Banking stock for the next 12 months suggested by more than 20 Analysts

The banking sector is currently showing significant upside potential for investors.

Right now, there’s talk of interest rates going down, and this could have a big impact on the banking sector

With a promising outlook and improving economic conditions, many banking stocks are poised for growth. Factors such as increasing consumer confidence, robust GDP growth, and a favorable interest rate environment are driving optimism in the sector.

Furthermore, regulatory reforms and stable financial policies are providing a strong foundation for banks to thrive and adapt to changing market dynamics. To learn more about stock market basics and stock analysis one can consider enrolling in our Stock Market Learning Courses, here.

This, combined with their ability to leverage customer data and insights, positions banks to enhance their services and tap into emerging markets.

Investors keen on capitalizing on the banking sector’s upside potential should closely monitor individual banks’ financial performance, management strategies, and adaptability to technological advancements. As the sector continues to evolve, opportunities for growth and profitability are likely to abound, making it an attractive prospect for investors seeking long-term gains.

Here is the list of banking stocks as reported in ET article with an analyst count of 40 (covering the sector) and upside potential of around 30%. Each stock is showing the count of analysts bullish on it :

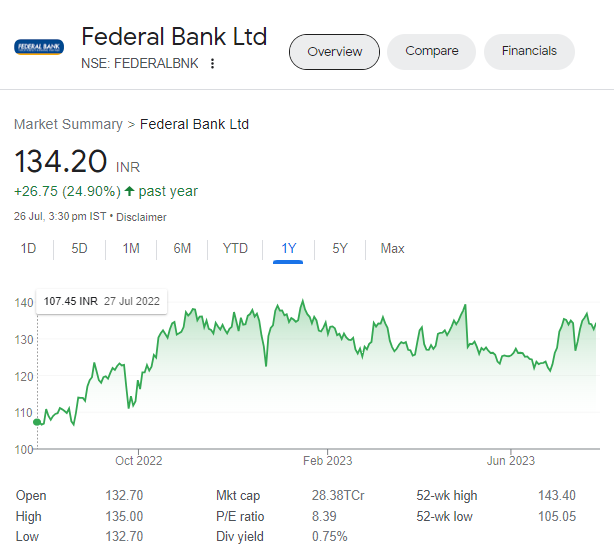

Federal Bank Ltd:

Mean Target Price: 162.00

Close Price: 134.20

Upside Potential: 20.90%

Analyst Count: 29

Federal Bank Ltd is a well-established private sector bank in India, with a rich history dating back to 1931. Headquartered in Kochi, Kerala, the bank has grown to become one of the country’s leading financial institutions, providing a wide range of banking and financial services to its customers.

Over the years, Federal Bank has built a strong reputation for its customer-centric approach, efficient operations, and focus on technology-driven banking solutions.

Federal Bank offers a comprehensive suite of banking products and services, catering to retail customers, SMEs, and corporate clients. Its offerings include savings accounts, current accounts, fixed deposits, loans, credit cards, foreign exchange services, and wealth management solutions.

Outlook:

Federal Bank Ltd, a well-established banking institution, has achieved a total business of over INR 4 lakh crores. In Q1 of FY24, the bank experienced strong sequential growth of approximately 5% across all its businesses, in line with their business plans and guidance.

The bank anticipates sustainable growth momentum and margin expansion in FY24. Credit growth opportunities remain intact, and the bank’s focus on better-rated segments is expected to increase high-yielding businesses.

In terms of financial performance, Federal Bank recorded a significant growth of 23% in PAT, reaching INR 937 Crores in FY23, compared to INR 760 Crores in FY22. Looking ahead, the bank aims for a 12%-15% growth in annual profit, driven by business growth and improved recovery.

Federal Bank’s loan growth in FY2024 is expected to mainly come from existing geographies and product profiles, with a focus on fine-tuning digital processes before exploring newer products and geographical expansion.

HDFC Bank Ltd:

Mean Target Price: 2,030.00

Close Price: 1,678.40

Target vs. Current(%): 20.90%

Analyst Count: 40

HDFC Bank Ltd is one of India’s largest and most successful private sector banks. Established in 1994, the bank is a subsidiary of Housing Development Finance Corporation Limited (HDFC), a leading housing finance company.

Over the years, HDFC Bank has grown to become a prominent player in the Indian banking industry, known for its customer-centric approach, efficient services, and technological innovations.

It serves a diverse customer base, including retail individuals, small and medium-sized enterprises (SMEs), and corporate clients.

Outlook:

The bank has a diverse loan portfolio, with retail loans constituting 55% and wholesale loans accounting for 45% of its loan book. The retail deposits have grown by 21.5% YoY and make up 83.5% of the total deposits, indicating strong customer engagement.

HDFC Bank’s net interest income grew by 21% YoY, while the GNPA ratio stood at 1.17%, with a core GNPA ratio of 1.03%. The bank reported a profit after tax increase of 30% over the prior year, showcasing its robust financial health.

The bank is well-capitalized with a total capital adequacy ratio of 18.9% and CET1 of 16.2%, ensuring a strong financial position. It aims to achieve a loan growth rate of 17-18% on a merged basis and expects an average retail deposit accretion of INR 1 trillion over the next six to eight quarters.

HDFC Bank is mindful of the impact of decreasing interest rates, which may put pressure on Net Interest Margins (NIM). However, it anticipates stabilizing NIM around 3.65-3.7% in FY2024. The bank’s profitability and outlook remain positive as it focuses on prudent risk management and customer-centric strategies.

City Union Bank Ltd:

Mean Target Price: 169.00

Close Price: 130.40

Upside Potential: 29.60%

Analyst Count: 22

City Union Bank Ltd (CUB) is a leading private sector bank in India, founded in 1904. Headquartered in Kumbakonam, Tamil Nadu, the bank has a rich legacy of over a century and has emerged as a trusted financial institution, known for its customer-centric approach and personalized services.

The bank’s offerings include savings accounts, current accounts, fixed deposits, loans, NRI banking services, and various other retail and corporate banking products.

With a strong emphasis on technology and innovation, City Union Bank has embraced digital transformation, providing its customers with convenient and seamless online and mobile banking facilities. The bank’s commitment to adopting modern technologies has enhanced its operational efficiency and customer experience.

Outlook:

City Union Bank Ltd (CUB), a trusted private sector bank, has shown promising financial performance. With a mean target price of INR 169.00 and a close price of INR 130.40 as of July 24, 2023, it exhibits an upside potential of 29.60%, as estimated by analysts.

In FY23, despite facing challenges, CUB made progress, achieving a 23% growth in PAT to reach INR 937 Crores, compared to INR 760 Crores in FY22. The bank aims for a 12%-15% growth in the current year, with a focus on recovery and credit quality.

CUB is actively adapting to the evolving financial landscape and anticipates pressure on Net Interest Margins (NIM) due to deposit re-pricing across the industry. Nevertheless, the bank remains optimistic about its outlook and is confident in maintaining ROA growth and reducing net NPAs in the upcoming fiscal years.

With a strong emphasis on MSMEs and digital banking, CUB aims to maintain a diversified loan portfolio. The bank’s proactive approach towards technological advancements and prudent financial management position it for a positive future.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————

Ethanol blending is a great innovation will it cut retail prices so drastically? “All the vehicles will now…Read More