01 Jul Buy or Sell: 3 Stocks to Watch This week on 3rd July

Sumeet Bagadia’s 3 Stock Recommendations for the Market next week

Indian stock market concluded the week on a positive note, buoyed by robust global market sentiments and healthy macroeconomic indicators.

On Friday, both the Nifty 50 index and BSE Sensex achieved record highs, reaching 19,201 and 64,768, respectively.

The Bank Nifty also surged to a new peak of 44,787 during the Friday trading session.

The India VIX, a measure of market volatility, decreased by 0.83% from 10.89 to 10.80 levels, indicating support for the bulls at record-high levels.

Chart readers note that the Nifty has been consistently forming higher highs on a weekly scale for the last fourteen weeks, indicating a sustained upward trend.

Resistance & Support Level:

-To maintain its upward momentum, the Nifty needs to hold above the 19,100 zones, with potential targets at 19,300 and 19,500.

-On the downside, there is support at 19,000 and 18,888 levels, which may act as potential support zones in case of corrections.

The Technicals this week

-Chandan Taparia of Motilal Oswal suggests that the Nifty needs to stay above 19,100 for the bullish trend to continue.

-Volatility remains below 11 zones, further supporting the positive sentiment in the market.

Sumeet Bagadia, Executive Director at Choice Broking, is optimistic about the stock market’s bullish trend.

According to Bagadia, Nifty’s immediate support level is at 19,200. If the Nifty sustains above this level, there is potential for the 50-stock index to reach levels between 19,600 to 19,700 in the near term.

On stocks to buy, Sumeet Bagadia recommended three stocks for next week.(Source:Livemint)

Also Read: Will the Nifty Reach 21,000?

Marico:

Buy around- Rs. 530

Target- Rs. 560

Stop loss- Rs. 515

The Technicals

-The stock has rebounded strongly from the support level of Rs. 520 and is showing a significant upward movement, indicating a potential breakout on the charts.

-This breakout is supported by high trading volumes, indicating strength in the stock.

-Any dips in the stock price around Rs. 520 can be considered as buying opportunities.

-There is minor resistance around the Rs. 532.90 level, which coincides with the 200-day EMA.

-Once the stock crosses this level, it is likely to move toward the target range of Rs. 560 to Rs. 570.

Company Overview

Marico is a leading Indian consumer goods company operating in the FMCG (Fast-Moving Consumer Goods) sector.

Marico has a strong presence in both domestic and international markets.

Promoter: Marico Limited is promoted by Harsh Mariwala, who is a renowned business leader and entrepreneur.

Business Overview: The company focuses on various product categories, including hair care, skin care, edible oils, and health foods.

Marico is known for its innovative and quality products that cater to the diverse needs of consumers.

Product Overview: Marico offers a wide range of popular consumer brands such as

-Parachute, Saffola, Hair & Care, Nihar, Livon, and Mediker.

These brands encompass products like hair oils, shampoos, conditioners, edible oils, cooking sprays, skincare products, and more.

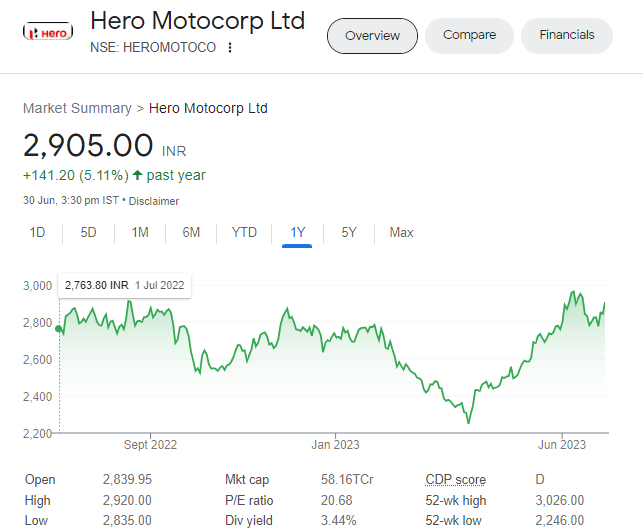

Hero MotoCorp: Buy at Rs. 2,940

Target Rs. 3,050

Stop loss Rs. 2,845.

The Technicals

-The share price of Hero MotoCorp is currently trading with higher highs and higher lows in the daily chart and is strongly supported around Rs. 2,800.

-A broader analysis reveals a soccer pattern, confirming the bullish trend.

-The stock has a minor resistance around the Rs. 2,930 to Rs. 2,935 range. Once it crosses and sustains above this level, further upside movement is expected in the coming days.

-The stock is trading above the 20-day and 40-day EMAs, and the relative strength index (RSI) remains above 60, indicating a positive trend.

Company Overview

Hero MotoCorp is the world’s largest manufacturer of motorcycles and scooters. It operates in the automotive sector and has a dominant presence in the Indian two-wheeler market.

Promoter: Hero MotoCorp is promoted by the Munjal family, with Brijmohan Lall Munjal being the founder. The Munjal family has been associated with the company since its inception.

Business Overview: Hero MotoCorp offers a wide range of motorcycles and scooters catering to different segments and customer preferences.

The company is known for its reliable and fuel-efficient vehicles.

Product Overview: The company’s product portfolio includes popular models like

-Splendor, Passion, Glamour, Xtreme, Maestro, and Pleasure.

Hero MotoCorp is known for its emphasis on technological innovation, superior performance, and customer satisfaction.

Related Read: MFs bought 1 crore Infosys shares in May- Should you buy now?

Infosys:

Buy around- Rs. 1,335

Target- Rs. 1,430,

Stop loss- Rs. 1,277.

The Technicals

-The stock has recently broken out above its 50-day exponential moving average (EMA) after a consolidation period of four months.

-This breakout indicates a potential reversal of the downward trend and suggests increased buying interest in the stock.

-Additionally, Infosys has been forming higher lows since mid-April, indicating a strengthening bullish sentiment.

Company Overview

The company operates in the IT (Information Technology) sector and provides a wide range of solutions and services to clients across various industries.

Promoter: Infosys was founded by a group of entrepreneurs led by Narayana Murthy, Nandan Nilekani, and others. The company has a strong legacy of visionary leadership and innovation.

Business Overview: Infosys is a global leader in consulting, technology, and outsourcing services.

Infosys is known for its expertise in digital transformation, cloud computing, artificial intelligence, and analytics.

Product Overview: Infosys offers a comprehensive suite of IT services, including application development, maintenance and support, system integration, consulting, and outsourcing solutions.

The company serves clients in industries such as

-Banking and financial services, healthcare, retail, manufacturing, and more.

Infosys is recognized for its strong focus on quality, delivery excellence, and client satisfaction.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————-

“Why this EV Stock is Having a Great Growth Potential? Imagine you’re driving your dream car, with all…….Read More

No Comments