“Exploring the Reasons Behind IRCTC’s Lagging Performance”

IRCTC’s share price has been struggling to rise again after reaching its highest-ever level in October 2021.

This means that people who own the company’s shares have not made any money over the past year, and the stock has fallen by 20% during this time.

IRCTC is a company that specializes in providing online railway ticket booking services, and it is the only railway stock that has been giving negative returns in the last year and this year so far.

Other railway companies, such as Rail Vikas Nigam Limited (RVNL), Ircon International, and Indian Railway Finance Corp (IRFC), have been performing well and giving positive returns to their shareholders.

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

The Reason- IRCTC is a Tech Stock with High Valuations:

Different Business model

-IRCTC is a tech company, and its business model is different from other railway companies.

-The other railway companies focus on building infrastructure like tracks and stations, while IRFC is a financial company that provides funding for these projects.

-This means that the other companies are benefiting from the Indian government’s attention to the infrastructure sector,

-while IRCTC is still waiting for the Indian Railways to take over its complete operations

-Though, It has almost a monopoly in the online railway ticket booking business.

-The Experts believe that the demand for its services is currently low.

Higher Valuation

-Other railway stocks, such as RVNL, Ircon International, or IRFC, are infra stocks and are available at more attractive valuations.

- Stock P/E 51 – IRCTC

- Stock P/E 15 – RVNL

- Stock P/E 9 – IRCON

- Stock P/E 6 – IRFC

Government Selling

-Experts think that one of the reasons for this is that the government is selling its shares in IRCTC, and

-Another reason is that the company’s shares are being sold at a high price, which is not attractive to buyers.

Company Overview:

-Indian Railway Catering and Tourism Corporation (IRCTC) is a subsidiary of the Indian Railways.

-It was incorporated in 1999 as a public sector undertaking (PSU) and is headquartered in New Delhi, India.

-The company offers online ticketing, tourism, and catering services for Indian Railways.

Business Model:

Online Ticketing:

IRCTC is the exclusive provider of online railway ticket booking in India. Customers can book tickets online through its website or mobile app.

Catering Services:

IRCTC provides catering services on trains and at railway stations through its subsidiary, IRCTC e-catering. Customers can order food online and have it delivered to their seats or at the station.

Tourism Services:

IRCTC offers a range of tourism services, including domestic and international tour packages, hotel bookings, and car rentals. It also operates luxury trains like the Maharajas Express.

Rail Neer:

IRCTC produces and sells packaged drinking water under the brand name Rail Neer, which is available on trains and at railway stations.

Other Services:

IRCTC also offers services such as travel insurance, retiring room bookings, and e-wallets for online payments.

IRCTC’s business model relies heavily on technology, as its core service is online ticket booking.

The company earns a commission on each ticket sold through its platform. Additionally, it earns revenue through catering and tourism services, as well as the sale of Rail Neer water. IRCTC has a near-monopoly on online railway ticket booking in India, which gives it a competitive advantage.

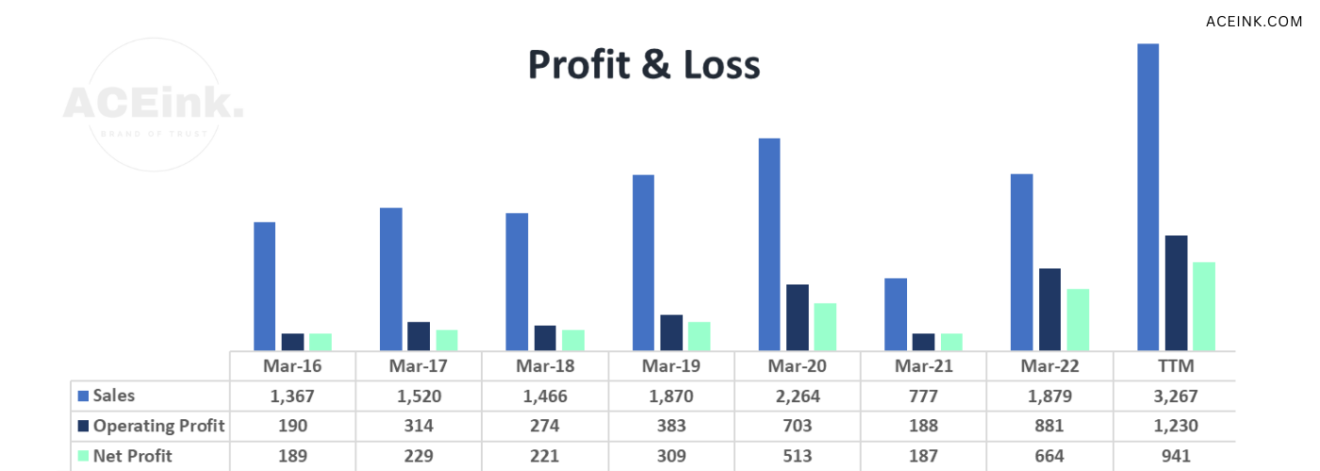

Strong Fundamental and financials:

- Market Cap ₹ 48,676 Cr.

- Current Price ₹ 608

- High / Low ₹ 775 / 557

- Stock P/E 51

- PEG Ratio 2.17

- ROCE 51 %

- ROE 39 %

- OPM 37 %

- Debt ₹ 178 Cr.

- Debt to equity 0.08

- Qtr Profit Var 21 %

- Qtr Sales Var 70 %

Future Outlook

-The experts believe that once the demand for online railway tickets and the announcement of new trains increase, IRCTC’s valuations may become bullish.

-They also think that the government divesting its stake in IRCTC could be a positive development for the stock as the risk of further stock selling is reduced.

——————-

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.