After a 136% increase in payment of home loan interest, will we see a fall in interest rate soon?

In a much-needed respite for borrowers, the new financial year FY 23-24 brings a glimmer of hope. During its second monetary policy meeting on June 8, the Reserve Bank of India (RBI) made a significant decision to keep the repo rate unchanged at 6.5%.

Also Read:These 6 banks offering more than 9% FD interest rates for senior citizens

This pause in repo rate hikes comes as a welcome relief for home loan borrowers who had been grappling with a rapid surge in interest rates from May 2022 to February 2023.

Home loan borrowers have experienced a significant increase in their Equated Monthly Installments (EMIs) due to a 2.5% rise in the repo rate over the past year.

For instance, if a home loan was taken at 7% for 20 years, extending the tenure to 30 years would result in a 136% increase in total interest paid, with the EMI also increasing to accommodate the impact of the repo rate hike, which raises the interest rate to 9.5%.To learn more about basics of Economic concepts and Stock market one can consider enrolling in our Stock Market Learning Courses, here.

So, What Should Existing Home Loan Borrowers Do?

What Should New Home Loan Borrowers Do?

Whether These Consecutive Pauses In Repo Rate Hikes Indicate The End Of The Current Rising Interest Rate Cycle?

Is This The Possibility Of Interest Rates Falling Soon?

Let’s find out the answers…

Impact of Rising Interest Rate Cycle:

The impact of the rising interest rate cycle has been significant, particularly for borrowers with loans linked to the repo rate. As the repo rate increased, their home loan interest rates also went up accordingly.

In response, lenders often extend the loan tenure to mitigate the impact.

However, there comes a point where further tenure increases become ineffective, leading lenders to raise EMIs.

For example,

A borrower with a 20-year loan of Rs 40 lakh at 7% would see their total interest payment rise from Rs 34.43 lakh to Rs 49.48 lakh due to a 2.5% rate increase.

Even with a tenure increase of 10 years, the EMI would rise by Rs 2,622, from Rs 31,012 to Rs 33,634.

In this scenario, the total interest outgo would increase from Rs 34.42 lakh to Rs 81.08 lakh, a massive rise of 136% when considering both the tenure and EMI increase.

To minimize the adverse impact of interest rate hikes, borrowers are advised to opt for an increase in EMIs rather than a tenure extension.

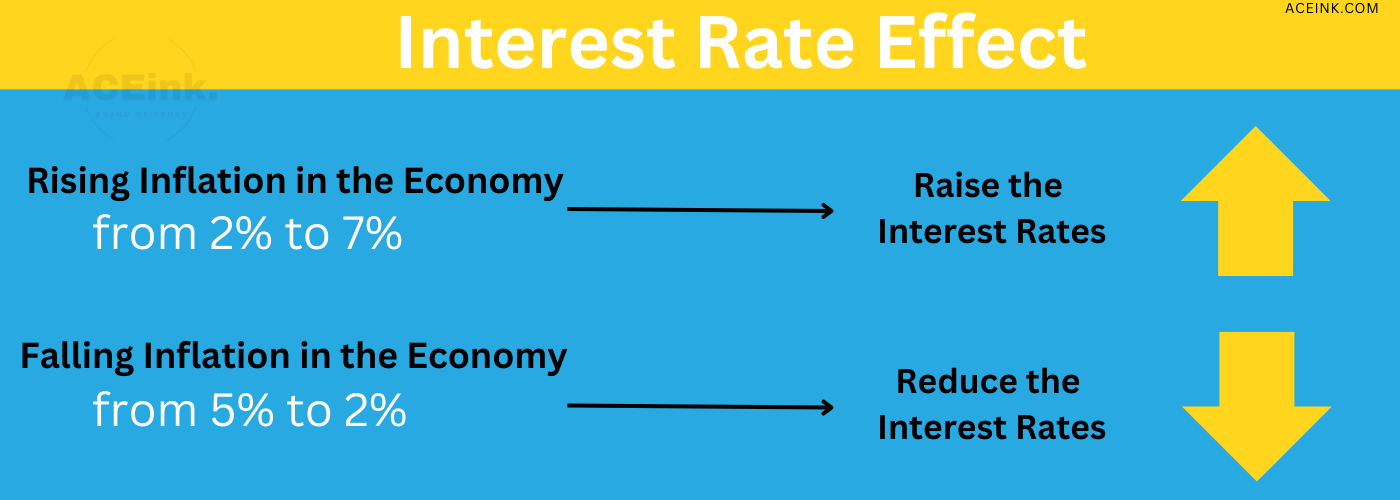

Possibility of Interest Rates Falling:

Regarding the future of interest rates, the RBI’s withdrawal of an accommodation stance suggests that the likelihood of a rate hike in the near future is highly unlikely. The direction of interest rates will depend on future inflation trends.

-The RBI’s primary responsibility is to maintain retail inflation in the range of 2-6%.

-Rising retail inflation due to supply chain disruptions influenced the interest rate hike cycle.

-Repo rate hikes helped bring inflation below 5% in April 2023, allowing for the pause in interest rate hikes.

-Factors such as falling crude oil prices, negative wholesale price index inflation, and declining 10-year G-sec yield indicate a potential easing of interest rates.

-The RBI’s projection for inflation in FY24 suggests a possible end to the rate hike cycle, making future rate cuts more likely.

-Favorable monsoon conditions and a positive global scenario could contribute to a rate cut in late 2023 or early 2024.

Experts suggest that while interest rate reductions may take some time, the chances of further rate hikes are low. The RBI’s projection for inflation in FY24 is lower than the previous forecast, indicating that the rate hike cycle may have reached its end.

Source ET

What Should Home Loan Borrowers Do?

As a home loan borrower, there are certain actions you can take to navigate the current interest rate environment and ensure you’re getting the best possible deal. Here are some steps to consider:

Evaluate your loan type:

If you’re an old borrower under previous regimes like the MCLR or base rate, now might be a good time to shift to the new External Benchmark Lending Rate (EBLR) regime. This transition can be advantageous as it allows you to quickly benefit from any future interest rate falls.

Stick to floating interest rates:

It’s advisable for home loan borrowers to stick with their floating interest-rate loans for now. While fixed-rate loans may be available at a discount, considering the expected rate cuts in the coming quarters, opting for floating-rate loans could be a more prudent choice.

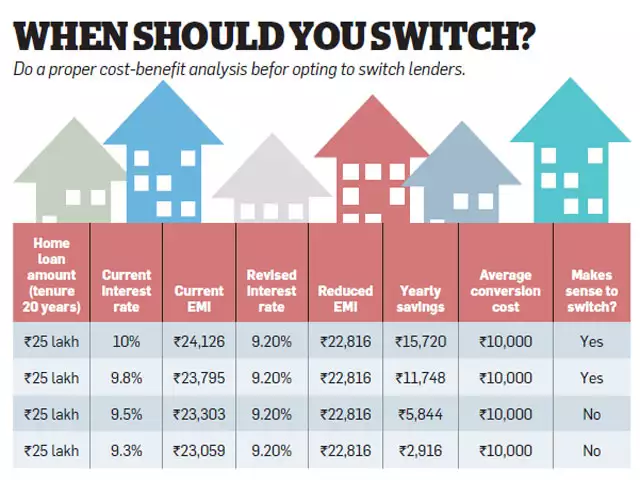

Compare and negotiate:

Compare your interest rate with offerings from other lenders. If you find a significantly lower interest rate for new borrowers, you may consider transferring your loan after calculating the net benefit. Negotiating with your current lender for a lower rate is also an option, albeit with possible repricing fees.

Research and credit score:

When selecting a new lender, thorough research and maintaining a good credit score can help you secure the best deal. Remember to consider the premium you pay over the repo rate, with prime borrowers typically enjoying lower premiums.

Repricing and restructuring:

If your lender provides a lower rate to new borrowers, you can request them to reprice your loan at the reduced rate. Keep in mind that repricing fees may apply, and your loan will be restructured accordingly.

Increase EMI or make prepayments:

your affordability has improved due to a salary raise or bonus, consider increasing your Equated Monthly Installment (EMI). This can help reduce your total interest outgo over the loan term. Additionally, if you have extra funds, partial prepayments can bring down your outstanding loan amount, subsequently reducing the tenure and overall interest costs.

Positive outlook for prospective buyers:

For those planning to purchase a house with a home loan, the current pause in interest rate hikes provides a more positive view of future rates. With rates already at elevated levels, this stability in lending rates benefits lenders, developers, and homebuyers alike.

First-time buyers and fence-sitters in the affordable and mid segments can have greater visibility of their EMIs, aiding their decision-making process.

By considering these steps and taking proactive measures, borrowers can navigate the current interest rate landscape and optimize their home loan experience.

Outlook for Future Interest Rates:

-Many advanced economies are struggling with low economic growth, and interest rate reductions may be employed to revive growth.

-Experts anticipate interest rate reductions starting globally by the year-end of 2023 or early 2024, depending on inflation trends.

-The RBI may follow suit if there are durable signs of inflation subsiding and a favorable monsoon.

-While interest rates may take time to fall, the chances of further rate hikes are highly unlikely.

Home loan borrowers may expect rates to decrease in the future, providing greater stability for their EMIs and buying decisions.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.