20 Apr 2 stocks from textile sector with a 47% potential upside : Analysts

Fundamentally Strong Textile Midcap Stocks

The textile industry in India is one of the oldest, but it has faced many challenges over the years, such as labor issues and competition from other countries.

However, after the Covid outbreak, the textile sector has become more important because many countries are looking for alternatives to China.

As a result, textile companies have gained attention in the stock market, especially those that benefit from government schemes. We will look at what analysts think about different companies in this sector, including those that make clothes, yarn, and fabric.

In the last 30 days, the stock market has been very volatile, During this time, some stocks have been able to perform well and outperform the market, despite the bearish sentiment in the first part of the month. , indicating that they are good at keeping their value during market turbulence.

This is a positive sign because it suggests that these stocks may continue to perform well once the market sentiment turns more positive. So, even though the market has been volatile overall, these textile stocks have been able to move up and gain weight.

Also Read: Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?

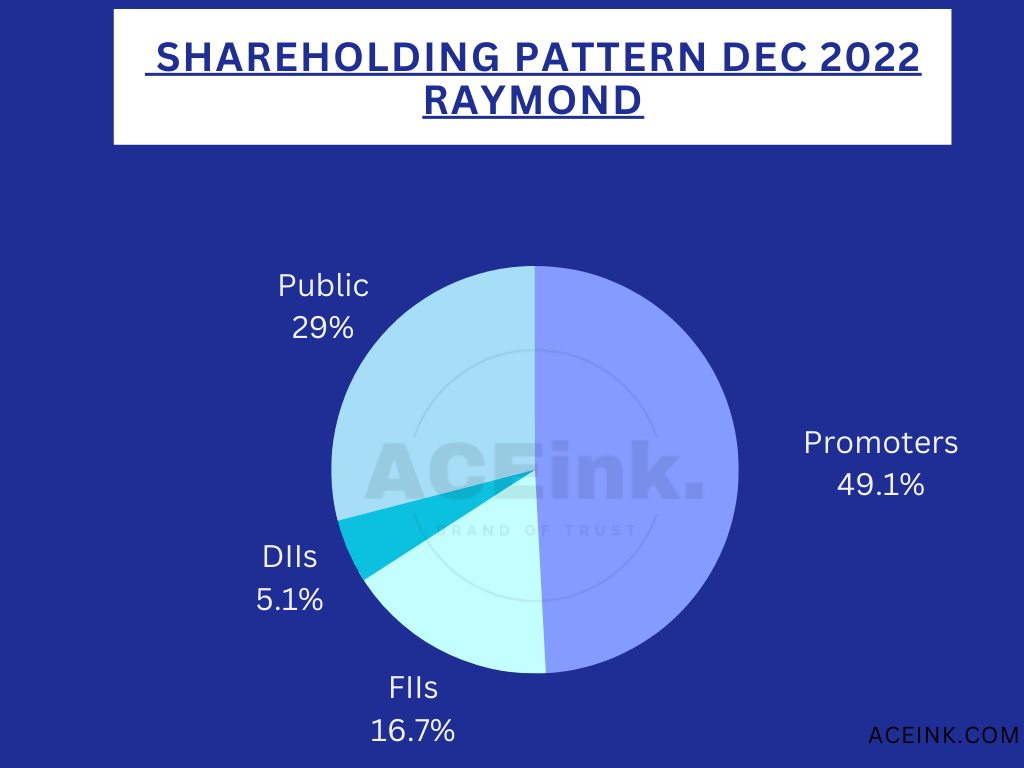

Raymond Limited:

-Raymond Limited is an integrated suiting manufacturer that offers end-to-end solutions for fabrics and garments.

-The company is committed to sustainable and eco-friendly manufacturing processes and has received various awards and recognitions for its efforts toward sustainability.

-The company operates in various segments such as Textile, Shirting, Apparel, Garmenting, Tools and Hardware, Auto Components, Real Estate and Development of Property, and Others.

Diversified business operations:

-Its Textile segment includes branded fabric, while the Shirting segment includes shirting fabric.

-The apparel segment includes branded readymade garments, while Garmenting segment includes garment manufacturing.

-The tools and Hardware segment is engaged in the business of manufacturing, sale, and distribution of precision-engineered components for tools and hardware, such as steel files and drills.

-The company also markets, sells, and distributes hand tools, power tool accessories, and power tool machines.

Raymond Limited has various well-known brands such as Raymond, Park Avenue, ColorPlus, Raymond Ready to Wear, Parx, Ethnix, Raymond Home, and Raymond Made to Measure.

-This diversification helps to reduce risk and create stable cash flows.

Strong brand portfolio:

Raymond Limited owns several well-known brands such as

Raymond,

Park Avenue,

ColorPlus, and

Ethnix,

which have strong brand recognition and loyalty among consumers. This can help the company maintain a competitive edge in the market.

End-to-end solutions:

Raymond Limited offers end-to-end solutions for fabrics and garments, from manufacturing to distribution, which allows for greater control over the supply chain and can lead to higher efficiencies and cost savings.

Wide distribution network:

The company has a widespread distribution network, including retail stores, multi-brand outlets, e-commerce platforms, and franchise stores, which enables it to reach a wider customer base.

-Raymond Limited has a strong retail presence with over 1,500 stores across India, as well as a global presence in more than 55 countries.

Strong Fundamentals & Financials :

- Market Cap ₹ 9,846 Cr.

- Stock P/E 13

- Industry PE 29

- ROCE 13 %

- ROE 16 %

- OPM 14 %

- Debt ₹ 2,399 Cr.

- Debt to equity 0.93

- Qtr Profit Var -4.23 %

- Qtr Sales Var 17 %

Here are some important risks to consider –

Intense competition:

The textile and apparel industry in India is highly competitive, with many players competing for market share. Raymond faces competition from both domestic and international companies, such as

Arvind Limited,

Aditya Birla Fashion and Retail Limited, and

Zara.

This could lead to pricing pressures and a potential loss of market share.

Dependence on a few key customers:

-Raymond generates a significant portion of its revenue from a few key customers, such as

-Reliance Retail and Aditya Birla Fashion and Retail Limited.

-A loss of these customers could significantly impact the company’s financial performance.

Fluctuations in raw material prices:

As a textile manufacturer, Raymond is vulnerable to fluctuations in the prices of raw materials such as cotton,wool, and polyester.

-For example, if the price of cotton rises sharply, Raymond may have to either raise its prices, which could hurt sales, or absorb the higher costs, which would hurt margins.

Exposure to macroeconomic risks:

As with any manufacturing company, Raymond Limited is exposed to risks associated with macroeconomic factors such as inflation, interest rates, and exchange rates, which can impact its financial performance.

-A slowdown in the Indian economy or a global economic recession could lead to reduced demand for Raymond’s products, which would hurt sales and profits.

Brand reputation:

Raymond has built a strong brand over the years, but any negative publicity or quality issues could damage the brand’s reputation and hurt sales.

-For example, if a batch of Raymond’s fabric or garments is found to be defective, it could lead to product recalls, which would be costly and could harm the company’s reputation.

Go Fashion (India) Ltd

-It is a clothing apparel company that designs, sources, markets, and retails women’s bottom-wear products under the brand Go Colors.

-Go Fashion outsources its manufacturing to third-party suppliers. The company has implemented a vendor rating system to ensure that its suppliers meet quality and ethical standards.

-The company also sells products through its own website, online marketplaces, and multi-brand outlets (MBOs).

-Go Fashion (India) Ltd has over 440 stores in India, spanning 110 cities.

Market Share:

-Go Fashion has a strong market share in the women’s bottom-wear category in India.

-The company’s brand, Go Colors, is popular among consumers and has helped the company gain a competitive edge in the market.

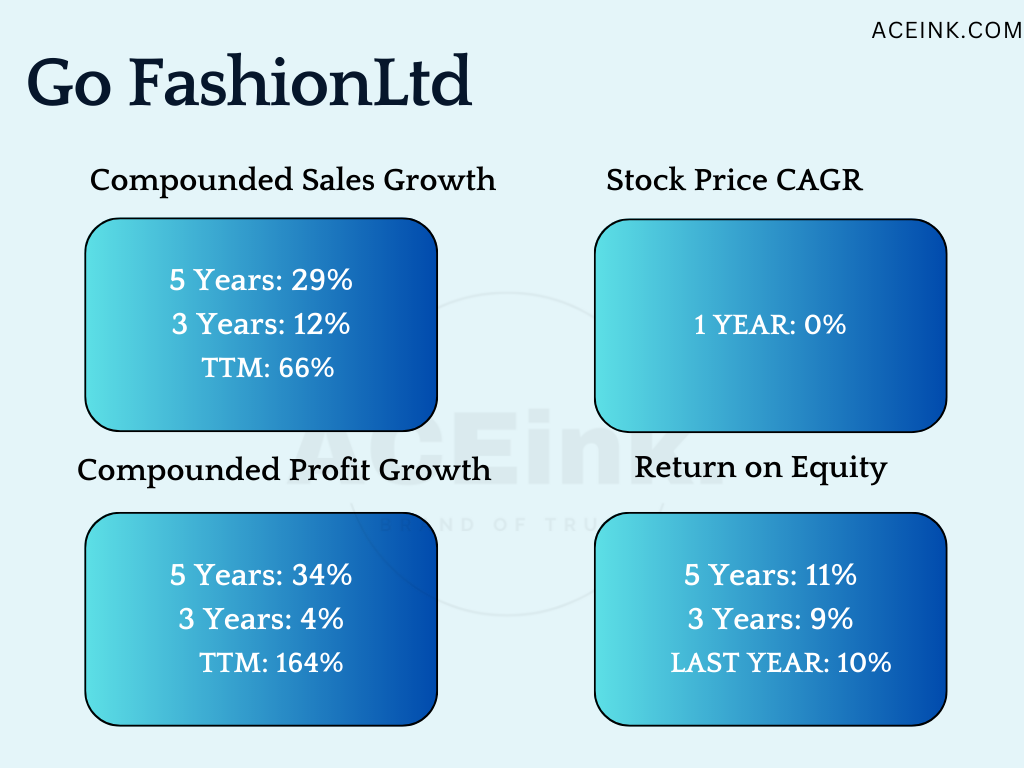

Financial Performance:

One of the most important factors to consider when analyzing a company’s fundamentals is its financial performance. Looking at Go Fashion’s financial statements, we can see that the company’s revenue has been consistently growing over the past few years. However, the company’s profit margins have been fluctuating, with a dip in FY 2020-21 due to the pandemic.

- Market Cap₹ 5,471 Cr.

- Stock P/E 68

- Industry PE 29

- ROCE 12 %

- ROE 9.72 %

- OPM 32 %

- Debt ₹ 294 Cr.

- Debt to equity 0.61

- Qtr Profit Var 2.62 %

- Qtr Sales Var 24 %

Industry Trends:

-The Indian apparel industry is expected to grow at a CAGR of 8.8% between 2021 and 2026, according to a report by ResearchAndMarkets.

-The report cites factors such as increasing disposable incomes, changing lifestyles, and a growing youth population as key drivers of this growth.

Consumer Trends:

-Consumers in India are increasingly looking for affordable yet trendy clothing options, which is where Go Fashion’s Go Colors brand comes in.

-The company has been successful in catering to this demand and has gained a loyal customer base as a result.

Sustainability:

Sustainability has become an increasingly important issue in the apparel industry, and Go Fashion has taken steps to address this. The company uses eco-friendly dyes and has implemented water conservation measures in its manufacturing process.

Future Outlook:

Despite the impact of the pandemic on the company’s financial performance, Go Fashion is well-positioned to capitalize on the growth opportunities in the Indian apparel industry. The company’s strong brand, wide distribution network, and focus on affordable yet trendy clothing should continue to drive growth in the coming years.

here are some potential risks that could impact Go Fashion’s future performance:

Dependence on a single product category:

Go Fashion’s business model is primarily focused on women’s bottom-wear products, which makes the company vulnerable to shifts in consumer preferences. Any decline in demand for these products could negatively impact the company’s revenue.

Intense competition:

Go Fashion faces competition from both domestic and international players.

While it has a strong presence in both offline and online retail channels, the company faces intense competition from other e-commerce players also.

-Competitors include companies like Future Lifestyle Fashions and Aditya Birla Fashion and Retail.

-Go Fashion will need to continue to innovate and differentiate itself in order to maintain its competitive edge.

Dependence on third-party suppliers:

Go Fashion outsources its manufacturing to third-party suppliers, which could lead to quality control and supply chain management issues.

-Any disruptions in the supply chain could impact the company’s ability to meet the demand for its products.

Online retail competition:

Any loss of market share to these players could impact the company’s revenue and growth prospects.

——————-

This electric vehicle EV stock is on the rise to reach an all-time high (ATH) in the current falling market. Here is the reason why…Read More

“Why This Fundamentally Strong EV Stock is on a Bullish Run in a Bear Market?”

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies are their own and not that of the website or its management. Aceink.com advises users to check with certified experts before taking any investment decisions.

No Comments