The Remarkable Turnaround of JLR: From Tata’s “Biggest Mistake” to a “Biggest Victory“

On June 2, 2008, Ratan Tata made a bold move by acquiring the UK-based luxury car brands Jaguar and Land Rover (JLR) for a hefty USD2.3 billion, despite the economic downturn and criticism from industry experts.

Many questioned this decision, dubbing it Tata’s “biggest mistake” due to the global recession and declining demand for luxury cars.

Tata Motors was burdened by INR 21,900 crore in debt and a staggering INR2,500 crore loss in FY09, marking its first loss in seven years. Both Tata Motors and JLR faced considerable difficulties.

Fast forward fifteen years, and the narrative has shifted dramatically.

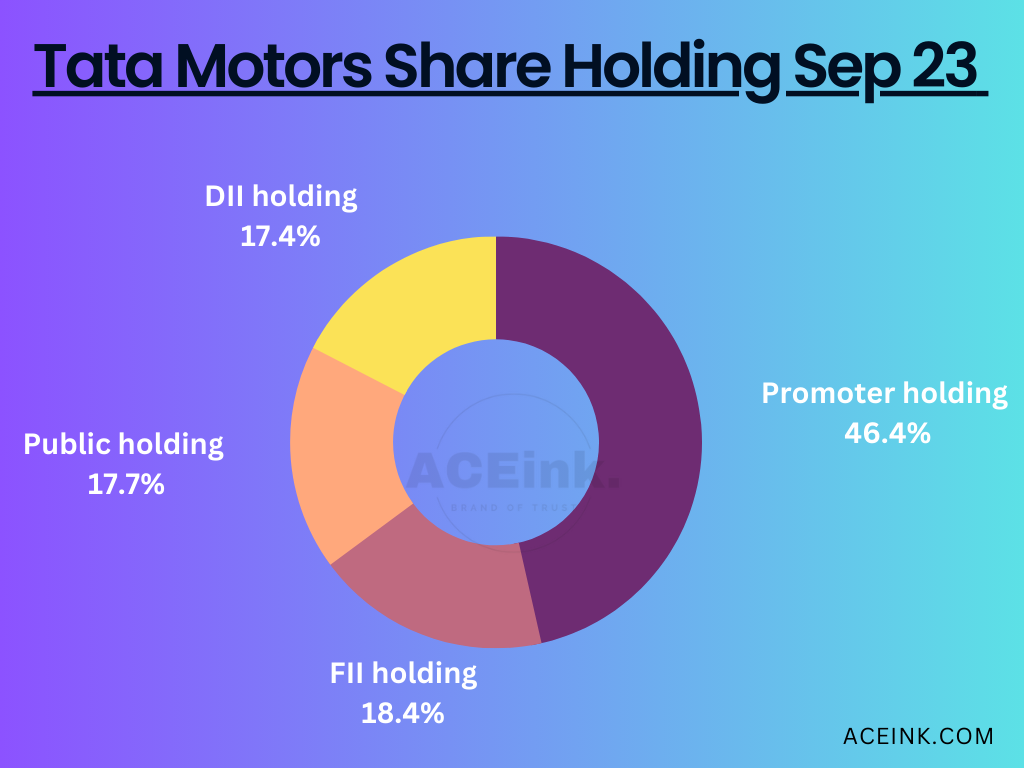

Tata Motors has become India’s third-largest carmaker, boasting a 13.4% market share in the passenger vehicle segment. Meanwhile, JLR has emerged as a significant contributor to Tata Motors’ consolidated revenues and profits.

Analysts have been particularly impressed by Tata Motors’ margin performance, which has consistently exceeded consensus expectations.

JLR’s Revival: From the “Biggest Mistake” to a Money-Maker

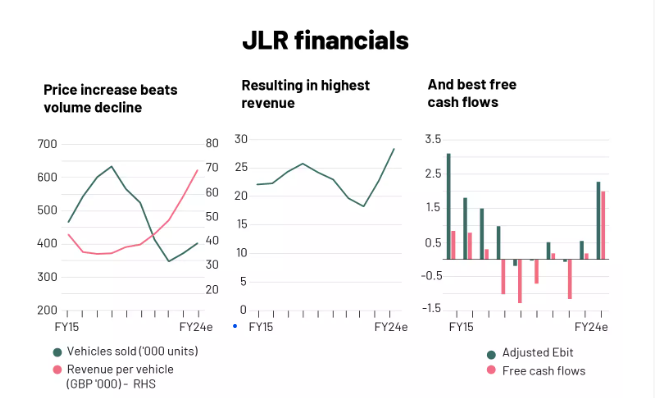

In the second quarter of FY24, JLR accounted for two-thirds of Tata Motors’ consolidated revenues and profits, making it a driving force in the company’s financial success. The most significant transformation has been JLR’s impressive recovery in profitability and, more crucially, free cash flows.

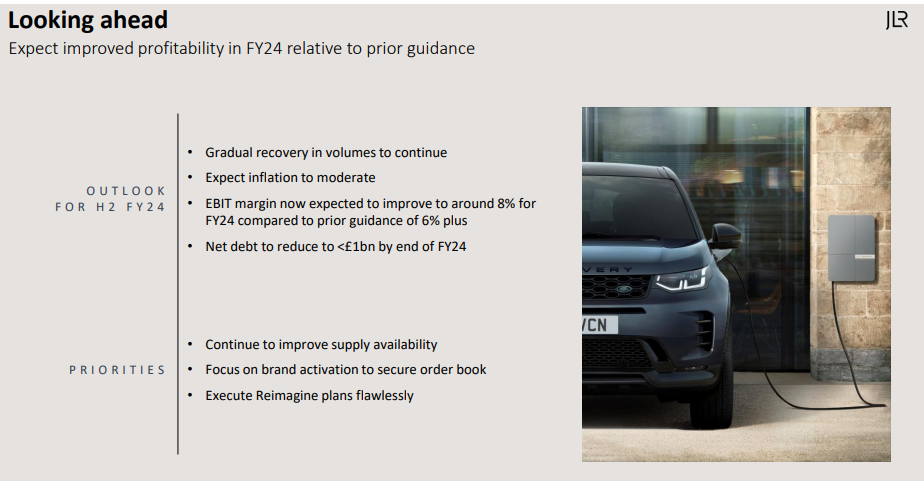

JLR is guiding toward generating over 2 billion pounds sterling in free cash flow for FY24 and reducing its net debt to less than 1 billion sterling by March.

The company has raised its operating margin target to approximately 8%, up from the previous 6%. This move underscores JLR’s confidence in its future prospects.

Source: Company, ET

Smart Strategy: Focus on High-Profit Cars

JLR’s remarkable turnaround is attributed to its strategic focus on high-profitability cars.

Products like Range Rover, Range Rover Sports, and the Defender now dominate sales, accounting for 64% of vehicle sales this year and 77% of the order book.

The company has abandoned low-profitability cars like the Jaguar sedan, planning to reintroduce it as a fully electric sports car in 2025 with premium pricing.

Upcoming Initiatives and Challenges

JLR’s next big move is the launch of battery electric Range Rovers, set for late 2024, and Range Rover Sports soon after.

These vehicles are expected to command higher price points but may pose challenges for maintaining profitability, as electric vehicles have been noted to impact margins.

JLR’s Path to Profitability in Electric Cars

The market’s apprehension regarding JLR’s profitability in electric cars is evident. If JLR can prove the profitability of its electric cars, it would set a remarkable precedent among traditional carmakers worldwide.

Tata Motors, with Production Linked Incentives (PLI), also aims for profitability in its EV business.

The success of JLR’s electric cars will be a significant factor for both Tata Motors and the entire automotive industry.

- Market Cap ₹ 2,39,313 Cr.

- Current Price ₹ 653

- High / Low ₹ 678 / 375

- Book Value₹ 161

- Face Value₹ 2.00

- Dividend Yield 0.31 %

- Return over 1year48.3 %

- Stock P/E 14.9

- Industry PE 28.2

- PEG Ratio -0.75

Growth Parameters

- Sales growth 33.0 %

- Profit growth 269 %

- Profit Var 3Yrs 31.2 %

- Sales growth 3Years 9.84 %

- OPM12.7 %

- ROCE 5.95 %

- ROE 5.62 %

Debt Profile

- Debt ₹ 1,27,864 Cr.

- Debt to equity 2.38

- Free Cash Flow ₹ 16,443 Cr.

- Int Coverage2.86

- Cash Equivalents₹ 40,554 Cr.

Tata Motors is optimistic about sustaining its growth momentum and achieving double-digit EBITDA margins in the commercial vehicle business. This optimism is based on a better product mix, successful execution of demand-pull strategies, and digital offerings.

Tata Motors also aspires to maintain robust margins in its passenger vehicle (PV), electric vehicle (EV), and commercial vehicle (CV) businesses.

Moreover, with the launch of new-generation products and increased deliveries in the passenger vehicle segment, the company expects to drive profitable growth in the latter half of the year.

Here are some particular risks associated with Tata Motors:

- Global Economic Conditions: Tata Motors’ performance is heavily influenced by global economic conditions, as it operates in multiple international markets. Economic downturns or recessions in key markets could lead to reduced demand for its vehicles, impacting sales and profitability.

- Supply Chain Disruptions: Tata Motors relies on a complex global supply chain to source components and materials for its vehicles. Disruptions in the supply chain, such as natural disasters or political issues, can lead to production delays and increased costs.

- Environmental Concerns: Increasing environmental awareness and regulations on emissions could lead to higher costs for Tata Motors to develop eco-friendly vehicles and adhere to stricter emissions standards.

- Geopolitical Risks: Political instability or conflicts in regions where Tata Motors operates can affect its operations and profitability.

- Dependence on JLR: Tata Motors’ profitability is significantly linked to the performance of Jaguar Land Rover. Any challenges faced by JLR, such as declining demand for luxury vehicles, can impact the parent company’s financial health.

- Brand Perception: Negative publicity, quality issues, or recalls can harm the reputation of Tata Motors and its subsidiaries, leading to reduced sales and customer trust.

- Debt Levels: Tata Motors carries a substantial amount of debt, particularly due to its acquisition of JLR. High debt levels can lead to increased interest expenses and financial vulnerability during economic downturns.

It’s essential for investors and stakeholders to be aware of these risks and for Tata Motors to have strategies in place to mitigate them to ensure sustainable growth and profitability.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

“A Profitability Turnaround In The Company : Will It Sustain?”