26 May Rs 25 Lakhs Free Foreign Trip by Using Credit Card-Really!

How to use Credit Cards Smartly: Are they Good Or Bad?

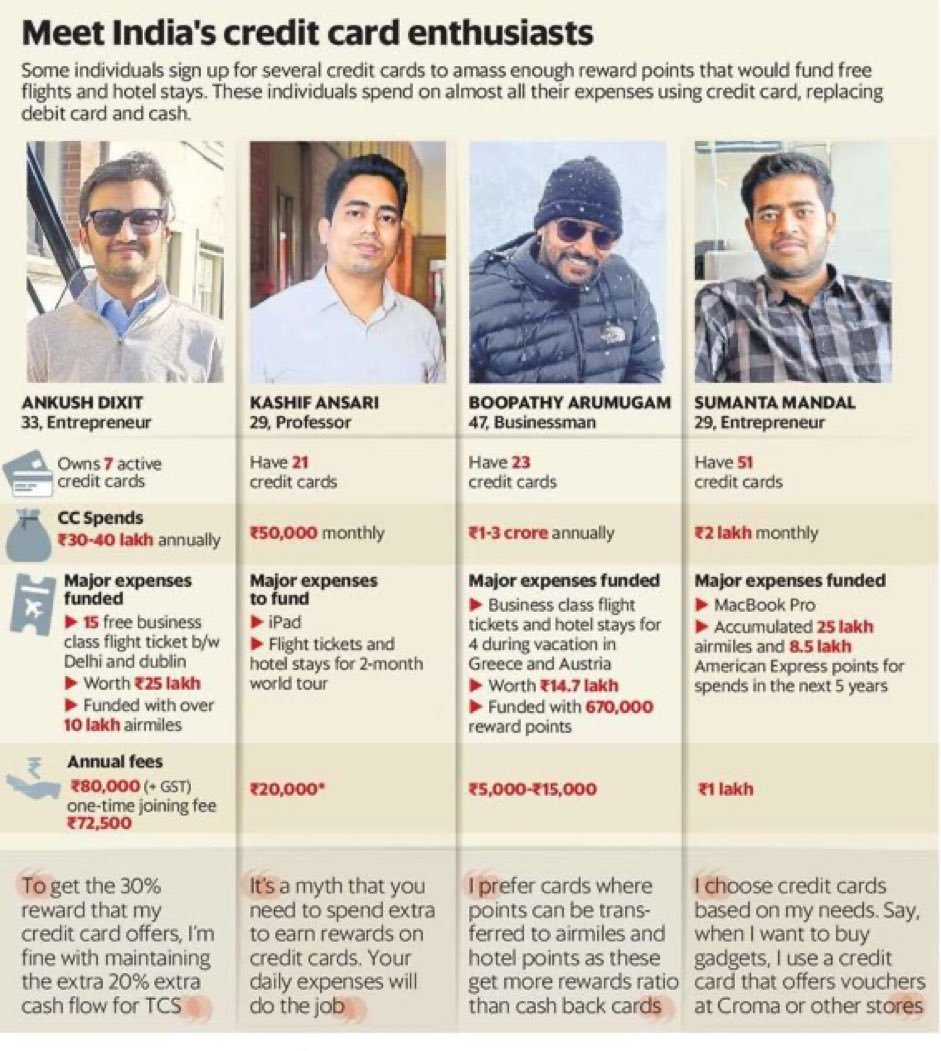

In a world where overseas travel may seem out of reach for many, a group of credit card enthusiasts in India has found a way to make their dreams come true.

By mastering the art of accumulating rewards points, these individuals have unlocked the incredible opportunity to enjoy free trips worth up to Rs 25 lacks as reported by LiveMint.

Credit cards have become a ubiquitous part of modern life, offering convenience, financial flexibility, and a range of enticing rewards.

However, the question of whether credit card usage is ultimately good or bad is a subject of ongoing debate.

In this exploration, we delve into the world of credit cards, examining their benefits and drawbacks from a balanced perspective.

Image: Mint

Image: Mint

Credit Card Usage: Evaluating the Pros and Cons

Credit card usage is a topic that elicits various opinions and experiences.

While credit cards can offer numerous benefits and conveniences, it is essential to consider both the positive and negative aspects before deciding whether they are good or bad for you. Here are some points to consider:

Convenience and Financial Flexibility:

Credit cards provide a convenient and widely accepted method of payment. They eliminate the need to carry cash and offer financial flexibility, allowing you to make purchases even when you don’t have immediate funds available.

Building Credit History:

Responsible credit card usage can help establish and build a positive credit history.

Making timely payments and keeping credit utilization low can contribute to a higher credit score, which can be beneficial when applying for loans or mortgages in the future.

Rewards and Perks:

Many credit cards offer rewards programs, such as cashback, travel miles, or discounts on purchases.

If you use your credit card strategically and pay off the balance each month, these rewards can add significant value and save you money on everyday expenses or special purchases.

Consumer Protection:

Credit cards often come with built-in consumer protection features, such as fraud liability protection and purchase dispute resolution.

This can provide an added layer of security and peace of mind when making transactions.

Potential Debt Accumulation:

One of the significant risks associated with credit card usage is the potential for accumulating high-interest debt.

If you carry a balance and only make minimum payments, interest charges can add up quickly, leading to financial strain and long-term debt.

Overspending and Impulse Purchases:

Having a credit card readily available can sometimes tempt individuals to make impulsive purchases or spend beyond their means. It is crucial to exercise discipline and budgeting skills to avoid falling into a cycle of debt.

Fees and Interest Rates:

Credit cards often come with fees, such as annual fees or foreign transaction fees. Additionally, if you carry a balance or make late payments, high-interest rates can accumulate, increasing your overall debt burden.

Impact on Credit Score:

Irresponsible credit card usage, such as missing payments or maxing out credit limits, can negatively impact your credit score. A lower credit score can make it challenging to secure loans or obtain favorable interest rates in the future.

Some Live Examples of Optimal Use of Credit Cards Earning Up to Rs 25 Lakh Rewards

(As per Mint article)

Credit card enthusiasts employ various tricks to maximize rewards.

-Ankush Sethia, for example, buys vouchers and sells them to friends at a discount to meet spending milestones.

-They also take advantage of discounts and cashback offers during sales on e-commerce platforms, earning rewards without spending their own money.

-Understanding the types of payments eligible for rewards is crucial, as some cards exclude common expenses like utilities and groceries, but workarounds like purchasing vouchers or using digital wallets can still yield benefits.

-Each credit card offers different rewards, and the rewards programs can be complex. For example, some cards allow the transfer of rewards to airline miles or hotel loyalty programs, requiring careful evaluation of conversion rates.

-While it may be complex for beginners, credit card nerds have mastered the art and turned their passion into professions, such as running credit card comparison platforms or providing personal finance advice.

-Credit card enthusiasts often own multiple cards, strategically choosing them based on their needs and preferences.

For example, using a card that offers reward points redeemable for vouchers at electronic stores when purchasing gadgets, while also accumulating air miles for future travel.

They are aware of the limits and fees associated with international transactions and plan accordingly to optimize rewards.

The importance of timely payments:

Managing multiple credit cards requires diligence and discipline.

It is crucial to make bill payments on time, especially when juggling multiple cards.

Late payments can result in high fees and penalties, negatively impacting credit scores.

While some individuals may receive leniency from banks due to their timely payment history, it’s always recommended to settle all dues promptly to maintain a good credit standing.

Long-term rewards accumulation:

Credit card nerds like Ankush Dixit and Sumanta Mandal have long-term strategies when it comes to reward accumulation.

They strategically choose credit cards based on their needs and preferences, earning rewards for future travels or specific purchases.

By leveraging the benefits of various cards, they optimize their rewards over time, making informed choices to maximize their overall value.

Is it for everyone?

While credit card rewards can be lucrative, they are not suitable for everyone.

-Premium credit cards often come with high annual charges, and overspending to earn rewards can be risky.

-It is essential to assess personal cash flows before using credit cards and settle all dues in full and on time to avoid high-interest rates and negative impacts on credit scores.

-Booking award tickets requires advance planning, and missed payments can have severe consequences on credit scores.

-It’s worth mentioning that the most rewarding credit cards are premium products that come with high annual charges, ranging from ₹10,000 to 1 lakh.

In conclusion, credit card usage can be both beneficial and risky, depending on how it is managed.

When used responsibly, credit cards offer convenience, rewards, and the opportunity to build a positive credit history. However, it is crucial to avoid overspending, pay off balances in full, and be mindful of fees and interest rates.

Assessing your financial habits, budgeting wisely, and understanding the terms and conditions of your credit card are essential in determining whether credit cards are a good fit for your financial goals and lifestyle.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.

No Comments