These 32 stocks are to turn ex-dividend this week including L&T, Ashok Leyland & Redington

Dividends are like little bonuses that you get for being a part-owner of a company.

When you buy shares of a company’s stock, you become a shareholder, which means you own a tiny piece of that company. And when that company makes a profit, it might decide to give some of that profit back to its shareholders as dividends.

Dividends are usually paid out regularly, like every three months or once a year. It’s like getting a little gift in your mailbox or bank account just for owning some shares of a company.

If you want to receive the dividend payment from a company, you need to buy the stock before a certain date called the ex-dividend date. This is important because it ensures that your name is on the company’s list of shareholders by the record date.

Also Read: Buy or Sell: Sumeet Bagadia’s 3 Stock Recommendations for This Week

If you buy the stock on or after the ex-dividend date, you won’t get the next dividend payment. So, make sure to buy the stock before that date if you want to receive the dividend. To learn more about stock market basics and stock analysis one can consider enrolling in our Stock Market Learning Courses, here.

There’s a list of stocks that will trade ex-dividend this week. If you want to receive the dividend for any of these stocks, make sure to buy them before their ex-dividend dates mentioned here.

Ex-dividend date – 03 July 2023

AXTEL INDUSTRIES LTD: Dividend Per Share: Rs.3.0

– Axtel Industries Ltd is a leading industrial solutions provider with a global presence.

– Axtel Industries specializes in manufacturing and supplying innovative equipment and technologies for diverse industries.

– Axtel Industries offers a wide range of cutting-edge products, including

-Machinery, automation solutions, and engineering services, to enhance operational efficiency and productivity

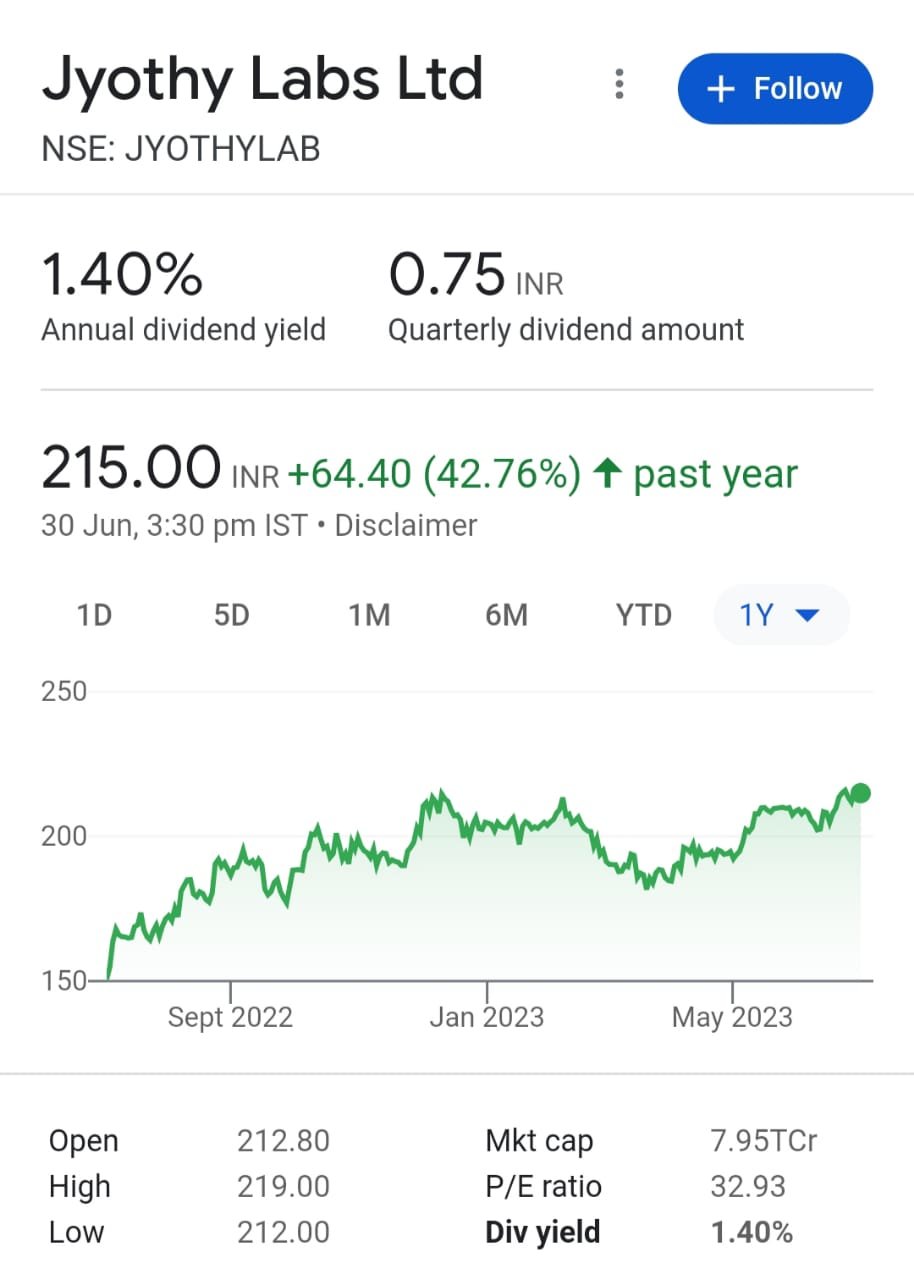

JYOTHY LABS LTD: Dividend Per Share: Rs.3.0

-Jyothy Labs Ltd is a renowned consumer goods company known for its high-quality products.

– Jyothy Labs operates in the FMCG sector, focusing on manufacturing and marketing a wide range of household and personal care products.

-Jyothy Labs offers a diverse portfolio of products, including cleaning agents, detergents, fabric care, personal hygiene, and air care products, catering to the needs of households and individuals.

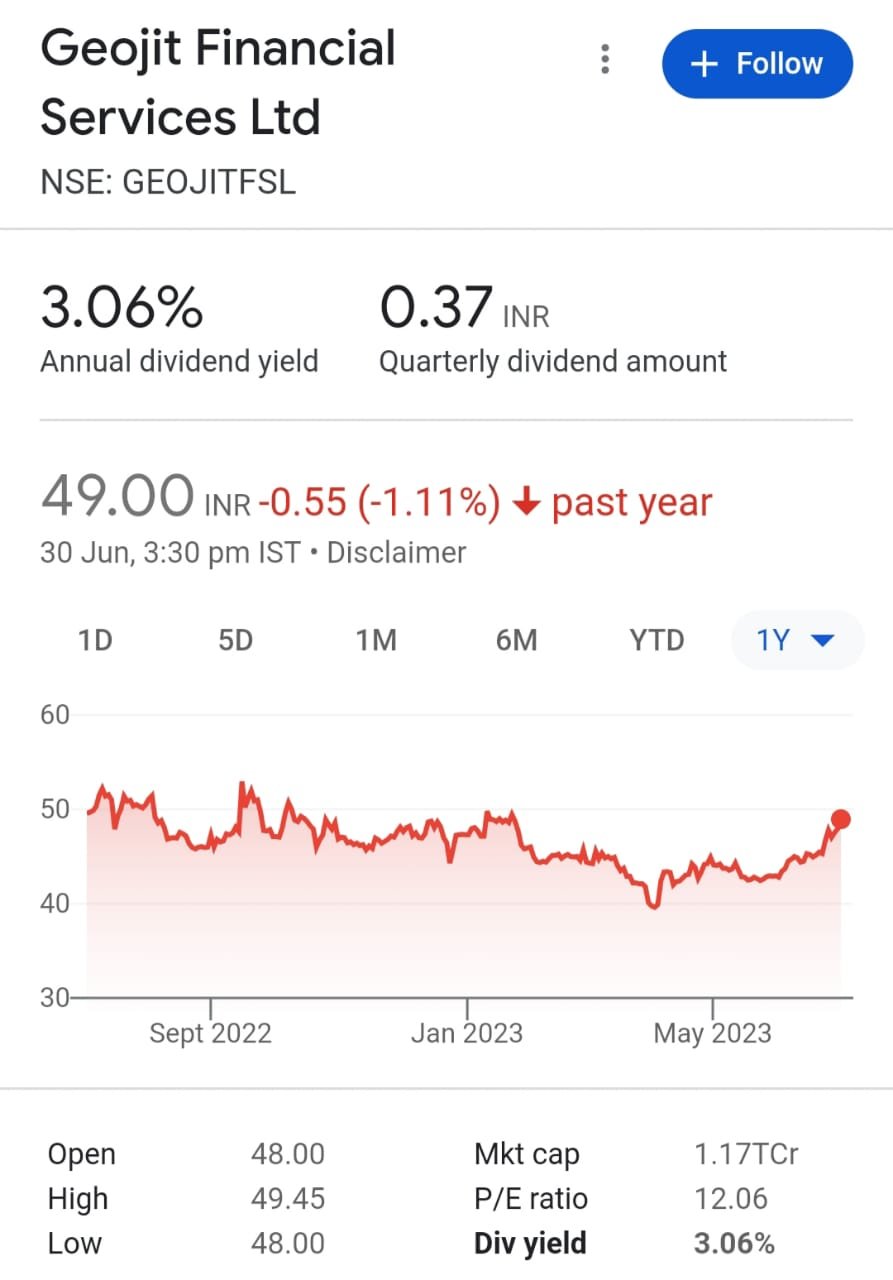

GEOJIT FINANCIAL SERVICES LTD: Dividend Per Share: Rs.1.50

-Geojit Financial Services Ltd. is a leading retail financial services company based in India.

-Geojit offers a wide range of investment and trading services, including stockbroking, mutual funds, insurance, and portfolio management.

-Geojit provides online trading platforms and personalized advisory services to help investors make informed decisions in the financial markets.

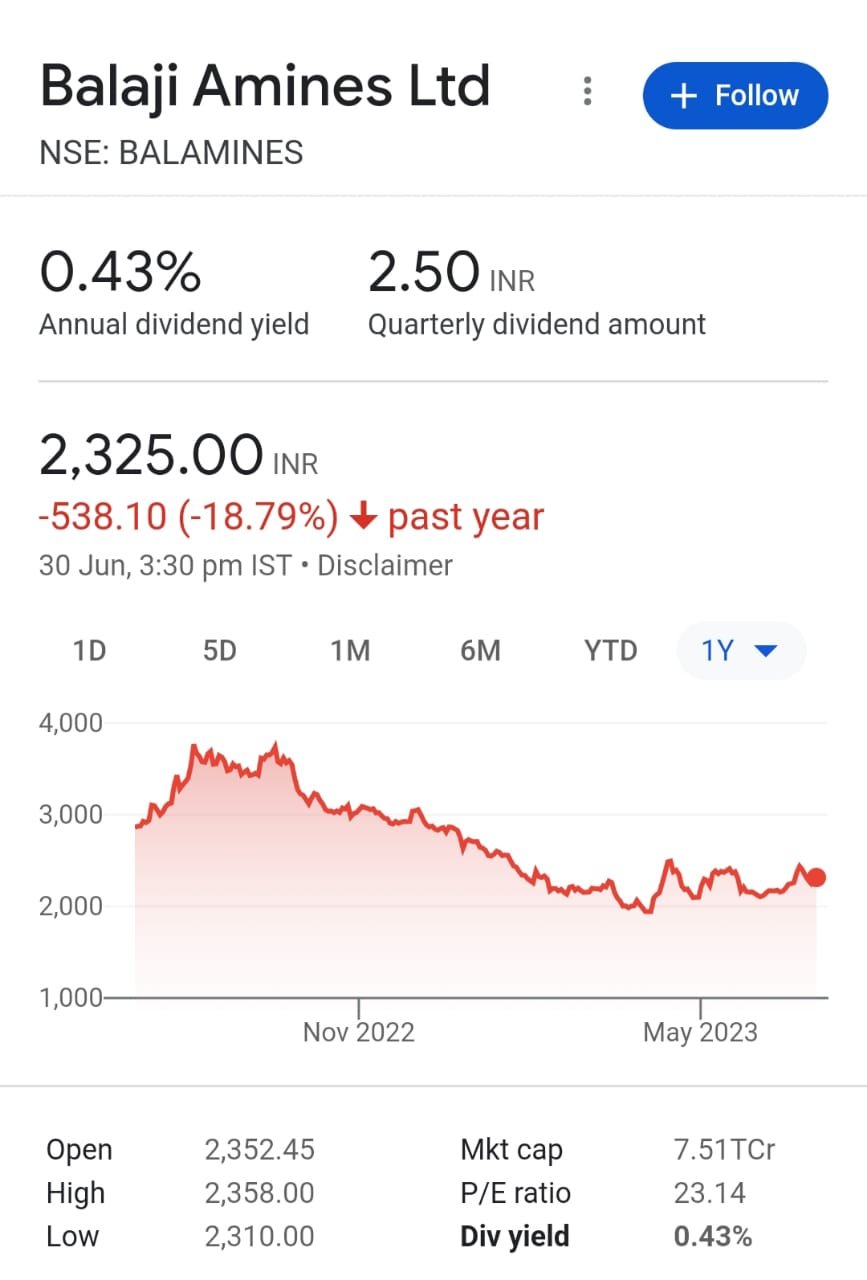

BALAJI AMINES LTD: Dividend Per Share: Rs.10.0

– Balaji Amines is a leading manufacturer of specialty chemicals, primarily focusing on amines and its derivatives.

-The company operates in multiple sectors, including pharmaceuticals, agrochemicals, and water treatment.

– Balaji Amines offers a wide range of products, including methylamines, ethylamines, specialty amines, and their derivatives.

Ex-dividend date – 04 July, 2023

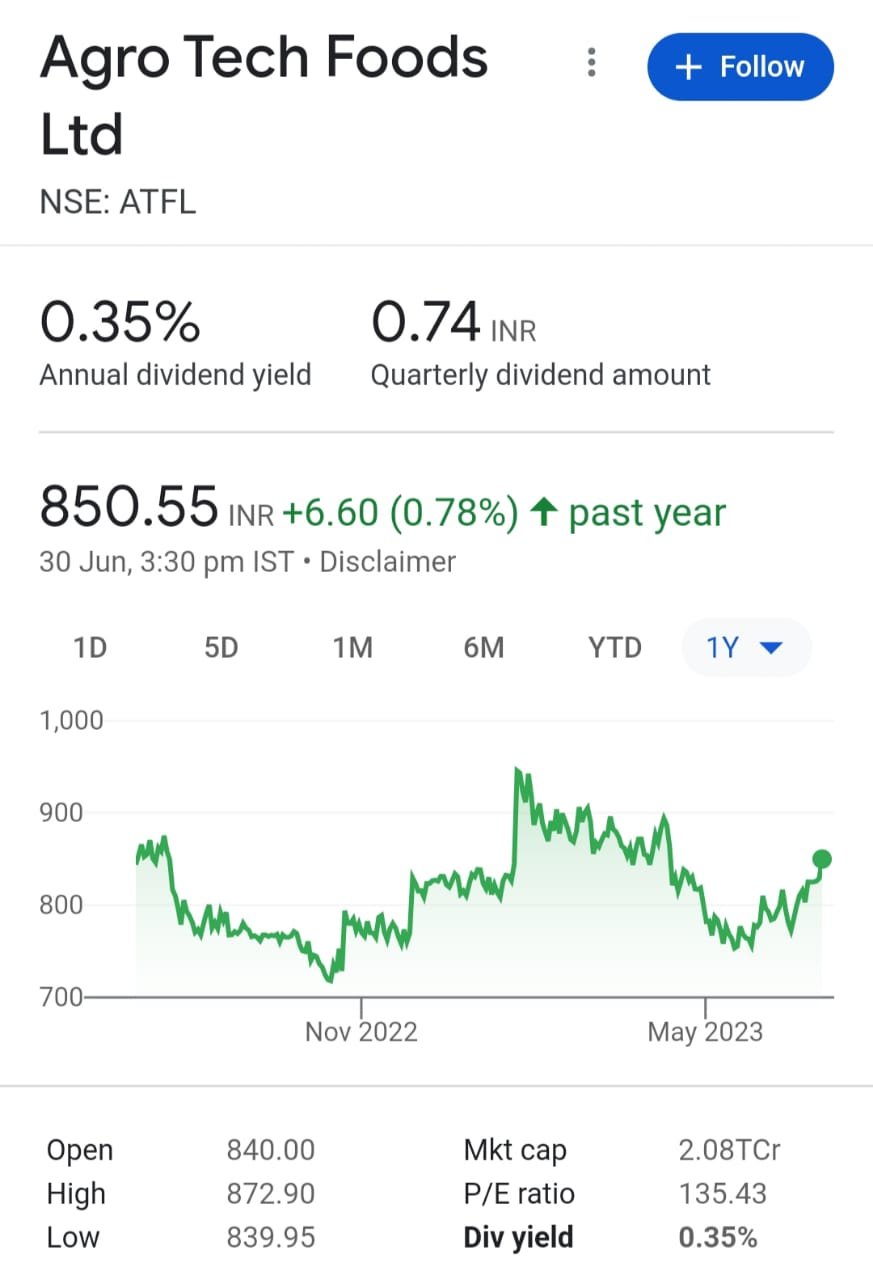

AGRO TECH FOODS LTD: Dividend Per Share: Rs.3.0

– Agro Tech Foods is a leading agro-food company operating in India.

-Agro Tech Foods specializes in manufacturing and marketing edible oils, spreads, and snacks.

– Their product range includes cooking oils, peanut butter, mayonnaise, and potato chips, catering to the diverse culinary needs of consumers.

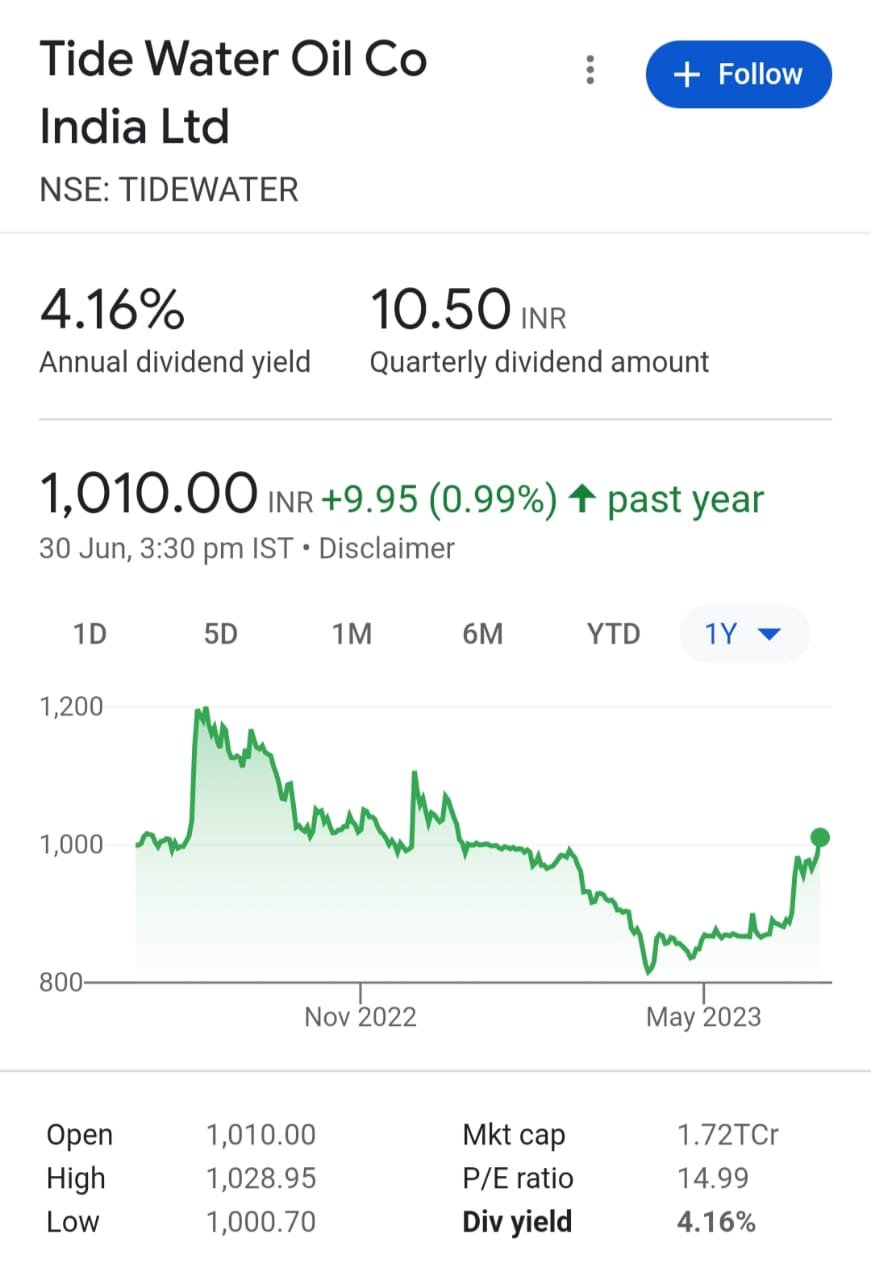

TIDE WATER OIL COMPANY INDIA LTD: Dividend Per Share: Rs.15.0

– Tide Water is a leading manufacturer and distributor of automotive and industrial lubricants.

– Tide Water operates globally, serving various industries including automotive, industrial, marine, and agriculture.

– Tide Water offers a wide range of high-quality lubricants for engines, gears, hydraulic systems, and more, catering to diverse customer needs.

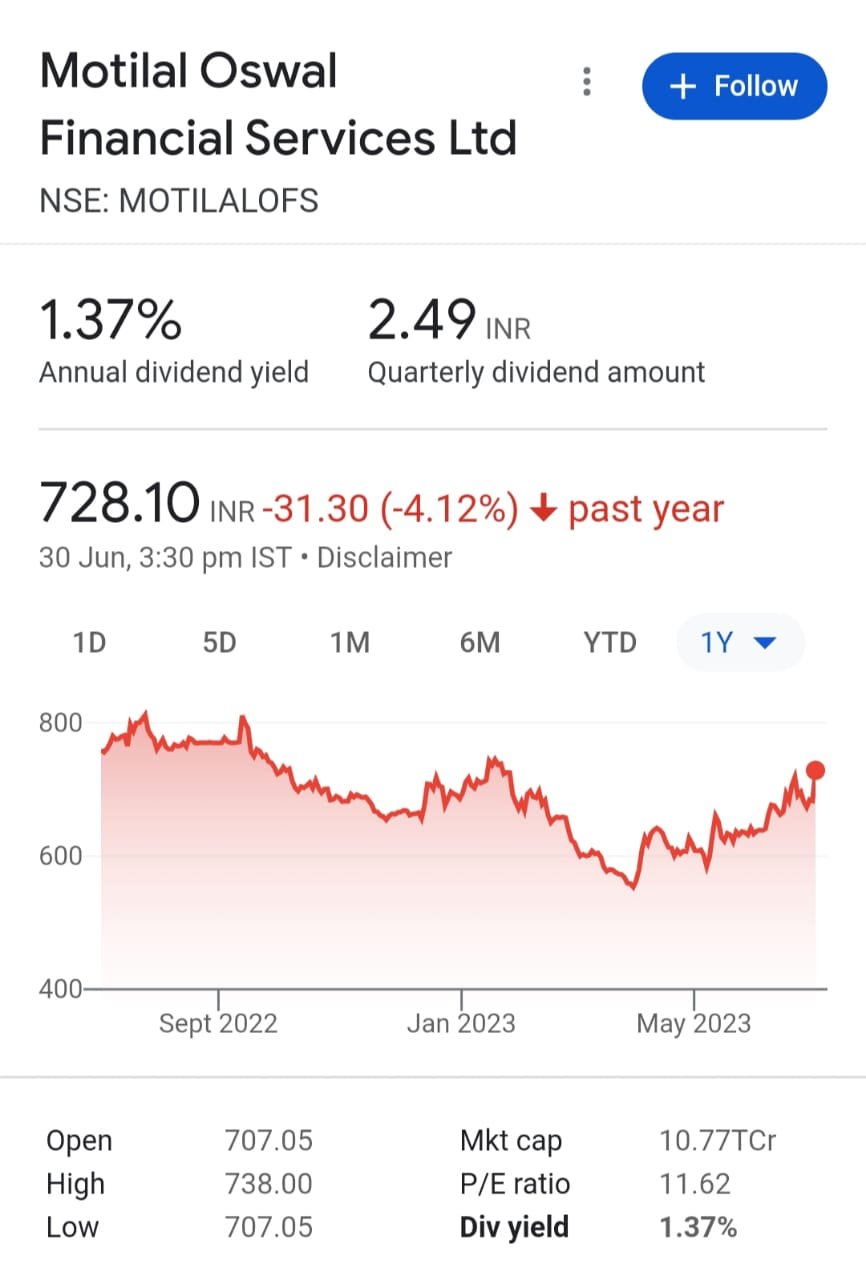

MOTILAL OSWAL FINANCIAL SERVICES LTD: Dividend Per Share: Rs.3.0

– Motilal Oswal is a leading Indian financial services company offering a range of investment and wealth management solutions.

– Motilal Oswal’s business includes brokerage, asset management, investment banking, and private equity.

– Motilal Oswal provides a diverse array of financial products such as equities, derivatives, mutual funds, commodities, and structured products.

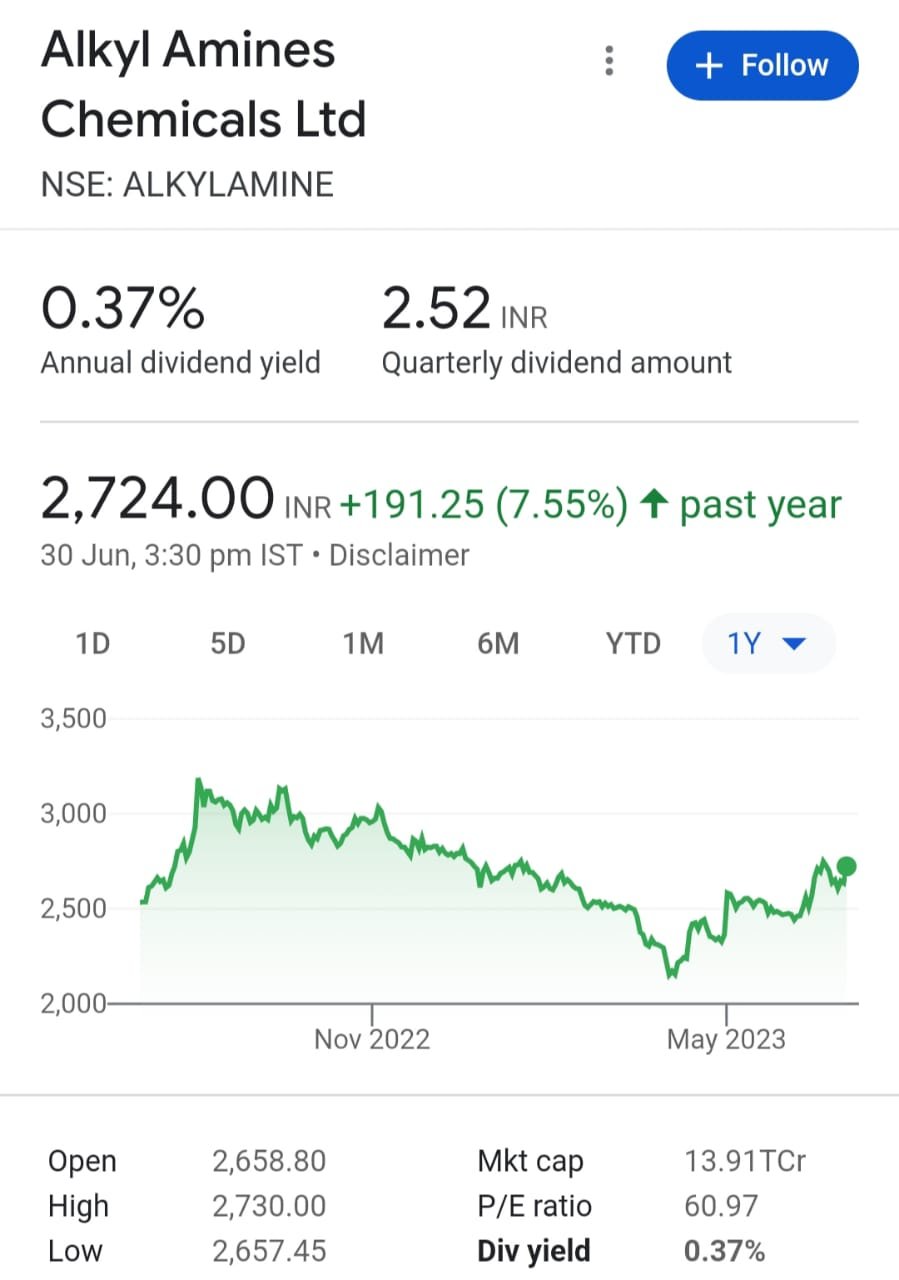

ALKYL AMINES CHEMICALS LTD: Dividend Per Share: Rs.10.0

-Alkyl Amines is a leading global manufacturer and supplier of specialty chemicals.

– Alkyl Amines specializes in the production and distribution of amines and amine-based chemical products.

– Alkyl Amines offers a wide range of high-quality amines for diverse applications including pharmaceuticals, agrochemicals, and water treatment.

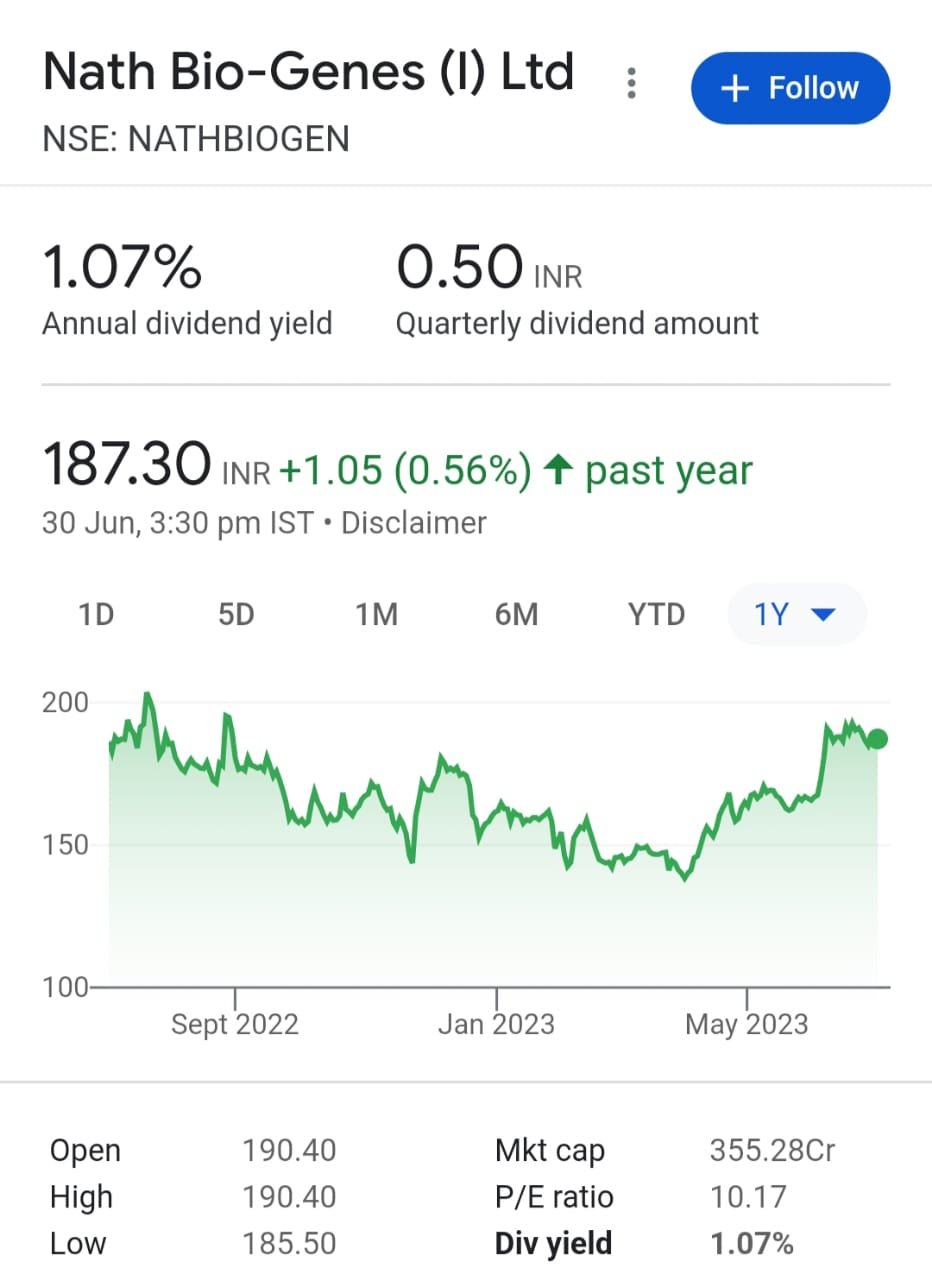

NATH BIO-GENES (INDIA) LTD: Dividend Per Share: Rs.2.0

-Nath Bio-Genes is a biotechnology company specializing in agricultural research and genetic solutions.

-Nath Bio-Genes focuses on developing high-quality seeds and advanced breeding technologies for improved crop productivity.

-Nath Bio-Genes offers a range of genetically enhanced seeds and innovative agricultural solutions to optimize farming outcomes.

Ex-dividend date – 05 July, 2023

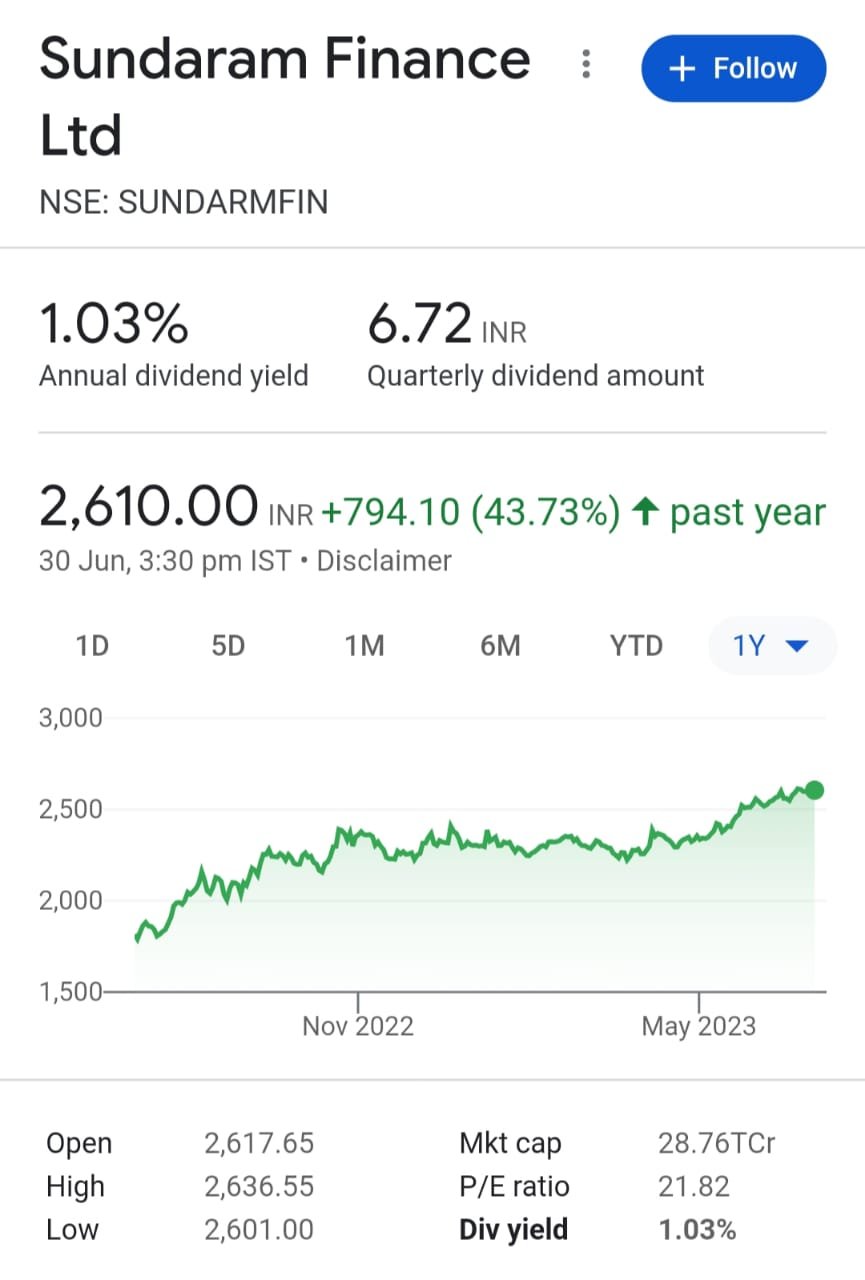

SUNDARAM FINANCE LTD: Dividend Per Share: Rs.15.0

– Sundaram Finance is a leading non-banking financial company (NBFC) in India.

– It provides a wide range of financial services, including vehicle financing, asset management, and insurance.

– Sundaram Finance offers comprehensive financial solutions for individuals and businesses, with a focus on vehicle loans and asset-based financing.

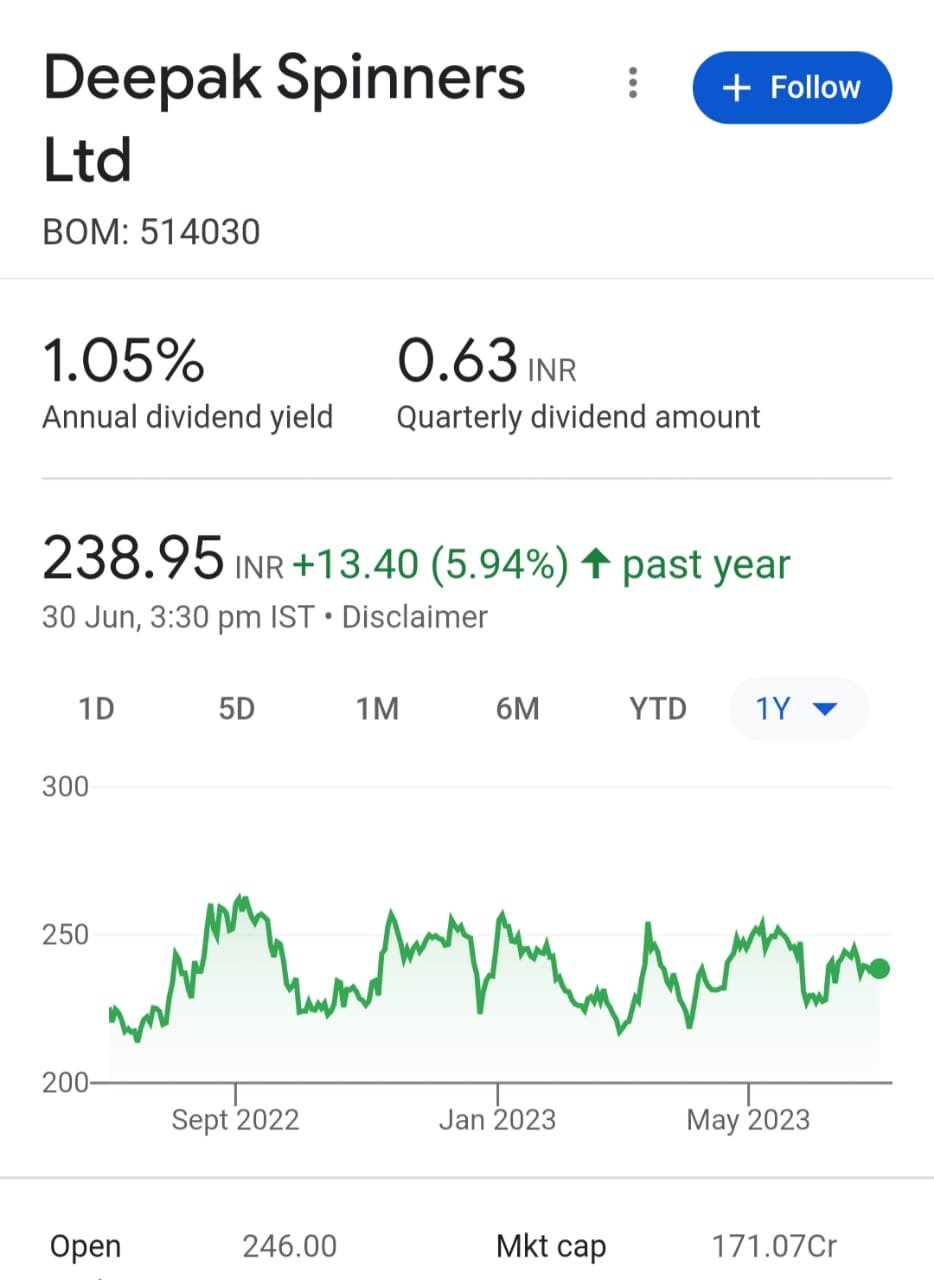

DEEPAK SPINNERS LTD: Dividend Per Share: Rs.2.50

– Deepak Spinners is a textile manufacturing company specializing in yarn production.

– Deepak Spinners operates globally, supplying high-quality yarn to various industries.

– Deepak Spinners offers a wide range of yarn products, including cotton, polyester, and blended yarns.

MPHASIS LTD: Dividend Per Share: Rs.50.0

– Mphasis is a global IT services and solutions provider.

– They specialize in application development, infrastructure management, and business process outsourcing.

– Mphasis offers a wide range of digital transformation solutions, including cloud services, analytics, and automation.

Ex-dividend date – 06 July, 2023:

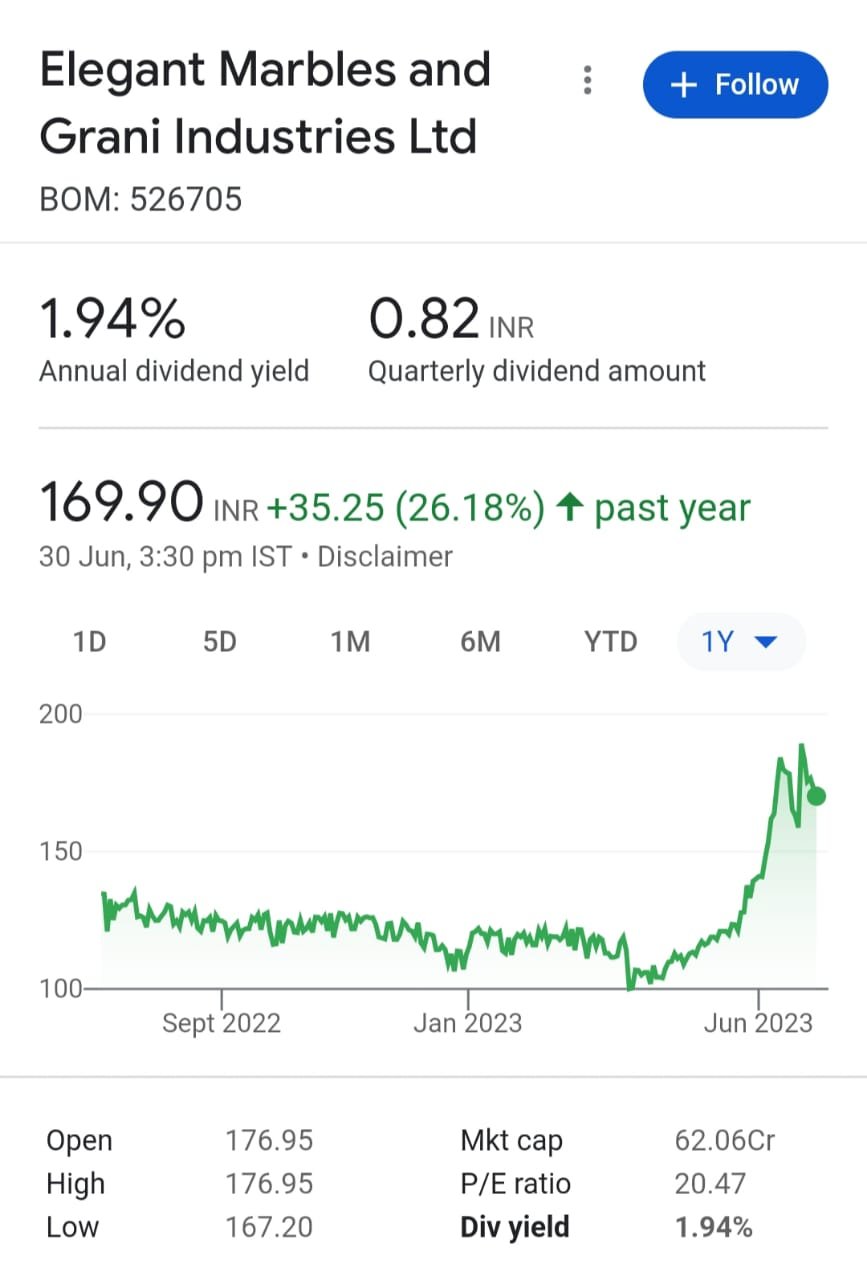

ELEGANT MARBLES & GRANI INDUSTRIES LTD: Dividend Per Share: Rs.3.30

-Elegant Marbles is a leading manufacturer and distributor of high-quality marble products.

-Elegant Marbles specializes in the production and supply of exquisite marble tiles, slabs, and custom designs.

-Elegant Marbles offers a wide range of luxurious marble products for residential and commercial applications, known for their exceptional craftsmanship and timeless beauty.

KALPATARU PROJECTS INTERNATIONAL LTD: Dividend Per Share: Rs.7.00

– Kalpataru Projects International Ltd is a global infrastructure development company.

– They specialize in construction, real estate, and civil engineering projects.

– They offer a wide range of residential, commercial, and industrial properties.

Ex-dividend date – 07 July, 2023:

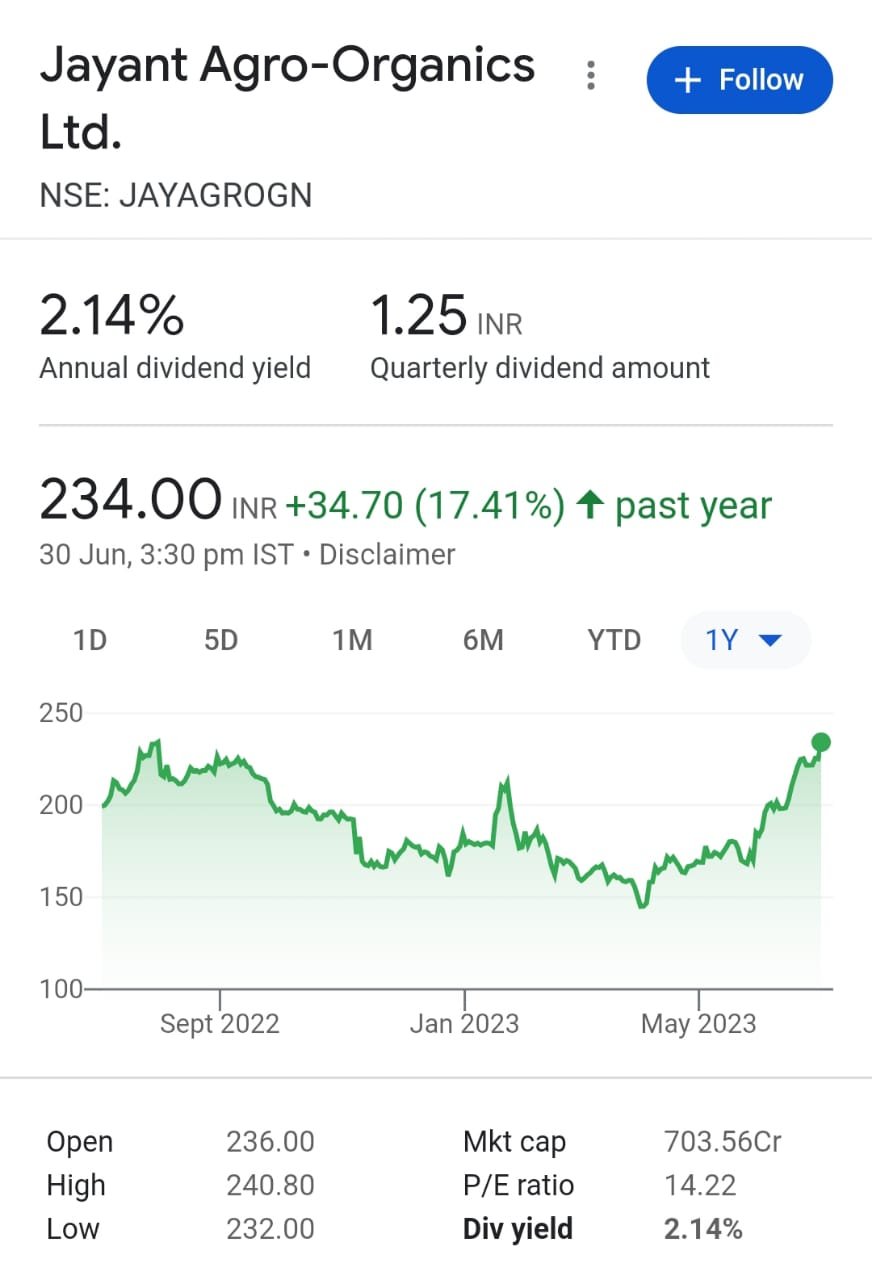

JAYANT AGRO ORGANICS LTD: Dividend Per Share: Rs.5.0

-Jayant Agro Organics Ltd is an Indian company engaged in the manufacturing and export of specialty oils and fats.

– The company focuses on producing eco-friendly and sustainable products for various industries such as food, personal care, and pharmaceuticals.

-Jayant Agro Organics offers a diverse range of products, including castor oil, castor derivatives, specialty chemicals, and renewable energy solutions.

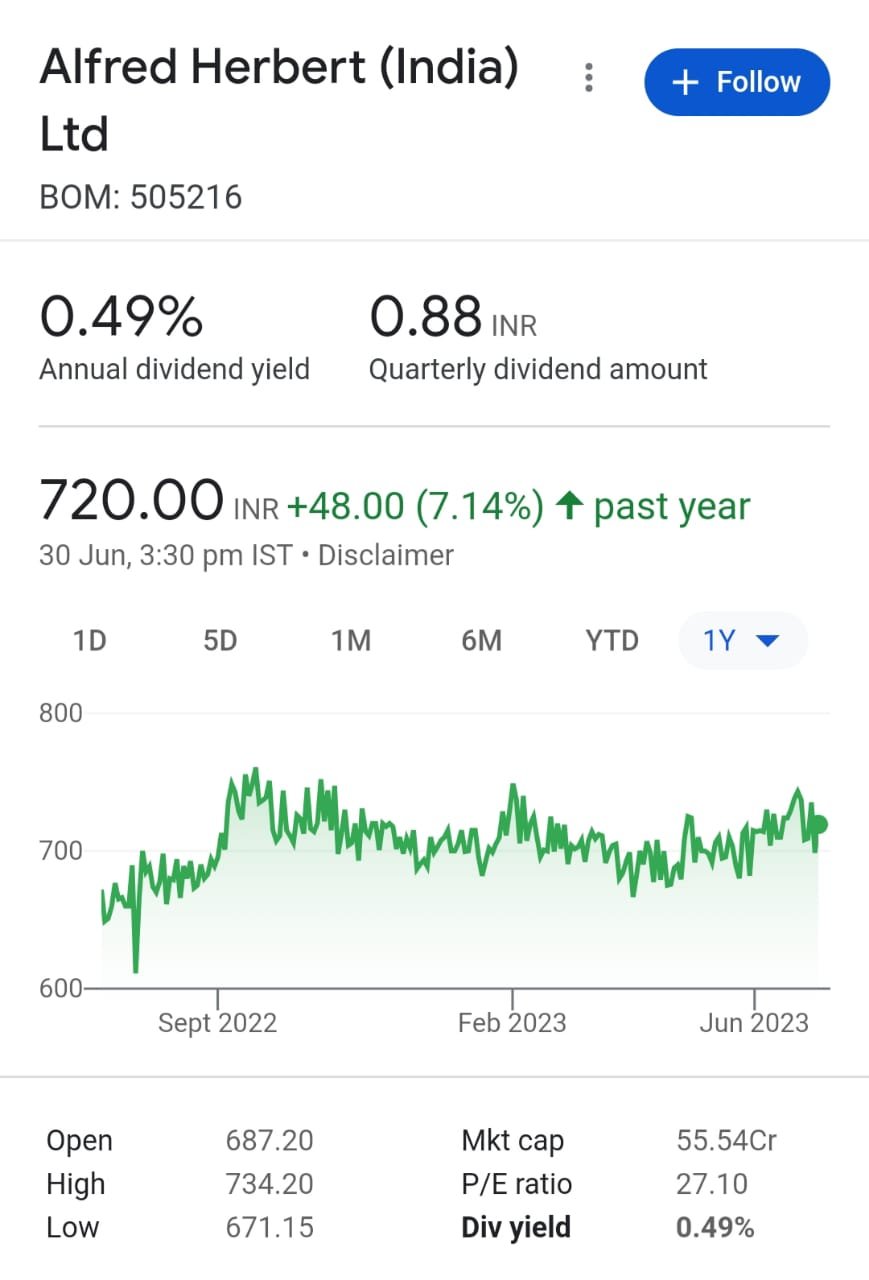

ALFRED HERBERT (INDIA) LTD: Dividend Per Share: Rs.3.50

– ALFRED HERBERT (INDIA) LTD is a manufacturing company based in India.

– They specialize in the production of machine tools and industrial machinery.

– Their products include lathes, milling machines, and other metalworking equipment.

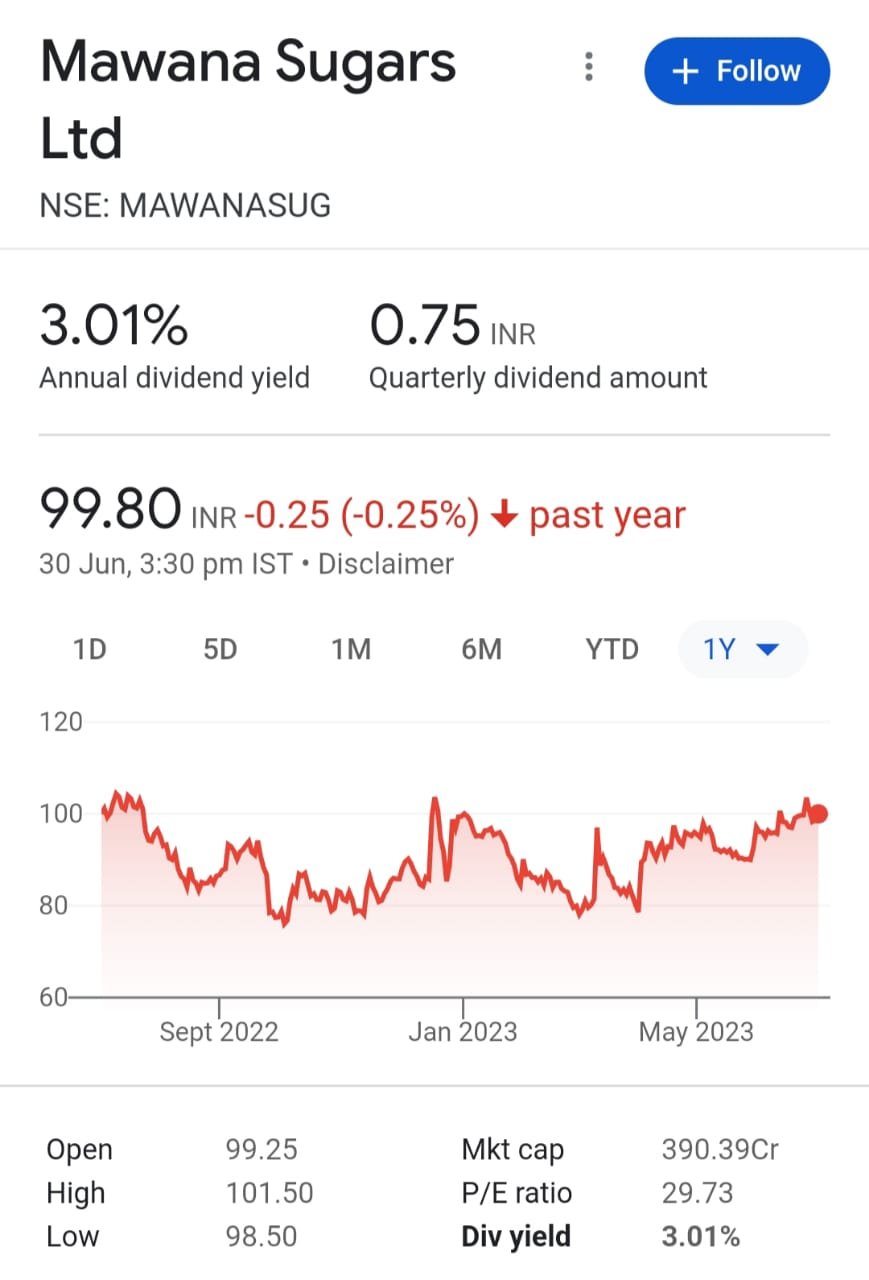

MAWANA SUGARS LTD: Dividend Per Share: Rs.3.0

-Mawana Sugars Ltd is a leading sugar manufacturing company in India.

-Mawana Sugars specializes in the production and sale of sugar, ethanol, and co-generation of power.

– Mawana Sugars offers a wide range of high-quality sugar and ethanol products to meet diverse customer needs.

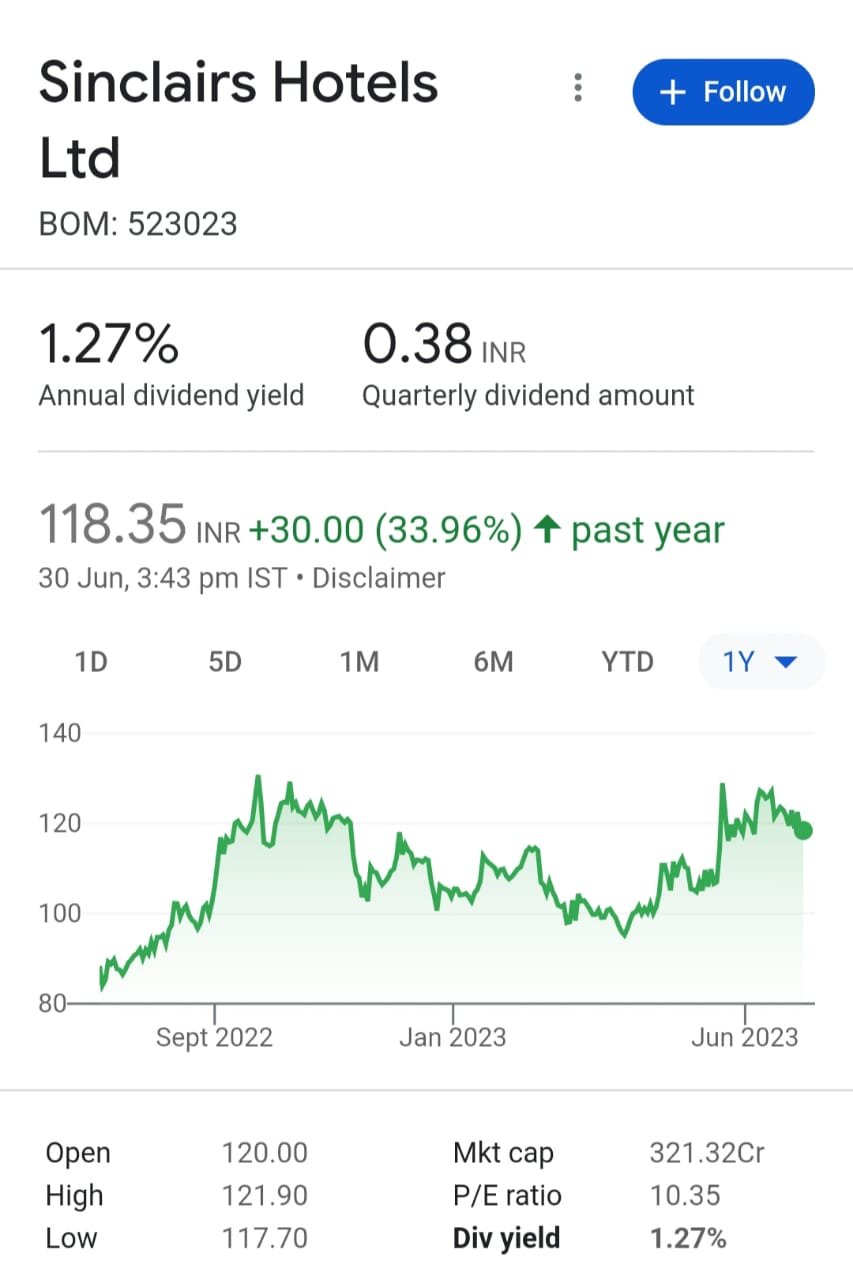

SINCLAIRS HOTELS LTD: Dividend Per Share: Rs.1.50

-Sinclairs Hotels Ltd is a renowned hospitality company offering luxurious accommodations and world-class services.

-Sinclairs Hotels Ltd operates a chain of upscale hotels and resorts across multiple destinations.

– Sinclairs Hotels Ltd provides exceptional hospitality experiences with elegant rooms, gourmet dining, and a range of leisure facilities.

SWARAJ ENGINES LTD: Dividend Per Share: Rs.92.00

– Swaraj Engines Ltd is an Indian company specializing in the manufacturing of engines for agricultural tractors.

– Swaraj Engines Ltd operates in the automotive industry, specifically focusing on providing engineering solutions for tractors.

-Swaraj Engines Ltd offers a range of high-quality and efficient engines designed for agricultural tractors.

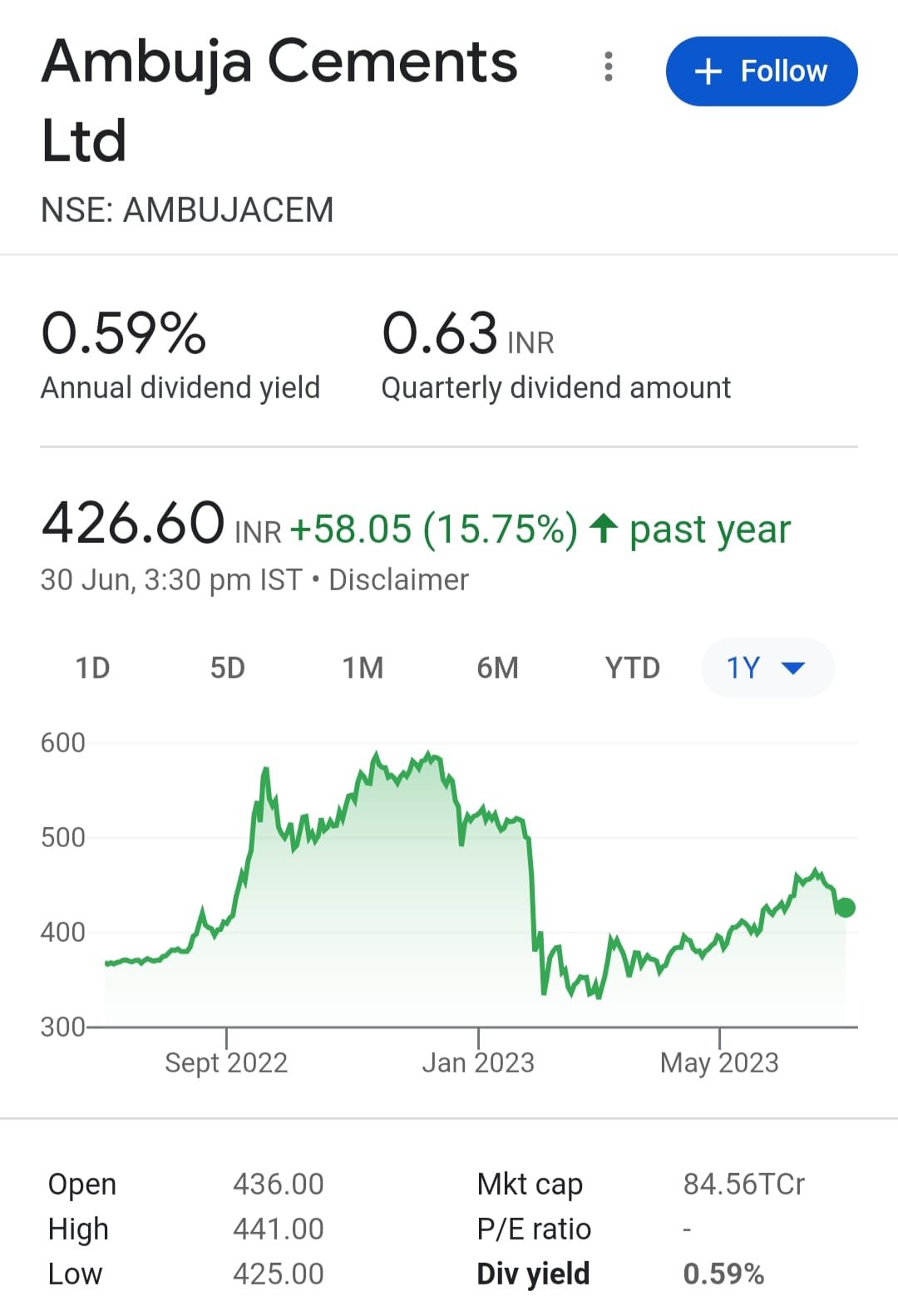

AMBUJA CEMENTS LTD: Dividend Per Share: Rs.2.50

-Ambuja Cements Ltd is a leading cement manufacturing company in India.

– Ambuja Cements Ltd specializes in the production and distribution of high-quality cement and building materials.

– Ambuja Cements offers a wide range of cement products for various construction needs, including Ordinary Portland Cement (OPC), Portland Pozzolana Cement (PPC), and ready-to-use concrete.

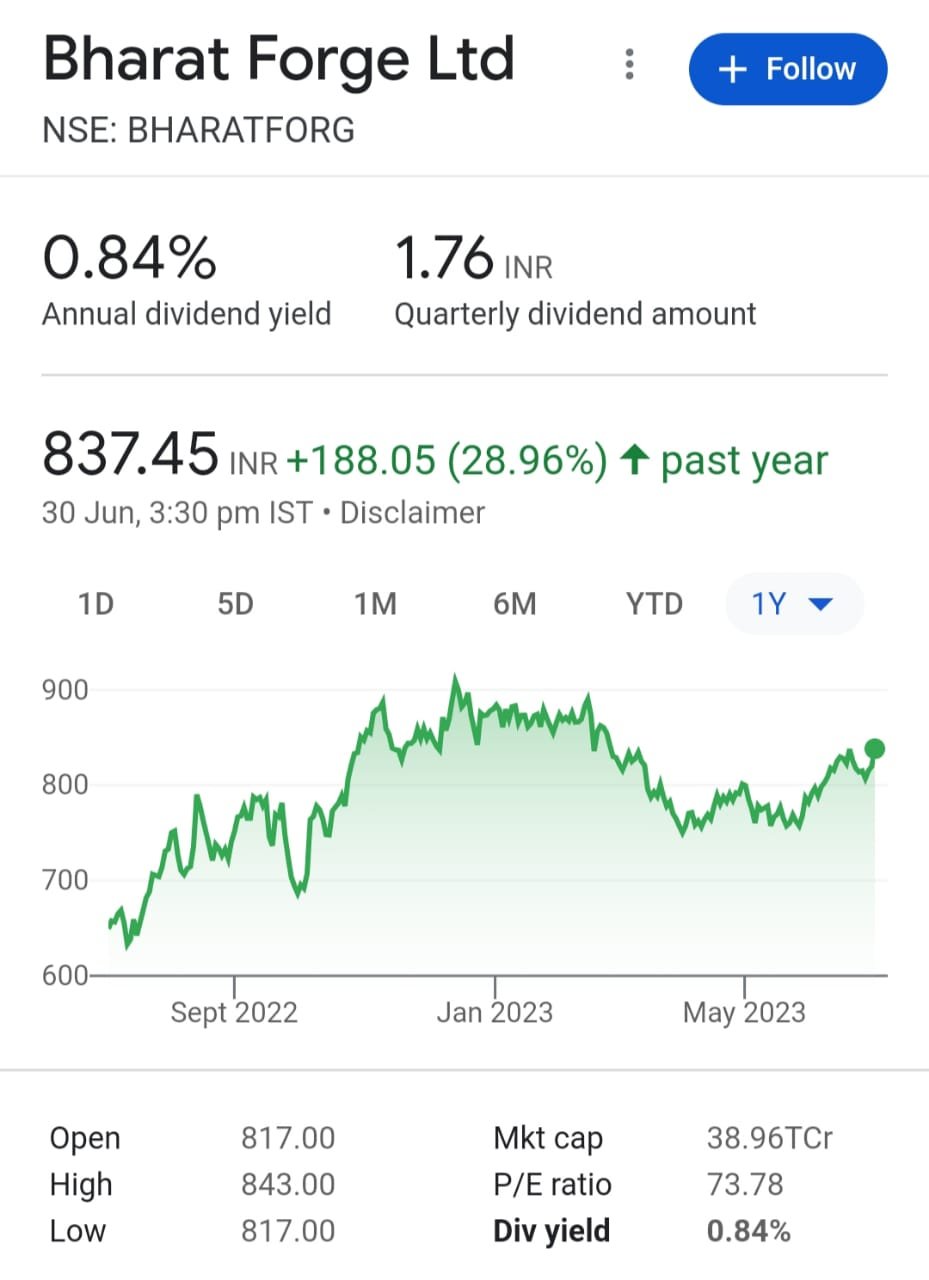

BHARAT FORGE LTD Dividend Per Share: Rs.5.50

-Bharat Forge Ltd is a leading Indian multinational company engaged in the manufacturing and supply of high-quality forged components and automotive systems.

-Bharat Forge operates in the automotive, power, oil and gas, and construction industries, providing innovative engineering solutions and global manufacturing capabilities.

-Bharat Forge offers a diverse range of products including engine components, chassis components, driveline systems, and non-automotive products like aerospace components and industrial machinery.

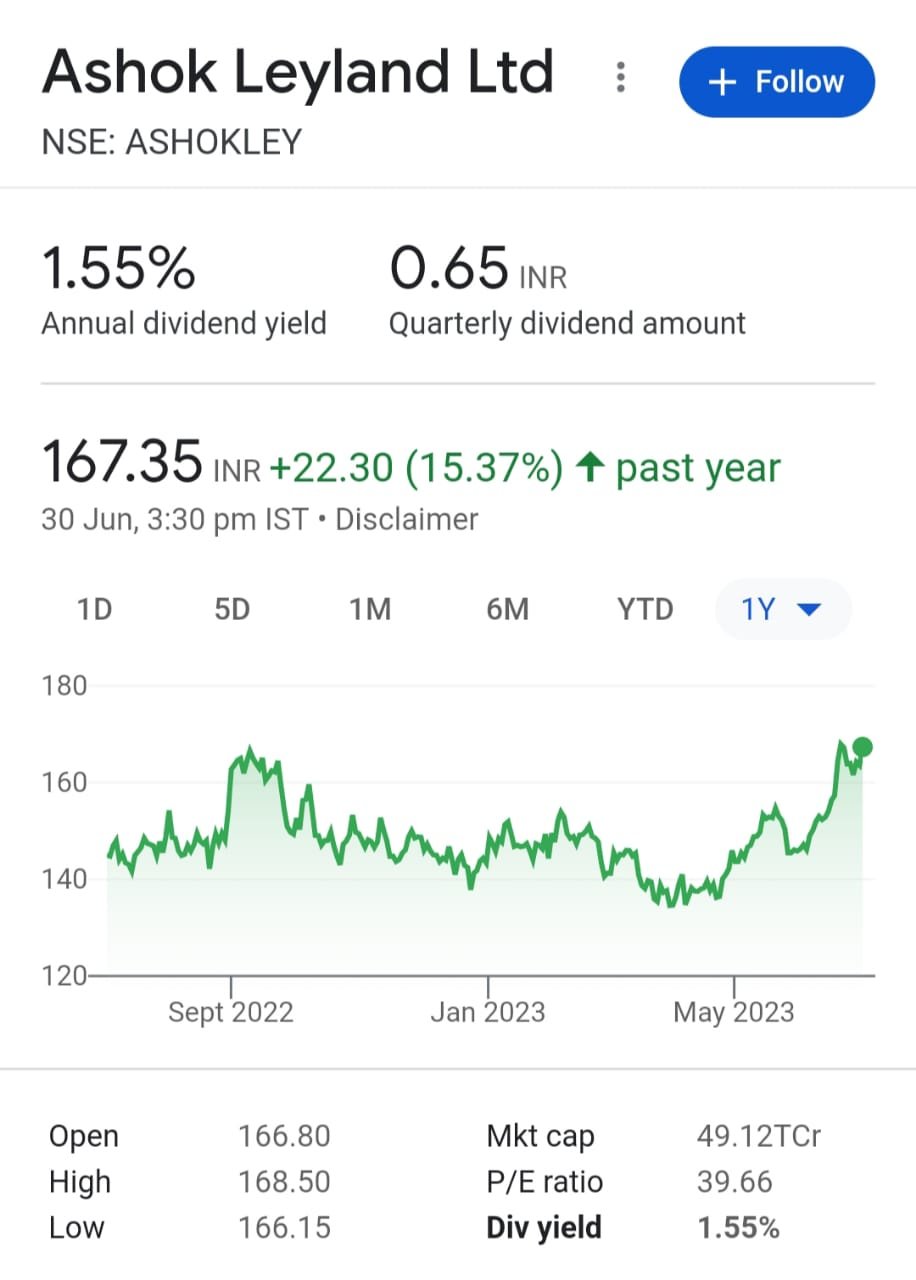

ASHOK LEYLAND LTD: Dividend Per Share: Rs.2.60

– Ashok Leyland Ltd is a leading Indian automotive company specializing in the manufacturing of commercial vehicles and related services.

– The company operates in the areas of commercial vehicle production, power solutions, and spare parts distribution.

-Ashok Leyland offers a wide range of trucks, buses, and power solutions, including electric vehicles, designed for various applications in the transportation industry.

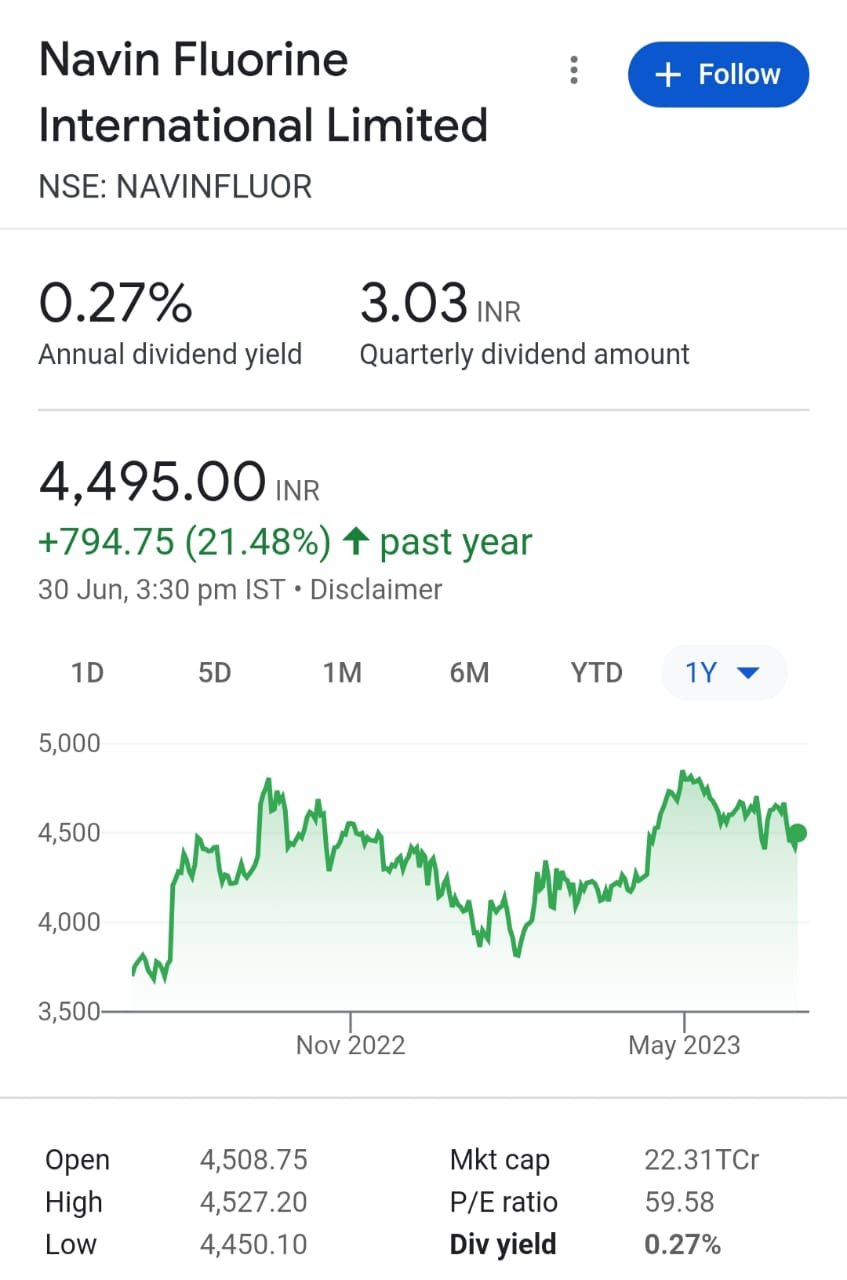

NAVIN FLUORINE INTERNATIONAL LTD: Dividend Per Share: Rs.7.00

– Navin Fluorine International Ltd is a leading Indian specialty chemicals company.

-They are engaged in the production of fluorine-based chemicals and specialty gases.

– Their portfolio includes refrigerants, agrochemicals, pharmaceutical intermediates, and electronic chemicals.

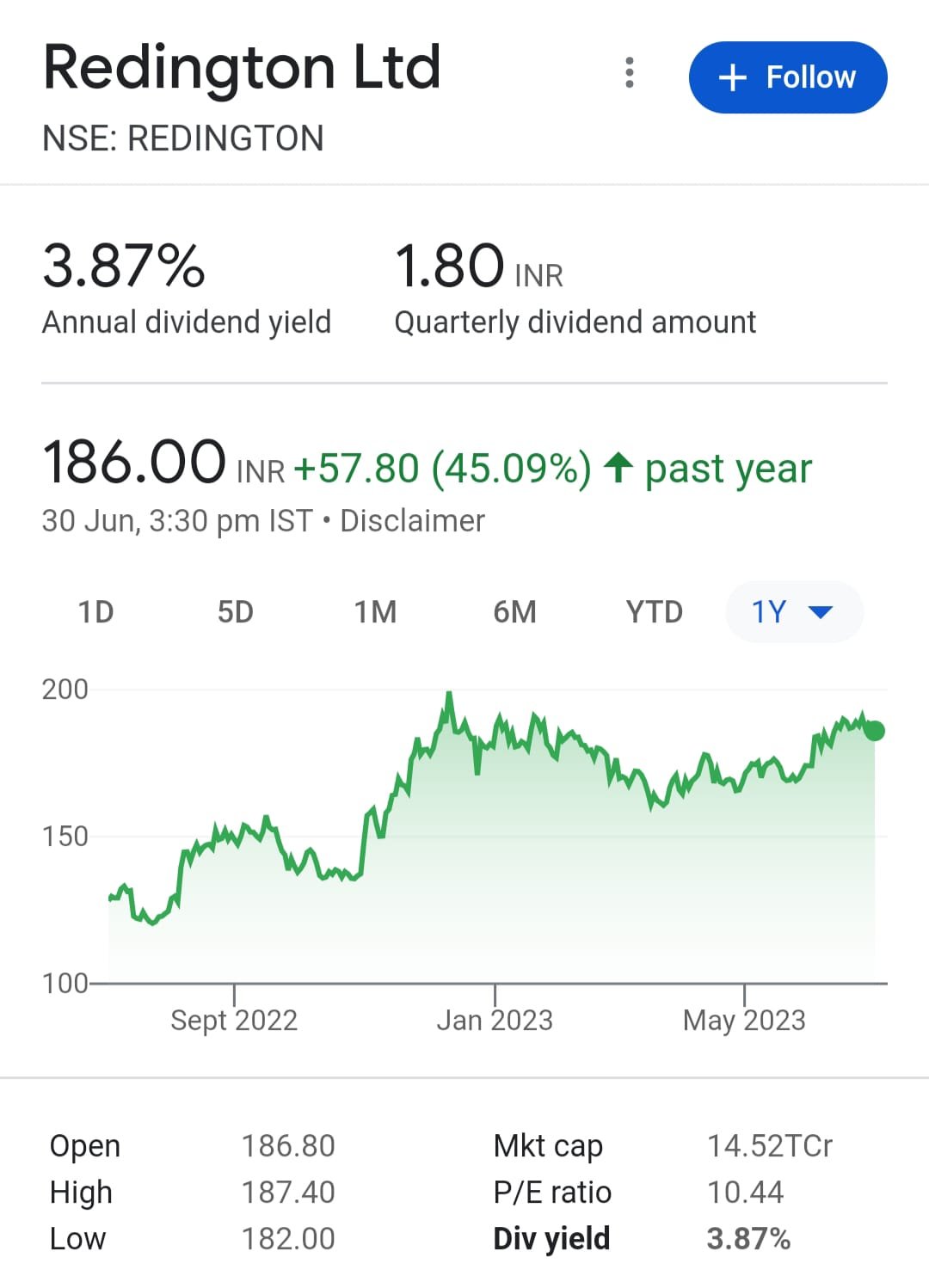

REDINGTON LTD: Dividend Per Share: Rs.7.20

– Redington Ltd is a leading supply chain solutions provider and distributor of technology products.

– Redington specializes in the distribution of IT hardware and software products across emerging markets.

– Redington offers a wide range of technology products, including computers, servers, networking equipment, software solutions, and consumer electronics.

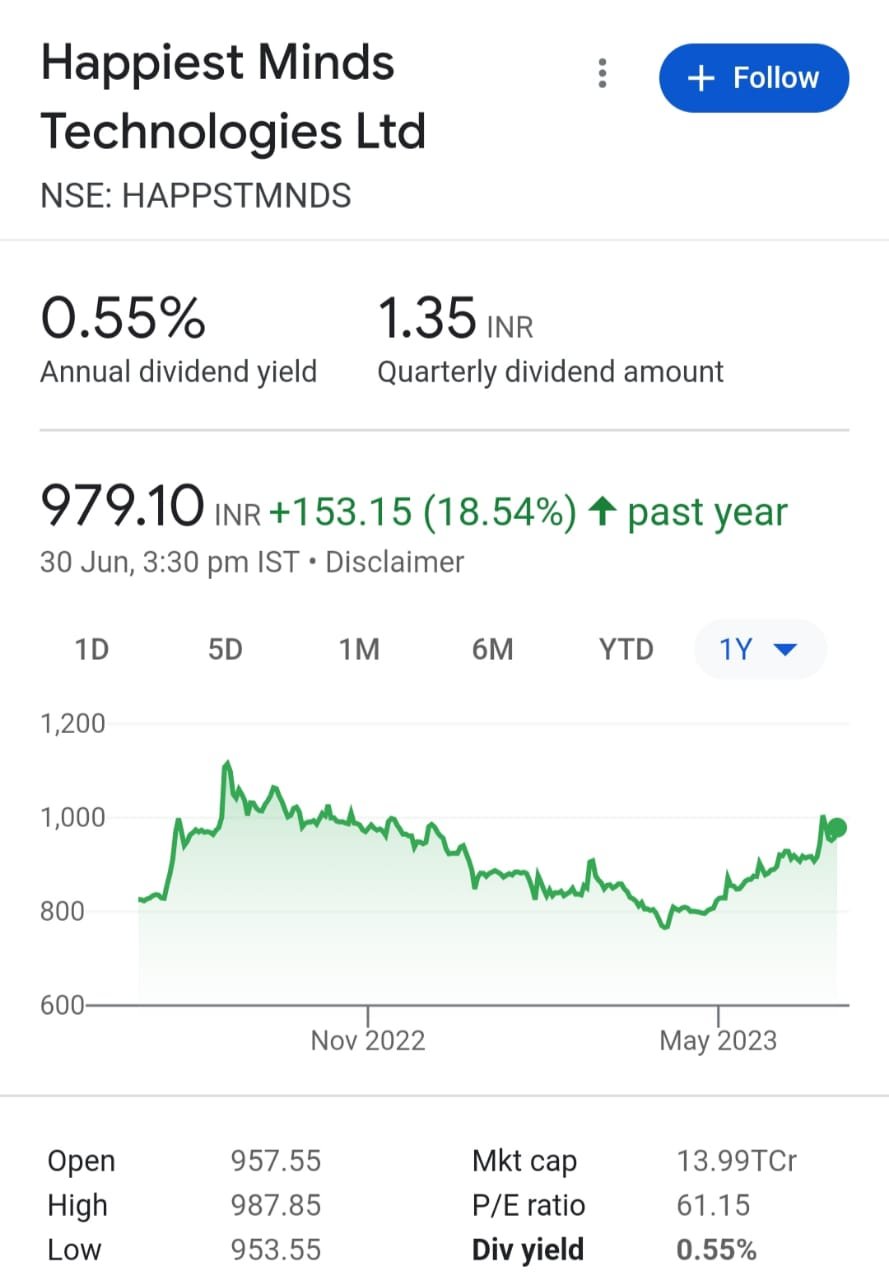

HAPPIEST MINDS TECHNOLOGIES LTD: Dividend Per Share: Rs.3.40

– Happiest Minds Technologies Ltd is a global digital transformation and IT services company.

– They provide cutting-edge solutions in areas like digital business, infrastructure management, security, and IoT.

-Their offerings include software development, cloud services, artificial intelligence, and blockchain solutions.

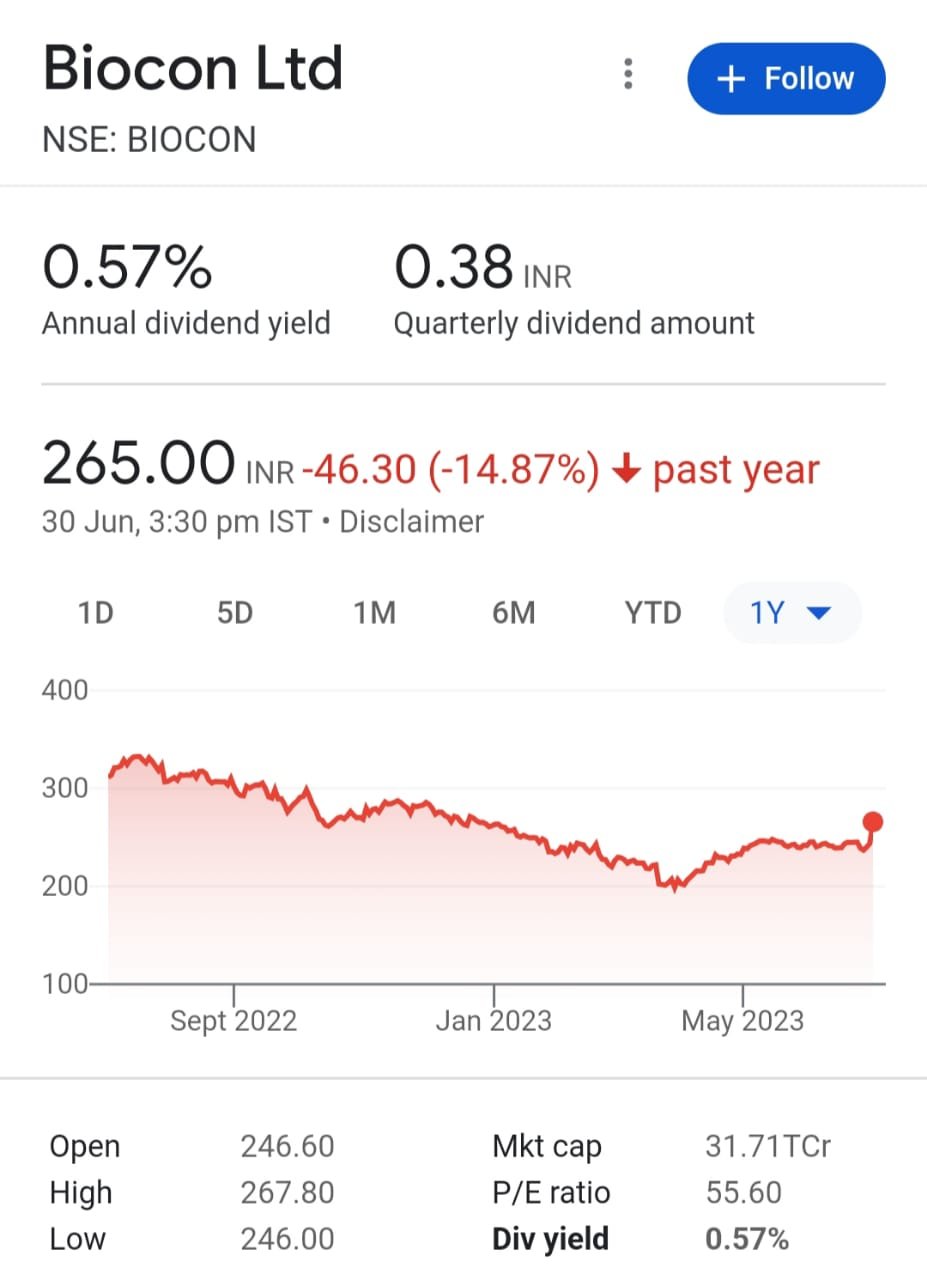

BIOCON LTD: Dividend Per Share: Rs.1.50

– Biocon Ltd is an Indian biopharmaceutical company focused on the research, development, and commercialization of innovative healthcare solutions.

– Biocon operates in the fields of biopharmaceuticals, research services, and contract manufacturing, with a strong emphasis on biosimilars and novel biologics.

– Biocon offers a diverse range of products including biosimilar drugs, branded formulations, and active pharmaceutical ingredients (APIs) for various therapeutic areas.

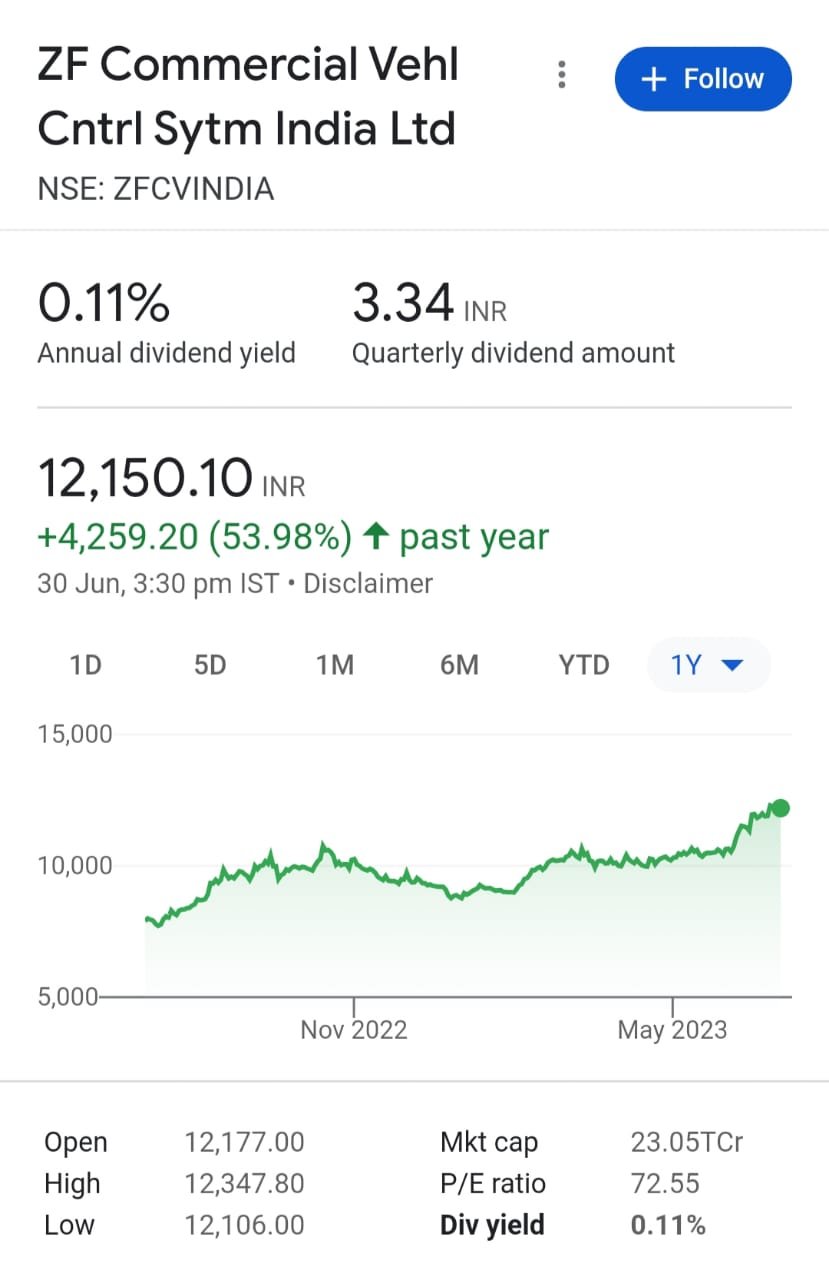

ZF COMMERCIAL VEHICLE CONTROL SYSTEMS INDIA LTD: Dividend Per Share: Rs.13.0

-ZF Commercial Vehicle Control Systems India Ltd is a leading manufacturer of advanced control systems for commercial vehicles.

-We specialize in providing innovative solutions for optimizing vehicle performance, safety, and efficiency.

– Our product portfolio includes cutting-edge control units, sensors, and software for various commercial vehicle applications.

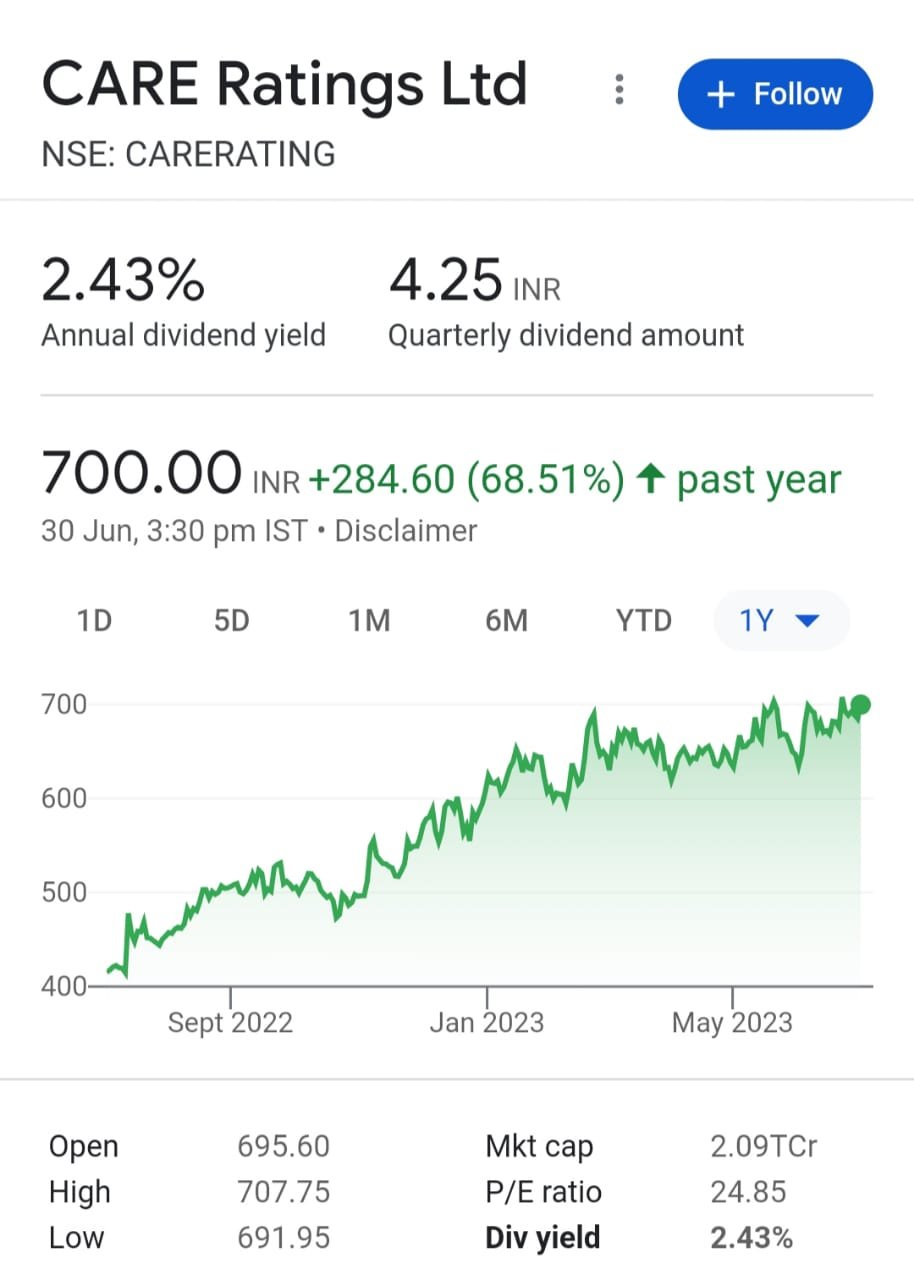

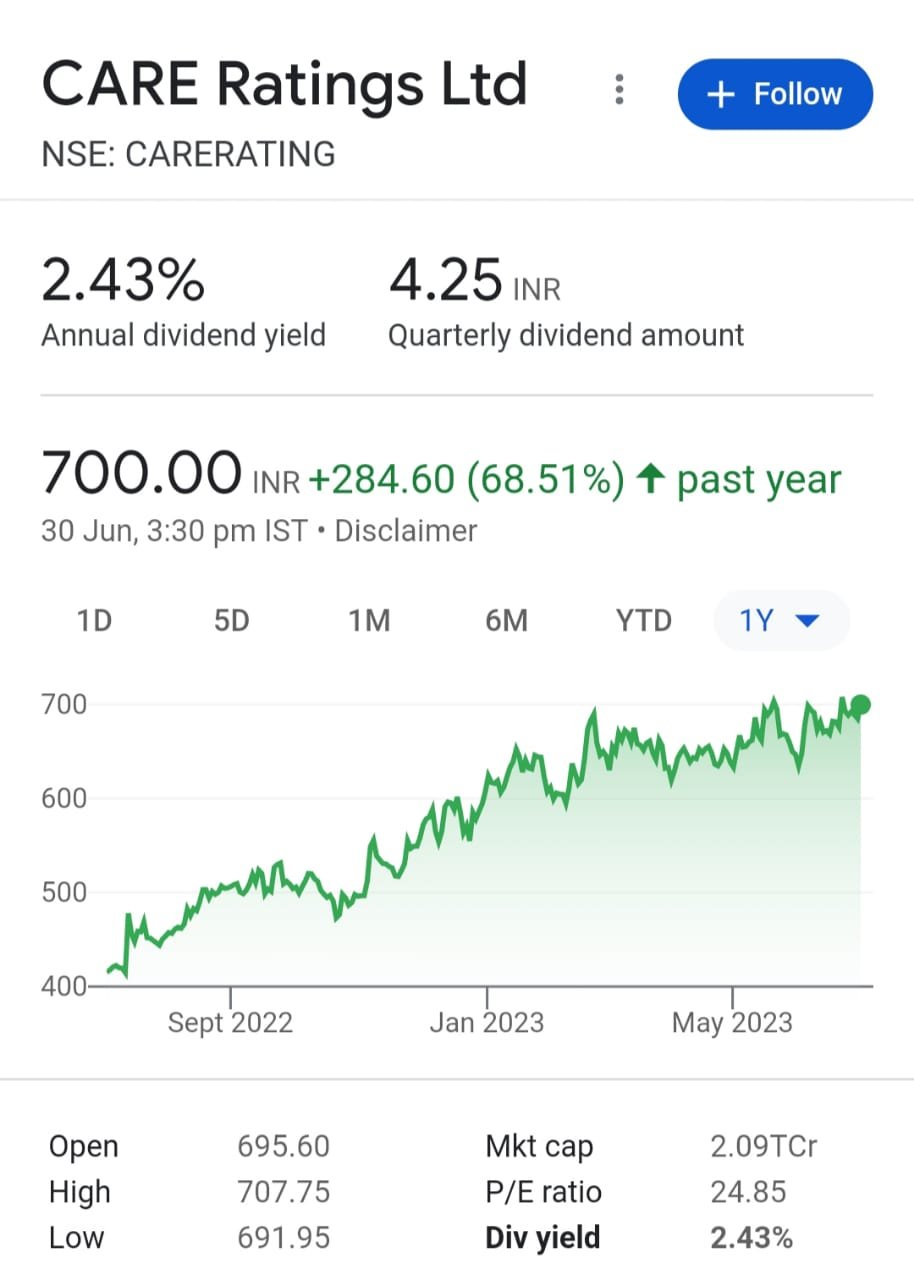

CARE RATINGS LTD: Dividend Per Share: Rs.8.0

– CARE Ratings Ltd is a leading credit rating agency providing insightful analysis and assessment of credit risk in the Indian market.

– CARE Ratings Ltd offers a wide range of credit rating services, including corporate ratings, bank loan ratings, and ratings for various debt instruments.

– CARE Ratings Ltd’s products enable investors and businesses to make informed decisions by evaluating the creditworthiness and financial stability of companies and debt issuers.

CARE RATINGS: Dividend Per Share: Rs.7.0

– CARE Ratings Ltd is a leading credit rating agency providing insightful analysis and assessment of credit risk in the Indian market.

-CARE Ratings Ltd offers a wide range of credit rating services, including corporate ratings, bank loan ratings, and ratings for various debt instruments.

-CARE Ratings Ltd’s products enable investors and businesses to make informed decisions by evaluating the creditworthiness and financial stability of companies and debt issuers.

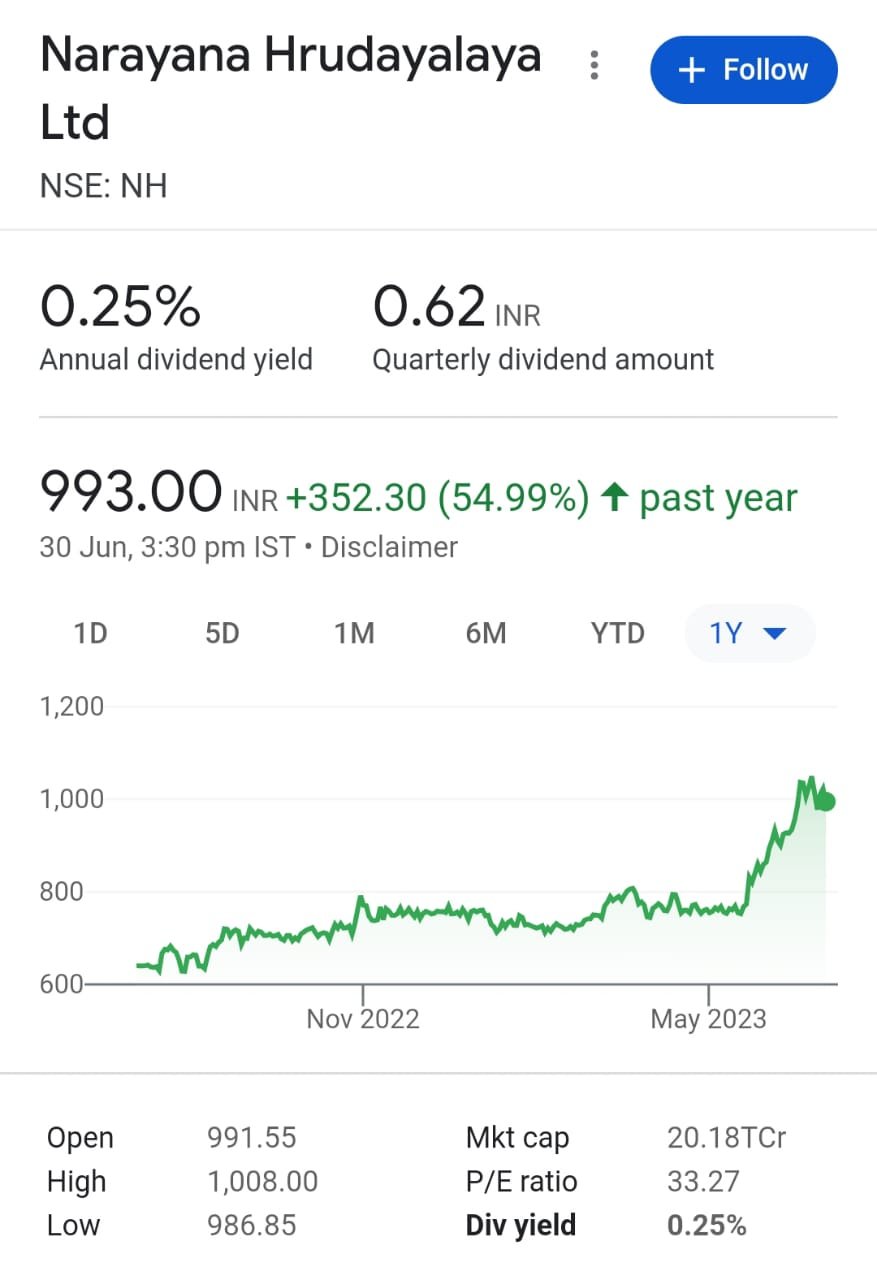

NARAYANA HRUDAYALAYA LTD: Dividend Per Share: Rs.2.50

-Narayana Hrudayalaya Ltd is a leading healthcare organization providing specialized medical services.

– Narayana Hrudayalaya operates a network of hospitals and clinics across India, offering a wide range of healthcare services.

– Narayana Hrudayalaya offers advanced medical treatments and surgical procedures in various specialties, including cardiology, neurology, oncology, and orthopedics.

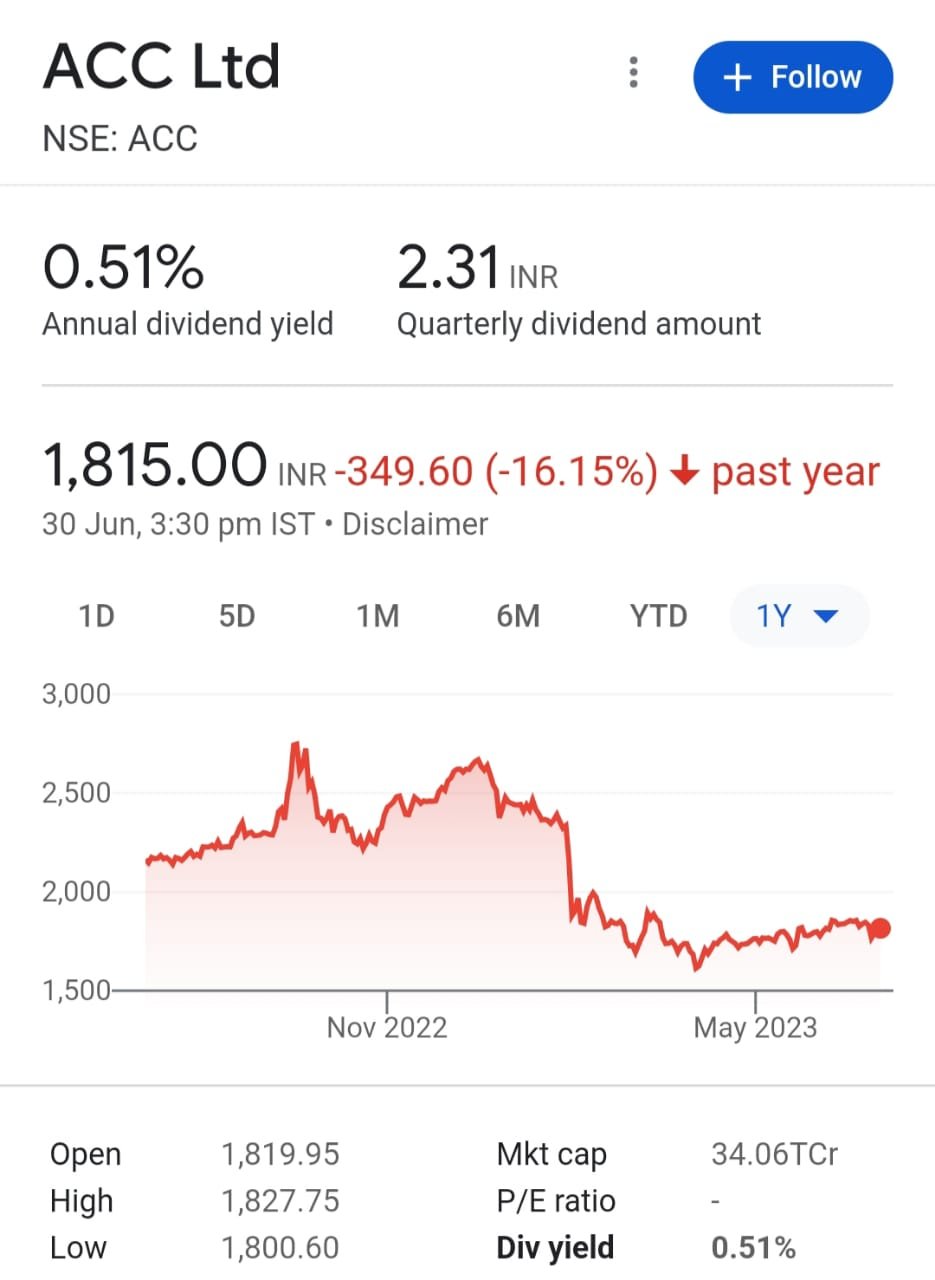

ACC LTD: Dividend Per Share: Rs.9.25

– ACC Ltd is a leading Indian cement manufacturer with a rich legacy and a strong presence in the construction industry.

– ACC Ltd specializes in the production and distribution of high-quality cement, ready-mix concrete, and other building materials.

– ACC Ltd offers a wide range of cement products, including ordinary Portland cement, blended cement, and specialty cement for various construction applications.

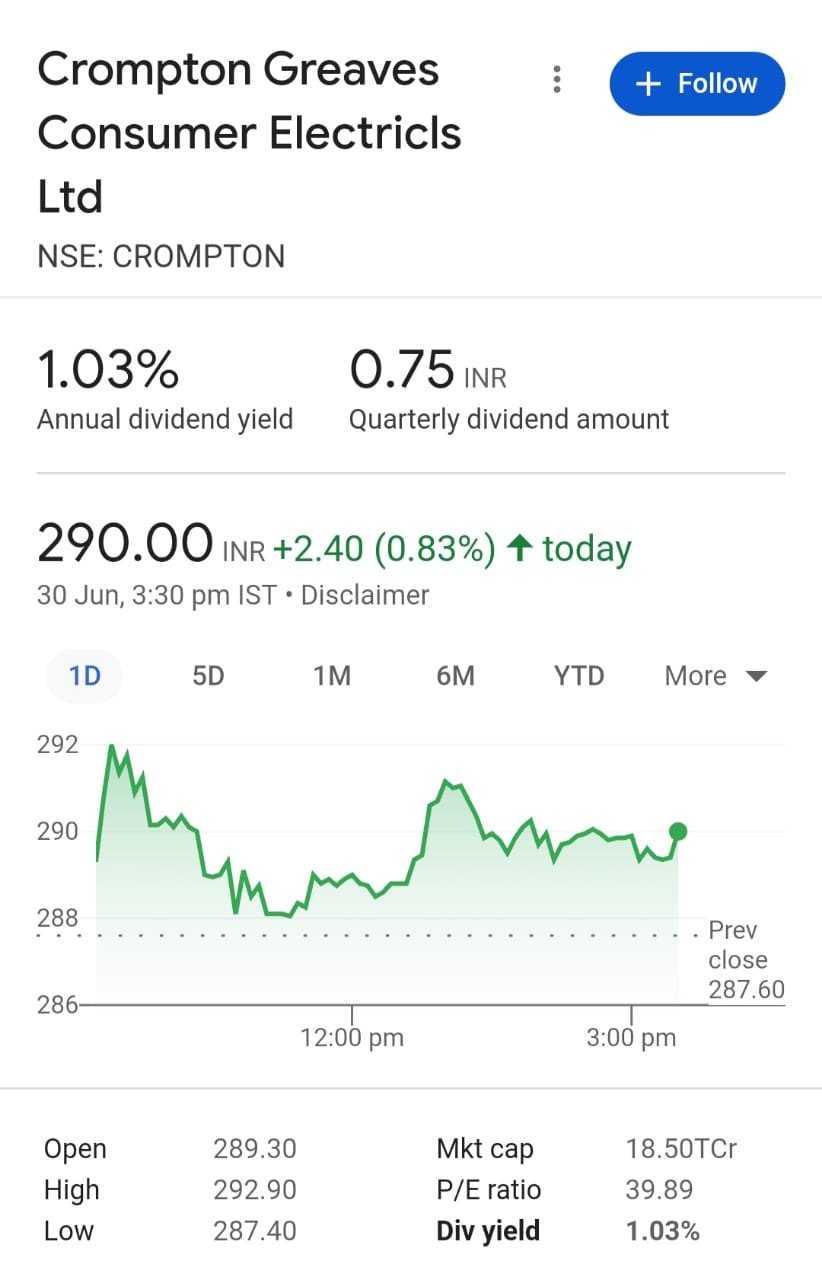

CROMPTON GREAVES CONSUMER ELECTRICALS LTD: Dividend Per Share: Rs.3.0

– Crompton Greaves Consumer Electricals Ltd. is a leading electrical equipment manufacturing company.

– Crompton Greaves Consumer Electricals specializes in the production and distribution of consumer electrical products.

– Their product portfolio includes a wide range of innovative and high-quality electrical appliances for residential and commercial use.

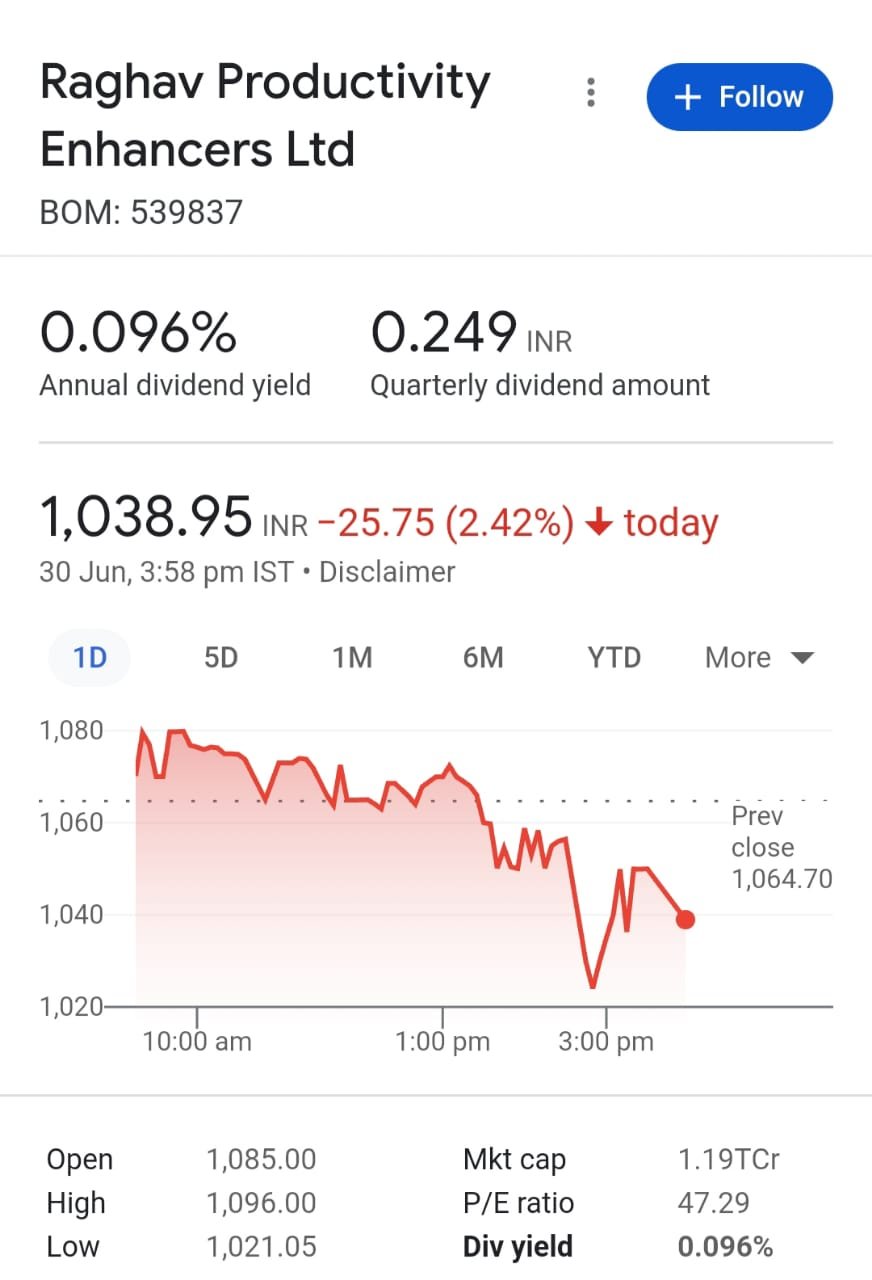

RAGHAV PRODUCTIVITY ENHANCERS LTD: Dividend Per Share: Rs.1.0

– RAGHAV PRODUCTIVITY ENHANCERS LTD – A dynamic company focused on enhancing productivity through innovative solutions.

– RAGHAV PRODUCTIVITY ENHANCERS LTD specializes in providing cutting-edge tools and services to optimize business efficiency.

– RAGHAV PRODUCTIVITY ENHANCERS LTD offers a diverse range of products designed to boost productivity, including software solutions, automation tools, and training programs.

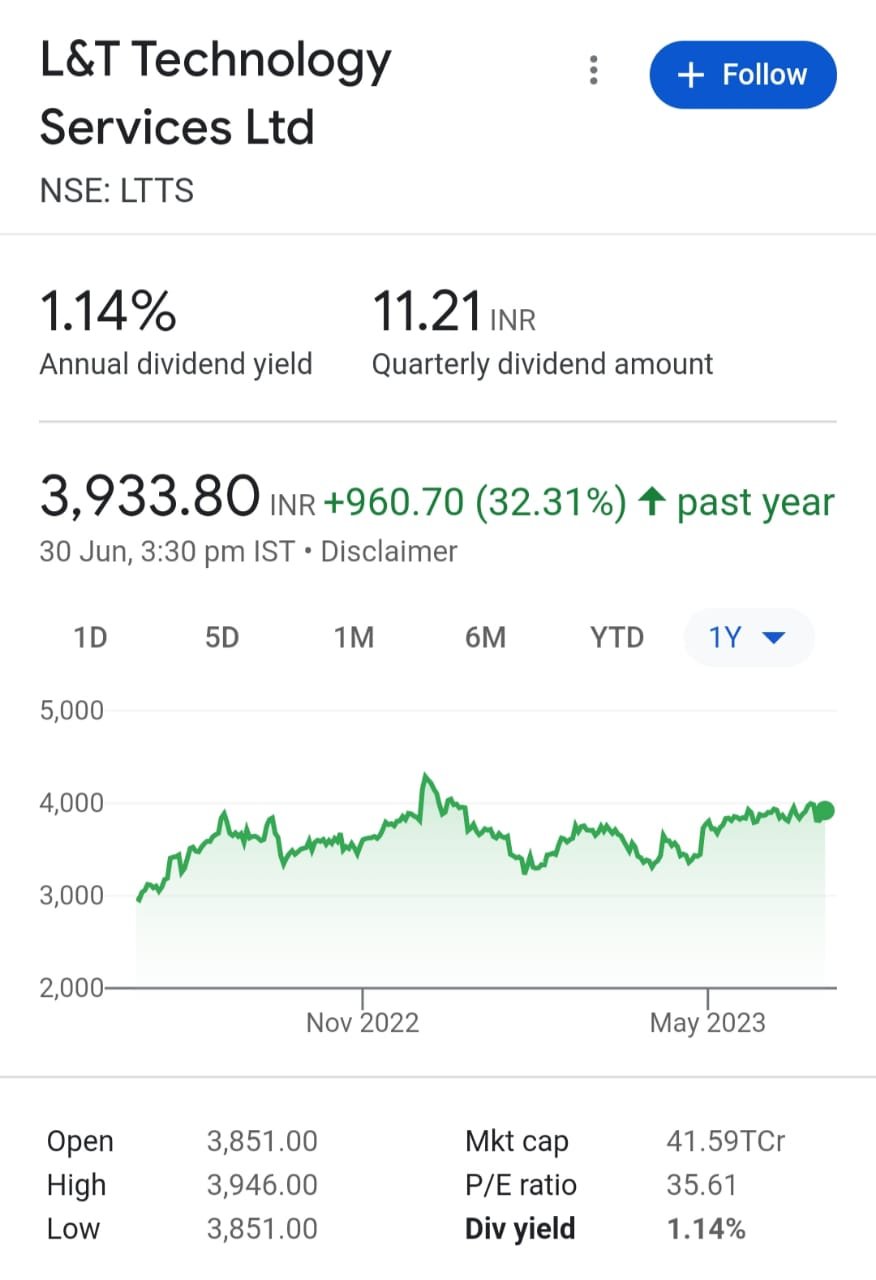

L&T TECHNOLOGY SERVICES LTD: Dividend Per Share: Rs.30.0

– L&T Technology Services Ltd is a leading global engineering services company.

-They provide innovative solutions and services in various industries, including automotive, aerospace, industrial products, and more.

– Their offerings include engineering design, product development, testing and validation, and digital transformation solutions.

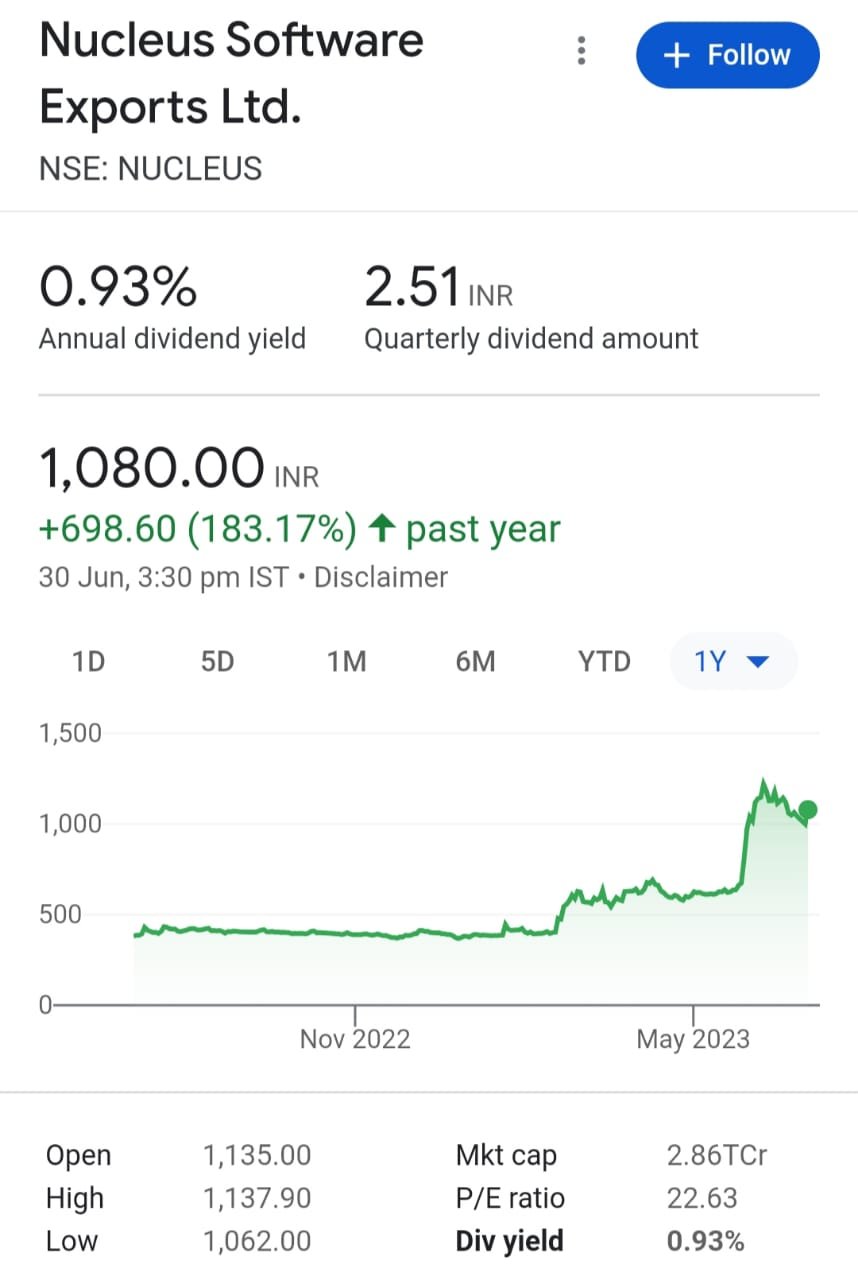

NUCLEUS SOFTWARE EXPORTS LTD: Dividend Per Share: Rs.10.0

– Nucleus Software Exports Ltd is a leading software company specializing in providing innovative solutions for the financial services industry.

– Nucleus Software offers a comprehensive suite of digital and lending solutions to banks, financial institutions, and credit unions worldwide.

– Nucleus Software’s flagship product, FinnOne, is a powerful lending platform that enables efficient loan management and digital banking experiences.

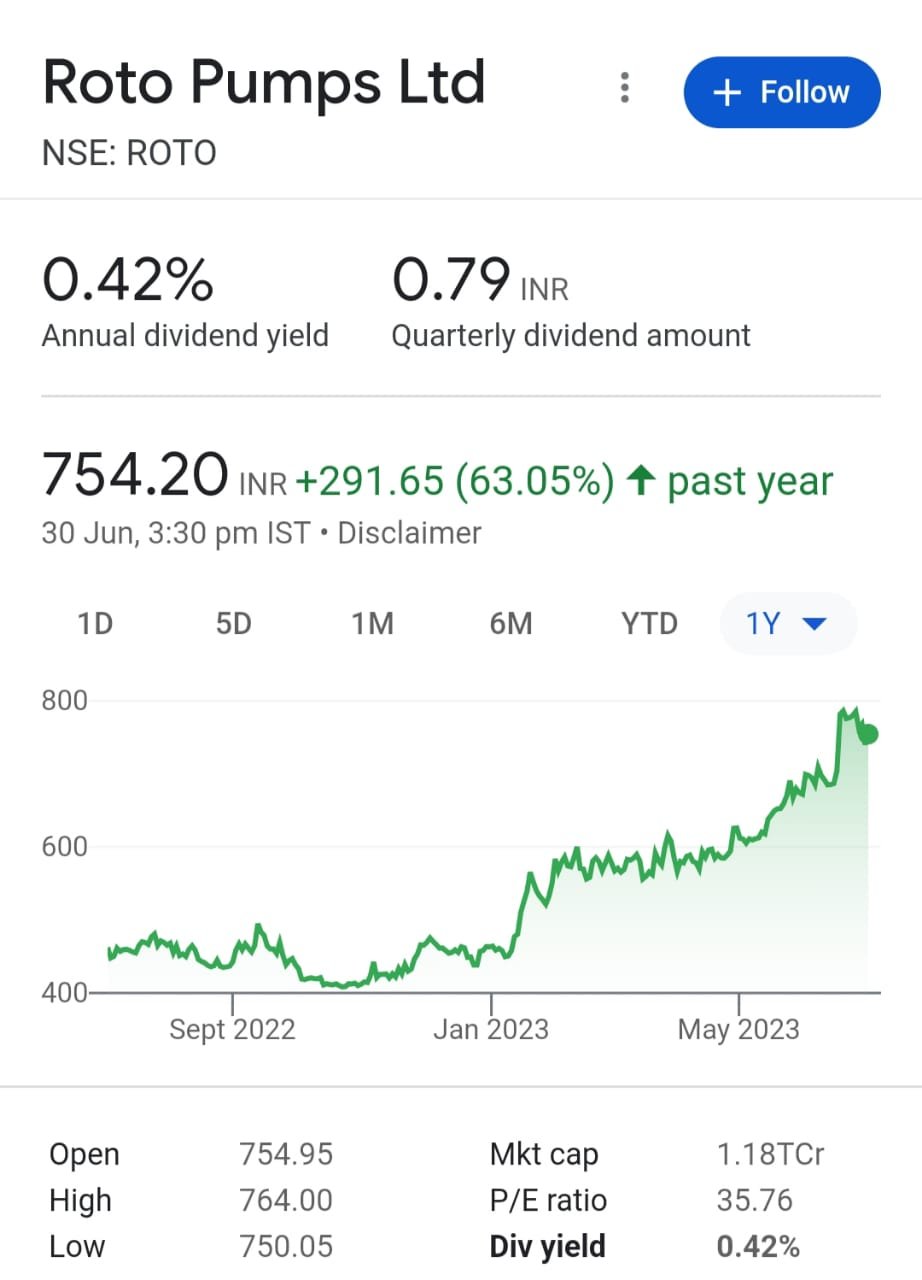

ROTO PUMPS LTD: Dividend Per Share: Rs.3.15

-ROTO PUMPS LTD is a leading manufacturer of industrial pumps and fluid handling solutions.

– ROTO PUMPS LTD specializes in providing innovative pumping solutions for various industries worldwide.

– ROTO PUMPS LTD offers a wide range of reliable and efficient pumps, including rotary, reciprocating, and progressive cavity pumps, designed for handling diverse fluids and challenging applications.

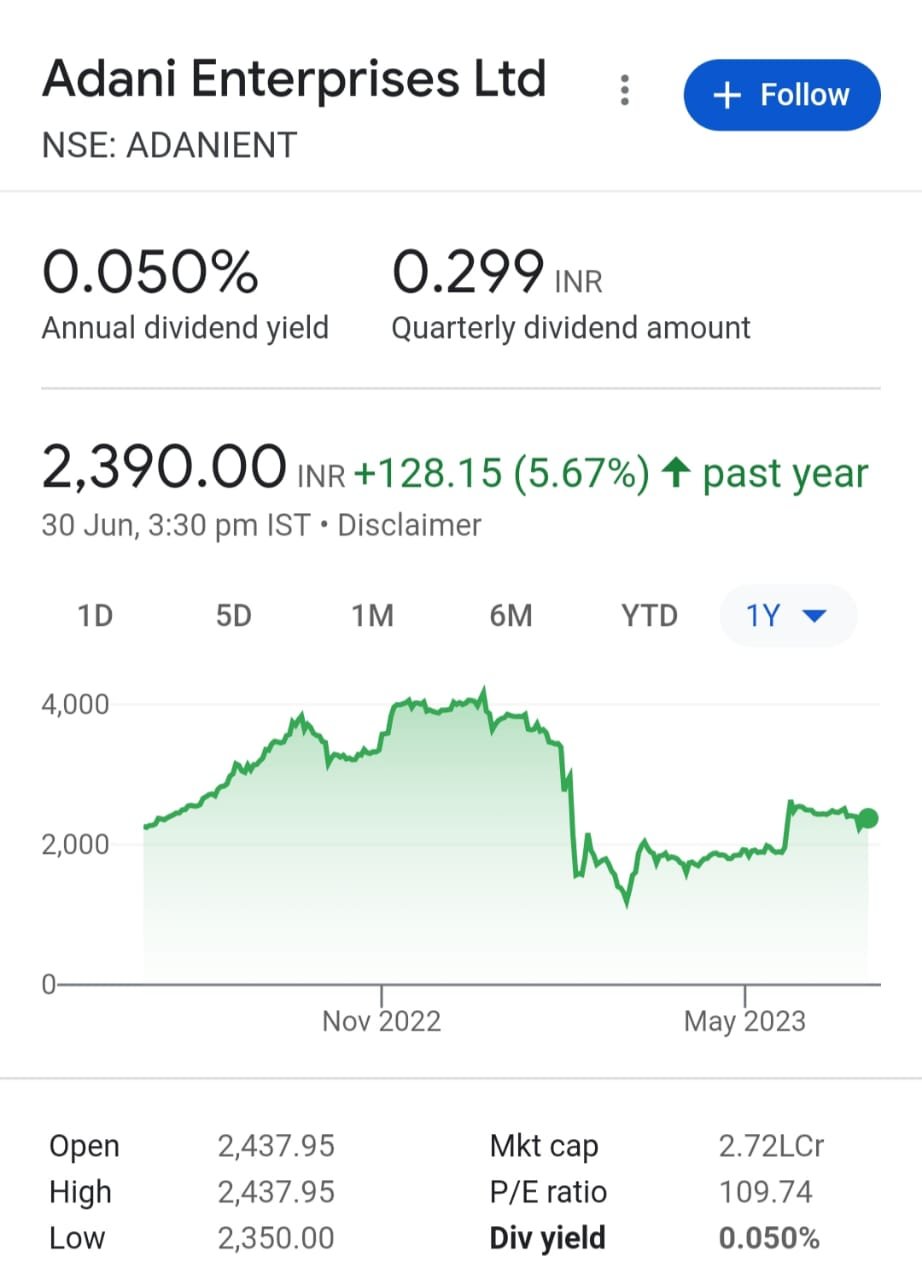

ADANI ENTERPRISES LTD: Dividend Per Share: Rs.1.20

-Adani Enterprises Ltd is a leading global integrated infrastructure company.

– Adani Enterprises operates across sectors such as energy, logistics, agribusiness, and resources.

– Adani Enterprises offers a diverse range of products including coal, renewable energy, edible oils, and ports.

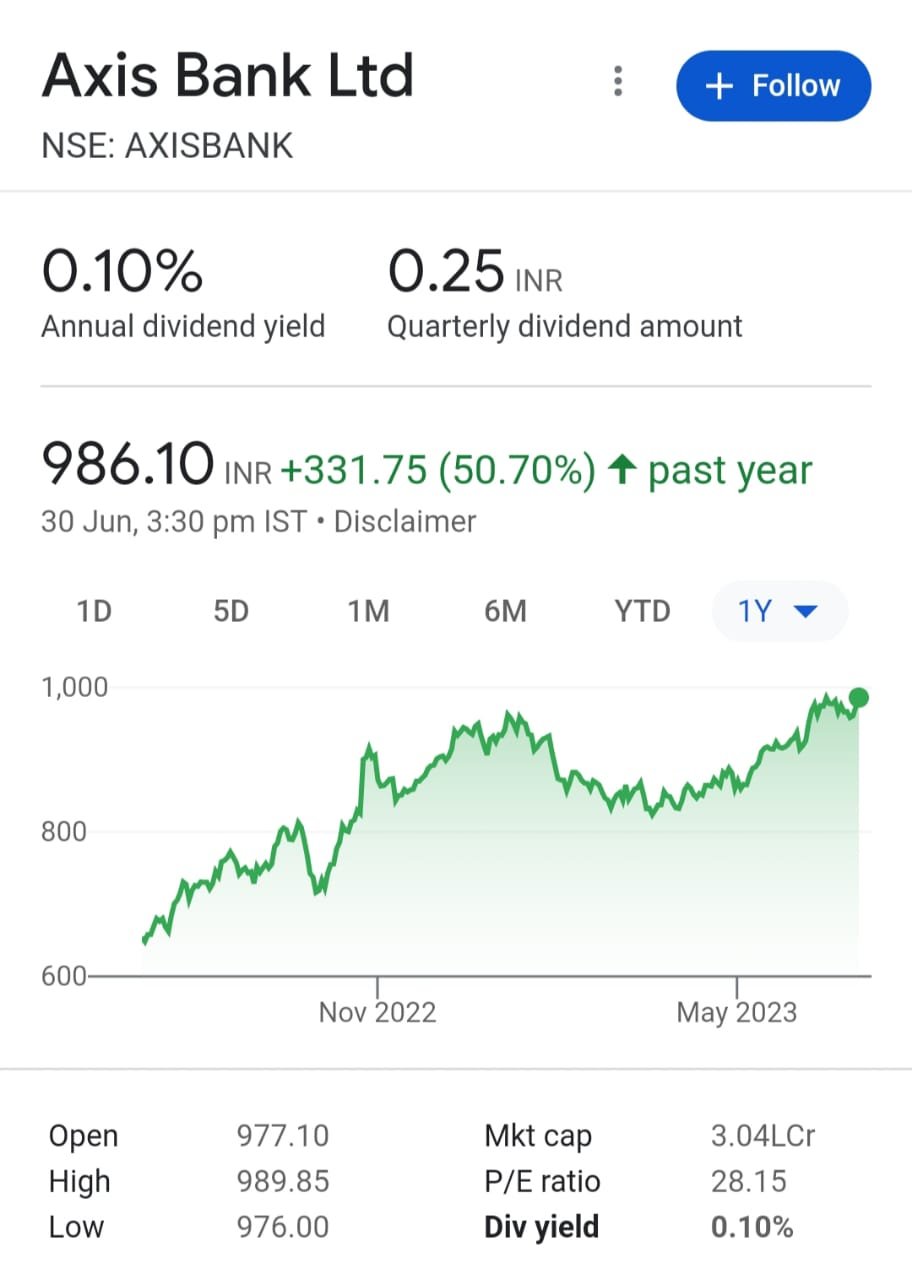

AXIS BANK LTD: Dividend Per Share: Rs.1.0

-Axis Bank Ltd is a leading private sector bank in India offering a wide range of financial services.

– Axis Bank operates in retail banking, corporate banking, and treasury operations, serving individuals, businesses, and institutions.

– Axis Bank provides various products including savings accounts, loans, credit cards, investment options, insurance, and digital banking solutions

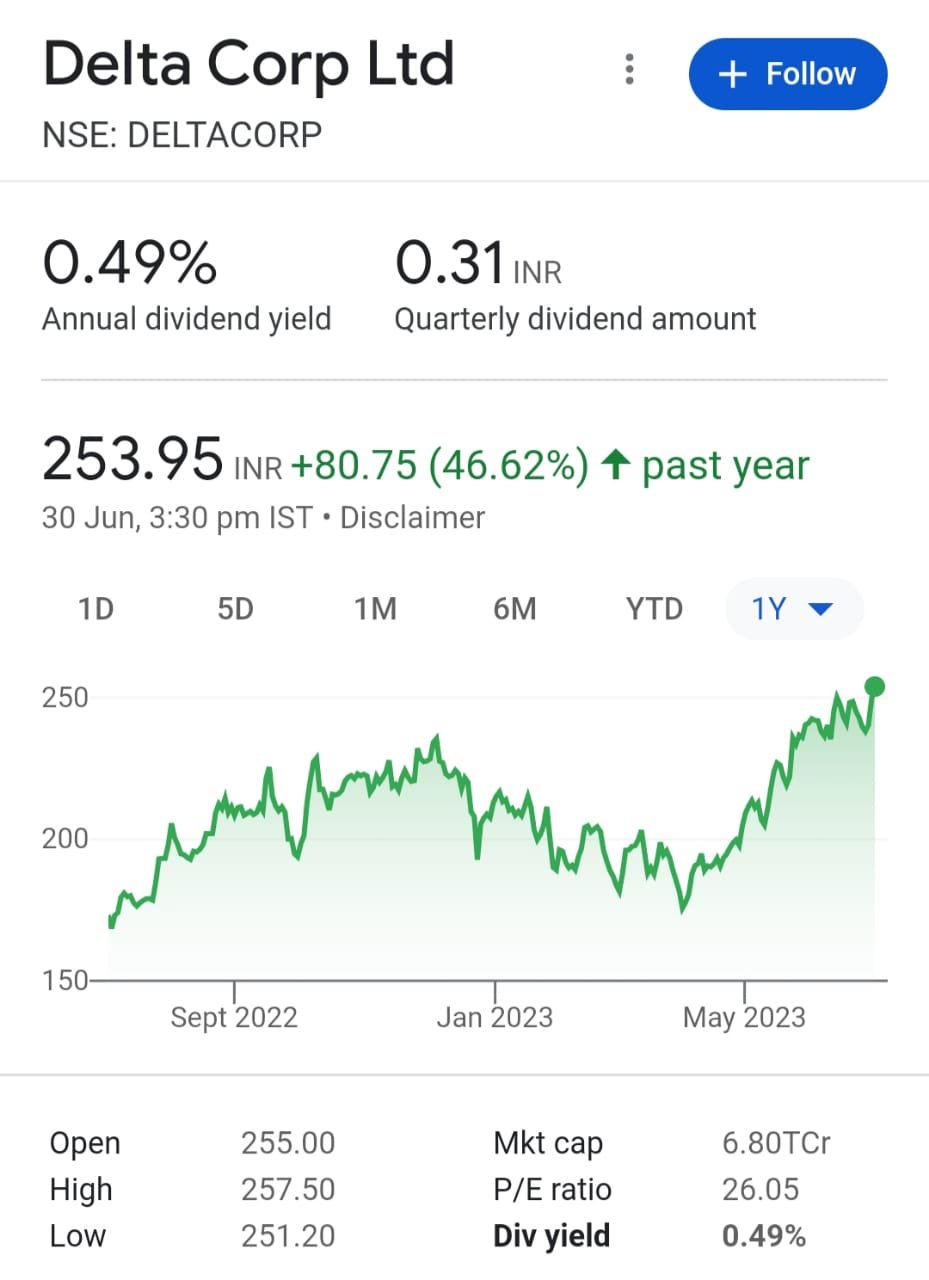

DELTA CORP LTD: Dividend Per Share: Rs.1.25

-Delta Corp Ltd is a leading hospitality and gaming company in India.

– Delta Corp operates integrated resorts, hotels, and casinos, offering entertainment and leisure experiences.

– Delta Corp’s products include gaming facilities, luxury accommodations, dining options, and entertainment services for a diverse customer base.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“Why this EV Stock is Having a Great Growth Potential? Imagine you’re driving your dream car, with all…….Read More

——————-

“Driving Growth – A Fundamentally Strong Small Cap Company” A key player in the chemical industry , showcasing growth. Here is the reason why…Read More