29 Jul Buy or Sell: 3 Stocks For This Week 31st July

The market next week: Sumeet Bagadia’s 3 Stock Recommendations

The market is experiencing strong momentum in earnings, although it is still early days. However, the disappointing performance of some key IT companies has cast a shadow on the market. As a result, the Nifty is struggling to reach the elusive 20,000 mark, presenting a case of being so near yet so far. Investors are eagerly watching the market trajectory for the coming days

On a positive note, FII inflows remain robust, contributing to India’s upbeat economic outlook. Furthermore, The IMF has raised India’s growth forecast to 6.1% for the fiscal year 2023-24, attributing this growth to domestic investments.

Despite the growth optimism, there is concern about inflation, which could potentially dampen the market mood. However, The US Federal Reserve is vigilant and not inclined to lower its guard.

Markets This Week:

With an action-packed week ahead, investors are advised to stay cautious and keep a close eye on market developments. Furthermore, being mindful of these factors will be crucial for making informed decisions in the dynamic market environment.

Also Read: “These banking stocks may give up to 30% returns

Here is the list of upcoming Events

Monday (July 31):

- Corporate Results: Adani Green Energy, Adani Transmission, BOSCH, GAIL (INDIA), IRB Infra, Maruti Suzuki, Oberoi Realty, Petronet LNG, PowerGrid, UPL.

- Fiscal Deficit Data: Additionally, India’s fiscal deficit data for June will be released, providing insights into the country’s debt position and fiscal health.

Tuesday (August 1):

- Corporate Results: Adani Total Gas, Cholamandalam Investment and Finance Company, Escorts Kubota, Metro Brands, PVR Inox, Thermax.

- India Manufacturing PMI: S&P Global India Manufacturing PMI data for July will reveal factory activity growth or contraction and new export order trends.

Wednesday (August 2):

- Corporate Results: Titan, Ambuja Cements, Adani Wilmar, Engineers India, Godrej Properties, Gujarat Gas, HPCL, InterGlobe Aviation (Indigo), Mankind Pharma, Metropolis Healthcare, Narayana Hrudayalaya.

- GST Council Meeting: The GST Council is expected to hold an unscheduled meeting to decide on the taxation of real-money games at 28%.

Thursday (August 3):

- Corporate Results: Adani Enterprises, Adani Power, Bharti Airtel, Blue Star, Cummins India, Dabur India, Eicher Motors, KEC International, Karnataka Bank, LIC Housing Finance, Lupin, MRF, Sun Pharma, Varun Beverages, Zomato.

- SBFC IPO Opening: Singapore-based SBFC Finance’s IPO, aiming to raise Rs 1,025 crore, will open for subscription.

- India Services PMI and Composite PMI: S&P Global India Services PMI data for July will reveal the pace of expansion in the service sector and new business growth.

Friday (August 4):

- Corporate Results: Alembic Pharma, Bharat Dynamics, BHEL, Dilip Buildcon, JK Tyre, M&M, SBI, Tata Investment Corporation, Tatva Chintan Pharma Chem, Bank of Baroda.

- Foreign Exchange Reserves: India’s foreign exchange reserves data will reflect the country’s currency position and economic stability.

Also Read: “These banking stocks may give up to 30% returns

Trading Strategy:

Sumeet Bagadia believes that the market trend has turned cautious after the recent sell-off over two consecutive days. As of now, Nifty has immediate support at 19,550 and faces resistance at 19,750 levels. The direction of the trend can be assumed to be bullish or bearish based on the breakage of either side of this range.

Stocks to Buy:

Sumeet Bagadia recommends three stocks to buy on Monday for this week:

Related Read: 5 stocks of sugar sector with upside potential

1. NMDC:

- Buy at Rs 112.55

- Target: Rs 117

- Stop loss: Rs 110

-NMDC’s share price has formed strong support near Rs 110.70 levels, which coincides with the 20-day Exponential Moving Average (EMA).

-The stock is currently trading around Rs 112.55, above its short-term (20-day), medium-term (50-day), and long-term (200-day) EMAs, indicating positive momentum.

-A minor resistance is visible around Rs 114.65, a recent top.

-Once the stock surpasses this resistance, it has the potential to move towards the higher levels of Rs 117.

Company Information: NMDC (National Mineral Development Corporation) is a state-owned mineral producer in India. Headquartered in Hyderabad, Telangana, it is one of the largest iron ore mining companies in the country. Additionally, the company has played a crucial role in contributing to India’s industrial growth and development.

Business Overview: NMDC is primarily engaged in the exploration and production of minerals, with a major focus on iron ore mining.

Moreover, the company operates several mines across India, making significant contributions to the nation’s iron ore production.

Product Overview: NMDC’s key product is iron ore, a crucial raw material for the steel industry.

The company produces and sells various grades of iron ore, catering to the diverse needs of both domestic and international customers.

Also Read: “What Mutual Funds are buying right now?

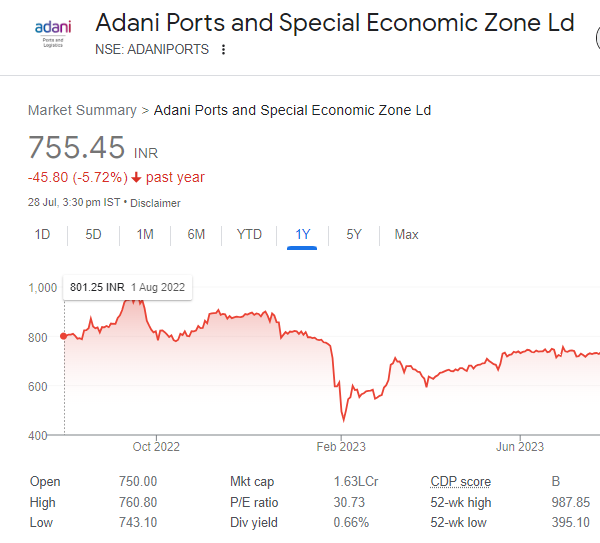

2. Adani Ports:

- Buy at Rs 755

- Target: Rs 800

- Stop loss: Rs 720

-Adani Ports’ share price has experienced consolidation within the range of Rs 714 to Rs 760 over the last two months, indicating stability.

-A potential upward trend is likely if the stock breaks out above Rs 760 with significant trading volumes.

-Currently, the stock is trading above its short-term, medium-term, and long-term Exponential Moving Averages, suggesting positive momentum.

Company Information: Adani Ports and Special Economic Zone Limited (APSEZ) is a leading private port operator in India. Additionally, It is part of the Adani Group, a conglomerate with interests in various sectors.

Business Overview: APSEZ operates and manages several ports and terminals across India, providing essential logistics and cargo handling services.

The company plays a vital role in facilitating trade and commerce through its state-of-the-art port infrastructure.

Product Overview: Adani Ports offers a wide range of port services, including

-container handling, bulk cargo operations, and integrated logistics solutions.

It serves diverse industries, such as shipping, manufacturing, energy, and trade.

Also Read: “Public Sector Banks: Share Prices are Still 80% Down from All-Time Highs Despite Recent Rally

3. Marico:

- Buy at Rs 565

- Target: Rs 600 to Rs 608

- Stop loss: Rs 554

-On the Daily Chart, Marico’s share price is in an uptrend, showing good volume participation along with the breakout of a falling trendline.

-The stock has formed higher highs and higher lows on larger time frames, indicating a positive trend.

-Bollinger Band expansion and price action suggest increased volatility and potential upward movement in the stock.

Company Information: Marico Limited is a leading Indian consumer goods company headquartered in Mumbai, Maharashtra. It is known for its various brands in the personal care and food segments.

Business Overview: Marico operates in the fast-moving consumer goods (FMCG) sector, with a focus on personal care products, edible oils, and health foods. Moreover, the company has a strong presence in both the Indian and international markets.

Product Overview: Marico offers a diverse portfolio of products, including

-hair oils, skin care products, edible oils, health supplements, and more.

Some of its well-known brands include Parachute, Saffola, Livon,

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website.

Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————

Defense stock rally up to 64% on strong growth prospects but here is a twist! In recent times,…Read More

No Comments