“Investing Made Simple: Timing the Market vs Time in the Market”

In the last two years, the Nifty50 index has only given a 3.5% return which is not enough to beat inflation.

This has made new investors hesitant about investing in stocks. A lot of people have stopped their monthly investments in stocks which shows that they’re losing patience.

It’s natural to think that it’s best to wait for the market to stabilize and only invest when things are better.

In case of constant disappointing returns the most common question that arises is whether to time the market or spend time in the market.

So, What’s Your Approach?

Both approaches have their pros and cons, but which one is the best for you?

Let’s understand both and find out the answer with live market examples.

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

What is Timing the Market?

“Timing the market” refers to the strategy of trying to predict the market’s future performance and investing only when you think the market is going to improve.

-Timing the market involves buying and selling stocks based on the expectation of future price movements.

-This approach requires investors to be actively involved in the market, analyzing trends, and making decisions

based on market forecasts.

-The goal is to buy low and sell high, but timing the market is easier said than done.

What is Time in the Market?

On the other hand, spending time in the market involves a long-term approach to staying invested in the market regardless of short-term fluctuations.

-This approach requires patience, discipline, and a focus on long-term goals.

-The goal is to benefit from the power of compounding over time, where returns accumulate on top of previous returns,

-resulting in significant growth over the long run.

Impact on Returns?

Another important factor to consider is that timing the market increases the risk of losing money.

If you buy stocks when the market is high and sell when it’s low, you may end up selling at a loss. In contrast, staying invested in the market reduces the risk of losing money as the stock market tends to go up in the long run.

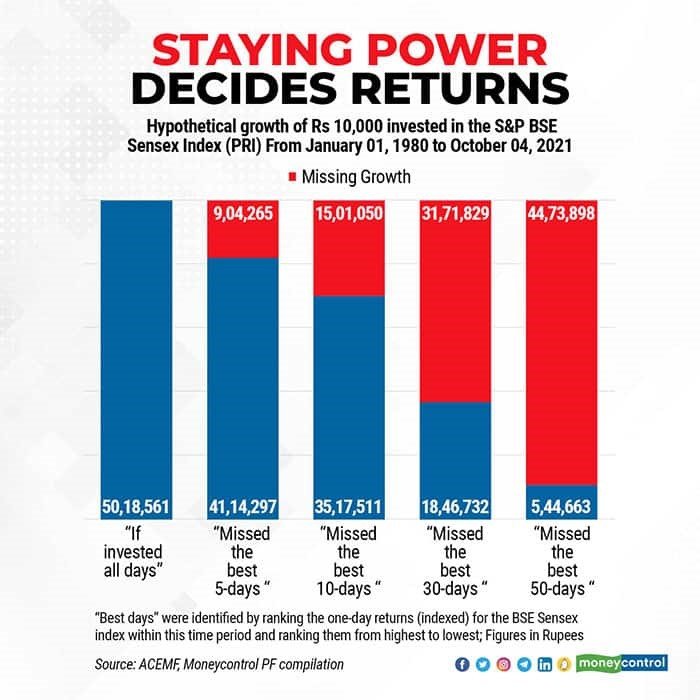

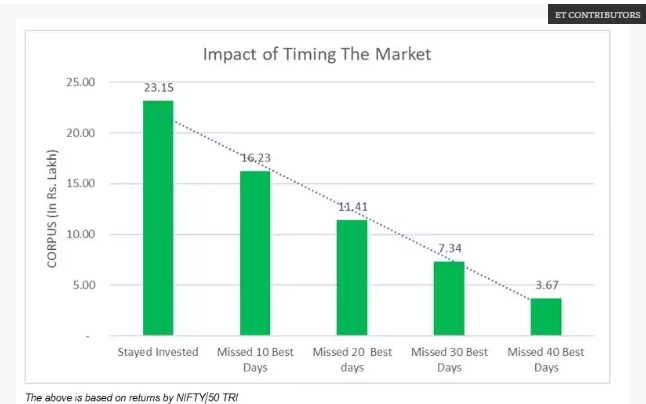

When you try to time the market, you may miss some of the best days when the market rises. This can have a big impact on your investment returns.

Let’s understand it with live market incidents:

Let’s say you invested Rs 100,000 in stock in January 2020.

In the first year of your investment, the stock market was very volatile due to the pandemic. If you tried to time the market and sold your stock during one of the market dips, you may have missed out on some of the best days when the market bounced back.

If you had stayed invested throughout the year, your investment would have grown to Rs 125,000. But if you missed just the 10 best days during that year, your investment would have only grown to Rs 108,000.

That’s a difference of Rs 1,7000 or nearly 17% of your investment.

Let me provide you with another example

Let’s say you invested Rs 10,000 in a mutual fund that tracks the BSE Sensex in January 2010 and decided to time the market. If you missed the best 10 days of the market during the next 10 years until January 2020, your investment would have grown to about Rs 32,000.

However, if you had stayed invested during the entire period, your investment would have grown to about Rs 47,000.

This means that by trying to time the market and missing just 10 days, you would have missed out on potential gains of Rs 15,000 over the 10-year period.

This shows that timing the market can be a risky strategy that can significantly reduce your investment returns.

So, even missing just a few of the best days in the market can significantly reduce your investment returns.

The key takeaway here is that timing the market is a challenging task and requires a lot of skill and experience. Most professional investors cannot time the market correctly, and the same applies to individual investors.

So, If you want to make a fortune in the stock market, it’s all about spending time wisely.

Trying to time the market is like trying to predict the weather in the middle of a tornado. You might get lucky, but the chances are slim. Instead, it’s smarter to stick to a simple strategy of spending your time in the market.

Why?

Because history shows that being patient and staying invested for the long haul can help you build a bigger nest egg than trying to make quick moves based on market fluctuations.

Here’s a table showing the relationship between time and the chances of losing money and earning good returns:

The longer the time horizon, the lower the chance of losing money and the higher the chance of earning good returns. This is because investing in the stock market is a long-term game, and short-term volatility can be smoothed out over longer periods of time.

Therefore, it’s important to have a long-term perspective when investing in the stock market.

In conclusion, timing the market can be tempting, but it’s not a sustainable strategy for most investors. The best approach for most people is to spend time in the market, staying invested for the long term. This approach requires patience, discipline, and a focus on long-term goals. The power of compounding can work wonders if given enough time to grow, so start early, stay invested, and watch your wealth grow over time.

——————-

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.