“RVNL shares hit fresh one-year high; Here’s why?”

On Tuesday, Rail Vikas Nigam Ltd (RVNL) witnessed a significant surge in its stock prices, hitting a fresh one-year high level for the fourth consecutive session.

Yesterday, the stock price soared by 20% to reach a day high of Rs 105.36.

Today, the Stock has made an intraday high of Rs 114.70 which is a new 52-week high.

This rise in RVNL’s stock prices was part of a larger trend, with most railway counters experiencing an upward trend in the last two sessions following reports of Indian Railways’ plans to start manufacturing advanced Vande Bharat trains by August 2023.

Will the rally continue?

Only time will tell…

But we can find out the reasons behind the rally and the factors to support it in the future along with the risk factors.

So, Let’s start…

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

Company Background:

-RVNL is a public sector enterprise under the Ministry of Railways, Government of India,

-established in 2003

-to undertake rail infrastructure development projects.

Objectives:

The company’s primary objective is to enhance the rail infrastructure capacity in the country by

-developing new rail lines,

-doubling of existing lines, and

-electrification of tracks.

The company also undertakes projects related to

-gauge conversion,

-railway electrification,

-modernization of stations, and

-construction of bridges.

Services:

RVNL’s services include

-project management consultancy,

-construction, and

-execution of railway projects.

The company has a team of experienced professionals who specialize in various aspects of railway infrastructure development, including civil engineering, signaling, and telecommunication.

Project Management:

-RVNL has a robust project management system in place to ensure timely completion of projects.

-The company’s projects are spread across the country,

-covering both urban and rural areas, and

-aim to connect various parts of the country through rail networks.

Notable Projects:

RVNL has successfully completed several prestigious projects, including the

-Electrification of the Delhi-Kolkata and Delhi-Mumbai rail corridors,

-The construction of the Kashmir rail link project, and

-The construction of the 112 km Kharagpur-Adityapur third line project.

Indian Railways’ Production of 120 Advanced Vande Bharat Express Trains and RVNL’s Involvement :

Indian Railways to Produce 120 Advanced Vande Bharat Express Trains:

Indian Railways plans to start production of 120 advanced Vande Bharat Express trains by August 2023, which is a significant step towards modernizing railway infrastructure and improving the country’s transportation system.

Vande Bharat Express:

The Vande Bharat Express is India’s first semi-high-speed train with a maximum speed of 160 km/h. It reduces travel time, increases passenger comfort, and is more energy-efficient compared to traditional trains.

Marathwada Railway Coach Factory to Produce Vande Bharat Trains:

The Marathwada Railway coach factory in Latur, Maharashtra, will produce the 120 advanced Vande Bharat Express trains. The tendering process for coach manufacturing is almost complete, and the contract is soon to be finalized.

Marathwada Railway Coach Factory:

The Marathwada Railway coach factory is a joint venture between Indian Railways and the Maharashtra government. It was inaugurated in 2019 and is expected to provide employment opportunities to the local community.

RVNL Emerged as the Lowest Bidder for Manufacturing cum Maintenance of Vande Bharat Trains:

RVNL, in a joint venture with Russia’s Transmashholding (TMH), emerged as the lowest bidder for manufacturing cum maintenance of Vande Bharat trains.

They were also the lowest bidder for Mumbai Metro line 2B of MMRDA project worth Rs 378 crore.

RVNL’s Approval for Automatic Block Signaling:

RVNL received approval from North Western Railway for the provision of automatic block signaling on Madar-Sakhun Section (51.13 Kms) of the Jaipur division, worth Rs 63 crore.

RVNL has set up a subsidiary company called Kinet Railway Solutions.

RVNL’s Capabilities in Railway Projects:

RVNL’s expertise lies in executing complex railway projects, from conceptualization to commissioning, and providing consultancy services to other organizations. Some of its capabilities include:

Project Management:

RVNL has a dedicated team of professionals who manage railway projects from start to finish, ensuring timely completion and adherence to quality standards.

Design and Planning:

RVNL has a team of engineers who design and plan railway infrastructure, including tracks, stations, and bridges, to ensure safe and efficient train operations.

Execution:

RVNL has a vast experience in executing railway projects, including laying tracks, constructing bridges and tunnels, and electrification of rail lines.

Maintenance:

RVNL also provides maintenance services for railway infrastructure, including track maintenance, signaling, and electrification.

Consultancy Services:

RVNL provides consultancy services to other organizations for railway projects, including feasibility studies, detailed project reports, and technical advice.

Strong Fundamentals:

- Market Cap ₹ 21,476 Cr.

- Stock P/E 15

- Industry PE 35.6

- PEG Ratio 0.62

- Book Value ₹ 33.7

- Price to book value 3.05

- Dividend Yield 1.77 %

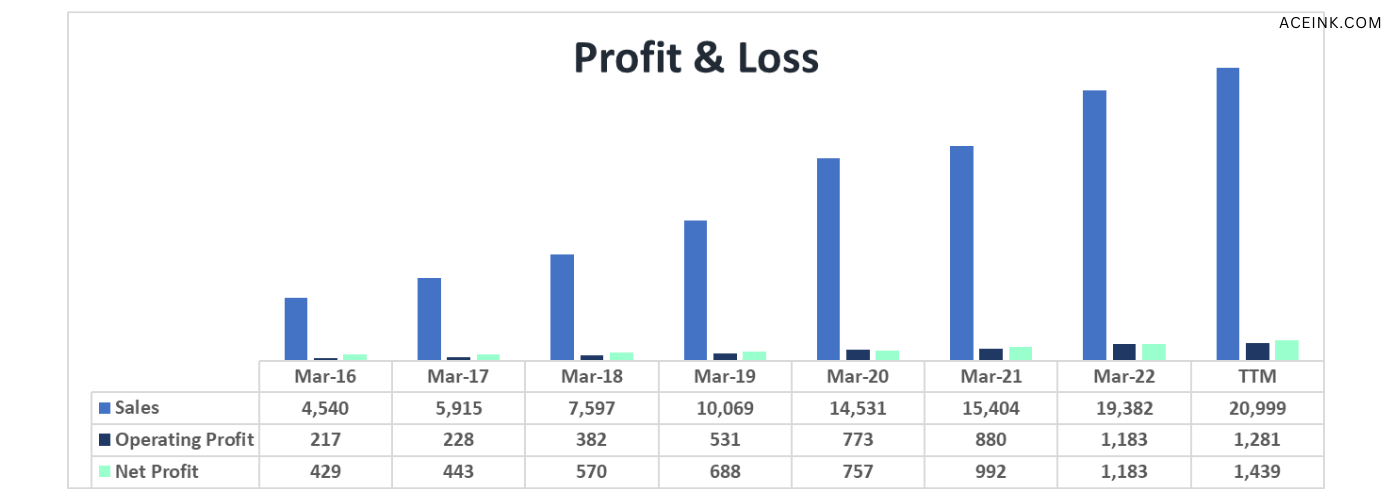

Strong Financials:

- ROCE 16.8 %

- ROE 19.7 %

- OPM 6.10 %

- Debt₹ 6,361 Cr.

- Debt to equity 0.91

- Qtr Profit Var 30.5 %

- Qtr Sales Var -0.74 %

Valuation

-RVNL’s current price-to-earnings ratio (P/E ratio) is around 15, which is lower than the industry average.

Here are some potential risks associated with investing in RVNL:

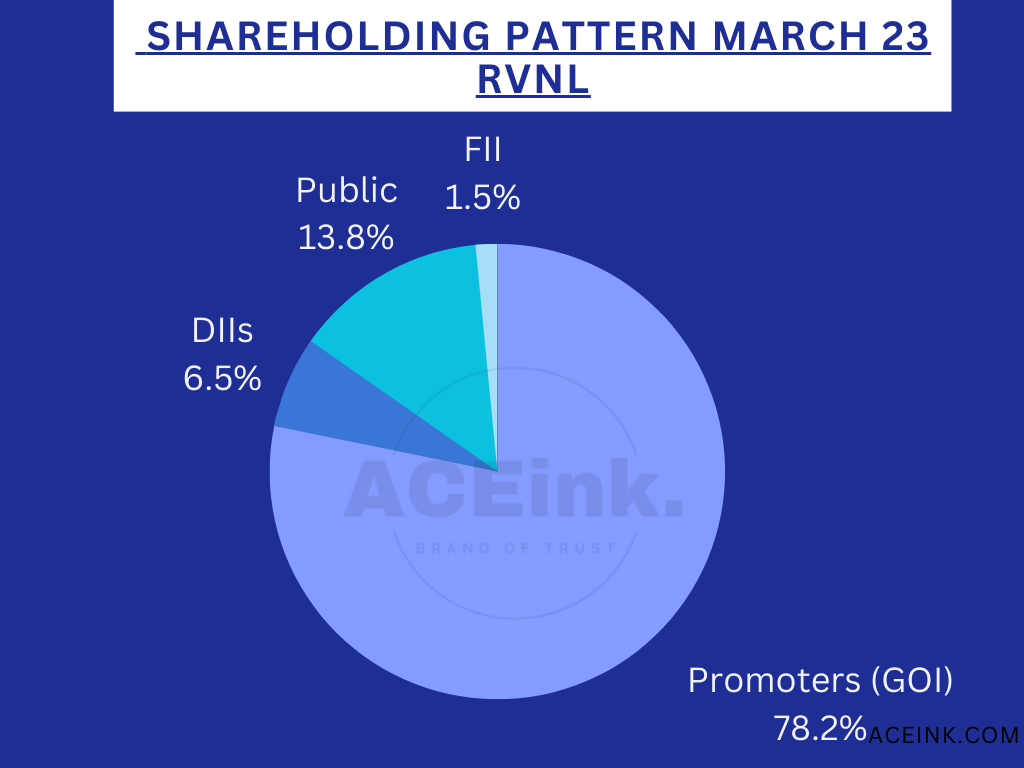

Dependence on government contracts:

-RVNL is heavily dependent on Indian Railways for its contracts and revenue.

-Any changes in government policies or decisions could impact the company’s financial performance.

Political and regulatory risks:

-As a government-owned entity, RVNL is susceptible to political and regulatory risks.

-Changes in government policies or regulations could affect the company’s operations and financial performance.

Infrastructure risks:

-The nature of RVNL’s business involves developing and maintaining railway infrastructure,

-which can be risky due to the large-scale and complex nature of such projects.

-Delays or cost overruns can impact the company’s financial performance.

Competition risks:

-RVNL faces competition from other players in the railway infrastructure sector.

-If the company is unable to compete effectively, it could impact its revenue and profitability.

Financial risks:

RVNL’s financial performance is subject to various risks such as

-interest rate fluctuations,

-inflation,

-currency risks, and

-liquidity risks.

Any adverse economic conditions or events could affect the company’s financial performance.

Technological risks:

-RVNL’s business is dependent on advanced technology and equipment.

-Any technological failure or obsolescence could impact the company’s operations and financial performance.

Environmental risks:

-RVNL’s projects involve significant environmental risks, such as pollution and ecosystem damage.

-Any environmental damage or non-compliance with regulations could result in penalties or lawsuits, impacting the company’s financial performance.

In conclusion, RVNL’s recent contract wins and its strong capabilities in executing complex railway projects have been reflected in its stock performance. As India aims to modernize its railway infrastructure and improve its transportation system, RVNL is well-positioned to play a significant role in this endeavor.

RVNL’s consistent financial performance, competitive advantage, and growth potential make it a promising company in the railway infrastructure development industry.

However, investors should also consider the risks associated with government funding and changes in the economic and political environment before making any investment decisions.

——————-

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.