23 Jun 3 High Dividend Paying Stocks – Up to 25%

3 Stocks – Consistently Paying High Dividends and Potential Returns

Investing in stocks can be an excellent way to grow your wealth over time.

While many investors focus on buying stocks that might increase in value, there’s another strategy worth considering: dividend stocks.

Dividend stocks offer a unique advantage by providing a steady stream of income in addition to potential capital appreciation.

In this blog, we’ll explore the world of dividend stocks and why they can be an attractive investment option, especially for those seeking regular income. Whether you’re a seasoned investor or just starting your investment journey, understanding the basics of dividend stocks can help you make informed decisions and potentially build a more stable financial future.

Also Read:Why This Smallcap Auto stock Rallied 44%?

What are Dividend Stocks?

Dividend stocks are shares of companies that distribute a portion of their earnings back to their shareholders.

These distributions, called dividends, are usually paid out quarterly, although some companies may choose to pay them annually or on a different schedule.

Dividends are typically a portion of the company’s profits and are paid in cash or additional shares of stock.

The Benefits of Investing in Dividend Stocks:

Regular Income:

One of the most significant advantages of dividend stocks is the consistent income they can provide. By investing in companies with a history of paying dividends, investors can receive regular payments, which can be particularly appealing for those seeking a steady income stream or looking to supplement their existing earnings.

Potential Growth and Stability:

Dividend-paying companies are often well-established and financially stable. These companies tend to have a track record of generating consistent profits and may offer more reliable returns compared to non-dividend-paying stocks. Dividend stocks can be an attractive option for investors looking for a balance of potential capital appreciation and income stability.

Compounding Effect:

Reinvesting dividends can have a powerful compounding effect on your investment over time. By reinvesting the dividends received, you can purchase additional shares, which, in turn, generate more dividends. This compounding effect can accelerate the growth of your investment portfolio, especially when reinvested dividends themselves start generating additional income. To learn more about stock market basics and stock analysis one can consider enrolling in our Stock Market Learning Courses, here.

Investing in dividend stocks offers an opportunity to earn regular income while potentially benefiting from long-term capital appreciation. However, like any investment, it’s crucial to conduct thorough research, evaluate the financial health of the companies, and consider your investment goals and risk tolerance.

Here is a list of stocks that have given higher dividends and potential returns over the last one year

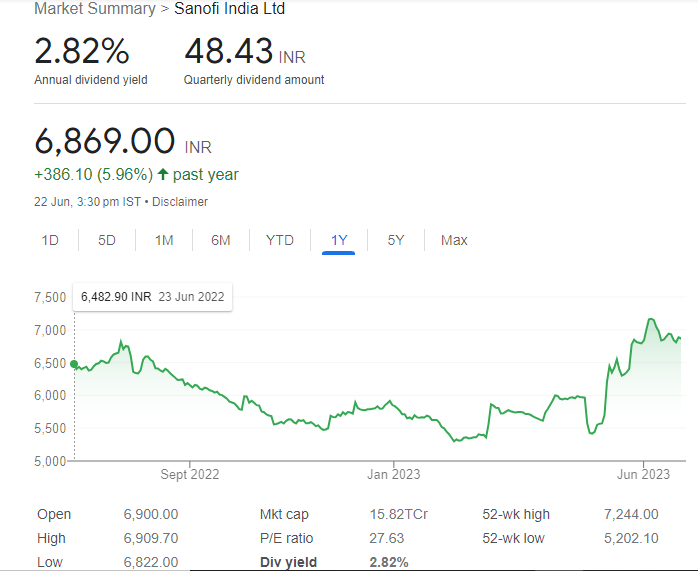

Company Information: Sanofi India Ltd

Sanofi India is a subsidiary of Sanofi, a global pharmaceutical company headquartered in France. Over the years, Sanofi India has expanded its presence and diversified its product portfolio to cater to various therapeutic areas.

-Sanofi India was established in 1956 and has since been a prominent player in the Indian pharmaceutical industry.

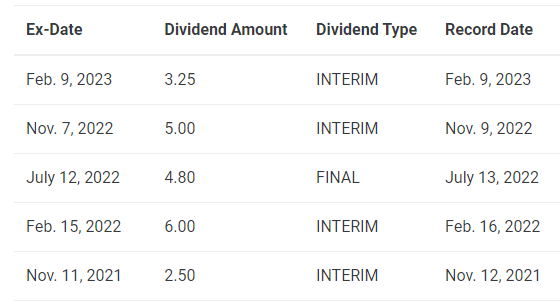

Dividend history for Sanofi India

Sanofi India Ltd. has declared 48 dividends since May 17, 2001.

In the past 12 months, Sanofi India Ltd. has declared an equity dividend amounting to Rs 570.00 per share.

At the current share price of Rs 6843.85, this results in a dividend yield of 8.33% from June 2022 to till date.

Business and Product Description:

Sanofi India operates in the Indian pharmaceutical market and focuses on providing healthcare solutions to improve people’s lives. The company is committed to delivering high-quality and affordable medicines, vaccines, and healthcare products.

Pharmaceuticals:

Sanofi India develops, manufactures, and markets a wide range of prescription drugs for various therapeutic areas.

The company’s pharmaceutical portfolio includes medications for

-Cardiovascular diseases, diabetes, central nervous system disorders, oncology, and other medical conditions.

Vaccines:

Sanofi India is dedicated to promoting public health through the development, production, and distribution of vaccines.

The company offers a range of vaccines for the prevention of infectious diseases, including vaccines for diseases such as

-Influenza, polio, pertussis, hepatitis, and meningitis.

Consumer Healthcare:

Sanofi India also provides a diverse portfolio of over-the-counter (OTC) consumer healthcare products.

These products are available without a prescription and are designed to address common health and wellness needs.

The consumer healthcare portfolio includes

-Nutritional supplements, pain relief medications, cough and cold remedies, gastrointestinal products, and skincare products.

Manufacturing Facilities:

Sanofi India has state-of-the-art manufacturing facilities that adhere to stringent quality standards and regulatory requirements.

These facilities produce a wide range of pharmaceutical products, including

-Tablets, capsules, injections, and vaccines.

Sanofi India’s manufacturing processes prioritize quality, safety, and efficiency to ensure a reliable supply of medicines and healthcare products.

Company Information: REC Ltd

REC Ltd (Rural Electrification Corporation Limited) is a government-owned public sector undertaking (PSU) in India. It primarily operates in the power sector and focuses on financing and promoting rural electrification projects in the country.

-REC Ltd was established in 1969 and is headquartered in New Delhi, India.

-It is a Navratna company, which is a status granted to top-performing PSUs in India.

Dividend history for REC Ltd.

REC Ltd. has declared 32 dividends since Sept. 8, 2008.

In the past 12 months, REC Ltd. has declared an equity dividend amounting to Rs 13.05 per share.

At the current share price of Rs 159.05, this results in a dividend yield of 8.20%. Adjusting for Bonus/Splits the dividend yield is 7.45% from June 2022 to till date.

Business and Product Description:

REC Ltd (Rural Electrification Corporation Limited) primarily operates in the power sector and focuses on financing and promoting rural electrification projects in India. While REC Ltd is primarily involved in financing and supporting power projects, it does not directly manufacture or offer specific products. However, here are the key areas of its business operations:

Financing Services:

REC Ltd provides financial assistance to power sector projects, including

-Thermal power plants, hydroelectric projects, renewable energy projects, transmission lines, and distribution infrastructure.

The company offers

-Loans, debt refinancing, bridge financing, and other financial instruments to support the development and expansion of power projects.

Rural Electrification:

REC Ltd’s primary focus is on promoting and facilitating rural electrification in India.

The company provides financial support to

-State electricity boards, utilities, and other entities for electrification projects in rural areas.

Renewable Energy Projects:

The company provides financial assistance and technical support to projects involving

-Solar power, wind power, biomass, and small hydroelectric power generation.

Transmission and Distribution Infrastructure:

The company provides financial assistance for

-The construction and upgrade of transmission lines, substation infrastructure, and distribution networks.

It aims to enhance the efficiency and reliability of power transmission and distribution across the country.

Government Initiatives and Programs:

REC Ltd actively participates in and supports various government initiatives and programs related to the power sector.

It collaborates with the government to implement schemes such as the Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY) and the Integrated Power Development Scheme (IPDS).

These initiatives focus on improving rural electrification infrastructure, reducing power distribution losses, and promoting energy efficiency.

Company Information: Hindustan Zinc Limited

Hindustan Zinc Limited, a subsidiary of Vedanta Limited, is one of the world’s largest integrated producers of zinc and lead.

-The company was incorporated in 1966 and is headquartered in Udaipur, Rajasthan, India.

-Hindustan Zinc plays a crucial role in the development and exploration of zinc, lead, and silver resources in India.

Dividend history for Hindustan Zinc Ltd.

Hindustan Zinc Ltd. has declared 39 dividends since June 28, 2001.

In the past 12 months, Hindustan Zinc Ltd. has declared an equity dividend amounting to Rs 75.50 per share.

At the current share price of Rs 310.70, this results in a dividend yield of 24.30% from June 2022 to till date.

Business and Product Description:

Hindustan Zinc’s core business involves mining operations, which include

-Exploration, extraction, and processing of zinc, lead, and silver ores.

The company operates several mines in Rajasthan, India, known for their significant zinc-lead-silver deposits.

Smelting and Refining:

Hindustan Zinc has integrated smelting and refining facilities where mined ores are processed and refined into metal products.

The company operates smelters in Rajasthan, including Chanderiya and Dariba smelters, to convert the extracted ores into high-quality zinc, lead, and silver products.

Zinc Products:

Hindustan Zinc produces a variety of zinc products, including:

–Special High-Grade Zinc (SHG Zinc): High-purity zinc metal that meets stringent quality standards. It is used in industries such as automotive, construction, and infrastructure.

–Zinc Alloy Ingots: Zinc alloys with specific compositions and properties tailored for different applications, including die-casting, galvanizing, and manufacturing of various products.

–Continuous Galvanized Rebars (TMT bars): Zinc-coated rebars used in construction to enhance durability and corrosion resistance.

Lead Products:

Hindustan Zinc offers a range of lead products, including:

-Refined Lead Ingots: High-quality lead ingots used in diverse industries such as batteries, cables, ammunition, and construction.

-Lead Alloys: Customized lead alloys with specific compositions to meet the requirements of different applications.

Silver Products:

Hindustan Zinc is a significant producer of silver and offers various silver products, including:

-Silver Bars: Refined silver in the form of bars, which are used in industrial applications, investment, and jewelry manufacturing.

-Silver Granules: Small-sized granules of refined silver that find applications in specialized industries like electronics and chemical catalysts.

Mining Services:

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“Fundamentally Strong Midcap IT Stock ” A Leader in Cloud Communication and Blockchain Solutions, If you are looking for a company that is in…….Read More

——————-

“2 Midcap Stocks suggested by Research Analysts that can give Potential Returns in 1-2 years ” Given the optimistic sentiment prevailing in the market, investors are actively seeking stocks that are outperforming the overall market performance….Read More

No Comments