Stock to Watch: Up 20% in a month!

This construction stock has more upside; should you buy?

NBCC (India), a company focused on civil construction, experienced a substantial increase of around 20% in just one month, reaching a new high for the past 52 weeks. This surge indicates a strong presence of optimistic market trends.

Experts recommend that short-term traders consider buying the stock, aiming for a potential target price of Rs 55 within the next 2-3 months.

Within the span of a month, starting on July 4 and ending on August 7, the stock value climbed from Rs 40.20 to an impressive high of Rs 48.89. This remarkable ascent reflects a gain of more than 21% in such a brief period.

During May, the stock successfully broke out from a 5-year Triangle pattern on the weekly charts.

Unfortunately, it was unable to maintain this momentum. However, in June, it revisited the breakout area before making a recovery.

Additionally, in February, the stock managed to break free from a consolidation range. There were instances in January and February when it briefly dropped below the 50 and 200-week moving averages on the weekly charts.

To learn more about stock market basics and stock analysis one can consider enrolling in our Stock Market Learning Courses, here.

Also Read: Buy or Sell: Sumeet Bagadia’s 3 Stock Recommendations for This Week

According to Gaurav Bissa, a VP at InCred Equities,

The stock has bounced back after retesting the triangle breakout and has triggered a buy signal in the Ichimoku setup. This suggests the possibility of a strong upside in the coming weeks.

“NBCC has been one of the few PSU stocks to not participate in the strong rally seen in many of the other names. The stock gave a breakout from a 5-year triangle pattern on the weekly charts but failed to witness strong momentum,”

“The stock has bounced back strongly after retesting the triangle breakout and has given a fresh swing breakout on the weekly charts, suggesting it is now ready for a strong upside in the coming weeks,” he observes

Potential Target:

Experts suggest a possible target of Rs 55 in the next 2-3 months for short-term traders. A stop loss is recommended below Rs 43 on a closing basis.

-The Relative Strength Index (RSI) is at 72.6, which is above the overbought threshold of 70. This suggests that a pullback might be possible.

-The Moving Average Convergence Divergence (MACD) is also above its center and signal line, which is considered a bullish indicator.

-The stock is trading above several crucial short- and long-term moving averages, including the 5, 10, 30, 50, 100, and 200-day moving averages (DMA) on the daily charts. This indicates a positive trend.

Breakouts and Patterns: The stock has shown multiple breakout patterns, including a 5-year triangle pattern and a consolidation range breakout in February. These breakouts are seen as indications of potential further upward movement.

Volume: The stock has experienced aggressive volumes in recent weeks, which is seen as a positive factor that could drive the stock higher.

Also Read: IRFC @ 52 Week High: Buy, Sell, Hold: What Analysts Say?

Company Overview:

Business Segments:

NBCC operates primarily in two major business segments:

1. Project Management Consultancy (PMC):

-Consultancy Services: NBCC offers comprehensive consultancy services that encompass project planning, design development, procurement, and construction management.

-Project Planning and Design: The company assists clients in the planning and design phase of projects, ensuring that the structures are well-conceived and aligned with the intended purpose.

-Construction Management: NBCC’s expertise lies in efficiently managing the construction process, adhering to quality standards, timelines, and budget constraints.

-Execution and Monitoring: The company oversees the execution of projects, closely monitoring each phase to ensure compliance with specifications and regulations.

2. Real Estate Development:

-Residential Projects: NBCC develops residential complexes that cater to various income groups. These projects often include modern amenities, landscaped areas, and eco-friendly features.

-Commercial Projects: The company also ventures into the construction of commercial spaces, including office complexes and retail centers.

-Redevelopment: NBCC specializes in revitalizing old government colonies and areas, turning them into contemporary and sustainable living spaces.

Notable Projects:

Amrapali Group Projects:

-NBCC undertook the completion of various projects of the Amrapali Group, a major real estate developer.

The projects were stalled due to financial issues, and NBCC’s intervention aimed to provide relief to the homebuyers and complete the pending developments.

-Successfully sold approximately 2600 units in the Amrapali Housing project, generating around INR 8,200 crores in revenue.

-Expected completion of the Amrapali project by the end of ’24, with a projected standalone revenue of around INR 8,000 crores.

-Aim to construct the balance Floor Area Ratio (FAR) of Amrapali, estimated to be worth INR 7,000-8,000 crores.

-Pragati Maidan Redevelopment: NBCC is involved in the redevelopment of the iconic Pragati Maidan exhibition complex in New Delhi. The project aims to transform the exhibition venue into a modern international trade center while preserving its historical significance.

-The World Trade Center project: recorded inventory sales of INR 2,100 crores in the fiscal years ’22 and ’23, with the intention to complete inventory sales by the current financial year’s end.

-Property sales of INR 47 crores in Sarojini Nagar, with plans for a bulk sale of INR 1,350 crores.

-Real estate revenue turnover of INR 200 crores for own inventory and INR 2,200 crores for redevelopment projects in FY23, projecting INR 250 crores for own inventory and INR 6,000 crores for Ministry’s projects in FY24.

-Targeting the monetization of two commercial projects worth INR 13,300 crores in the current financial year.

New Projects:

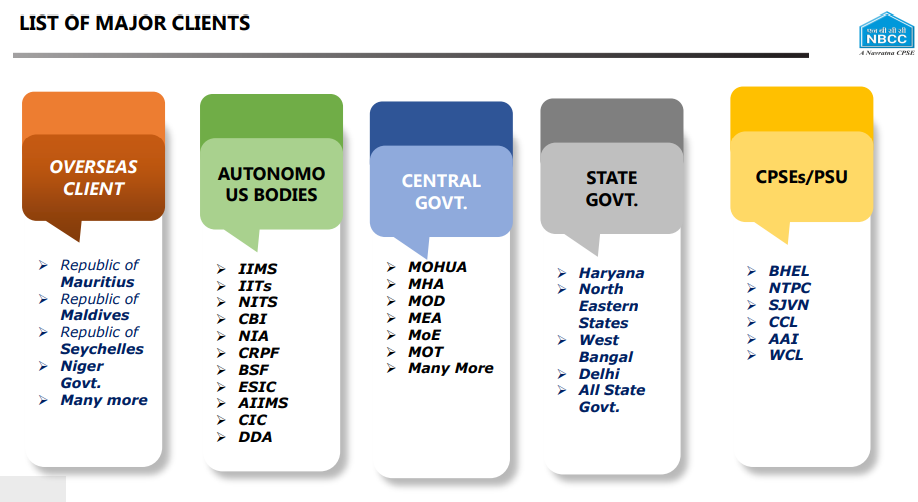

-Engaging in discussions with various state governments, the Central Government, and Public Sector Undertakings (PSUs) for project awards.

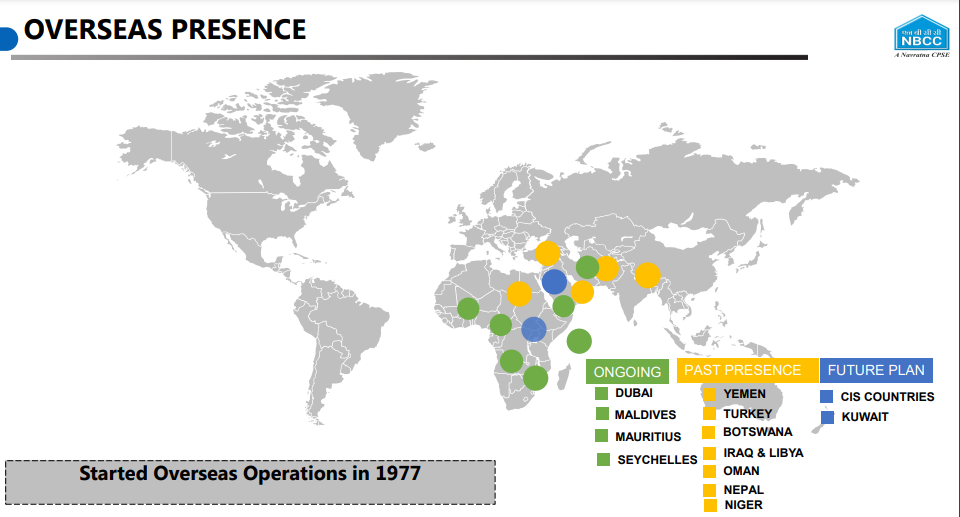

-Signed an MOU with Zambia for the construction of mass housing units.

-Undertaking a major international project in Maldives valued at INR 1,000 crores and exploring opportunities in Mauritius, Zambia, Seychelles, Burundi, and Jeddah.

-Exploring various domestic prospects, particularly redevelopment projects with state governments.

Financial Performance:

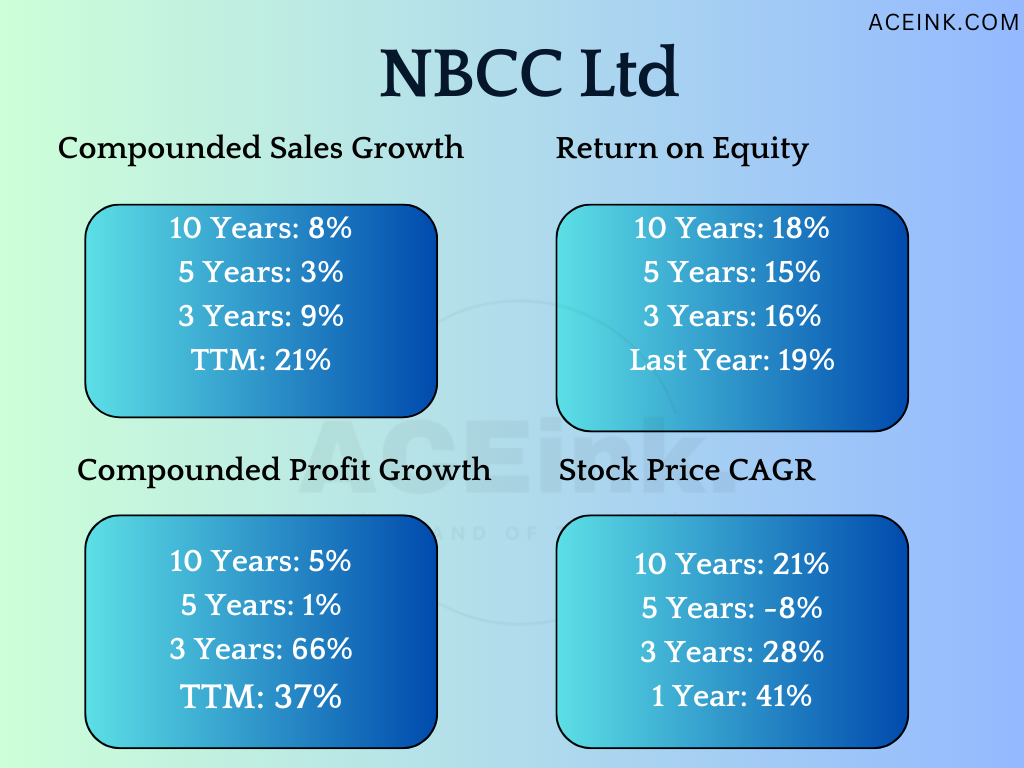

- Achieved a turnover of INR 7,000 crores, marking a 21% increase compared to the previous year.

- Profit before tax (PBT) experienced a 31% growth.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margin improved to 4.5%.

- The order book stands at INR 45,000 crores, with plans to develop a business in the range of INR 12,000 crores to INR 15,000 crores in the upcoming financial year.

- Currently managing projects worth INR 20,000 crores out of the INR 45,000 crores order backlog.

- Intention to award projects valued between INR 10,000 crores to INR 12,000 crores in FY24.

- The projected consolidated revenue guidance for FY24 is INR 11,500 crores, aiming for an EBITDA margin of 5% and a PAT (Profit After Tax) margin of 4% to 4.15%.

- ROCE 26.2 %

- ROE 19.3 %

- OPM 4.47 %

- Debt ₹ 0.08 Cr.

- Debt to equity 0.00

- Profit Var 3Yrs 66.3 %

- Qtr Profit Var -8.91 %

- Qtr Sales Var 23.7 %

- Free Cash Flow ₹ -222 Cr.

Also Read: “These banking stocks may give up to 30% returns

Fundamentals

- Market Cap ₹ 8,786 Cr.

- Current Price ₹ 48.8

- High / Low ₹ 49.6 / 29.8

- Book Value ₹ 10.6

- Dividend Yield 1.02 %

- Face Value ₹ 1.00

- Stock P/E 24.7

- Industry PE 32.3

- PEG Ratio 18.7

- Return over 1year 40.6 %

Order Book vs. Market Capitalization :

-The order book of INR 45,000 crores on a standalone basis and INR 54,200 crores on a consolidated basis suggests that NBCC has a substantial pipeline of projects to work on.

-This indicates a potential for revenue generation and growth in the coming years as these projects are executed and revenue is recognized.

-The current market capitalization of INR 8,786 crores appears relatively lower in comparison to the value of the projects in the order book.

-This difference might imply that the market has not fully priced in the future revenue potential from these projects.

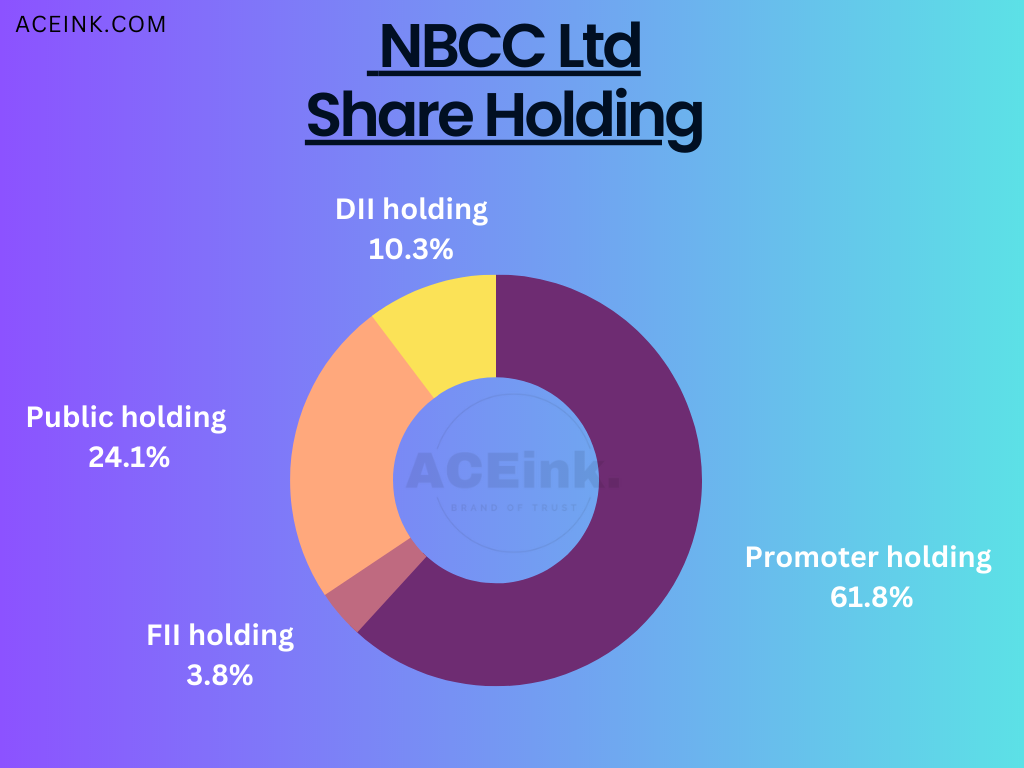

Shareholding pattern :

- Promoter holding 61.8 %

- FII holding 3.84 %

- Public holding 24.1 %

- DII holding 10.3 %

- Change in Prom Hold 0.00 %

- Chg in FII Hold 0.41 %

- Chg in DII Hold -0.28 %

Also Read: Defense stocks having ‘Buy’ Recommendations with an upside potential of up to 25%

When considering an investment in NBCC (India) Limited, it’s important to be aware of potential risks that could affect your investment decision.

Here are some specific and particular risks associated with investing in NBCC:

Project Execution Risks: As NBCC is involved in project management and construction, any delays, cost overruns, or execution issues in its ongoing projects could impact the company’s financial performance.

Delays in project completion or unexpected challenges could lead to revenue setbacks and negatively affect investor sentiment.

Dependency on Government Projects: A significant portion of NBCC’s revenue comes from government contracts and projects. This dependency on government projects exposes the company to changes in government policies, budget allocations, and project approvals.

Any slowdown in government spending on infrastructure and construction projects could impact NBCC’s business prospects.

Regulatory and Policy Risks: The construction and real estate sectors are subject to various regulatory and policy changes that can impact operations. Changes in zoning regulations, environmental norms, or other regulatory requirements could lead to project delays, increased costs, or even project cancellations.

Market Sentiment: The stock price of NBCC can be influenced by market sentiment, which might not always correlate with the company’s fundamentals. External factors such as macroeconomic conditions, global events, and overall market trends could impact investor confidence and result in stock price volatility.

Competition and Pricing Pressure: The construction and real estate sectors are competitive, and NBCC competes with both public and private sector players. Intense competition could lead to pricing pressure, potentially affecting profit margins.

Litigation and Legal Risks: Legal disputes related to project contracts, land acquisition, or regulatory compliance can lead to litigation and financial liabilities. Legal proceedings could tie up resources and potentially impact the company’s financial stability.

Please note that we are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

DISCLAIMER:

We are not SEBI-registered advisors or analysts. All the views shared in this article and all the content shared on aceink.com are only for learning and educational purposes. Any part of the article or any information on Aceink.com should not be interpreted or considered as investment advice. None of the opinions, views, or content posted on Aceink.com constitutes investment advice, as we are not SEBI-registered advisors or analysts.

Aceink.com or any person associated with this website accepts no liability or responsibility for any direct, indirect, implied, or any other consequential damages arising directly or indirectly due to any action taken based on the information provided on this website. Please conduct your own research, and we suggest seeking investment advice only from a SEBI-registered investment advisor.

The views expressed by investment experts, broking houses, news and media houses, rating agencies, etc., are their own and not those of Aceink.com or its management. Aceink.com advises users to consult a SEBI-registered investment advisor before making any decisions.

——————

“Riding High – Key Drivers Behind the Momentum of this small-cap stock” This small-cap stock is poised to…Read More