09 Sep Buy or Sell: 3 Stocks For This Week 11th Sep

The market next week: Sumeet Bagadia’s 3 Stock Recommendations

Despite weak global market cues due to rising China-US tension, the Indian stock market had a positive week.

The NSE Nifty gained 92 points, closing at 19,819 levels, marking its best week in the last two months. The BSE Sensex finished 33 points higher, reaching 66,598 points, and the Bank Nifty index ended 278 points up at 45,156 levels.

In the broader market, the small-cap index rose by 0.43 percent, while the mid-cap index increased by 0.92 percent.

Stock Market Strategy for Next Week:

Sumeet Bagadia, Executive Director at Choice Broking, has a positive outlook for the market.

- He believes that the market sentiment has improved significantly, especially following Nifty’s closure above the crucial 19,800 level on Friday.

- Bagadia suggests that Nifty is on track to reach new all-time highs and potentially touch the coveted 20,000 mark.

Here are the key events and data for the upcoming week :

Monday (September 11):

Car Sales: Total passenger vehicle sales in India went up by 2.9 percent from a year earlier to 302,251 in July.

Tuesday (September 12):

Industrial Production: India’s factory output expanded 3.7 percent year-on-year in June.

Inflation Rate: Retail inflation, as measured by the consumer price index, jumped to a 15-month high of 7.44 percent in July.

Wednesday (September 13):

RR Kabel sets IPO price band: Global private equity firm TPG-backed RR Kabel has fixed the price band at Rs 983-1,035 per share for its maiden public issue.

US Inflation Rate: The monthly inflation rate in the US went steady at 0.2 percent in July.

Thursday (September 14):

WPI Inflation: India’s wholesale prices came down by 1.36 percent year-on-year in July.

Samhi Hotels IPO to open: Equity International, ACIC Mauritius, and Goldman Sachs-backed Samhi Hotels is set to hit the IPO market on September 14.

Friday (September 15):

Balance of Trade: India’s merchandise trade deficit shrank to $20.67 billion in July.

Foreign Exchange Reserves: Foreign exchange reserves in India fell to $594.86 billion for the period up to August 25.

Stock Recommendations for Next Week:

Sumeet Bagadia has recommended three stocks to consider for the upcoming week:

Also Read: “ Stock on Radar : Tata Power- Time to Buy?”

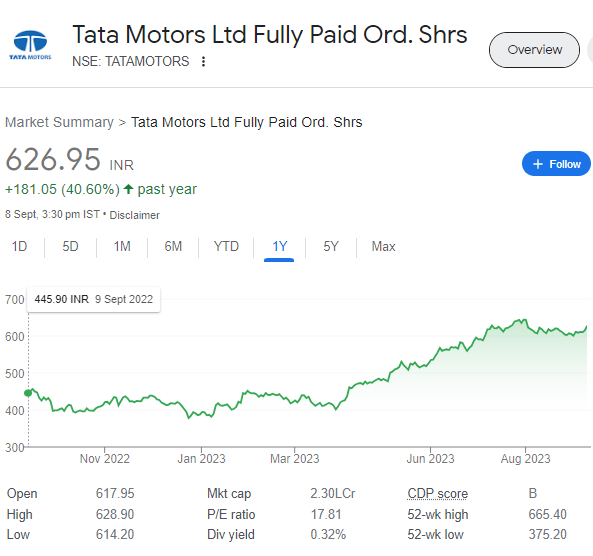

Tata Motors:

- Buy at Rs. 627.25

- Target: Rs. 665

- Stop Loss: Rs. 602

Technical Analysis:

- Strong bounce-back from support at Rs. 602 (50 Day EMA)

- Currently trading above 20, 50, and 200 Day EMA levels

- Strong volumes indicate strength

- RSI near 60 levels, indicating bullishness

- Resistance near Rs. 635, with a target of Rs. 665

Business Overview: Tata Motors Limited is one of India’s largest automobile manufacturing companies.

It is a part of the Tata Group and is known for its diverse range of vehicles, including passenger cars, trucks, vans, buses, and more.

Tata Motors has a global presence and is a significant player in the automotive industry. They are involved in manufacturing both commercial and passenger vehicles, serving various market segments.

Tata Motors produces a wide range of vehicles under different brands. In the passenger vehicle segment, they offer popular models like the

-Tata Tiago, Tata Nexon, Tata Harrier, and Tata Safari.

In the commercial vehicle segment, they manufacture trucks and buses under the Tata Motors and Tata Daewoo brands, catering to logistics and transportation needs.

Also Read: “ 6 Large Cap Stocks For Volatile Markets”

HCL Technologies:

- Buy at Rs. 1250

- Target: Rs. 1310 and Rs. 1325

- Stop Loss: Rs. 1225

Technical Analysis:

- Bullish trend with Higher High Higher Low formation

- Gradual rise in volume confirms bullishness

- Support at 40 and 20 Exponential Moving Averages

- RSI and MACD confirm the positive trend

- Breakout of resistance zone of 1235

Business Overview: HCL Technologies is a leading global IT services and solutions company.

It provides a wide array of services, including IT consulting, software development, infrastructure management, cybersecurity, and more

HCL Technologies offers a comprehensive range of IT services and solutions, including

-Custom software development, application maintenance and support, cloud computing, IoT (Internet of Things), and digital transformation services.

They work with clients to address their specific technology needs and drive business growth.

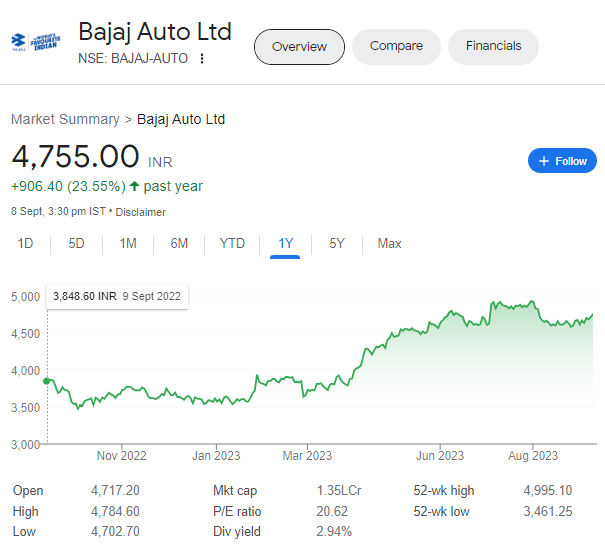

Bajaj Auto:

- Buy at Rs. 4759

- Target: Rs. 4900

- Stop Loss: Rs. 4650

Technical Analysis:

- Trading above key Exponential Moving Averages (20-day, 50-day, 100-day, and 200-day)

- RSI at 57 with upward slope, indicating growing buying momentum

- Potential to reach a target price of Rs. 4900

- Set a stop-loss at Rs. 4650 for risk management

Business Overview: Bajaj Auto Limited is one of India’s largest two-wheeler and three-wheeler manufacturing companies. It has a strong presence in the domestic and international markets.

Bajaj Auto is known for its motorcycles, scooters, and auto-rickshaws. The company is recognized for its focus on innovation and efficiency in the automotive industry. They are known for brands like

-Bajaj Pulsar, Bajaj Discover, Bajaj Platina, and Bajaj Avenger.

Additionally, Bajaj Auto manufactures three-wheeled vehicles primarily used for passenger and cargo transportation.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

No Comments