“Tata Power Q4FY23 profit jumps 48%, beats estimates”

Tata Power, a leading integrated power company, recently announced its fourth-quarter earnings for the financial year 2022-2023.

The results were mixed with better year-on-year growth, but sequential performance was weaker.

Despite the mixed results, industry experts remain optimistic about Tata Power’s future prospects.

In this blog, we will delve into Tata Power’s Q4 performance, understand the reasons behind the mixed results, explore expert opinions on the company’s outlook, and provide a comprehensive overview of the company’s current status and future prospects.

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

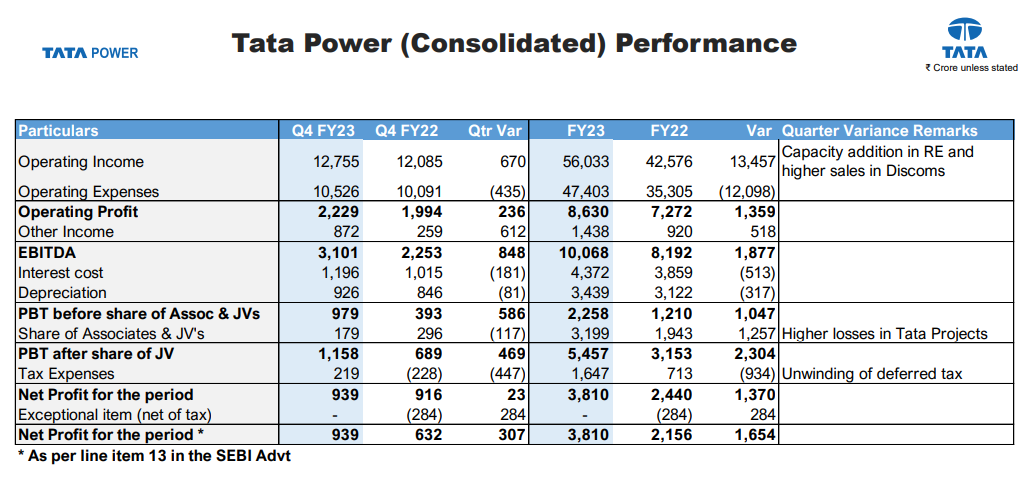

Source: Company Presentation

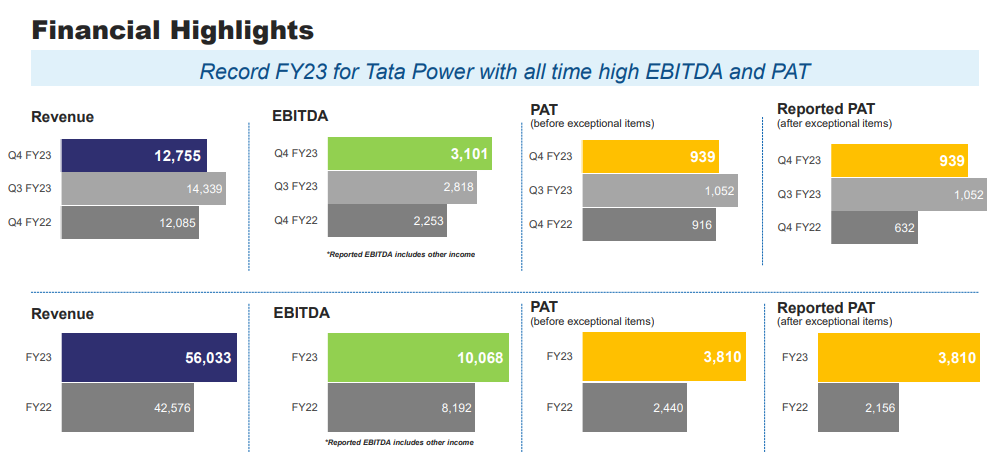

Source: Company Presentation

Q4FY23 Results Highlights:

-Consolidated net profit of Rs 939 crore for Q4FY23, an increase of 48% YOY from Rs 632 crore

-Its consolidated revenue was up by 6% at Rs 12,755 crore

-due to higher sales across distribution companies and capacity addition in renewables.

-The consolidated EBITDA was up by 38% at Rs 3,101 crore

-due to lower under-recovery in Mundra, capacity addition in renewables, and execution of solar EPC projects.

-The company’s board recommended a dividend of Rs 2 per share.

Source: Company Presentation

Company History and Background:

-Tata Power was founded in 1915 as the Tata Hydroelectric Power Supply Company, making it one of the oldest and largest power companies in India.

-It is a subsidiary of the Tata Group, a global conglomerate with operations in various industries such as steel, automotive, and telecommunications.

Business Model:

Integrated Operations: Tata Power has an integrated business model that includes

Power generation,

transmission, and

distribution.

This allows the company to have greater control over the supply chain and enables it to optimize its operations for efficiency and reliability.

For example, the company has implemented a predictive maintenance program that uses artificial intelligence and machine learning to optimize the maintenance of its power plants and transmission and distribution networks.

Diversification: Tata Power’s diversified portfolio has provided it with a balanced mix of revenue streams.

For example, the company has a significant presence in the rooftop solar segment, which has seen rapid growth in recent years. Tata Power has installed rooftop solar systems for a range of customers, including residential, commercial, and industrial customers.

The company is also exploring emerging technologies such as electric vehicles and energy storage, which could provide additional growth opportunities.

International Presence: Tata Power has a significant international presence, with operations in

Singapore,

Indonesia, and

South Africa.

The company also has strategic partnerships and joint ventures in various countries, including Nepal, Bhutan, and Oman.

Goals and Initiatives:

Net Zero Emissions: Tata Power has set an ambitious target to become net zero by 2045, which includes reducing emissions from its power generation operations and increasing its renewable energy portfolio.

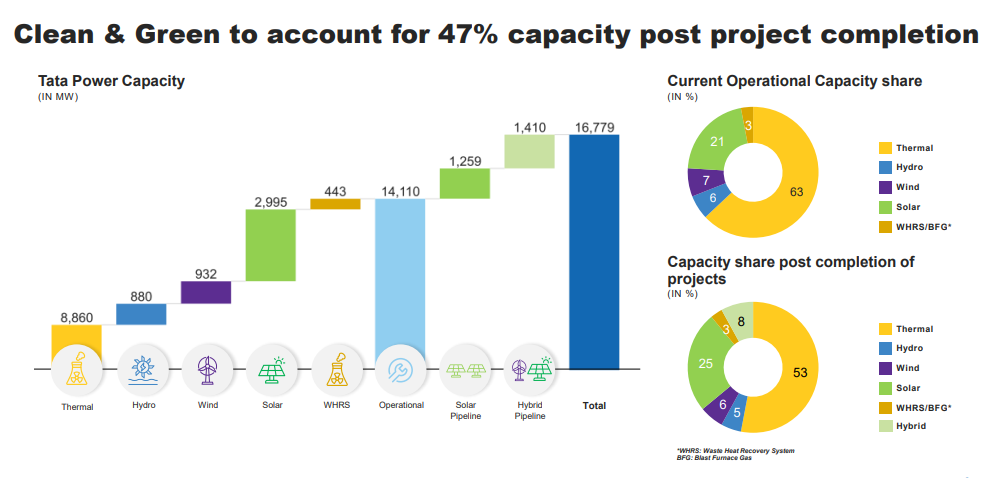

Focus on Renewable Energy: With the Indian government’s push for clean and renewable energy, Tata Power is focusing on adding more capacity in solar, wind, and other renewable energy sources.

The company plans to add 2-3 GW of capacity every year.

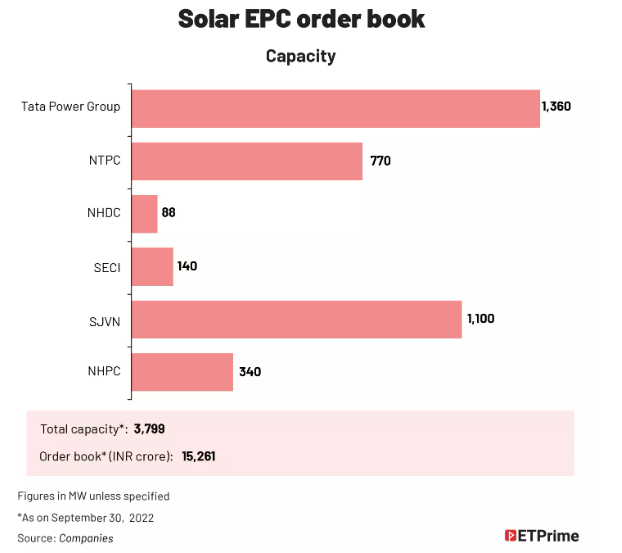

PAT Margin: Tata Power aims to achieve a PAT (profit after tax) margin of at least 5% in its Solar EPC (engineering, procurement, and construction) business.

Investment in Solar Manufacturing: The company plans to invest ₹3,400 crores in manufacturing solar wafers and solar modules, which will help to increase its capacity in the renewable energy sector.

Projects and Capacity:

Large-Scale Utility Projects: Tata Power is expected to add 1.5GW of capacity in large-scale utility projects in the full year, with 500MW to be commissioned in the current quarter.

EPC Projects: EPC projects were deferred due to the high prices of modules and cells, but Tata Power plans to pick up these projects as prices come down.

Distribution and Transmission Capacity: Despite a focus on renewable energy, Tata Power is also adding capacity in distribution and transmission.

Renewable Capacity: The company has won over 2GW of renewable capacity this year, which will be implemented in the next 12-18 months.

Group Captive Capacity: Tata Power plans to add 500MW to 800MW of group captive capacity every year, with a goal of reaching 8GW to 9GW of capacity by FY26 or FY27.

Future Renewable Plans:

Expansion of Renewable Energy Portfolio:

-Tata Power’s renewable energy business has been expanding across EPC, Utility Scale, and Rooftop verticals and is well poised to lead India’s green energy transition.

-The company completed Rs 4,000 crore ($525 million) worth of capital infusion into its renewables business, one of the biggest value unlocks in renewable business globally, enabling the company to fuel the next leg of growth.

-Moreover, the renewables business bagged 1.6 GW capacity across solar and hybrid.

-TPSSL received a Letter of Award of Rs 1,755 crore to set up a 300 MW solar project for NLC India in Rajasthan.

-TPREL won a 255 MW hybrid order from Tata Power Delhi Distribution Limited (TPDDL) post-exercising of the green-shoe option.

-Tata Power has set a target of achieving 70% of its total generation capacity from renewable energy sources by 2025.

-The company plans to add 2-3 GW of renewable energy capacity every year, with a focus on solar and wind power projects.

Green Hydrogen:

-Tata Power is exploring opportunities in green hydrogen, which could be a game-changer for the renewable energy industry.

-The company plans to develop green hydrogen projects,

-which would involve using renewable energy to produce hydrogen fuel for transportation and other applications.

For example, the company is working on a pilot project to produce green hydrogen using renewable energy. The project involves using wind power to produce hydrogen fuel for transportation.

Energy Storage:

-Tata Power is exploring opportunities in energy storage, which is crucial for integrating renewable energy into the grid.

-The company is working on developing battery storage solutions and

-other energy storage technologies that could help to increase the reliability and stability of the grid.

For example, the company has installed a 10 MW battery energy storage system in Mumbai, which is one of the largest such systems in India.

Tata Power is also working on developing other energy storage solutions, including pumped hydro storage and compressed air energy storage.

Microgrids:

-Tata Power is exploring opportunities in microgrids, which could provide energy access to remote and underserved communities.

-The company is working on developing innovative solutions for microgrids, including the use of renewable energy and energy storage technologies.

For example, the company has installed a microgrid in Bihar, which is providing electricity to a rural community. The microgrid includes solar panels, battery storage, and a diesel generator, and is providing reliable and affordable electricity to the community.

Electric Vehicles:

-Tata Power is exploring opportunities in electric vehicles, which are expected to play a significant role in the transition to a low-carbon economy.

-The company is working on developing charging infrastructure for electric vehicles and is exploring other opportunities in the electric mobility space.

Tata Power has been expanding its electric vehicle (EV) charging infrastructure by partnering with various companies and municipalities.

For example, the company has installed a network of electric vehicle charging stations across India, which is helping to promote the adoption of electric vehicles in the country.

Tata Power is also working on developing charging infrastructure for electric buses and other public transportation vehicles.

-Recently,It has deployed 8 chargers, including super-fast 60 kW charging points, across a mall in Mumbai.

-It has also entered into a partnership with Coimbatore Municipal Corporation in Tamil Nadu to install 20 new fast EV Charging Stations in the city to further EV adoption.

-Moreover, Tata Power plans to install EV charging points at GAIL Gas Station in Bangalore.

Impact:

Tata Power’s focus on renewable energy and EV infrastructure is likely to contribute to India’s efforts to transition to cleaner energy. Its focus on the renewable energy and EV sectors makes it a potentially attractive investment for several reasons:

Government support: The Indian government has set a target of achieving 175 GW of renewable energy capacity by 2022, which creates a supportive regulatory environment for Tata Power’s renewable energy projects.

Diversification: Tata Power has a diversified portfolio of renewable energy assets, including solar, wind, and hydropower. This diversification helps to reduce risk and increase stability in the company’s earnings.

Strong financial position: Tata Power has a strong balance sheet, which enables it to invest in growth opportunities and expand its presence in the renewable energy and EV sectors.

Partnerships: Tata Power has entered into partnerships with other companies in the EV sector, such as Coimbatore Municipal Corporation and GAIL Gas Station in Bangalore, which helps to strengthen its position in the market.

Focus on innovation: Tata Power has a focus on innovation, with initiatives such as the installation of super-fast 60 kW charging points at a mall in Mumbai, which helps to position the company as a leader in the EV sector.

Valuation:

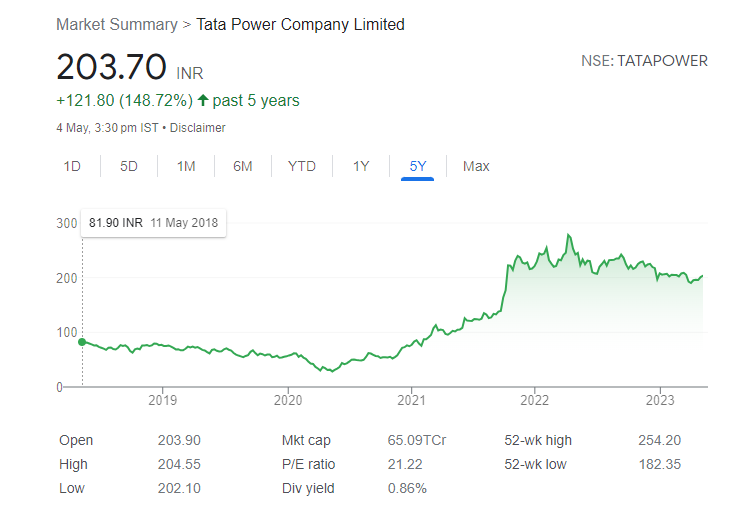

Tata Power’s stock has shown strong performance in recent years, with its share price increasing from around Rs. 50 in 2016 to over Rs. 200 in 2021. However, it should be noted that the stock has been volatile in the short term, and investors should take a long-term view when evaluating the company.

As of May 4th, 2023, Tata Power’s stock is trading at a price-to-earnings (P/E) ratio of around 21, which is lower than the industry average of 25.6. The company’s price-to-book (P/B) ratio is also below the industry average, indicating that the stock may be undervalued relative to its peers.

However, investors should also consider the risks associated with investing in Tata Power. The company operates in a highly regulated industry, and changes in government policies or regulations could impact its business. Additionally, Tata Power faces competition from other power companies in India and abroad, and changes in the competitive landscape could impact its financial performance.

Fundamentals:

- Return over 1year-16.8 %

- Stock P/E 21

- PEG Ratio 0.43

- Book Value ₹ 90

- Price to book value 2.26

- ROCE 12 %

- ROE 13 %

- OPM 14 %

- Debt ₹ 52,923 Cr.

- Debt to equity 1.84

- Qtr Profit Var -21.3 %

- Qtr Sales Var 4.13 %

- Promoter holding 46.9 %

- FII holding 9.45 %

- Public holding 29.2 %

- DII holding 14.2 %

Risks and Challenges

Like any other company, Tata Power faces several risks and challenges that could affect its performance and growth prospects.

-One of the biggest risks for the company is the volatility of commodity prices, especially coal prices, which could impact its power generation costs.

-The company also faces regulatory risks, as any adverse changes in policies and regulations could impact its operations and financials.

-Another risk is the increasing competition in the renewable energy sector, which could affect Tata Power’s growth plans and profitability.

Experts Opinion:

Sumeet Bagadia, Executive Director at Choice Broking, believes that there is significant potential for Tata Power’s shares to increase in value.

Bagadia notes that Tata Power’s shares had previously experienced a sharp decline from their 52-week high, but have since reached a bottom and begun to recover. Over the past month, the stock price has steadily increased and recently broke out above 202 levels on a closing basis during a Wednesday session. This suggests that there is potential for significant gains in the near future.

Vaishali Parekh, Vice President – Technical Research at Prabhudas Lilladher, has given a “buy” recommendation for Tata Power shares.

Parekh stated that after a long period of time, the stock has come into their radar as it is breaking out of a downward channel pattern and showing positive candle patterns. The stock has declined from ₹250 per share to bottom out at ₹180, but the bias is gradually improving.

Parekh believes that the positive candle pattern suggests strength and has the potential to rise further in the coming days. The RSI is also strong, indicating a trend reversal and a buy signal. Parekh recommends buying the stock for a short-term upside target of ₹217 (200 DMA) and a long-term target of ₹235, with a stop loss at ₹190.

Conclusion:

Overall, Tata Power is well-positioned to benefit from the growth in India’s power sector, particularly in the renewable energy segment. The company has a diversified business model, with operations across generation, transmission, and distribution, as well as renewable energy projects and EV charging infrastructure.

Tata Power’s strong financial performance in recent years and its plans for expansion into renewable energy and EV charging make it an attractive long-term investment opportunity. However, investors should be aware of the risks associated with investing in the company, including regulatory and competitive risks.

——————-

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.