29 Mar “Should Investors Be Worried About the Inverted Yield Curve? Here’s What You Need to Know”

“Inverted Yield Curve 101: Everything You Need to Know in Simple Terms”

If you’re interested in finance or economics, you may have heard of the term “inverted yield curve.” It’s a concept that can be a bit confusing at first, but it’s actually a really important indicator of the health of the economy.

Essentially, an inverted yield curve occurs when the yield on long-term bonds is lower than the yield on short-term bonds, which is the opposite of what we normally expect.

In this article, we’ll explore what an inverted yield curve is, why it happens, what it could mean for the economy and stock market, and how it could impact short-term as well as long-term investing.

So, first, let’s discover some fundamental terms

What is Yield Curve?

Interest rates refer to the cost of borrowing money, and they’re set by central banks in different countries. The interest rates set by central banks influence other interest rates, such as those for mortgages, car loans, and credit cards.

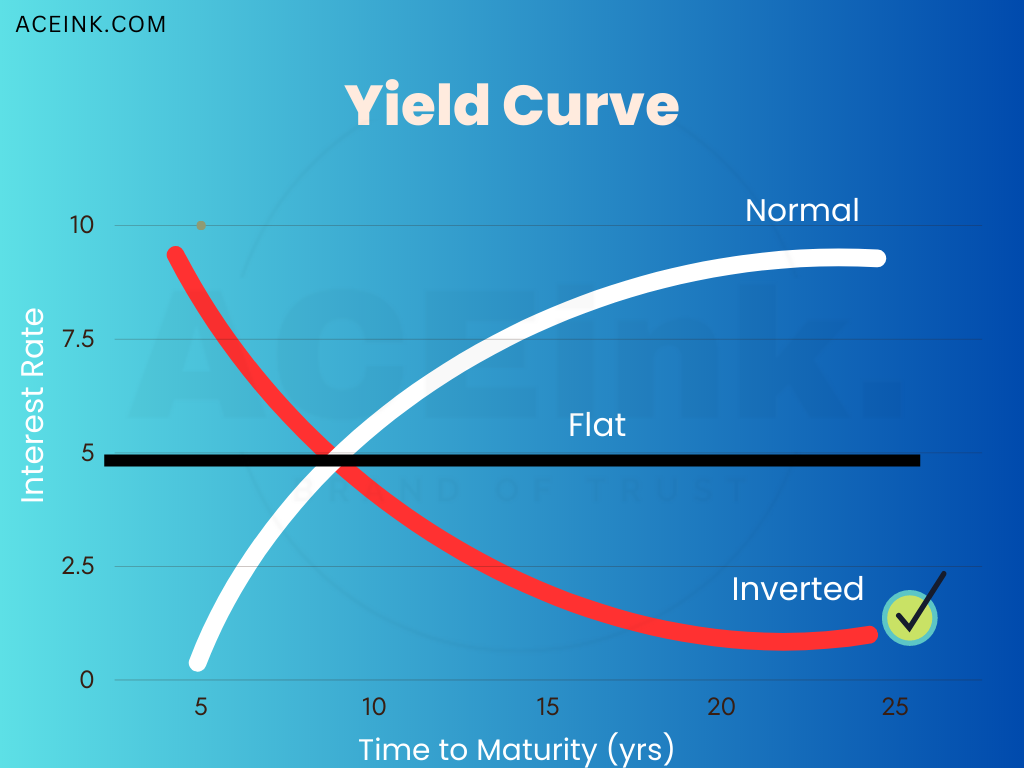

The yield curve, on the other hand, is a graph that plots the interest rates of government bonds with different maturities. Typically, the yield curve slopes upward, with long-term interest rates being higher than short-term interest rates.

What is an inverted yield Curve?

Inverted yield refers to a situation where the yield on longer-term bonds (such as 10-year or 30-year bonds) is lower than the yield on shorter-term bonds (such as 2-year or 5-year bonds).

Normally, investors expect to earn a higher return when they lend money for a longer period of time, so longer-term bonds typically have a higher yield than shorter-term bonds. However, when investors are worried about the future and think that the economy might not do well, they may be willing to accept a lower return on longer-term bonds as a way to protect their money. This can cause the yield curve to invert.

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

Why does it happen?

An inverted yield curve can happen for a few different reasons, but it usually occurs when investors are worried about the future and have a pessimistic outlook on the economy. Here are a few factors that can contribute to an inverted yield curve:

• Expectations of a recession: When investors think that a recession might be coming, they may prefer to invest in long-term bonds as a way to protect their money from the volatility of the stock market. This can drive up the price of long-term bonds and push their yields down, leading to an inverted yield curve.

• Central bank policies: In some cases, central banks may lower short-term interest rates to stimulate economic growth. This can cause short-term bond yields to fall, while long-term . bond yields remain relatively stable, leading to an inverted yield curve.

• Inflation expectations: Inflation can erode the value of bonds over time, so investors may demand higher yields on longer-term bonds to compensate for the risk of inflation. When inflation expectations are low, however, investors may be willing to accept lower yields on longer-term bonds, which can contribute to an inverted yield curve.

Overall, an inverted yield curve is typically a sign that investors are worried about the future and are looking for safe places to park their money. It’s important to note that an inverted yield curve doesn’t necessarily cause a recession, but it can be a warning sign that one could be on the horizon.

What it could mean for the economy?

When short-term interest rates are higher than long-term interest rates, it indicates that investors expect the economy to slow down in the near future. This is because central banks tend to raise short-term interest rates when they believe the economy is growing too fast and inflation may become a concern. When investors believe that the economy is going to slow down, they tend to buy more long-term bonds, driving down long-term interest rates.

How does it affect Stock Market?

An inverted yield curve can affect the stock market in a few different ways. Here’s an explanation of how it works:

• An inverted yield curve can be a warning sign that investors are worried about the future of the economy, and they may start looking for safer investments.

• When investors start moving their money out of the stock market and into bonds, this can drive down stock prices.

• Banks may find it harder to make money when the yield curve is inverted, as they typically make a profit by borrowing money at short-term rates and lending it at longer-term rates.

• When the yield curve is inverted, the profit margins for banks can shrink, which can lead to lower stock prices.

• An inverted yield curve can create uncertainty and anxiety in the stock market, which can lead to increased volatility and potentially lower prices.

• It’s important to remember that the stock market is influenced by many different factors, and an inverted yield curve is just one of them.

It’s important to note that an inverted yield curve doesn’t necessarily mean a recession is imminent, but it is a warning sign that should be taken seriously. In fact, an inverted yield curve has preceded every recession in the United States since 1950.

So, what should you do if you hear that short-term interest rates are high and the yield curve is inverted? It’s important to stay informed and keep an eye on economic indicators, but it’s also important to remember that investing is a long-term game. Trying to time the market based on short-term fluctuations can be risky, and it’s often better to stick to a long-term investment plan that takes market fluctuations into account.

——————–

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.

Prakash Karnani

Posted at 17:28h, 29 MarchExcellent