Exploring the Reasons Behind the Strong Analyst Recommendation of These Large-Cap Stocks

Over the past year, the equity markets have had a lot of bad news, from the war in Ukraine to the US Federal Reserve raising interest rates, supply chain disruptions, and the re-emergence of COVID-19. And on top of all that, the US banking system caused some trouble for the global markets.

In addition to the challenges faced by the global markets, the domestic markets in India have had their own share of headwinds.

One major challenge has been high commodity prices, particularly for oil. When commodity prices are high, it can put pressure on companies that rely on those commodities as inputs, as their costs go up. This can ultimately impact their profitability and, in turn, their stock price.

Another challenge has been the continuous outflows of foreign money from the Indian markets. Foreign investors play an important role in the Indian market, and when they pull their money out, it can lead to a decline in stock prices. In addition, in the last two months, there has been news flow around the Adani group, which has caused some volatility in the markets.

Despite the turbulence in the market over the past year, some stocks have been able to outperform and even increase in value. Even a small increase of one percent in a bearish market is significant and worth looking at.

What does it mean?

This suggests that companies with strong fundamentals are able to outperform in long term. To illustrate P/E ratio measures a stock’s price relative to its earnings per share, while PEG ratio factors in earnings growth rate. Both help determine a company’s value and growth potential.

Favorable ratios indicate strong fundamentals and suggest long-term outperformance despite market fluctuations.

Below is a list of large-cap stocks that gave positive returns in the last year and more than 35 analysts recommending these stocks

The Auto Sector

The overall auto industry did not do so well in past years. However, the future may bring changes to the industry.

The development of better infrastructure for both road and rail transport can have a positive impact on the auto industry as a whole. Improved road transport can benefit both commercial and passenger vehicles, leading to increased demand for cars and trucks.

In addition, the rise of electric vehicles and the push for more sustainable transportation options may also have an impact on the industry.

While there may be changes in the auto industry in the next five years, there are also opportunities for auto companies to adapt and thrive in a changing market.

But it is true that high-interest rates make it more difficult for people and businesses to borrow money to purchase vehicles, which has impacted the automobile industry. However, if interest rates decrease in the future, it could provide a boost for the industry as more people are able to finance their vehicle purchases.

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

Mahindra & Mahindra (M&M):

Mahindra & Mahindra is a diversified company with interests in multiple sectors, including automotive, defense, and engineering. In addition to manufacturing commercial vehicles and SUVs, the company has a number of subsidiary companies that are involved in various engineering and technology-related activities.

For example, Mahindra Engineering Services is a subsidiary that provides engineering and design services to a variety of industries, including automotive, aerospace, and industrial products. Mahindra Defense Systems is another subsidiary that is involved in the manufacturing of defense-related products such as armored vehicles and aircraft.

Recently, M&M increased its stake in Mahindra Aerospace to 100% from 91.59%.

M&M, as a manufacturer of SUVs, has benefitted from the higher sales of SUVs in the past year despite the decline in the industry. Also, it has already started to invest in electric vehicles and is well-positioned to capitalize on this growing trend.

The diversification of M&M’s business operations can provide a degree of stability and resilience to the company, as it is not solely reliant on one industry or product line. This can help the company weather economic downturns or changes in consumer preferences.

Ashok Leyland

Ashok Leyland is the flagship company of the Hinduja Group, has been present in the domestic medium and heavy commercial vehicle (M&HCV) segment for several decades and has a strong brand reputation in the market. The company has a well-diversified distribution and service network across the country, with over 4,000 touchpoints including dealerships, service centers, and spare parts outlets.

Ashok Leyland is also a global player with a presence in over 50 countries, exporting its commercial vehicles to various international markets. The company has a fully-integrated manufacturing setup with in-house capabilities for the design, development, and production of vehicles and components.

It is possible that Ashok Leyland, as a commercial vehicle manufacturer, could benefit from the factors mentioned. Here is why:

-New product launches: Launching new products, especially in the growing electric vehicle (EV) market, can help Ashok Leyland stay competitive and appeal to a wider range of customers. Expanding into segments such as multi-axle, tipper, and haulage can also provide additional revenue streams for the company.

-Expanding domestic network: Increasing its domestic network could help Ashok Leyland reach more customers and increase its market share in India’s commercial vehicle market. This could be achieved through expanding its dealership network or through strategic partnerships.

-Increasing global presence: Expanding globally can provide Ashok Leyland with additional revenue opportunities and help reduce its reliance on the Indian market. This could involve establishing partnerships or joint ventures in new markets or increasing exports to existing markets.

-The increasing intensity of infrastructure: Improvements in infrastructure, such as better roads and highways, can help increase demand for commercial vehicles in India. This could lead to increased sales and revenue for Ashok Leyland.

-Softening of raw material prices: Raw materials, such as steel and rubber, can account for a significant portion of the cost of manufacturing commercial vehicles. If prices of these raw materials decrease, it could help lower the cost of production for Ashok Leyland, leading to higher profit margins.

It is important to note, however, that the success of Ashok Leyland’s strategy will depend on various internal and external factors, such as competition, economic conditions, and government policies.

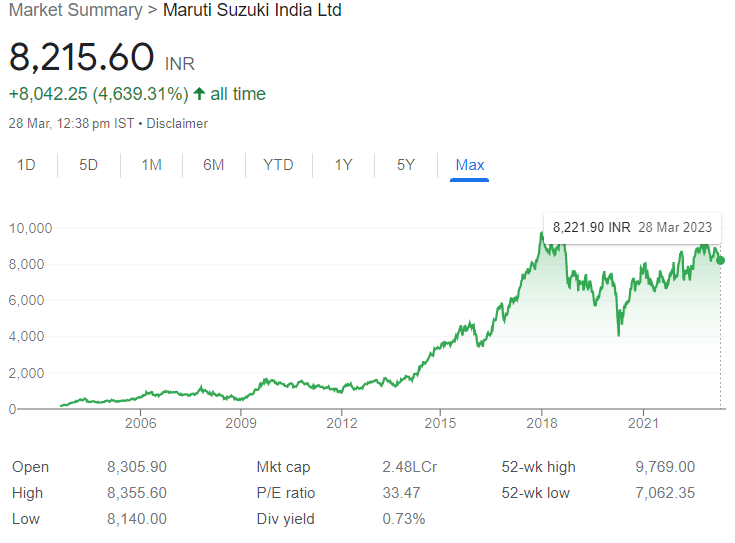

Maruti Suzuki

Maruti Suzuki, India’s largest car manufacturer, is betting big on SUVs to grow its dominance in the passenger vehicle segment. The company currently has a market share of 45 percent and it aims to increase the share to 50 percent in the near future.

Maruti Suzuki’s revenue is primarily generated from the sale of its passenger cars and light-duty utility vehicles, with additional revenue streams coming from other segments such as spare parts, service income, and rental income

Now, Plans to introduce more vehicles with a focus on CNG variants and hybrid vehicles.

Maruti Suzuki has also recently launched a new Grand Vitara with a booking of over 75,000 units, indicating a strong response to its new products. The company states that around 35% of the orders for the Grand Vitara are for the strong hybrid variant, which is an encouraging sign for the company’s efforts in the hybrid vehicle segment.

The company believes that there will be a better demand for hybrid vehicles in the next 1-2 years as compared to electric vehicles due to various factors, such as the availability of charging infrastructure and the pricing of EVs.

Additionally, Maruti Suzuki expects that most of the new bookings will be for the top variants of its vehicles, which will result in better average selling price (ASP) and margins for the company.

The Risk in Investment

There are several risks involved in investing in the auto sector in India, some of which are:

Cyclical Nature of the Industry

Intense Competition

Regulatory Risks

Supply Chain Risks, etc.

To elaborate on supply chain risk, The auto industry relies heavily on complex supply chains, which can be disrupted by factors such as natural disasters, political instability, and raw material shortages. Right now, the industry is facing a big shortage of semiconductor chips which is hampering the manufacturing of electric vehicles and thus the revenues.

Investors should carefully consider these risks and conduct thorough due diligence before investing in the auto sector in India. It is important to diversify investments and have a long-term investment horizon to weather the cyclical nature of the industry.

——————–

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.