Why this EV Stock is Having a Great Growth Potential?

Imagine you’re driving your dream car, with all its fancy features and smooth ride. Ever wondered how all those buttons, lights, and systems are connected and work together seamlessly?

Well, that’s where Motherson Sumi Wiring India Limited (MSWIL) comes into the picture!

MSWIL is like the superhero behind the scenes, creating wiring harnesses that bring life to your car.

But what is a wiring harness?

A wiring harness is like a bundle of electrical wires that are grouped together. It connects different electrical parts, like lights or switches in a vehicle. It helps the electricity flow smoothly and keeps everything organized and protected.

Using the latest and greatest technologies, MSWIL makes sure all the important electrical connections in your car are perfectly set up. They work closely with car manufacturers, making customized wires that fit each car’s specific needs.

The Company is making a buzz in the market about its exciting growth plans and working model, which makes it a strong candidate for future growth and potential. To learn more about stock market basics and stock analysis one can consider enrolling in our Stock Market Learning Courses, here.

Market leader :

Supplying to 10 out of 12 top-selling passenger vehicle models in India.

Supplying 2 out of the top 3 electric vehicles PV OEMs in India.

Supplying 2 out of the top 5 electric vehicles and 2W OEMs in India.

Key Customers Include :

-Toyota

-Maruti Suzuki

-TATA Motors

-Ashok Leyland

-Yamaha

Strong Partners :

MSWIL has some powerful supporters behind it, like Samvardhana Motherson International Ltd. (SAMIL) and Sumitomo Wiring Systems Ltd (SWS). These companies own more than 50% portion of MSWIL’s shares.

SWS is a global leader in the field of wiring harnesses and has extensive expertise and knowledge in this area. By being associated with SWS, MSWIL gains access to valuable insights, advanced technologies, and research and development capabilities. This means MSWIL can leverage the best practices and innovative solutions that SWS has developed on a global scale.

SAMIL, on the other hand, provides strong support and partnership to MSWIL. This support enhances MSWIL’s capabilities and helps them navigate challenges effectively.

Offers customized wiring solutions for vehicles :

MSWIL doesn’t just focus on one type of vehicle, they actually make wiring harnesses for many different kinds of vehicles. This includes

-Cars,

-Bikes,

-Three-wheelers,

-Recreational vehicles (like campers and trailers),

-Trucks,

-And Even multi-purpose vehicles.

MSWIL doesn’t just provide the wiring harnesses themselves, they offer a complete package. They take care of everything from designing the products to supplying them directly to the production line. This means they make sure everything works together perfectly and gives reliable performance.

MSWIL works closely with car and vehicle manufacturers to understand what each type of vehicle needs. They know that different vehicles have different requirements, so they create customized wiring solutions to meet those needs.

Adapting to the Dynamic Indian Market :

MSWIL understands the Indian automotive industry and puts a lot of effort into absorbing its unique needs. They know that what works in other countries may not work as well in India, so they pay special attention to the preferences and requirements of the Indian market.

To meet these specific needs, MSWIL focuses on developing its products and processes. They don’t just offer generic solutions, they create wiring harnesses that are tailor-made for the Indian market. This means their products are designed to work perfectly and give the best performance in Indian vehicles.

MSWIL doesn’t work alone in this. They work closely with the automotive Original Equipment Manufacturers (OEMs), the big companies that make cars and vehicles. Together, they come up with solutions that are reliable, efficient, and cost-effective. They know that the Indian market is always changing and evolving, so they make sure their products align with the latest trends and demands.

Commitment to Innovation and Industry Adaptation :

MSWIL knows that the automotive industry is changing, especially with a greater focus on electric vehicles and advanced technologies.

To stay ahead of the game, MSWIL has prepared itself by offering special wiring harness solutions and high-voltage solutions specifically designed for electric and alternative powertrain vehicles. They understand that these vehicles have different electrical requirements, and they want to make sure everything works perfectly for them.

MSWIL’s commitment to innovation and adaptation is what keeps them on top. They are always thinking ahead and making sure they can meet the evolving needs of the industry.

Diverse Facilities for Production and Innovation :

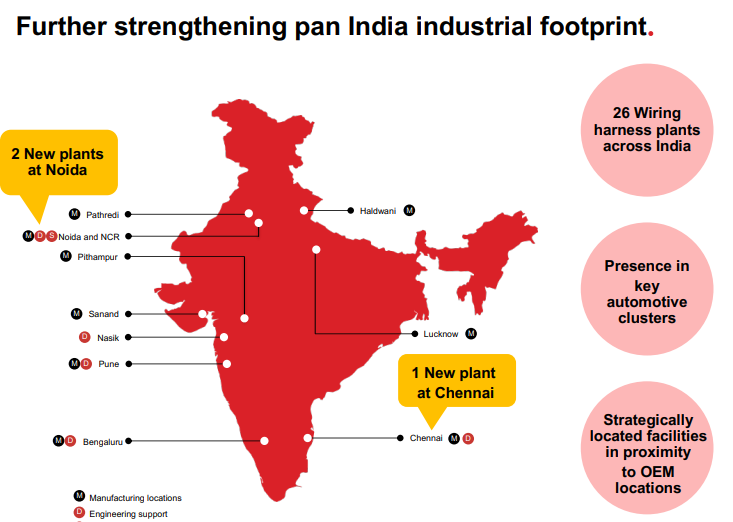

MSWIL has been set up in 23 different places in India.

They have different types of facilities like

Factories -where they make their products,

Places- where they assemble everything,

And technical centers – where they work on new ideas and technologies.

These facilities are strategically placed near the places where cars and vehicles are made by big automotive companies. This helps MSWIL work efficiently and serve its customers better.

Fundamentals of the company :

- Market Cap ₹ 25,023 Cr.

- Current Price ₹ 56.6

- High / Low ₹ 71.2 / 45.2

- Stock P/E 51.4

- Face Value₹ 1.00

- Dividend Yield 1.07 %

- Industry PE 28.4

- Return over 1year13.4 %

Shareholding Pattern

- Promoter holding 61.7 %

- Change in Prom Hold0.00 %

- FII holding 9.92 %

- Chg in FII Hold-1.11 %

- DII holding 18.9 %

- Chg in DII Hold0.68 %

- Public holding 9.32 %

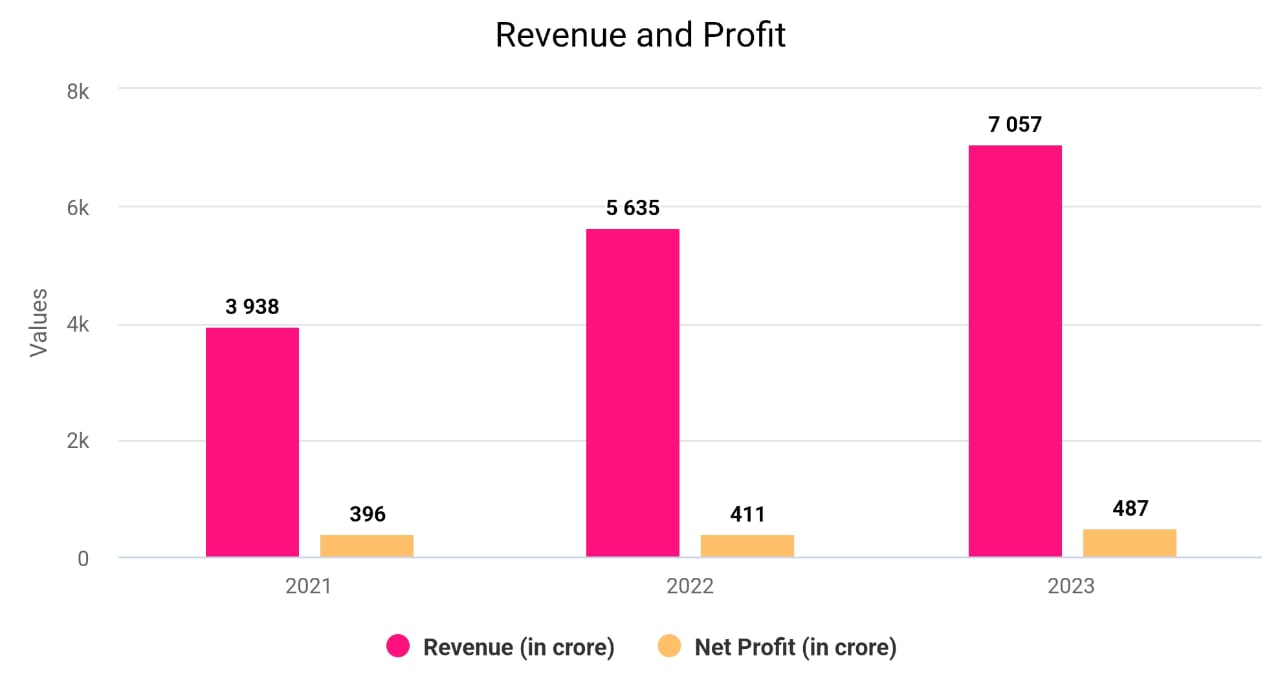

Financials

- ROCE 43.9 %

- ROE 39.8 %

- OPM 11.1 %

- Debt ₹ 373 Cr.

- Debt to equity 0.28

- Int Coverage 24.4

- Qtr Profit Var 82.2 %

- Qtr Sales Var 12.2 %

- Free Cash Flow ₹ 25.9 Cr.

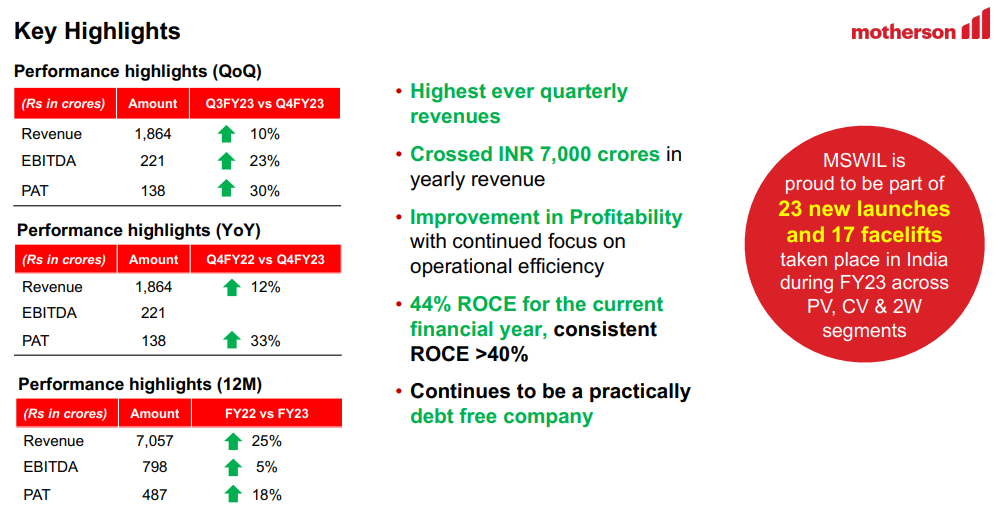

Working Capital and Cost Improvement:

-Working capital levels are relatively high, but there is scope for improvement.

-Teams are working hard to improve efficiencies on the inventory side.

-Significant improvement in the cost side of the business.

-EBITDA margin has improved on a sequential basis.

Ambitious Goals for the Future :

MSWIL has set ambitious goals for the future. By the year 2025,

-They aim to achieve a Return on Capital Employed (ROCE) of 40%, which means making the most out of their investments and generating good profits.

-They also have a target to generate a top-line revenue of USD 36 billion through their sales and services.

-While the automotive industry remains their primary focus, MSWIL plans to explore new divisions to diversify their business for 25% of total revenues.

-They also plan to share their success by distributing up to 40% of their consolidated profit as dividends to reward their stakeholders.

To achieve these goals, MSWIL focuses on various aspects of its operations. They pay attention to working capital deployment, which means using their money wisely to run their business smoothly. They also focus on inventory management to ensure they have the right amount of materials and products without waste.

MSWIL is committed to reducing scrap in its manufacturing process, aiming to minimize waste or mistakes during the production of wiring harnesses.

Challenges of the company :

MSWIL operates in a world where things can change quickly, and they face different challenges. Some of these challenges include

-Changes in the prices of raw materials,

-Shortages of electronic chips,

-Increases in energy costs.

The MSWIL Strategy:

These factors can affect MSWIL’s business, but they have strategies in place to deal with them.

To learn more about in-depth stock analysis like this, one can consider enrolling in our Stock Market Learning Courses, here.

-Changes in the prices of raw materials,

When the prices of raw materials go up, MSWIL makes sure that the increased costs are appropriately managed. They have arrangements in place to pass on any cost increases to their customers. This helps them maintain stability in their operations and continue providing their products and services.

-Shortages of electronic chips,

The shortage of electronic chips is another challenge that MSWIL faces. These chips are important components used in various electronic devices, including vehicles. To mitigate the impact of chip shortages, MSWIL works closely with its suppliers and customers. They maintain strong relationships and collaborate to find solutions that minimize disruptions to their operations.

-Increases in energy costs.

Energy costs can also increase over time, affecting MSWIL’s operations. However, they have measures in place to manage these costs effectively. They may explore energy-saving initiatives, implement efficient processes, or negotiate favorable agreements with energy providers.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“2 Midcap Stocks suggested by Research Analysts that can give Potential Returns in 1-2 years ” Given the optimistic sentiment prevailing in the market, investors are actively seeking stocks that are outperforming the overall market performance….Read More

——————-

“Driving Growth – A Fundamentally Strong Small Cap Company” A key player in the chemical industry , showcasing growth. Here is the reason why…Read More

——————-

“ 3 High Dividend Stocks – Consistently Paying High Dividend Up to 25% with Potential Returns Read More

——————-

“Fundamentally Strong Midcap IT Stock ” A Leader in Cloud Communication and Blockchain Solutions, If you are looking for a company that is in…….Read More