24 Aug 7 metal stocks to deliver up to 40% returns

“Metals in the Spotlight: China’s Impact and 7 Potential Winners”

China, a global metal consumer of copper, aluminum, and steel, saw a significant shift as news of Evergrande’s bankruptcy filing reverberated across the market, leading to a decline in metal stocks.

The question arises: Was this development unexpected, or has the final blow been dealt?

It becomes evident from the news flow that the Chinese government may be allowing the worst to unfold, intending to introduce a stimulus package to rejuvenate the real estate sector.

One key reason behind the spotlight on large companies could be their remarkable earnings over the past two years, resulting in some substantial debt reduction. While China had recently introduced measures to boost its real estate market, Evergrande’s troubles rekindled concerns.

Being the leading consumer of metals, China’s economic moves directly affect global metal prices and stock performance. Surprisingly, despite negative developments in China, the impact on metal stocks hasn’t been as severe or prolonged as observed in the past.

Could this indicate that the corrective phase that metal stocks have undergone for more than a year has already factored into the current scenario?

Contrary to the uniform optimism seen in 2021 and early 2022 due to supply chain bottlenecks, the current bullish sentiment seems selective. The focus is on specific stocks, particularly those with large capacities, full integration, or even a monopoly in certain segments.

Another contributing factor to the concentration on large companies is their ability to decrease debt owing to their substantial earnings in recent years.

After the pandemic-induced disruptions, the first half of 2023 witnessed a decline in commodity prices worldwide. With China reopening, some metal prices showed signs of recovery. However, fears of a US recession due to persistent inflation acted as a constraint on metal prices. To learn more about Fundamentals & Basics of Finance and Stock Market one can consider enrolling in our Stock Market Learning Courses, here.

In recent weeks, certain metals have experienced volatile fluctuations. The impact of bearish news appears short-lived, and stocks struggle to surpass recent highs. Despite currently being below the levels of FY 22, metals have settled in a range above the lows of 2020, establishing a sense of equilibrium.

The trajectory of metal stocks largely hinges on the stimulus package introduced by the Chinese government post-Evergrande’s bankruptcy. A mere statement from China’s authorities could propel stocks sharply upwards.

Additionally, the market will keenly observe the unfolding situation in the US and monitor the behavior of the dollar in the near term.

This report delves into analysts’ perspectives on metal stocks, spanning the steel sector and beyond. The list includes companies with potential upside targets in the metals sector, encompassing various industrial houses, state, and central PSUs. The data presented is sourced from the latest Stock Reports Plus report dated August 23, 2023 by ET.

For this analysis, stocks were required to have an overall rating of either “Strong Buy,” “Buy,” or “Hold.” The list has been organized with the highest-potential stock at the forefront.

Also Read: Buy or Sell: Sumeet Bagadia’s 3 Stock Recommendations for This Week

SAIL – Steel Authority of India Limited

- Recommendation: Hold

- Analyst Count: 22

- Upside Potential: 40.0%

- Institutional Stake: 15.9%

Steel Authority of India Limited (SAIL) plays a pivotal role in the steel manufacturing landscape of India. The company’s operations encompass various segments, including Bhilai Steel Plant, Durgapur Steel Plant, Rourkela Steel Plant, Bokaro Steel Plant, IISCO Steel Plant, Alloy Steels Plant, Salem Steel Plant, Visvesvaraya Iron & Steel Plant, and others. SAIL’s diverse portfolio covers a wide array of steel products, ensuring a significant contribution to the nation’s industrial growth.

Product Range:

SAIL is renowned for its comprehensive range of steel products that cater to various industrial needs. Some of the key products include:

- Pig Iron

- Cold Rolled Products

- Pipes

- Semi-Finished Products

- Structural Components

- TMT (Thermo-Mechanical Treatment) Bars

- Galvanized Products

- Bars and Rods

- Rebars

- Plates

- Railway Products

- Wheels and Axles

- Hot Rolled Products

- Stainless Steel Products

- Electrical Steels

- SAIL SeQR TMT

SAIL’s commitment to delivering high-quality steel products is evident across its diverse offerings. The company’s extensive production capabilities contribute significantly to infrastructure development, manufacturing, and various industrial sectors in India.

As a key player in the steel industry, SAIL’s operations have a substantial impact on the country’s economic growth and development. With a comprehensive product range and a dedication to quality, SAIL continues to drive India’s steel manufacturing sector forward.

Also Read: “Pharma Comeback: 5 Stocks to Watch”

Hindalco Industries Limited

- Recommendation: Buy

- Analyst Count: 21

- Upside Potential: 38.8%

- Institutional Stake: 42.8%

Overview: Hindalco Industries Limited stands as a formidable force in the metal industry, with diversified operations covering various crucial segments.

Novelis Segment: Hindalco’s Novelis segment is represented by Novelis Inc., a wholly owned foreign subsidiary. Novelis Inc. specializes in producing and distributing aluminum sheet and light gauge products across North America, South America, Europe, and Asia. This strategic presence across continents underscores its global significance.

Aluminium Segment: Under the Aluminium segment, Hindalco encompasses key entities like Utkal Alumina International Limited (UAIL), Hindalco Almex Aluminium Limited (HAAL), Suvas Holdings Limited (SHL), and Minerals and Minerals Limited (M&M). This segment embodies Hindalco’s prowess in the aluminum business, incorporating a range of enterprises dedicated to excellence.

Copper Segment: The company’s Copper segment covers Dahej Harbour and Infrastructure Limited, a wholly owned subsidiary. This entity operates a captive Jetty and is engaged in manufacturing and selling copper cathode, continuous cast copper rods, sulphuric acid, precious metals, and more.

All Other Segment: Hindalco’s diverse subsidiaries come together under the All Other segment. This encapsulates the company’s wide-ranging business endeavors, showcasing its versatility.

Hindalco Industries Limited’s extensive history, global reach, and commitment to innovation have positioned it as a major player in the aluminum and copper sectors. Its multi-faceted approach to the industry continues to drive growth and success.

Also Read: “Top Picks for the Current Market”

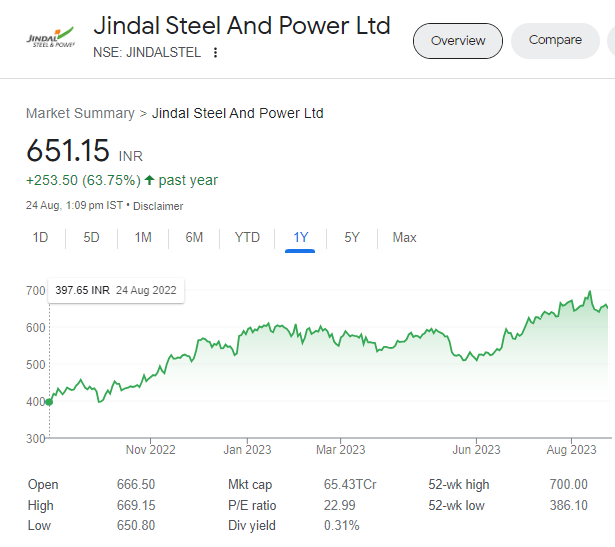

JSPL – Jindal Steel & Power Limited

- Recommendation: Buy

- Analyst Count: 23

- Upside Potential: 37.2%

- Institutional Stake: 20.5%

Jindal Steel and Power Limited (JSPL): Forging Excellence in Steel and Power

Overview: Jindal Steel and Power Limited (JSPL) stands as a prominent player in the steel industry, driven by its commitment to quality and innovation across various segments.

Iron & Steel Segment: The core of JSPL’s operations lies within the Iron & Steel segment, encompassing the manufacturing of steel products, sponge iron, pellets, and castings. This segment serves as the foundation for its diverse product portfolio.

Power Segment: JSPL’s Power segment is dedicated to power generation, reflecting the company’s comprehensive approach to meeting energy needs.

Others Segment: The Others segment comprises a range of activities including aviation, machinery division, and real estate. This diverse segment underscores JSPL’s versatility beyond its core domains.

Product Portfolio: JSPL’s impressive array of products includes rails, parallel flange beams and columns, plates and coils, angles and channels, wire rods, round bars, speed floors, and Jindal Panther Thermo mechanically treated (TMT) rebars. Additionally, the company offers Jindal Panther cement, fabricated sections, and semi-finished products.

Customized Offerings: JSPL’s commitment to customization shines through its product portfolio, catering to a diverse range of customers. The company delivers tailored solutions across flat, long, and special product categories, ensuring it meets the unique needs of its clientele.

Power Portfolio: Beyond its steel endeavors, JSPL boasts a substantial power portfolio. This includes independent power plants (IPPs) and captive power projects (CPP), showcasing its holistic approach to energy generation.

Jindal Steel and Power Limited’s unwavering dedication to excellence, coupled with its diverse offerings, positions it as a leader in the steel industry, while its robust power projects further solidify its impact on the energy landscape.

Also Read: “Top Picks for the Current Market”

Tata Steel Limited

- Recommendation: Buy

- Analyst Count: 26

- Upside Potential: 31.9%

- Institutional Stake: 29.8%

Tata Steel Limited: Forging Excellence in Steel Manufacturing

Overview: Tata Steel Limited stands as a leading force in the realm of steel manufacturing, committed to delivering quality and innovation across various industries.

Business of Steel Making: Tata Steel’s core operations revolve around steel making, encompassing the entire spectrum from raw materials to finishing operations. This comprehensive approach ensures the delivery of top-notch steel products.

Diverse Product Portfolio: Tata Steel’s extensive product range includes hot-rolled (HR) and cold-rolled (CR) coils, coated coils and sheets, precision tubes, tyre bead wires, spring wires, bearings, galvanized iron (GI), wires, and agricultural and garden tools, among others.

Segment Expertise: The company’s expertise spans across a multitude of sectors, each represented by distinct segments. These include Agriculture, Automotive, Steels, Construction, Consumer Goods, Energy and Power, Engineering, and Material Handling.

Brands and Divisions: Tata Steel operates under a range of notable brands and divisions, each catering to specific product categories and customer needs. These include Tata Agrico/Agriculture, Construction & Hand Tools, Tata Astrum, Tata Bearings, Tata Ferro Alloys and Minerals Division, Tata Steel Industrial By-products Management Division (IBMD), Tata Pipes, Tata Precision, and more.

Tata Steel’s unwavering commitment to quality, coupled with its diverse product offerings and expertise in various sectors, positions it as a powerhouse in the steel manufacturing industry. Its strong presence across segments and dedication to innovation continue to drive its success story.

Also Read: “Contra Bets: 5 Software Stocks with 29% Upside Opportunity”

National Aluminium Company Limited

- Recommendation: Buy

- Analyst Count: 8

- Upside Potential: 28.4%

- Institutional Stake: 23.7%

National Aluminium Company Limited: A Leader in Alumina and Aluminum

Overview: National Aluminium Company Limited (NALCO) takes center stage in the manufacturing and sale of alumina and aluminum products, exemplifying excellence and innovation in its domain.

Diverse Business Segments:

- Chemical Segment: NALCO’s chemical segment is a hub for calcined alumina, alumina hydrate, and other related products. This division underpins the foundation of its diverse product range.

- Aluminium Segment: In the aluminium domain, NALCO produces a range of products including aluminum ingots, wire rods, billets, strips, rolled materials, and associated products.

Manufacturing Powerhouses: NALCO operates a robust alumina refinery plant with an impressive annual capacity of over 22.75 lakh tons (TPA), situated in Damanjodi, Koraput district, Odisha. Additionally, the company boasts a state-of-the-art aluminum smelter producing approximately four lakh TPA, located in Angul, Odisha.

Powering the Future: NALCO’s commitment to sustainable practices shines through its ventures in the energy sector. It operates a captive thermal power plant adjacent to its smelter plant, generating around 1200 megawatts (MW) of power. Furthermore, the company’s dedication to renewable energy is evident in its ownership of four wind power plants across Andhra Pradesh, Rajasthan, and Maharashtra, with a collective capacity exceeding 198.40 MW.

NALCO’s journey is one of innovation, sustainability, and dynamic growth. With a focus on quality production and a diverse portfolio, NALCO continues to set benchmarks in the alumina and aluminum industry, making a significant impact on both local and global scales.

Also Read: “Pharma Comeback:5 Small and Midcap Pharma Stocks on the Verge of a Positive Shift”

MMTC – Metals and Minerals Trading Corporation of India

- Recommendation: Buy

- Analyst Count: 5

- Upside Potential: 28.3%

- Institutional Stake: 2.7%

MMTC Limited: Pioneering Global Trade Solutions

Overview: MMTC Limited, a distinguished name in international trading, plays a pivotal role in facilitating global commerce with a comprehensive range of products and services.

Diverse Offerings: MMTC engages in a wide spectrum of trade activities, spanning minerals, metals, precious stones, agricultural products, and more. Its vast portfolio caters to both domestic and international markets, making it a crucial player in global trade dynamics.

Minerals and Metals Expertise:

- Minerals: MMTC’s proficiency extends to minerals like coal, iron ore, and fertilizers, fostering essential industries that drive economic growth.

- Metals: With a focus on metals, MMTC ensures a seamless supply of essential commodities like gold, silver, and non-ferrous metals to meet global demand.

Precious Gemstones: MMTC’s expertise shines in the precious stones sector, where it facilitates the trade of exquisite gems, contributing to the beauty and luxury industries.

Agro Products and Beyond: MMTC’s influence extends to agro products, spices, and essential commodities, fostering agricultural trade and food security on a global scale.

Global Reach: MMTC’s extensive network spans continents, facilitating trade partnerships and ensuring the availability of essential commodities across borders.

A Vision for the Future: With a rich legacy of promoting international trade, MMTC continues to evolve, leveraging its expertise to meet the demands of a rapidly changing world. As a trailblazer in global trade, MMTC remains committed to driving economic growth and fostering international cooperation through its diversified offerings.

NMDC – National Mineral Development Corporation Limited

- Recommendation: Buy

- Analyst Count: 8

- Upside Potential: 27.4%

- Institutional Stake: 25.2%

Overview: NMDC Limited, a pioneering public sector enterprise, plays a pivotal role in India’s mineral sector by exploring, mining, and processing a diverse range of minerals essential for various industries.

Mineral Diversity: NMDC is a frontrunner in the extraction of minerals like iron ore, diamonds, copper, limestone, and more. Its strategic operations cater to the requirements of vital sectors, including steel, construction, and manufacturing.

Iron Ore Powerhouse:

- Iron Ore: NMDC’s iron ore mines are a backbone of India’s steel industry. The company’s consistent supply of high-quality iron ore contributes to the growth and development of the nation’s steel manufacturing capabilities.

Diamond Exploration: NMDC’s foray into diamond exploration showcases its commitment to uncovering India’s diverse mineral wealth, positioning the nation as a potential hub for precious gems.

Social Responsibility: Beyond minerals, NMDC is deeply committed to the well-being of local communities and environmental preservation. Its sustainable practices ensure a balance between industrial growth and societal harmony.

Innovation and Expansion: NMDC’s emphasis on technological innovation enhances its operational efficiency and environmental responsibility. The company’s expansion projects underscore its commitment to meeting India’s burgeoning mineral demands.

Global Aspirations: While rooted in India, NMDC’s aspirations are global. Its pursuit of international opportunities solidifies its role as a key player in the global mineral sector.

Towards a Bright Future: NMDC’s unwavering dedication to responsible mining, innovation, and economic growth exemplifies its pivotal role in propelling India’s mineral sector forward. With a legacy of excellence, NMDC remains focused on creating value for the nation and fostering sustainable development through its mineral exploration and production endeavors.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

No Comments