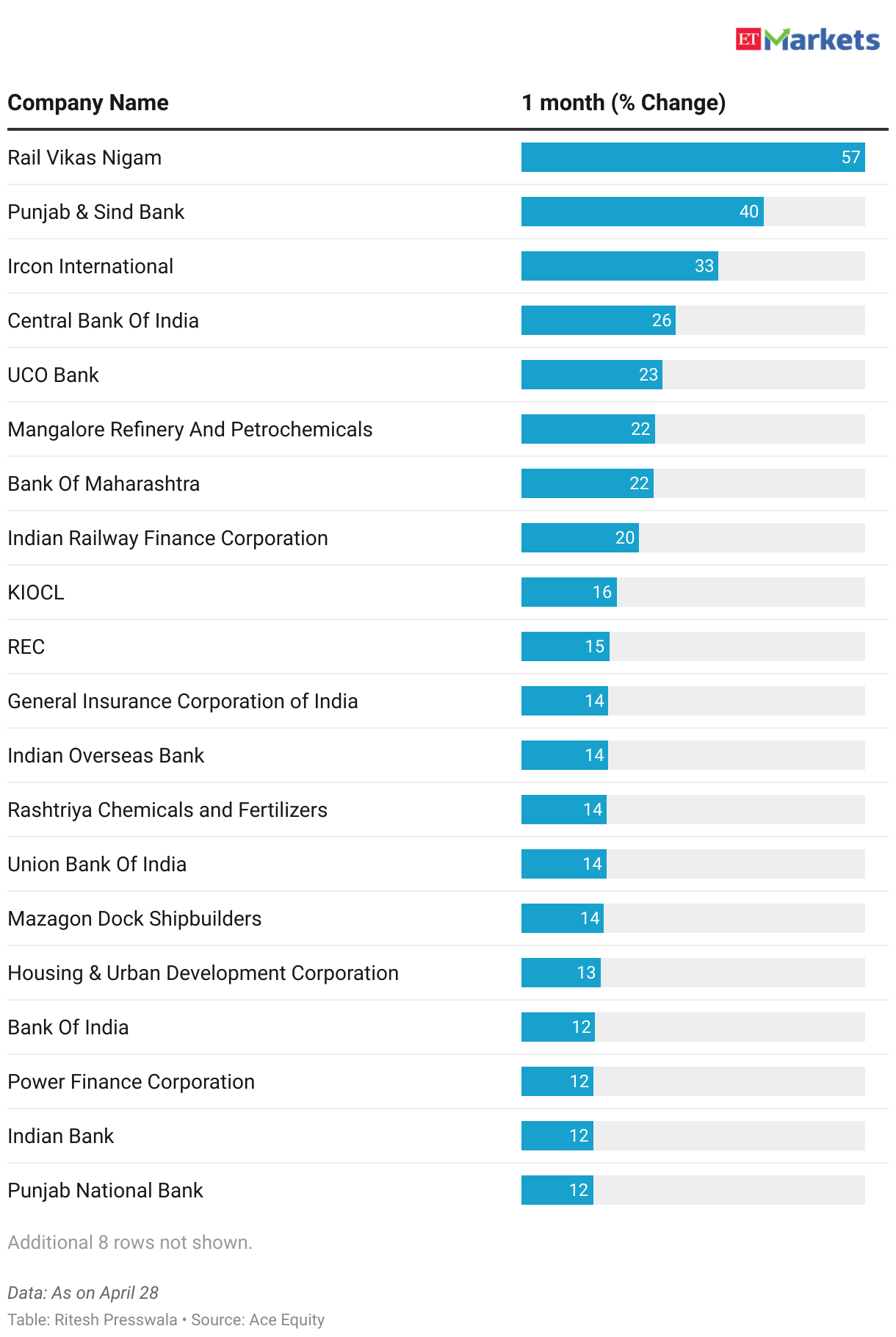

According to data, railway stocks have been the best-performing PSUs in April 2023, with Railway Vikas Nigam Limited RVNL leading the pack with a rise of over 56% in just one month.

Ircon International and Indian Railway Finance Corporation, both transport stocks, have also recorded substantial gains.

The Nifty PSU index rose by around 10%, compared to the benchmark Sensex and Nifty, which rose by 3%. On April, 28 PSU stocks delivered double-digit returns, with seven of them returning over 20%.

Out of all the PSU stocks, only two have recorded negative returns in the last month. Steel Authority of India Ltd (SAIL) has offered -0.28% returns, while NTPC has given -2.11%.

So,

What analysts are saying about the rally? and

What are the important factors that must take care of before investing in PSUs?

Let’s find out…

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

The Good Story of Railway Stocks and PSUs:

Analysts attribute the success of railway stocks to the INR 2.5 Lakh crore capex budget for rail infrastructure that was announced in the recent Indian budget as well as increased order inflows, both of which have helped boost momentum.

Here are the key points that experts are saying about the rally along with the important factors that must take care of before investing in PSUs:

-There is a momentum play happening with PSU companies, especially in the railway sector due to ambitious plans.

-Railway stocks and PSUs are performing well and are currently available at attractive valuations.

-The resistance and skepticism that investors had over PSUs are gradually decreasing.

-More and more investors want to add PSUs to their portfolios due to their cheap valuation and high dividend yield.

-Government policies are beneficial to these PSUs and they are able to maximize their profits due to their monopolistic or near monopolistic position in their respective sectors like RVNL.

-RVNL is currently catching up after many years of underperformance.

-The PSU tag is now a benefit in gaining more revenues and profits for these companies.

-There is no frenzy in railway stocks, capex stocks, defense, capex, industrials, and cyclical sectors.

-Certain stocks may be in the limelight for a few days or weeks, but then they may see sideways to a declining trend for months.

-Delivery volumes are on the higher side and valuations are not out of whack.

-Institutional volume is currently playing out on the stock market.

-The leverage in the system is extremely low.

-The cats and dogs have not started to move up as yet, so we are a long way from seeing any frenzy.

-We are just seeing sparks in the market after many months of sideways to a declining trend.

-The focus and strategy should be defined for the next RVNL or the next Gujarat-based PSU or where the action will be in the future.

–Gujarat-based PSU, Railways, or where the action is going to be in the future. We are in the earning season. It is the time when there is the highest degree of stock-specific volatility

-Analysts are optimistic about the current rally, but they are also cautious about investing in PSU stocks due to the government’s involvement.

-The concern is that as soon as PSUs start performing well, the government will opt for an IPO or OFS to raise funds because they are cash-strapped.

-This potential threat of an IPO or OFS always looms over the otherwise well-performing sector with good order books and positive future performance expectations.

——————-

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.