20 Jun ITR Filing 2023: All You Need to Know

Income tax return filing: A step-by-step guide on How to file Online, e-verify, common mistakes

Filing income tax returns is a crucial annual task that every taxpayer must complete. With the convenience and accessibility of online platforms, filing your income tax returns has become easier than ever. The deadline for filing ITR is July 31, after which taxpayers will have to file a belated ITR, which may attract penalties or other costs.

However, navigating through the process can still seem overwhelming, especially for those new to the online filing system.

To simplify this process and help you file your income tax returns accurately and efficiently, we present a comprehensive step-by-step guide.

In this blog, we will walk you through the entire process of filing your income tax returns online. From gathering the necessary documents to verifying your submission, we will cover every essential aspect to ensure a hassle-free filing experience. Whether you choose to file through the income tax department’s website or via intermediaries, we’ve got you covered.

Also Read:NPS withdrawal rule set to change Soon- All you need to know about NPS

To help you navigate through the online filing process, we will primarily focus on filing your income tax returns through the official Income Tax e-Filing portal.

This user-friendly platform offers pre-filled ITR forms, making the process even more convenient. However, it’s essential to manually fill in certain incomes such as capital gains.

Here’s a step-by-step guide to filing your income tax return (ITR) online, with headings for each section:

Section 1: Filing Options

The return can be filed in any of the following ways:

1. by furnishing in a paper form;

2. by furnishing electronically under a digital signature;

3. by transmitting the data in the return electronically under an electronic verification code;

4. by transmitting the data in the return electronically and thereafter submitting the verification of the return in return Form ITR-V.

Section 2: Filing ITR Online via the Official Website

Step 1: Access the Income Tax e-Filing Portal

Go to the official Income Tax e-Filing portal at https://www.incometax.gov.in/iec/foportal and log in by entering your user ID (PAN), password, and Captcha code, and click ‘Login’.

Step 2: Navigate to the ITR Filing Section

Click on the ‘e-File’ menu and select the ‘Income Tax Return’ link.

Step 3: Fill in the Required Details

On the Income Tax Return page, follow these steps:

-PAN will be auto-populated.

-Select the ‘Assessment Year’.

-Choose the ‘ITR Form Number’.

-Select ‘Filing Type’ as ‘Original/Revised Return’.

-Choose ‘Submission Mode’ as ‘Prepare and Submit Online’.

Step 4: Continue and Save Draft

Click on ‘Continue’. Read the instructions carefully and fill in all the applicable and mandatory fields of the online ITR form. To avoid loss of data, click on the ‘Save Draft’ button periodically to save the entered ITR details as a draft.

Step 5: Choose the Verification Option

In the ‘Taxes Paid and Verification’ tab, choose the appropriate verification option. You can select from:

-I would like to e-verify.

-I would like to e-verify later within 120 days from the date of filing.

-I don’t want to e-verify and would like to send a signed ITR-V through normal or speed post to “Centralized Processing Center, Income Tax Department, Bengaluru – 560 500” within 120 days from the date of filing.

Step 6: Preview and Submit

Click on the ‘Preview and Submit’ button and verify all the data entered in the ITR.

Step 7: E-Verify the ITR

If you choose the ‘I would like to e-Verify’ option, e-verification can be done through any of the following methods by entering the EVC/OTP when asked for:

-EVC generated through bank ATM or Generate EVC option under My Account.

-Aadhaar OTP.

-Prevalidated Bank Account.

-Prevalidated Demat Account.

Step 8: Submit and Verify

On choosing the other two verification options, the ITR will be submitted, but the process of filing the ITR is not complete until it is verified.

The submitted ITR should be e-verified later by using the

‘My Account > e-verify return’ option, or the signed ITR-V should be sent to CPC, Bengaluru.

Section 3: Alternative Methods of Verification

Verifying ITR using net banking:

-Log into the net banking account.

-Click on the ‘e-filing’ link provided by the bank.

-Select ‘Income Tax Return’ from the drop-down under the ‘e-File’ tab.

-Choose the relevant options and submit the return.

Verifying income tax returns using a bank ATM:

-Swipe the ATM card in the bank ATM.

-Select ‘PIN for e-Filing’ and receive the Electronic Verification Code (EVC) on the registered mobile number.

-Log into the e-filing portal and select the option to e-verify the return using a bank ATM.

Enter the EVC on the e-filing portal to verify the income tax return.

Verifying ITR using an Aadhaar card:

-Go to the e-filing portal.

-Select ‘Income Tax Return’ from the drop-down under the ‘e-File’ tab.

-Choose the relevant options and click ‘Continue’.

-Click on “Generate Aadhaar OTP” to receive the OTP on the registered mobile number.

-Enter the OTP and click “Submit” to verify the income tax return.

Verifying income tax returns using a bank account:

-Log into the e-filing portal.

-Pre-validate the bank account if not already done.

-Click on the e-verify link and select the option to e-verify using bank account details.

-Generate the OTP and receive it on the registered mobile number.

-Enter the OTP on the e-filing portal to verify the income tax return.

Verifying income tax returns using a Demat account:

-Log into the e-filing portal.

-Pre-validate the demat account number if not already done.

-Click on the e-verify link and select the option to e-verify using demat account details.

-Generate the OTP and receive it on the registered mobile number.

-Enter the OTP on the e-filing portal to verify the income tax return.

Please note that these alternative verification methods may have specific requirements and eligibility criteria.

It’s essential to follow the instructions provided on the Income Tax e-Filing portal and consult official guidelines for accurate and up-to-date information.

Common Mistakes to Avoid When Filing Your Income Tax Return (ITR)

Filing your income tax return (ITR) accurately and on time is crucial for every taxpayer.

However, certain common mistakes can lead to complications and unnecessary hassles. There are two key errors that taxpayers should avoid:

Forgetting to Verify Your ITR

Forgetting to verify your income tax return is a common mistake with potential consequences. Taxpayers often realize this error when they receive a notice from the Income Tax Department. Rectifying it can be costly and time-consuming.

Remember, taxpayers have 30 days to verify their ITR after submitting the form.

Selecting the Wrong Assessment Year

Tax terminologies can sometimes be confusing, leading to misunderstandings among taxpayers. One common source of confusion is the distinction between the terms “Assessment Year” and “Financial Year.”

Financial Year: The Financial Year refers to the period in which income is earned and financial transactions occur. In the context of income tax filing, it spans from April 1st to March 31st of the following year.

For example, if you file your income tax return on or before July 31, 2023, you are reporting your income earned between April 1, 2022, to March 31, 2023.

This specific period is referred to as the Financial Year 2022-23 or FY 2022-23.

Assessment Year: The Assessment Year is the year immediately following the Financial Year, during which taxpayers file their income tax returns.

It is the year in which the income earned during the Financial Year is assessed for tax purposes.

Following the previous example, if you file your tax returns in June or July 2023, the Assessment Year would be 2023-24.

To learn more about basics of Economic concepts and Stock market one can consider enrolling in our Stock Market Learning Courses, here.

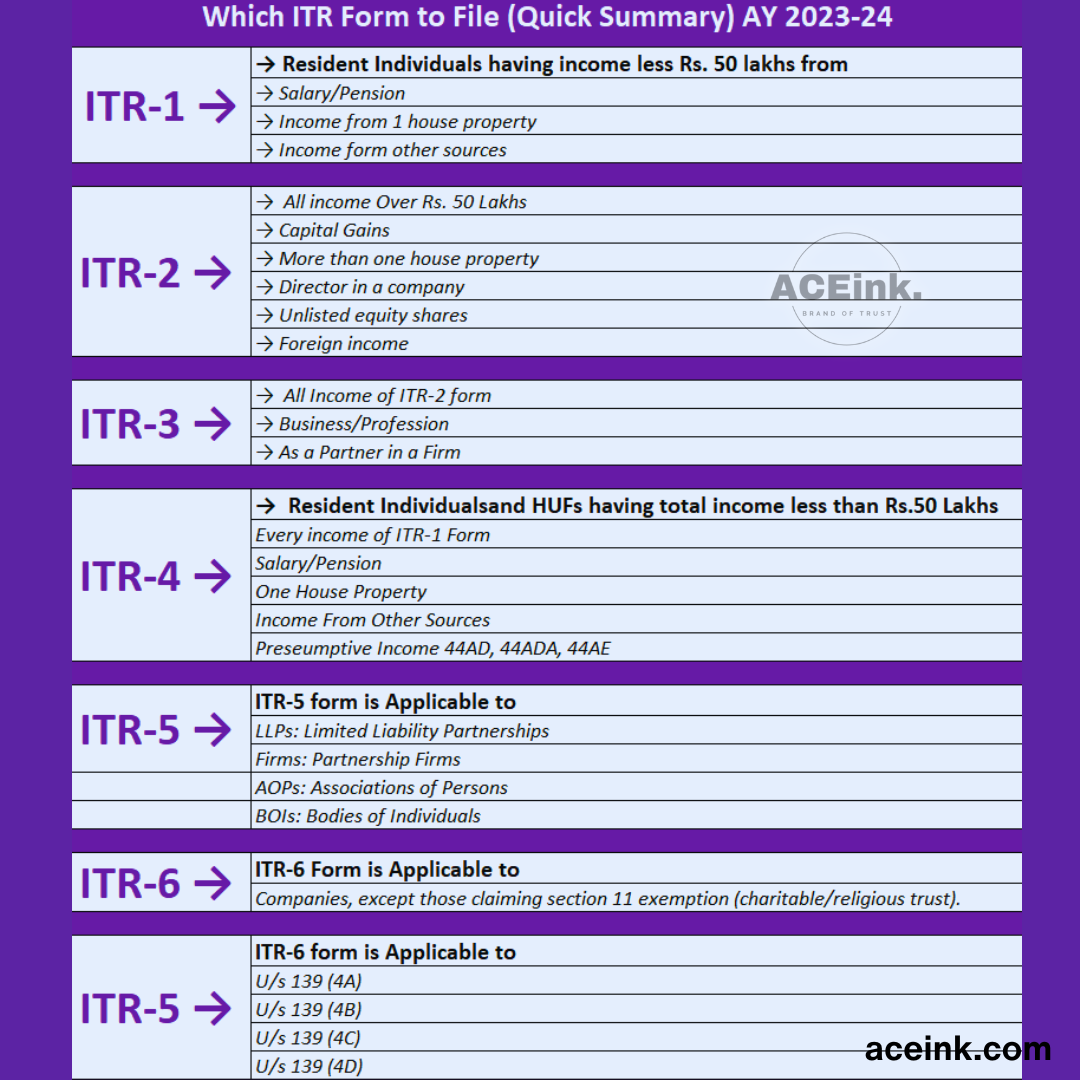

Filing your income tax return is an essential part of your financial planning and compliance. By selecting the right ITR form, filling it out correctly, and filing your return within the due dates, you can avoid penalties and interest.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“2 Midcap Stocks suggested by Research Analysts that can give Potential Returns in 1-2 years ” Given the optimistic sentiment prevailing in the market, investors are actively seeking stocks that are outperforming the overall market performance….Read More

——————-

“Driving Growth – A Fundamentally Strong Small Cap Company” A key player in the chemical industry , showcasing growth. Here is the reason why…Read More

Krutibasa Biswal

Posted at 20:35h, 20 JuneWhere is to show zerodha brokrage income in itr 3