The market next week: Sumeet Bagadia’s 3 Stock Recommendations

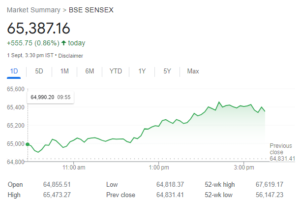

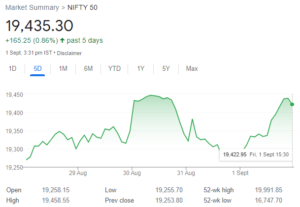

The Indian stock market broke a five-week losing streak, with both the BSE Sensex and Nifty50 recording gains. The Sensex rose by 0.77 percent, gaining 500.65 points to close at 65,387.16, while the Nifty50 increased by 0.87 percent, adding 169.5 points to finish at 19,435.30.

Small-Cap Surge: The BSE Small-cap index surged by an impressive 3.8 percent during the week. Several small-cap stocks, including Railtel Corporation of India, India Pesticides, and Optiemus Infracom, witnessed substantial gains ranging from 25 to 46 percent.

Mid-Cap Performance: The BSE Mid-cap Index also performed well, rising by 2.3 percent. Stocks like Bharat Heavy Electricals, Vodafone Idea, and Gland Pharma contributed to these gains, posting increases of 10 to 29 percent.

Large-Cap Gains: The BSE Large-cap Index registered a 1 percent gain. Key contributors to this growth included Tata Steel, Maruti Suzuki India, and Indus Towers.

Sectoral Trends: Among sectoral indices, the BSE Metal index saw a significant rise of 6 percent, followed by the BSE Realty index, which gained 5.7 percent. Additionally, the BSE Telecom index increased by 4.5 percent, while the BSE Power and Auto indices both added 3.4 percent. However, the BSE FMCG index experienced a minor decline of 0.5 percent.

Investor Activity: Foreign institutional investors (FIIs) continued their selling streak for the sixth consecutive week, offloading equities worth Rs 4,311.58 crore. On the other hand, domestic institutional investors (DIIs) purchased equities worth Rs 9,570.03 crore during the week.

Rupee Movement: The Indian rupee marginally depreciated, ending at 82.72 against the US dollar on September 1, compared to 82.65 on August 25.

Market Sentiment & Outlook:

- Indian stock market sentiment has turned positive following significant gains on Friday.

- The Nifty index may see further upside momentum if it breaches the immediate resistance level placed at 19,550 to 19,600.

Key events for the week ahead (September 4-8, 2023):

Monday (September 4):

- IPO: Ratnaveer Precision Engineering

Tuesday (September 5):

- India Services & Composite PMI: The August reading for India’s Services and Composite PMI will be announced.

Wednesday (September 6):

- Earnings: Concord Biotech Ltd

- IPO: Jupiter Life Line Hospitals Limited

- India Money Supply M3: Data for India’s M3 money supply for the fortnight ending August 25 is awaited.

- US Composite PMI: The final reading of the S&P Global US Composite PMI for August is awaited.

- US Services PMI: The final reading of the S&P Global US Services PMI for August is awaited.

Thursday (September 7):

- US Initial Jobless Claims: The initial jobless claims in the United States for the week ending September 2 will be announced.

- China Foreign Exchange Reserves: Data for China’s foreign exchange reserves in August will be announced.

Friday (September 8):

- India Deposit Growth: Data on the value of deposits in India for the week ending August 25 will be declared.

- India Foreign Exchange Reserves: Data on India’s Foreign Exchange Reserves for the week ending August 25 will be announced.

- India Bank Loan Growth: Data on the value of loans in India for the week ending August 25 will be declared

Stock Recommendations for Next Week:

Sumeet Bagadia has recommended three stocks to consider for the upcoming week:

Also Read: “ After a 16% Rally in a month Will it hit a Fresh 52-week High?”

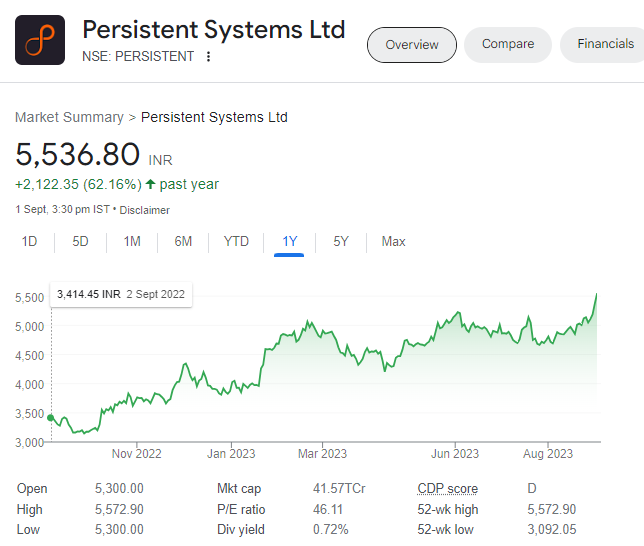

1. Persistent Systems:

- Current Stock Price: Rs. 5,543.30

- Target Price: Rs. 5,900

- Stop Loss: Rs. 5,275

- Overview: Persistent Systems is a technology company specializing in software product development and technology services. It serves various industries, including healthcare and finance.

Technical Analysis:

- Currently trading at around Rs. 5543.30, at all-time high levels, after breaking through strong resistance at Rs. 5275.

- Breakout supported by strong volumes.

- RSI is at 75, indicating strength.

- Trading above all important moving averages.

- Any dips in the stock could be considered buying opportunities.

2. Bajaj Finance:

- Current Stock Price: Rs. 7,320.60

- Target Price: Rs. 7,575

- Stop Loss: Rs. 7,150

- Overview: Bajaj Finance is a prominent non-banking financial company (NBFC) in India. It offers a wide range of financial products, including consumer loans and personal loans.

Technical Analysis:

- Strong support in the range of Rs. 7170 to Rs. 7190, close to the 50 and 20 Day Exponential Moving Average (EMA) levels.

- Recovered from support levels and is trading near Rs. 7320.60.

- RSI indicator comfortably trading near 57 levels, indicating strength.

- Currently trading above all important moving averages.

- Potential to move towards the Rs. 7575 level and beyond after surpassing resistance near Rs. 7360.

Also Read: “7 metal stocks to deliver up to 40% returns”

3. NTPC (National Thermal Power Corporation):

- Current Stock Price: Rs. 230

- Target Price: Rs. 245 to Rs. 255

- Stop Loss: Rs. 210

- Overview: NTPC is India’s largest state-owned power utility company, engaged in the generation and sale of electricity. It has a significant presence in the power generation sector.

Technical Analysis:

- Experienced a range breakout after a month-long consolidation between Rs. 224 and Rs. 212.

- RSI stands at 73 and is trending upward, reflecting strong buying interest.

- Trading above key Exponential Moving Averages (EMAs), including the 20-day, 50-day, 100-day, and 200-day EMAs.

- Consider buying in the range of Rs. 230 to Rs. 220, with a mid-term target of Rs. 245 to Rs. 255.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.